Overseas ATM Transaction Activation

According to Hong Kong Monetary Authority (“HKMA”) requirements, all cardholders of ATM cards and credit cards issued by banks in Hong Kong are required to activate "Overseas ATM Transaction" function in advance to perform Overseas ATM Cash Withdrawal. "Overseas ATM Cash Withdrawal" refers to the ATM cash withdrawal transactions (including cash advances) performed outside Hong Kong, excluding transactions through Jetco network in Macau and Mainland China.

If customers would like to withdraw cash at overseas ATM, would be required to activate the oversea ATM transaction function in advance through following channels:

CCB(Asia) Online Banking/ CCB(Asia) Mobile Banking;

Customer Service Hotline;

(CCB (Asia) UnionPay Dual Currency Debit Card - 277 95533)

(CCB(Asia) Credit Card - 317 95533 )

CCB (Asia) or Jetco ATMs (The detailed activation guide could refer below).

Activate the Overseas ATM Transaction function

Step 1) Please insert your card and input the ATM PIN.

-

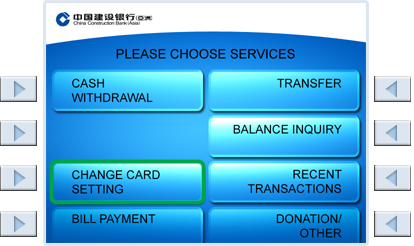

Step 2) After account selection, please select "Change Card Setting".

-

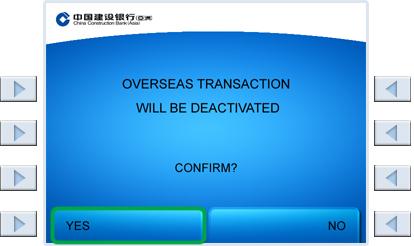

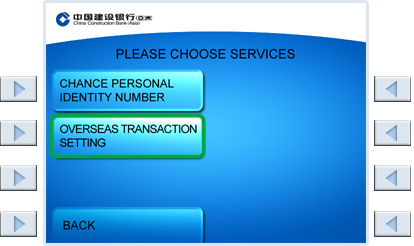

Step 3) i) Select "Overseas Transaction Setting".

ii) If the Overseas ATM Transaction status is deactivated, please press "Activate".

iii) Input the "Start Date"* for the overseas ATM transaction setting, the format of input should be "DDMMYYYY".

*Note: The Start Date of service must be on or later than the policy effective date, i.e.1 Mar, 2013.

iv) Input the "End Date" for the overseas ATM transaction setting, the format of input should be "DDMMYYYY".

*Note: The end Date of service must be on or before the card expiry date.

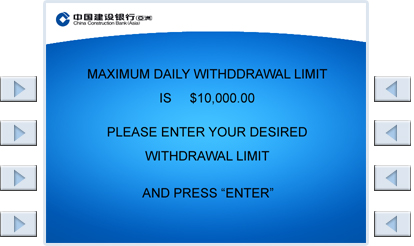

v) Input the “Overseas Daily Withdrawal Limit”, and then press "Enter" to proceed.

*Note: The daily maximum withdrawal limit is shared by both overseas and local ATM cash withdrawal. Our Bank has set different maximum daily limit for different card types. Customer can choose to lower the daily overseas withdrawal limit if preferred. Please visit our website for your maximum daily limit.

vi) Press “Confirm” to confirm the setting of Start Date, End Date and Overseas Daily Withdrawal Limit after review.

-

Step 4) Your instruction will be handled immediately. SMS or email notification will be sent to you if you have kept a valid mobile phone number or email address record with our bank.