Corporate Electronic Direct Debit Authorisation (eDDA)

Manage periodic payments and bills more efficiently and faster

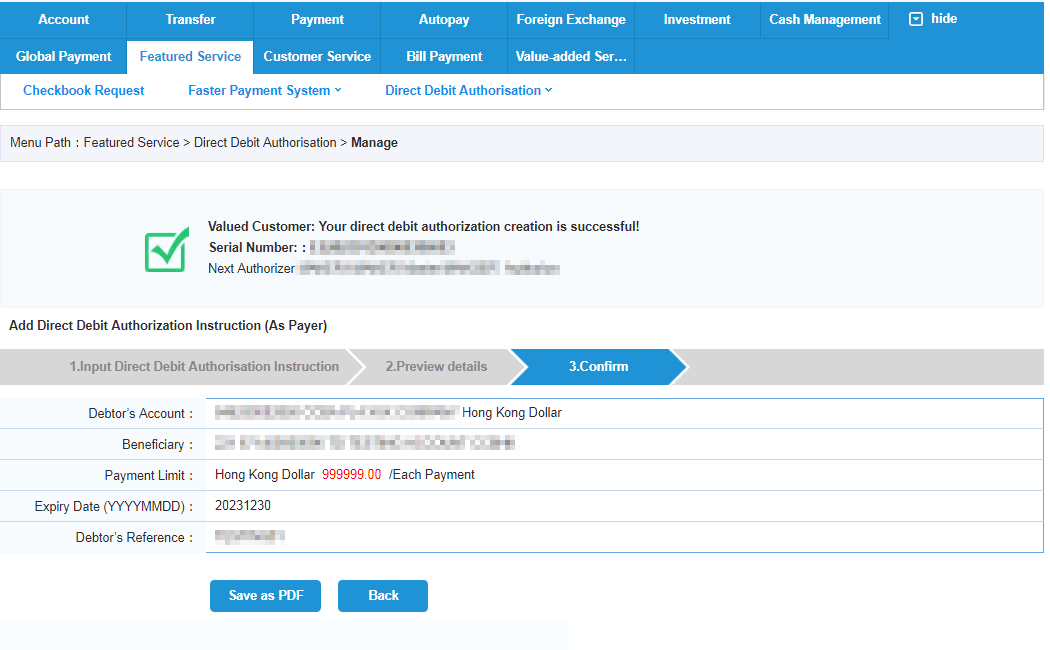

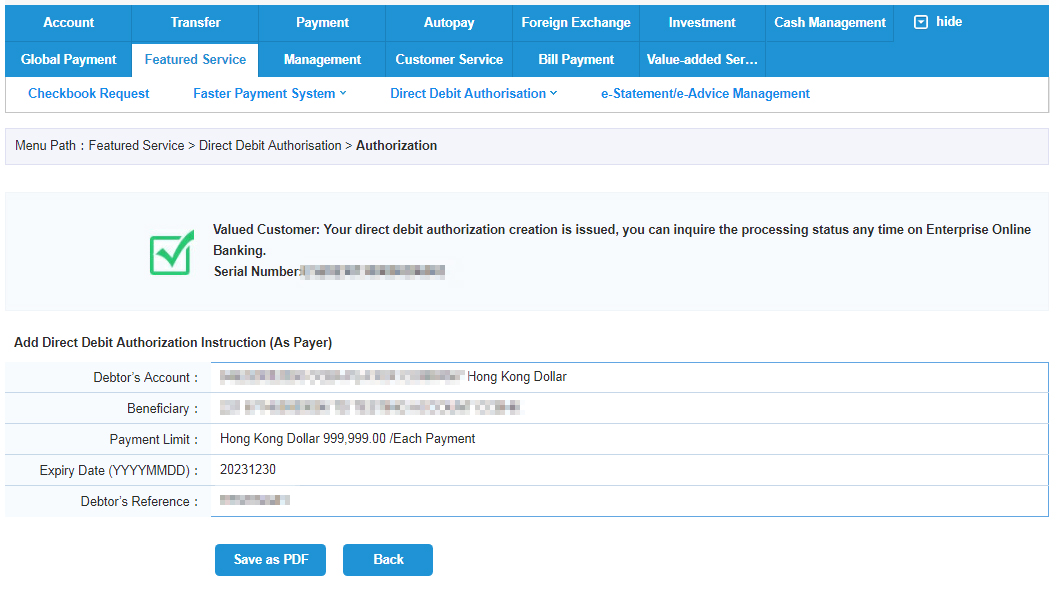

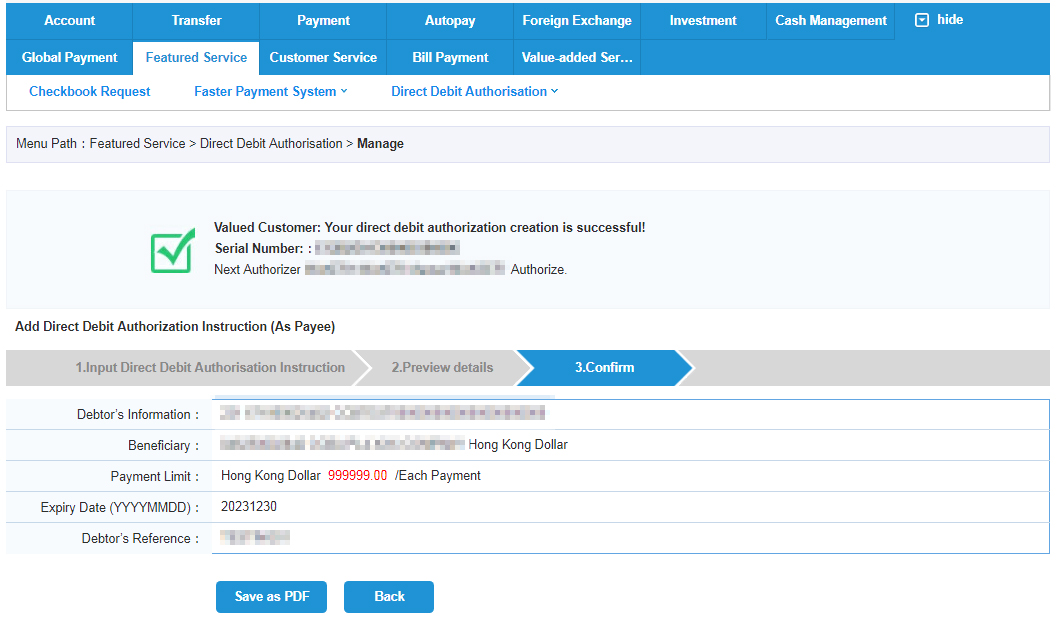

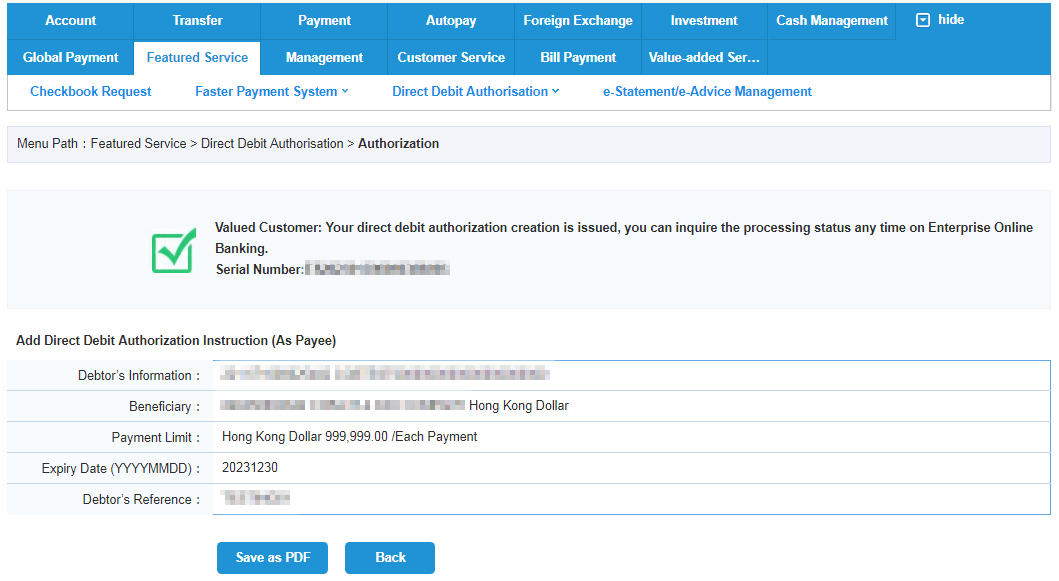

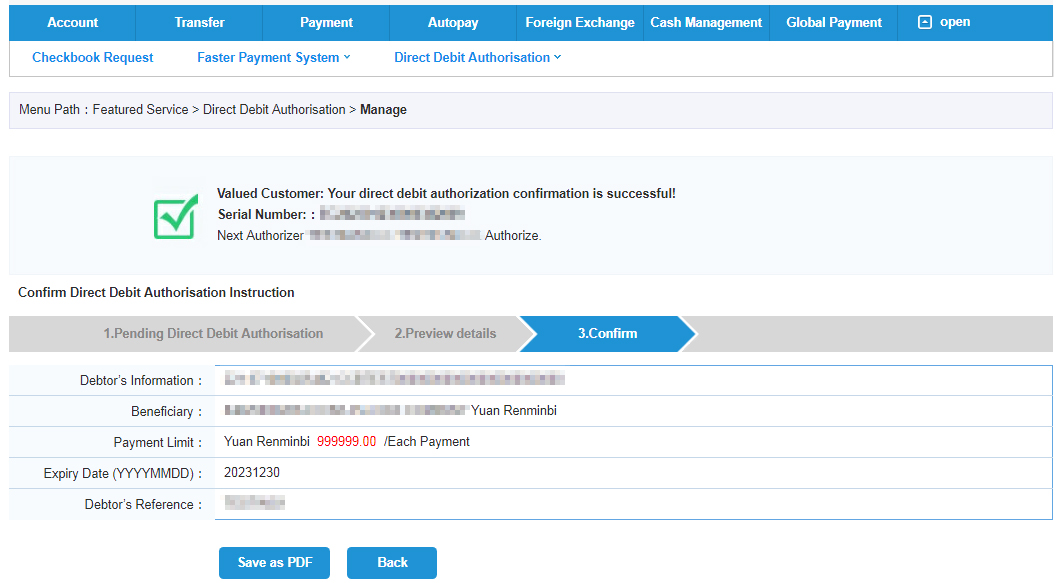

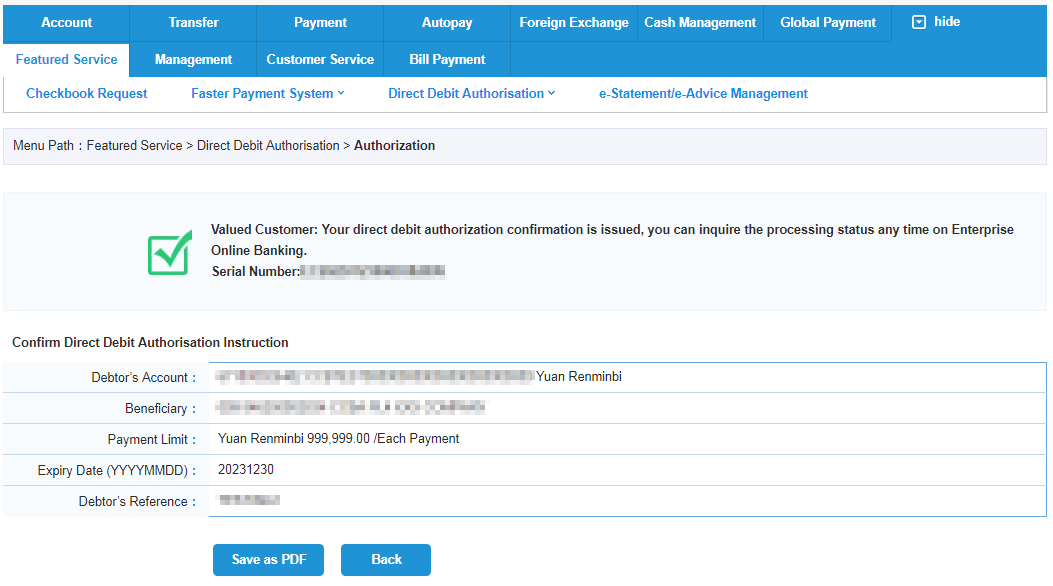

In just a few simple steps, your company can setup an Electronic Direct Debit Authorisation (eDDA) to approve and authorise merchant and company to debit your funds via Online Enterprise Banking. The eDDA function also allows you to manage commercial payments and periodic bills with ease and without the need to fill in any physical application forms.

Key features of Electronic Direct Debit Authorisation (eDDA) Service:

Cost-efficient

Setup an eDDA simply by logging into Online Enterprise Banking without needing to visit a branch for the submission of an application form.

Faster and reliable

In contrast with the traditional transfer methods, eDDA Service enables faster and more reliable payments.

Flexible setting

Your company may cancel or amend your eDDAs via Online Enterprise Banking from time to time to meet your business needs.

Learn more about the service:

Corporate Electronic Direct Debit Authorisation Service Demo

Safety Made Easy:

- Complex information is no longer required. Initiate 7 x 24 around-the-clock eDDA setups by following simple steps anytime and anywhere.

- No bank account number is required for setting up an eDDA.

- A dynamic security code generated by security device is required for verifying transactions, in turn strengthening your service security.

- Transaction notification and end-to-end encryption enables secure transactions.

Please contact your Relationship Manager for any enquiries regarding the details of relevant services.

Please click here for the Terms & Conditions relating to Corporate Electronic Direct Debit Authorisation (eDDA).

Remarks:

- The service is available only when the recipient banks that support the eDDA function and is subject to the relevant Terms & Conditions.

- Please note that service charges may apply and our Bank’s service charges might be updated from time-to-time. Furthermore, different service charge arrangements for fund collection may apply for other beneficiary banks.