Deposit Promotion and Rate Enquiry

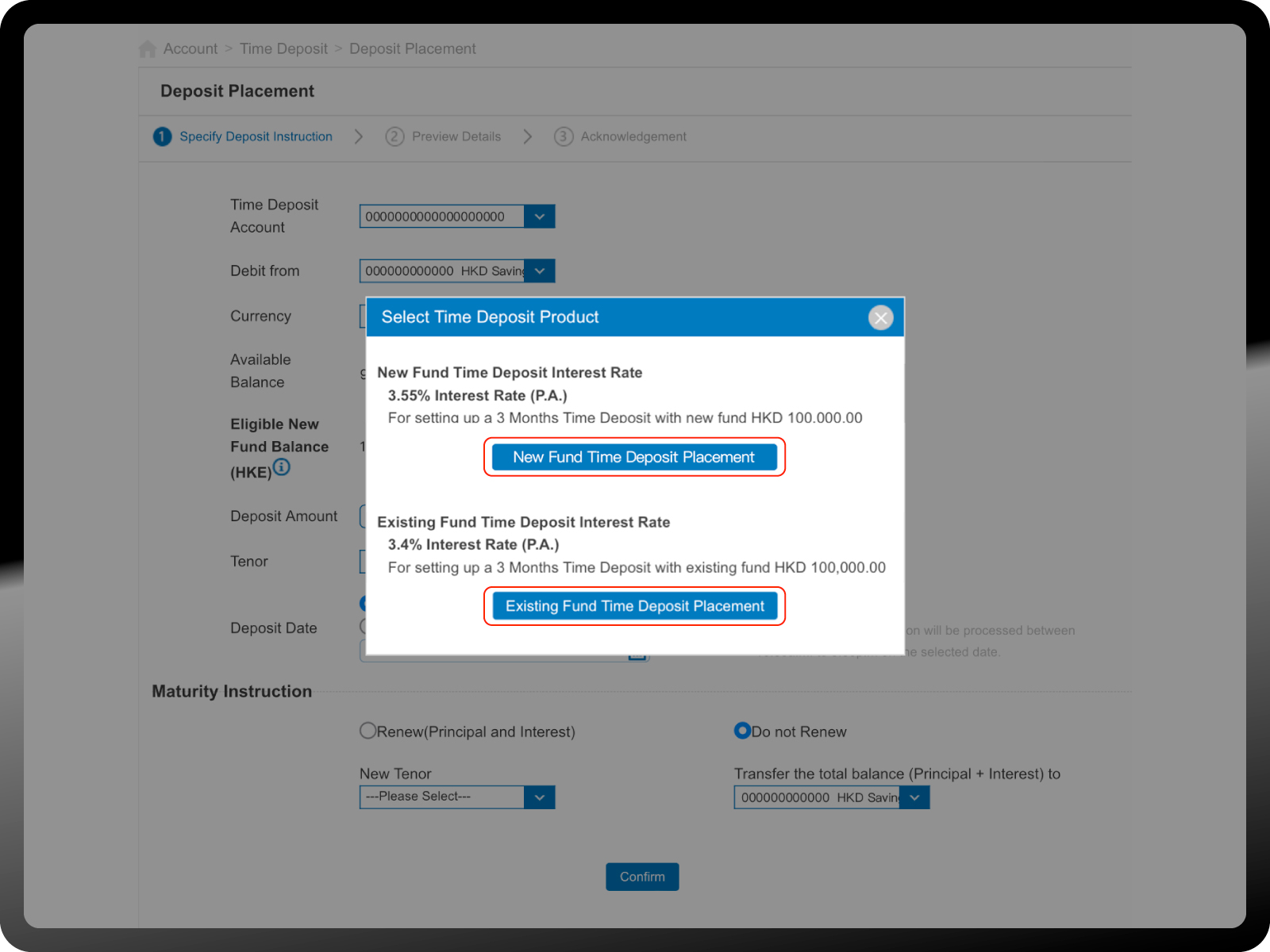

1. New Fund Time Deposit offers

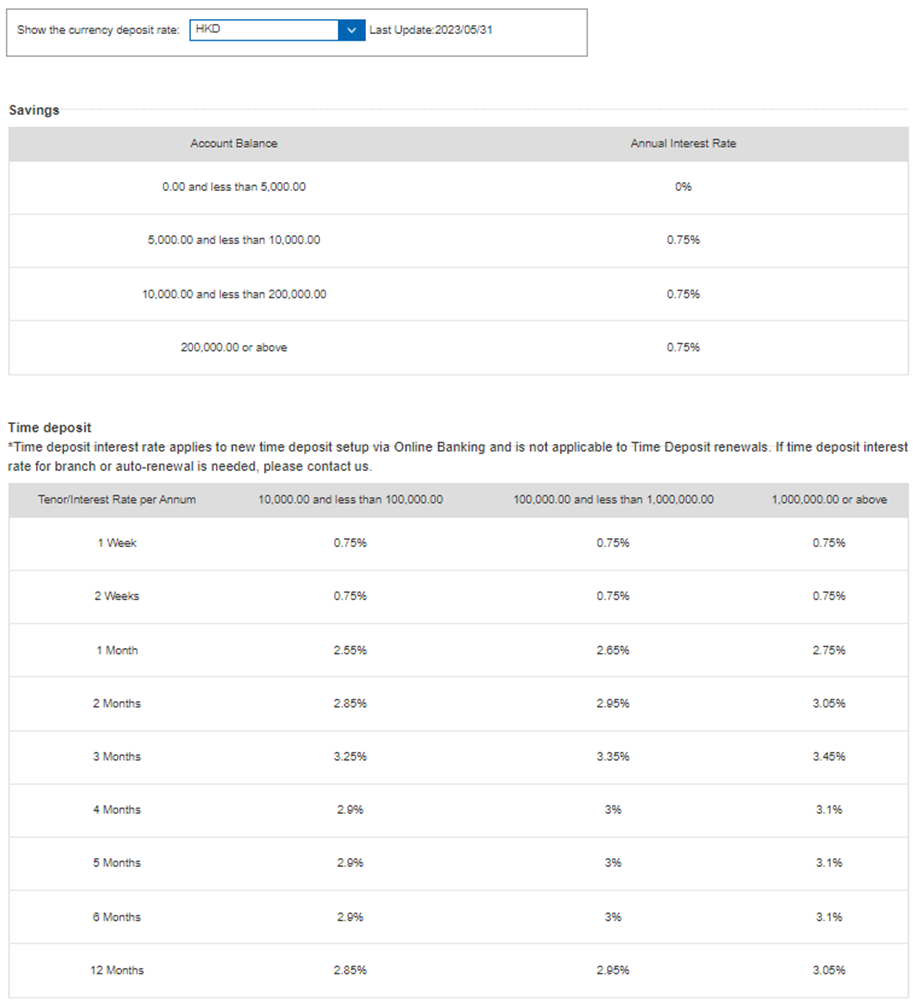

Customers can enjoy preferential interest rates2 by successfully setting up a Time Deposit for a designated amount of new funds1 with a designated currency and deposit tenor (refer to the table below):

-

“New Funds” refers to the incremental balance when comparing the latest Total Deposit Balance with the day end Total Deposit Balance as of 3 calendar days ago (T-3 day), after deduction of the sum of principal amount (if applicable) which has been entitled to new fund offer of Time Deposit within the latest 3 calendar days (T day, T-1 day and T-2 day), where T day is today:

- Total Deposit Balance refers to the available balance of all deposit accounts, including Savings Accounts and/or Checking Accounts and Time Deposits of Hong Kong Dollar and foreign currencies (whether accounts in sole name or as primary holder of joint name accounts).

- The Bank reserves the right of final decision should there be any dispute in the definition of New Funds.

