Security Token

Safeguard Your Online Banking

by using Security Token

Security Token can help you conduct designated Online Banking services safely. When you are conducting designated Online Banking services, you would be prompted to enter a security code displayed on your Security Token for verification. If the security code is correct, your transaction can be authenticated successfully.

Apart from Security Token, you may activate Mobile Token in CCB(HK&MO) Mobile App to authenticate designated Mobile and Online Banking transactions. Learn more about Mobile Token and Biometric Credential Authentication Service.

Which Online Banking services require the use of a Security Token?

Personal Banking:

- Funds Transfer To Unregistered Account

- Register Fund Transfer Account

- Register Designated Merchants of Bill

- Increase Transfer/Bill Payment Limit

- Online Securities Trading Services

- Update Email Address

- Electronic Direct Debit Service

- Other Designated High Risk Transaction services

Enterprise Banking:

- Funds Transfer To Same Name Account Held Within CCB (Asia)

- Funds Transfer To Registered Account

- Funds Transfer To Unregistered Account

- Setup eAlerts Services

- Employer Payroll Autopay Service

- Online Securities Trading Services

- Online Trade Services

- Time Deposit

- Update Email Address

The services listed above are subject to the related terms and conditions of the services.

How to activate the Security Token?

Upon the receipt of your Security Token, please follow the steps below to activate it immediately.

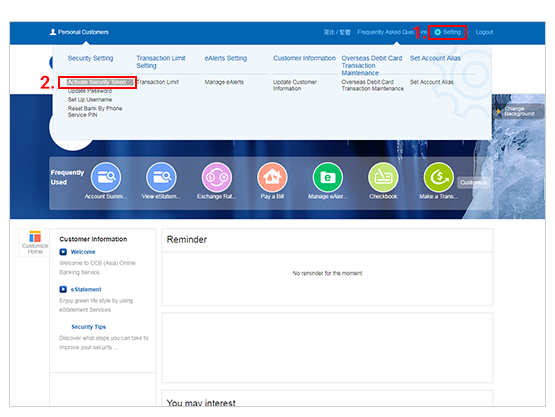

Step 1

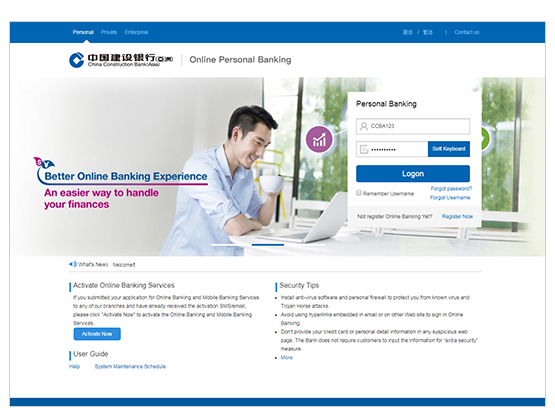

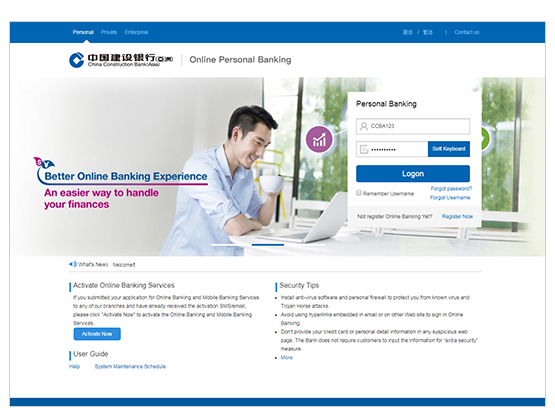

Logon to Online Banking with Username, Password and Verification Code.

