Corporate Daily Operation Scenario Solutions

Corporate Daily Operation Scenario Solutions

Local Enterprise Comprehensive Solution

- Pain Points for Corporate Cash Management

Frequent branch visit for business transact

Low efficiency of daily payments and receivables

Difficulty in managing multiple currencies

Lack of control over the subsidiaries

Low utilization rate of idle fund

- Cash Management Solutions

The multi-currency savings account provided by CCBA can facilitate your multi-currencies settlement, without the need of currency exchange, the fund directly deposit into the account for centralize management of multiple currencies.

With CCBA’s global account information report service, account information in different banks and regions can be viewed in a real-time basis, provides single point management of aggregate balance.

CCBA’s robust local real-time cash pooling and global cash pooling help manage parent company and subsidiaries account in single pool structure. Participating accounts in cash pool linked in a hierarchical manner to achieve real-time supervision, physical concentration, and dynamic sharing.

Our various receivables/payables services cater enterprises’ diverse needs such as autopay-in service, autopay-out service, payroll, dividend payment, merchant payment collection, QR code payment, batch payment, etc. Employees with CCBA payroll accounts could also enjoy concierge services and promotions.

Idle cash can enjoy maximum yield enhancement via CCBA’s interest enhancement services, including interest enhancement notional pooling, interest enhancement current account and flexible time deposit. Freely choose among these deposit service based on your own specific need.

CCBA’s corporate online banking and Host-to-Host Solution provide a convenient way of daily online account management. No more branch visit for business transact is required, these services greatly enhance administrative efficiency.

- Solution with Results

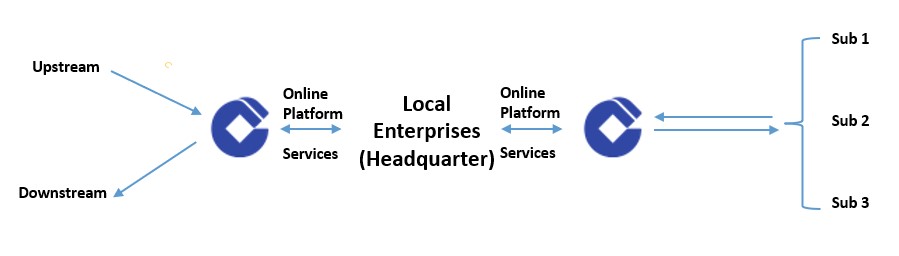

Our solution has comprehensive functionality that fully meet the needs of daily account management and capital operation for local SMEs or large enterprises. CCBA is committed to provide a full range of meticulous services for enterprises, including the timely return of corporate funds, regular payables/receivables to/from upstream/downstream, overall control of account information, and maximization efficiency of idle fund.

Note: The above sample diagram of “Solution with Results” workflow is for reference only

Comprehensive Solution for Multinational Enterprise

- Corporate Treasury Center Operating Model with Example

X Group is a state-owned multinational enterprise. Following their globalization development, X Group continues to expand overseas and gradually establishes branches/subsidiaries to carry out overseas M&A financing projects.

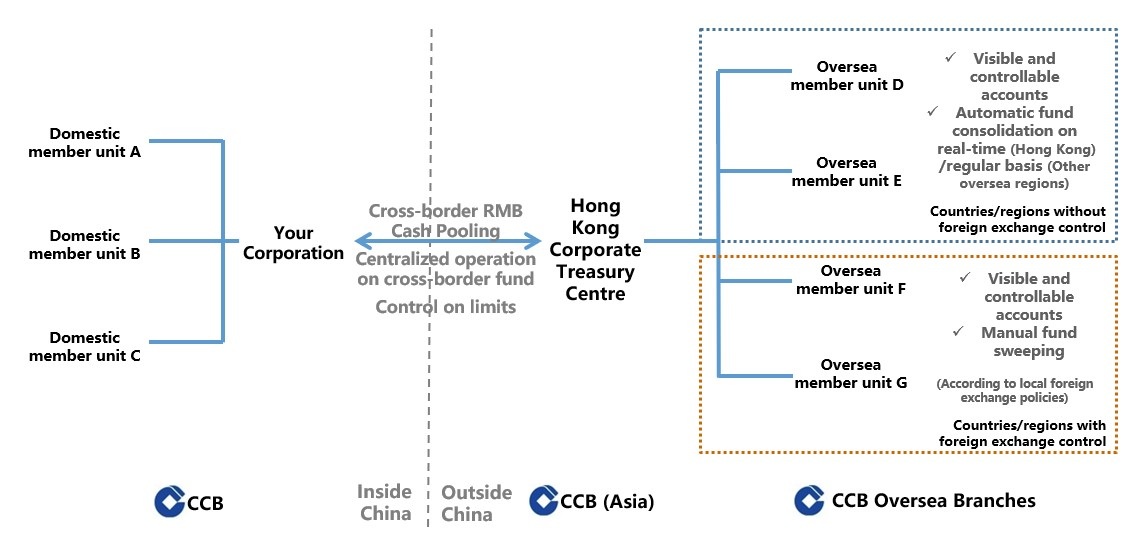

In order to centrally manage oversea fund, X Group plans to set up a Corporate Treasury Center (“CTC” below) in Hong Kong as an overseas capital management and financing platform to manage fund activities of overseas branches/subsidiaries. CTC’s main responsibilities includes capital lending, cash and liquidity management, fund allocation between member-companies, processing payments to/from sellers/suppliers, supporting group fund raising and risk management.- Cash Management Solutions

Using CTC as bridge, Cross-border RMB Cash Pooling build capital channel with the headquarters or financial companies. It serves as an in-house bank to maximize overall capital efficiency of the group, and form a scale effect.

- CCBA provides tailored solution for Group Corporate Treasury Centre. From three aspects, visible, controllable, adjustable, CCBA is committed to help clients enhancing fund operation efficiency and achieve aggregate management.

- Global account enquiry service and global account information report connect all domestic and cross-border bank accounts and monitor real-time account information such as balances and transactions. This service helps enterprise with internal control and risk management, and enhance fund security.

- Global payment service and cross-border remote remittance, through multi-channels such as corporate online banking, Host-to-Host Solution and SWIFT, provides comprehensive payment services to group member companies, centralize connection with different banks worldwide.

- Real-time cash pooling, global cash pooling and cross-border RMB cash pooling assist enterprise centrally manage group fund, increase cash liquidity, reduce monitoring costs and supervision costs, to achieve economies of scales.

- CCBA also provides different types of deposit enhancement services to maximize efficiency of idle cash, obtain a better yield with sufficient liquidity.

- CCBA’s advanced Fin-tech provides customers with diverse banking channel services, including corporate online banking, Host-to-Host Solution and SWIFT which enable enterprise transact cash management business intensively.

- Real-time Solution

The comprehensive solution of CTC provided by CCBA is committed to providing customers with multi-channel, multi-regional "visible", "controllable" and "adjustable" global cash management service, which can fully achieve the centralization of fund allocation and the flexibility of fund usage and assist the Group CTC to manage overall accounts information and capital flow.

Note: The above sample diagram of “Real-Time Solution” workflow is for reference only

Please contact our relationship managers for further enquiries.