- The above preferential interest rates are quoted as of which is for reference only and subject to change. The relevant interest rate will be subject to change based on current market condition. The Time deposit interest rates may vary on factors such as currency , tenor, deposit amount and customer segment. The final applicable interest rate will be determined by the bank when customers set up the time deposit.

| Date | Day End Total Deposit Balance | Transactions performed by customer | Sum of Principal Amount which has been entitled to new fund offer of Time Deposit |

| 19 January (T-3) | HK$100,000 (B) | -- | HK$0 |

| 20 January (T-2) | HK$300,000 | Transfer in New Fund of HK$200,000 | HK$0 (C1) |

| 21 January (T-1) | HK$300,000 (A) | Set up New Fund Time Deposit with HK$40,000 | HK$40,000 (C2) |

| 22 January (T) | -- | -- | HK$0 (C3) |

(T-1 day)

HK$300,000

(T-3 day)

HK$100,000

HK$40,000

(C=C1+C2+C3)2. Online New Fund Time Deposit offers

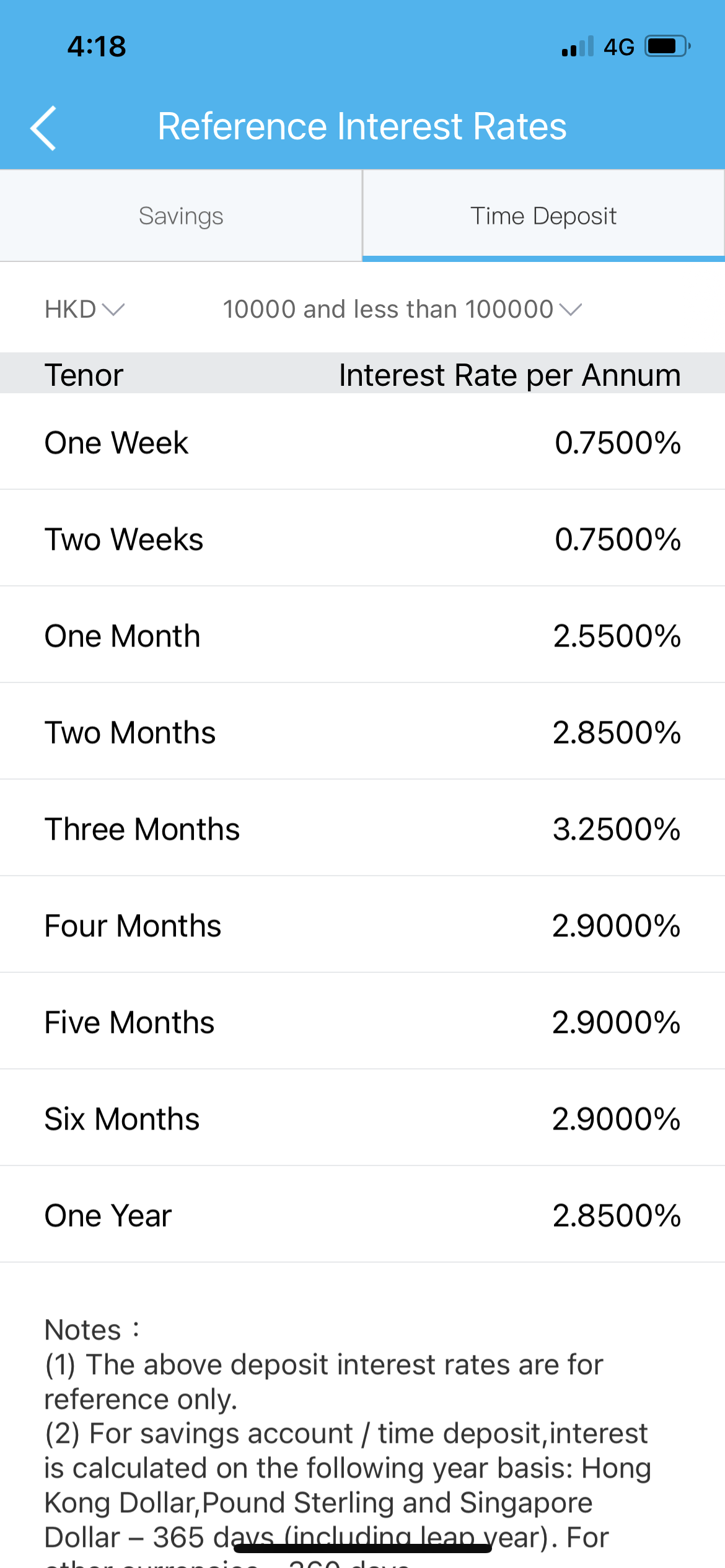

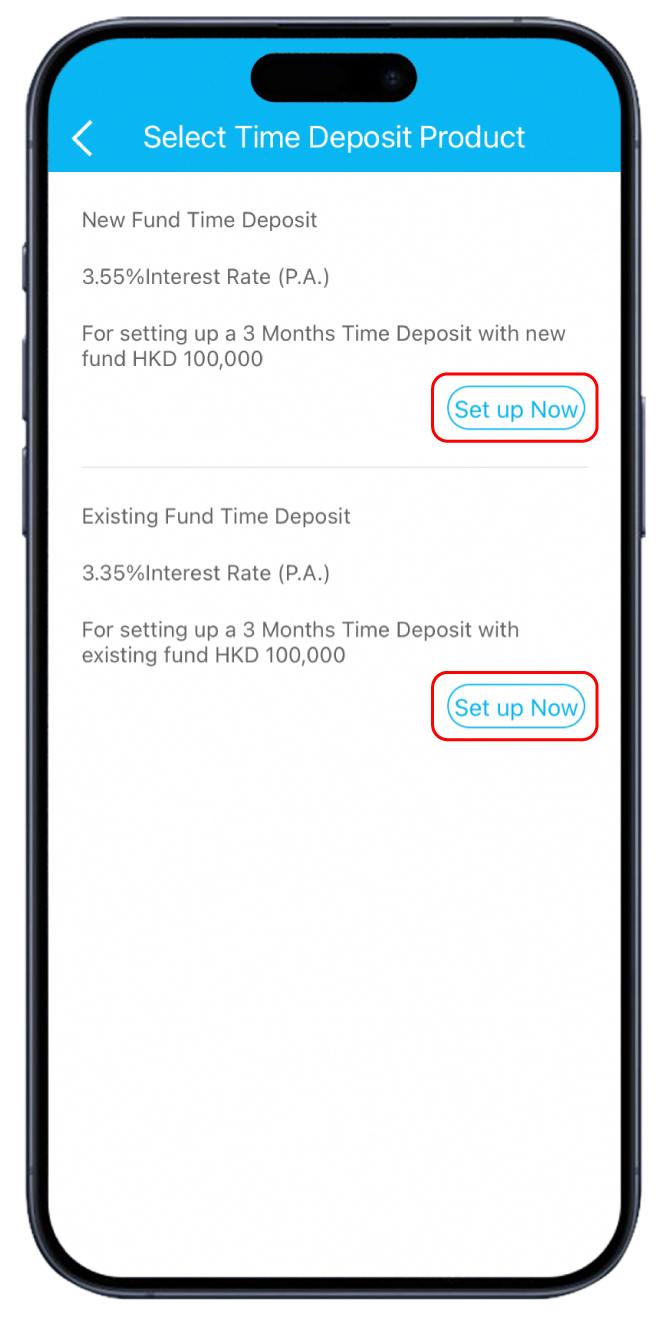

Customers can enjoy preferential interest rates by successfully setting up a Time Deposit for a designated amount of new funds with a designated currency and deposit tenor via Mobile Banking, Online Banking and Smart Teller Machines.