Step 2

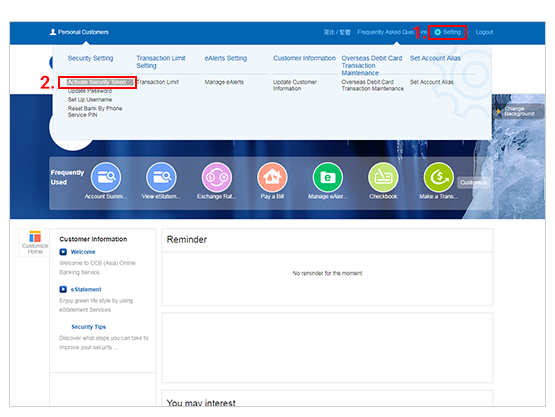

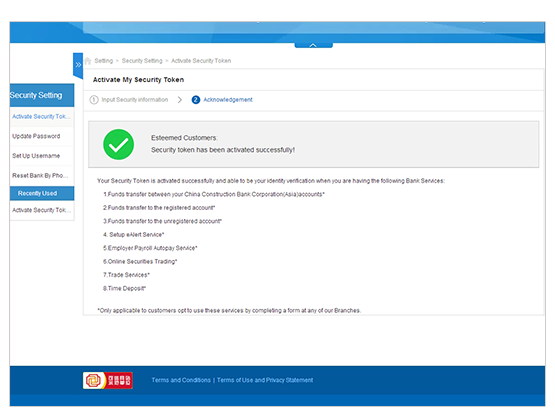

Click "Setting" and select "Activate Security Token".

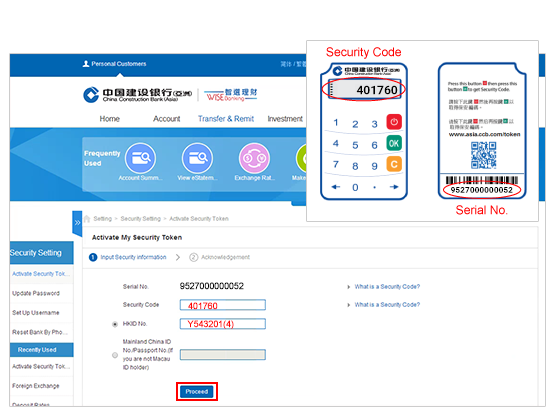

Step 3

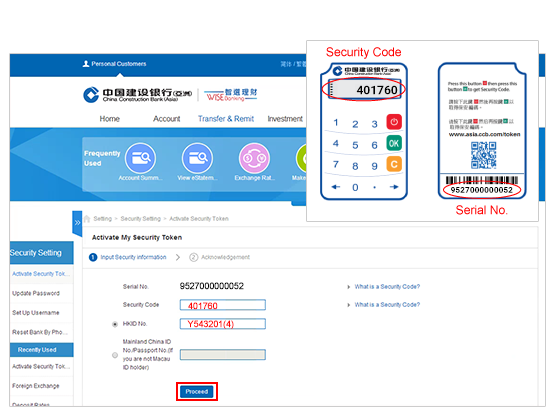

Please confirm the Serial No. is same as your security token serial number. Enter required information and click "Proceed".

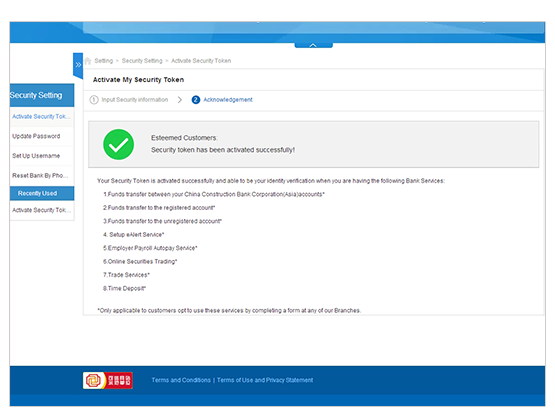

Step 4

Your Security Token is activated successfully.

Above logon page/activation process is eligible for Online Personal Banking customer. For Commercial Banking customer, please logon to Online Enterprise Banking .

The services listed above are subject to the related terms and conditions of the services.

