Corporate Account Aggregation Service

One-Stop Comprehensive Cash Management Solution with Banking Privileges Across the Greater Bay Area (“GBA”)

CCB (Asia) has launched its newest comprehensive cash management solution – Account Aggregation Service, which leverages on state-of-the-art fintech, customizable cash management services and banking privileges across GBA to help corporate customers improve control over their subsidiaries and affiliates and maximize the liquidity efficiency for their cross-border funds. This service will act as a powerful aid to support our corporate customers in optimizing capital utilization efficiency.

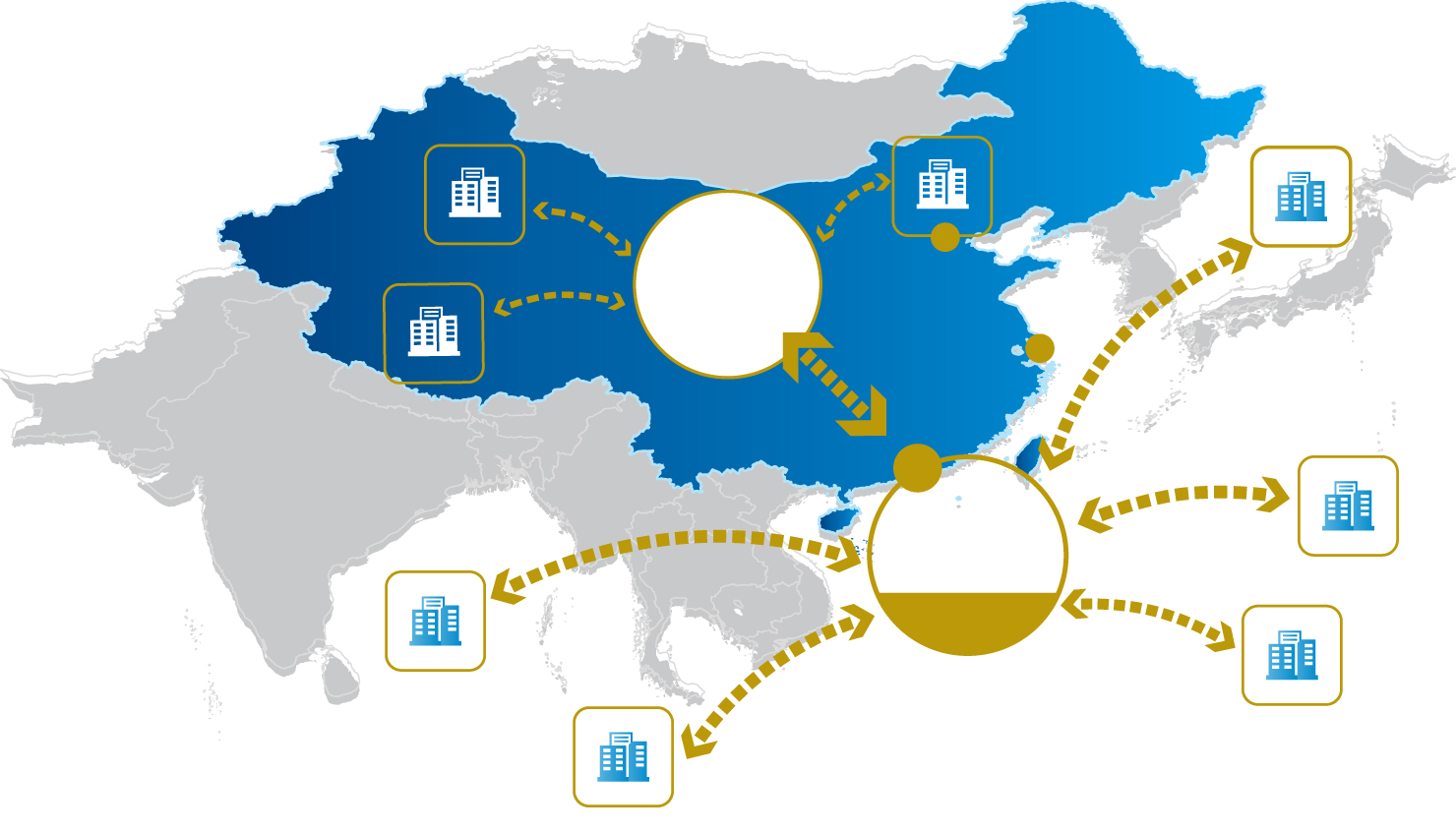

Structure Overview

Corporate

Headquarter

Headquarter

Beijing

Shanghai

Macau

Hong Kong

Hong Kong

Corporate

Treasury Centre

Corporate

Treasury Centre

In-House

Bank

Bank

Seamless Cash Management Solution

CCB (Asia)’s advanced and efficient New Generation System bridges customers to all CCB’s local, cross-border and overseas branches, allowing them to connect their financial systems through a diverse selection of supported customer channels including the Online Enterprise Banking Service, Host-to-Host solutions and financial messaging service. Through CCB (Asia)’s one-stop comprehensive cash management solution, corporate customers can facilitate cross-border account management with “visibility, control, liquidity”, together with value-adding deposit products and flexible funds pooling services.

Multi Bank

Statement

Service

Statement

Service

Global

Payment

Factory

Payment

Factory

Yield

Enhancement

Enhancement

Global

Account

Enquiry

Account

Enquiry

Autopay

SWIFT

Payment

Service

Payment

Service

SWIFT

Statement

Service

Statement

Service

Cash

Pooling

Pooling

Online Enterprise

Banking Service

Banking Service

CCB (Asia)

New Generation System

New Generation System

Gateway

Host-to-

Host

Host

ERP System

Service Features

Better Funds Visibility

CCB (Asia)’s Global Account Enquiry Service offers corporates with real-time account information and customised reports and diagrams on accounts maintained at global CCB branches. Fully understanding the capital conditions is the benefits for corporates to improve capital efficiency, which is beneficial for their global strategic decisions.

Strengthen Payables and Receivables Control

Through multiple channels such as SWIFT, Online Enterprises Banking Service and Host-to-Host solution, corporate headquarters can centralize the payment in a single process; respond directly to geographically-scattered subsidiaries; and focus on worldwide collaboration with banks. Resulting in a synergy that can solve the issue of daily numerous transactions; reinforce the monitor of business procedure, which allows more automation and improved control and greater savings.

Improve Cross-border Liquidity

CCB (Asia)’s Local Cash Pooling Service and Global Payment Factory Service together with policies on cross-border pooling in Mainland China helps go-global corporates to manage cash among their subsidiaries and affiliates more efficiently, offset surplus and deficit balances and reduce the spread paid to the banks, resulting in saving for the organization.

Our Advantages

Powerful Backing

CCB (Asia) is CCB’s largest financial institution established overseas by far.

CCB’s Overseas Funding Platform

CCB (Asia) serves as a cross-border RMB remittance centralized trading center.

Strong Market Influence

CCB (Asia) is the first Chinese-own licensed bank deep rooted in Hong Kong for over a century.

Professional Service Team

Our service team effectively respond to customers’ unique business demands with customized solutions based on our “1+1” model.

FAQs

- Global cash management helps corporates to have a full understanding and clear overview of their capital, benefiting their global strategic decisions, for the ultimate goal of “Risk control; Profit increment; Efficiency enhancement”.

For more details, please contact your account manager or email our Bank’s Cash Management Team at cash_management@asia.ccb.com.