Learn more

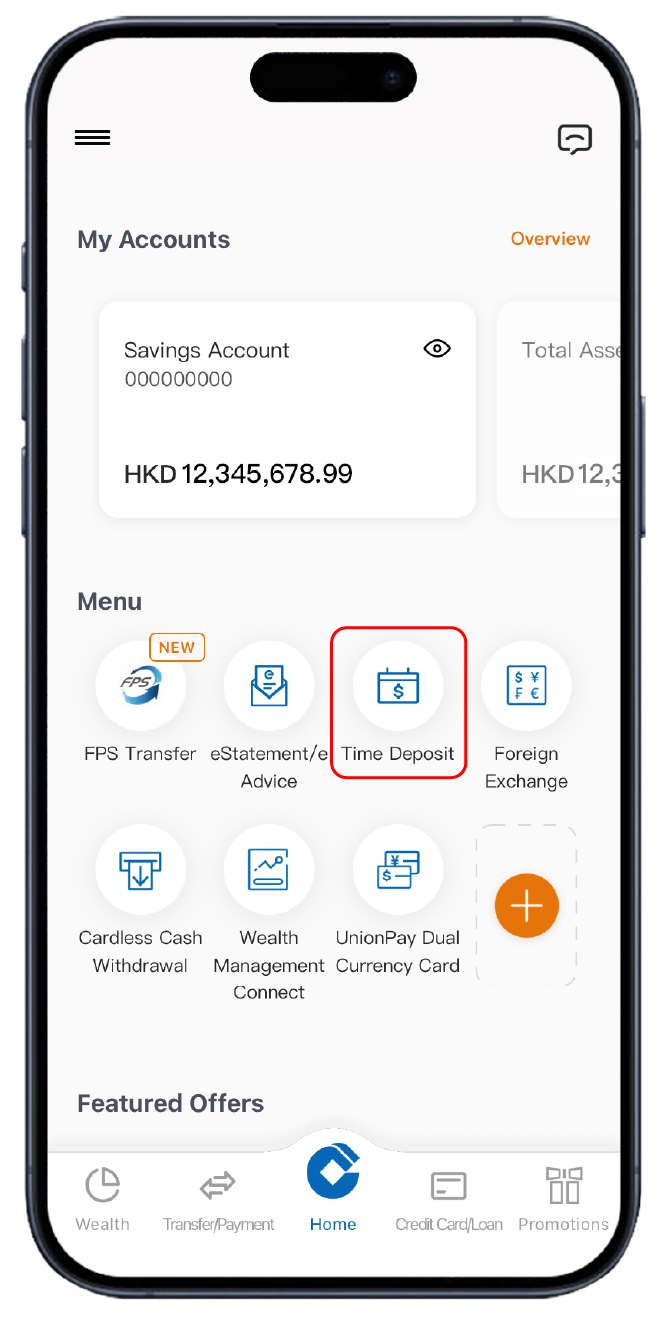

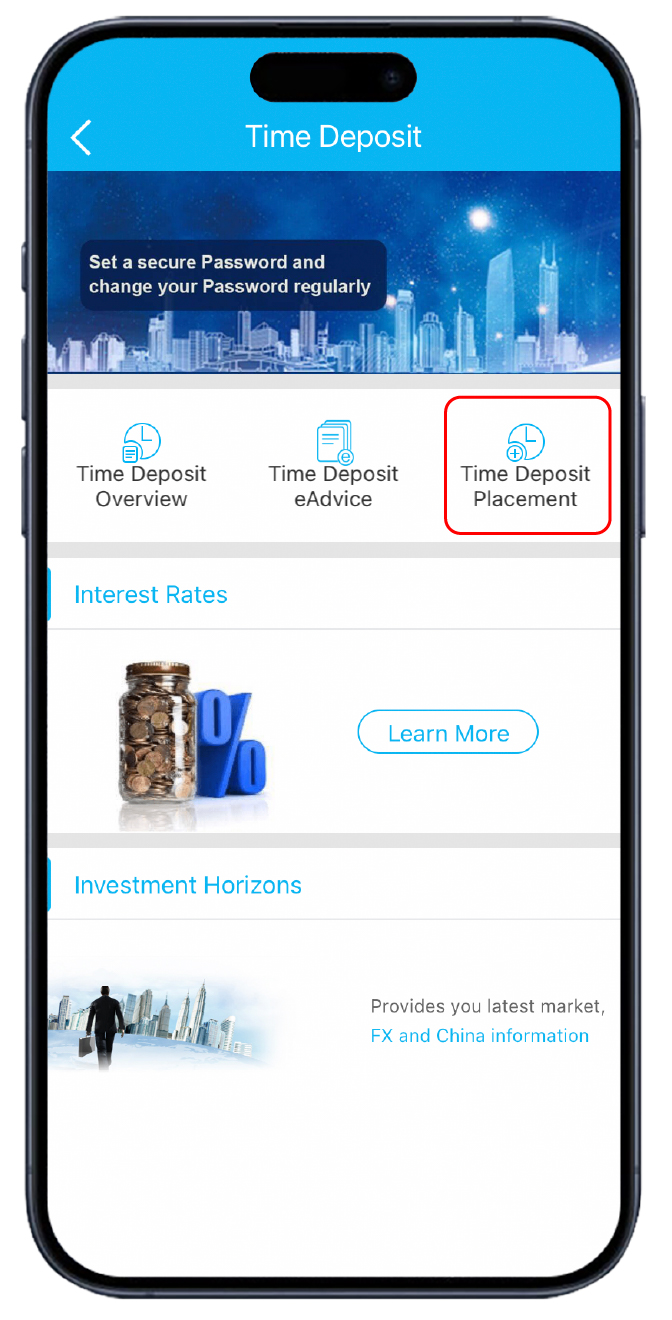

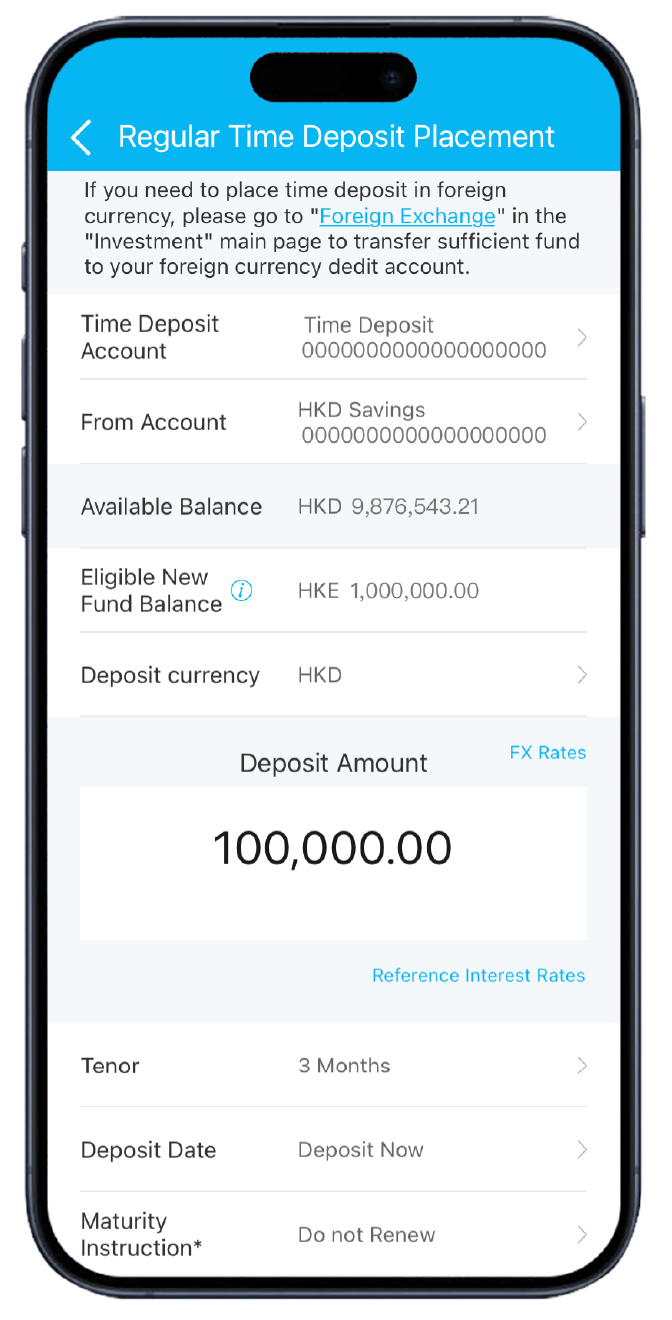

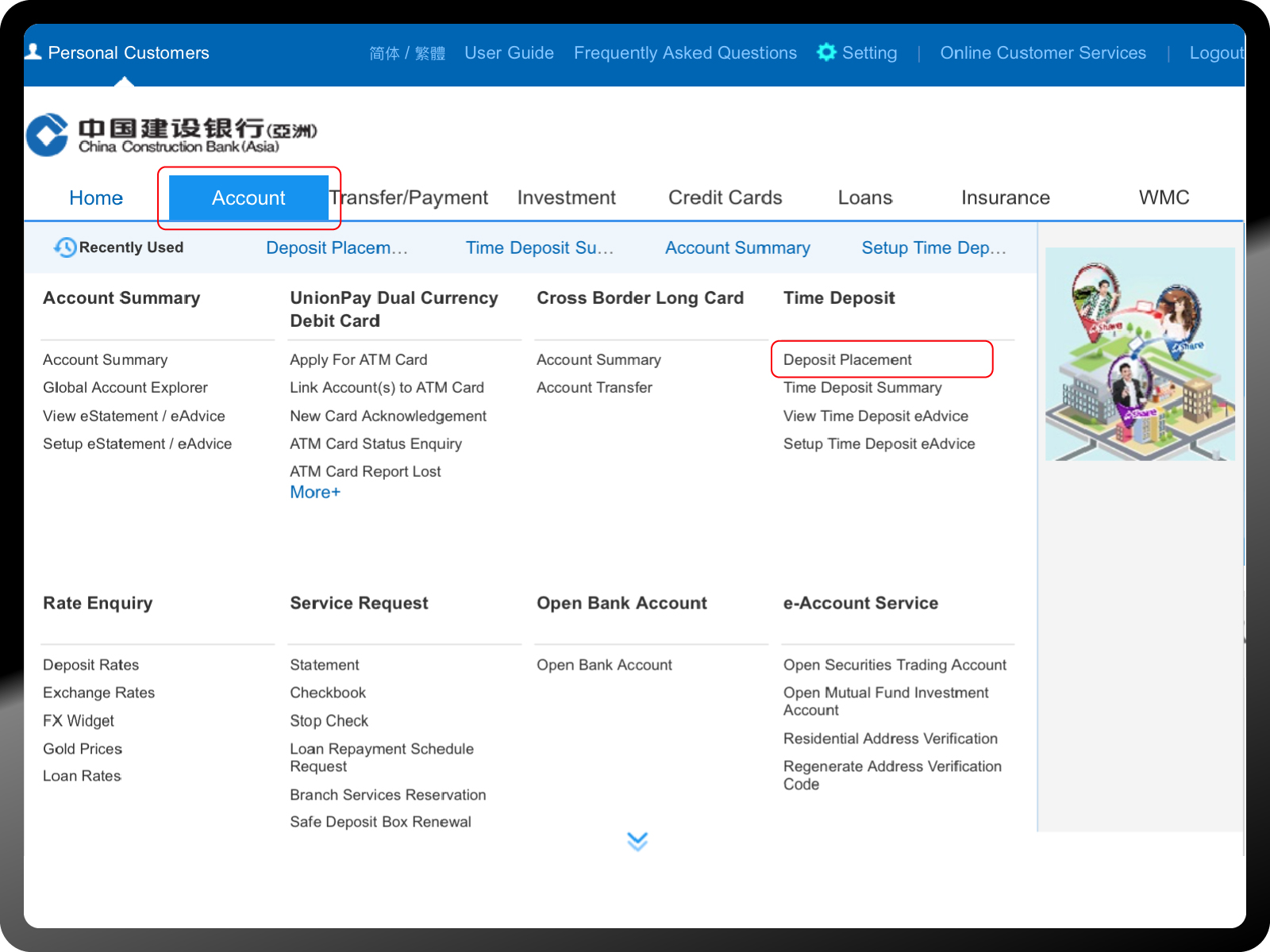

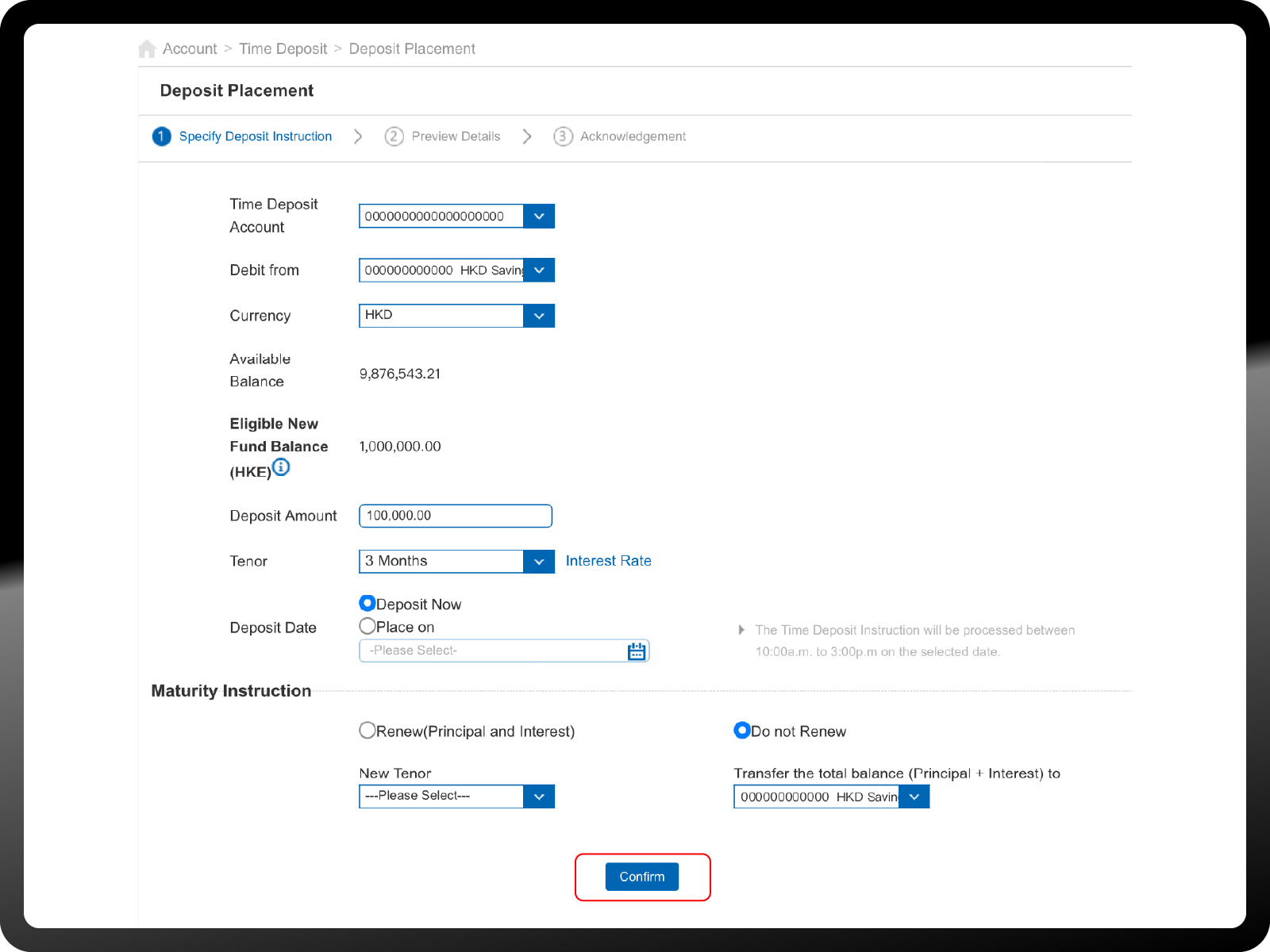

View Deposit Rates and Place a Time Deposit via e-Channels with just clicks away! (Demo)

- Time Deposit set up service hours:- Mobile Banking and Online Banking: 6am to 11pm, Mondays to Fridays (excluding public holidays)

Customer must currently hold a Time Deposit Account with the Bank in order to place time deposits via Online Banking or Mobile Banking. For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank’s branches for account opening.

Note:

(1) The above deposit interest rates are for reference only.

(2) For savings account/time deposit, interest is calculated on the following year basis: Hong Kong Dollar, Pound Sterling and Singapore Dollar – 365 days (including leap year). For other currencies - 360 days.

Risk Disclosure

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.