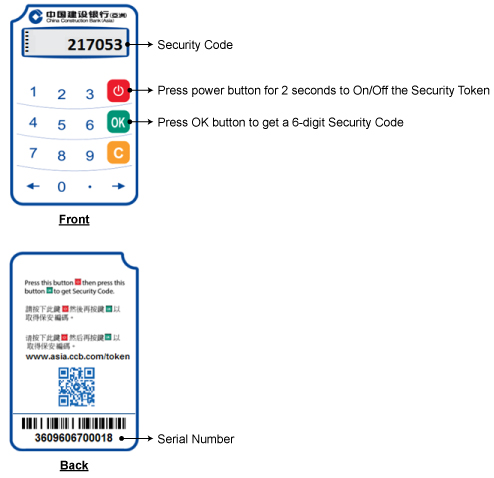

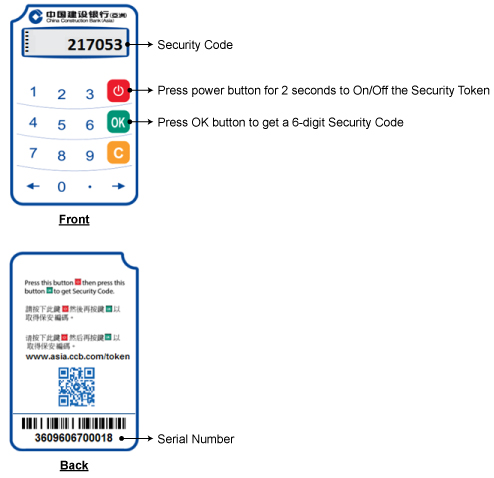

How to use the 2nd Generation Security Token?

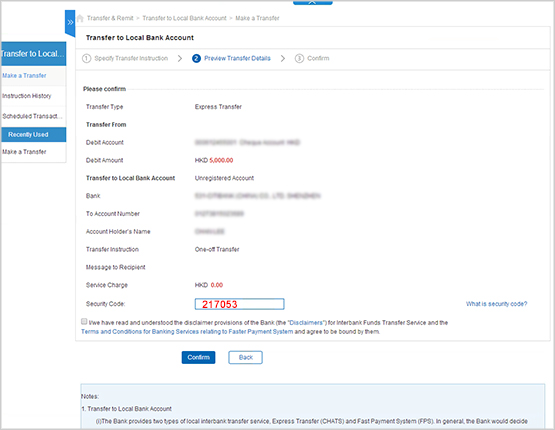

How to authenticate an unregistered account fund transfer transaction by using 2nd Generation Security Token?

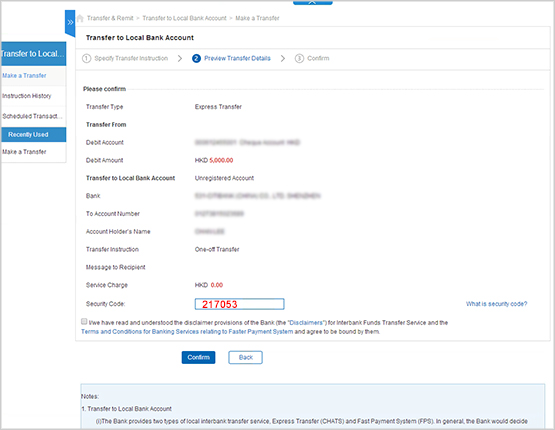

After entering the transfer details, you will be directed to a "Review & Approve" page to review the details and you are required to enter a 6-digit Security Code as authentication in order to complete the transfer.

2 steps to generate a Security Code with your Security Token:

- Press and hold the Power button

for 2 seconds to turn on the Security Token

for 2 seconds to turn on the Security Token - Press the OK button

to generate a 6-digit Security Code

to generate a 6-digit Security Code

The services listed above are subject to the related terms and conditions of the services.

for 2 seconds to turn on the Security Token

for 2 seconds to turn on the Security Token to generate a 6-digit Security Code

to generate a 6-digit Security Code