Money Safe

Protect your savings from scams

An extra layer of security to keep your savings secured

Money Safe is the latest anti-fraud and scam measure introduced by the

Hong Kong Monetary Authority (HKMA).

It provides an extra security for your bank deposits. You can lock the fund under Money Safe. The funds subject to Money Safe will be restricted from fund outflows via any transaction types and channels, including cash withdrawal, FPS, local and cross-border transfers, etc., lower the risk of scammers instantly transferring funds outs of the accounts.

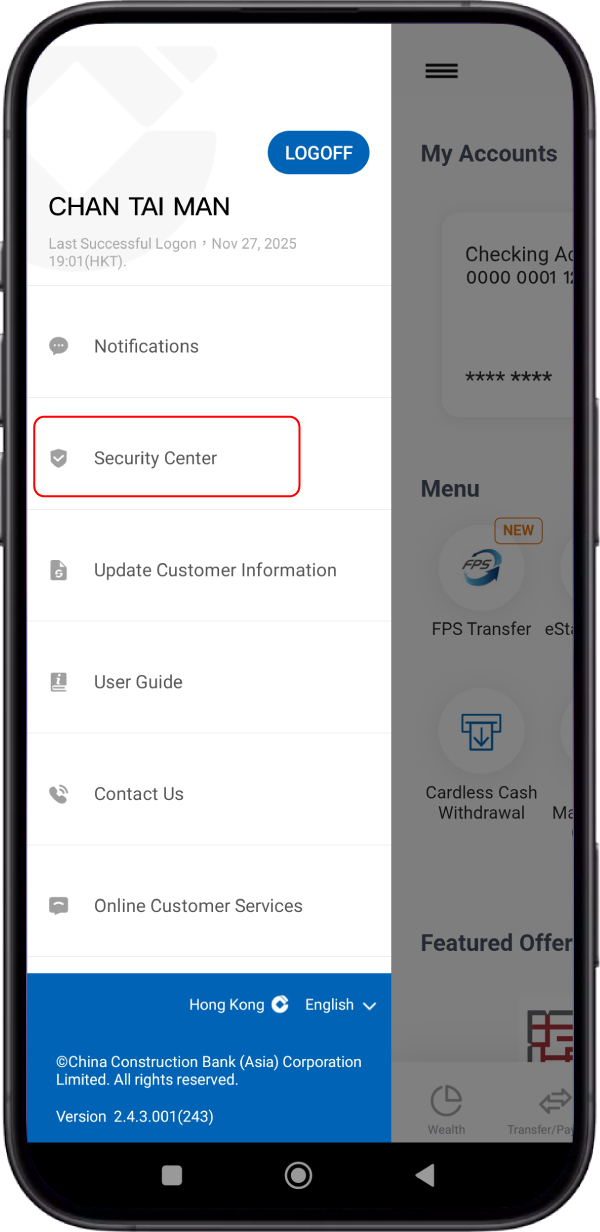

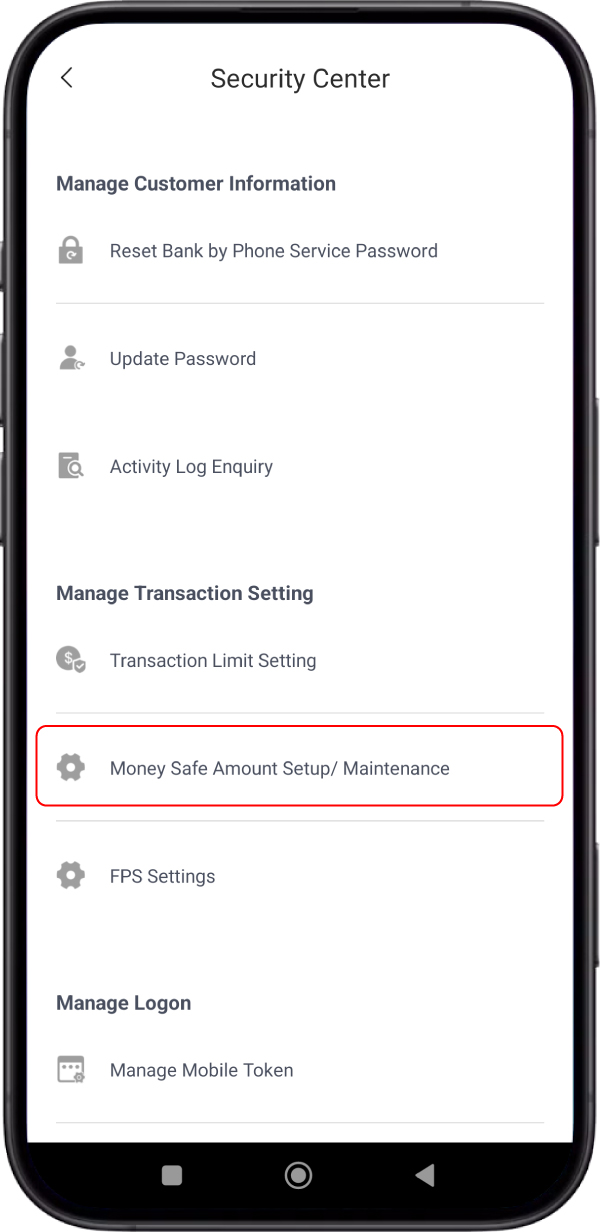

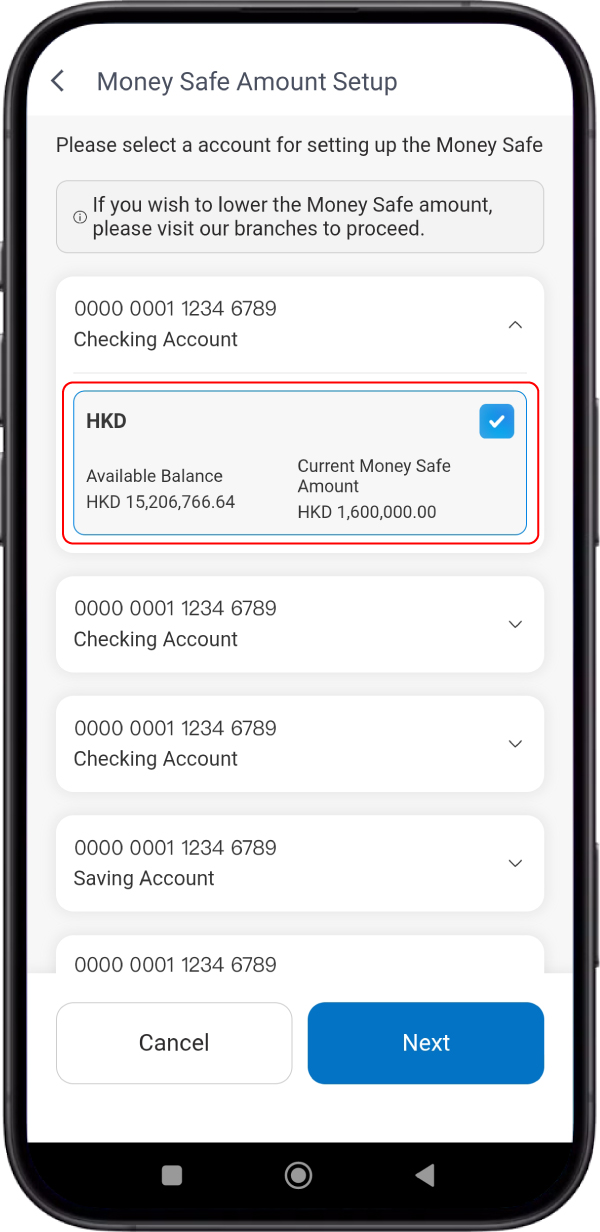

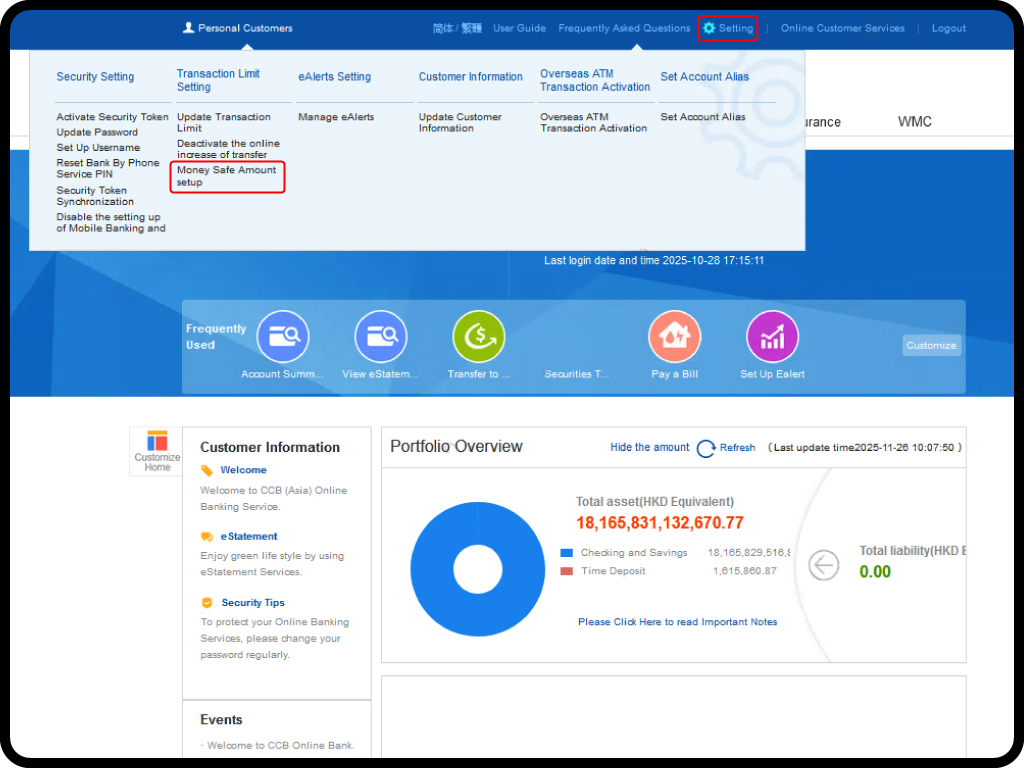

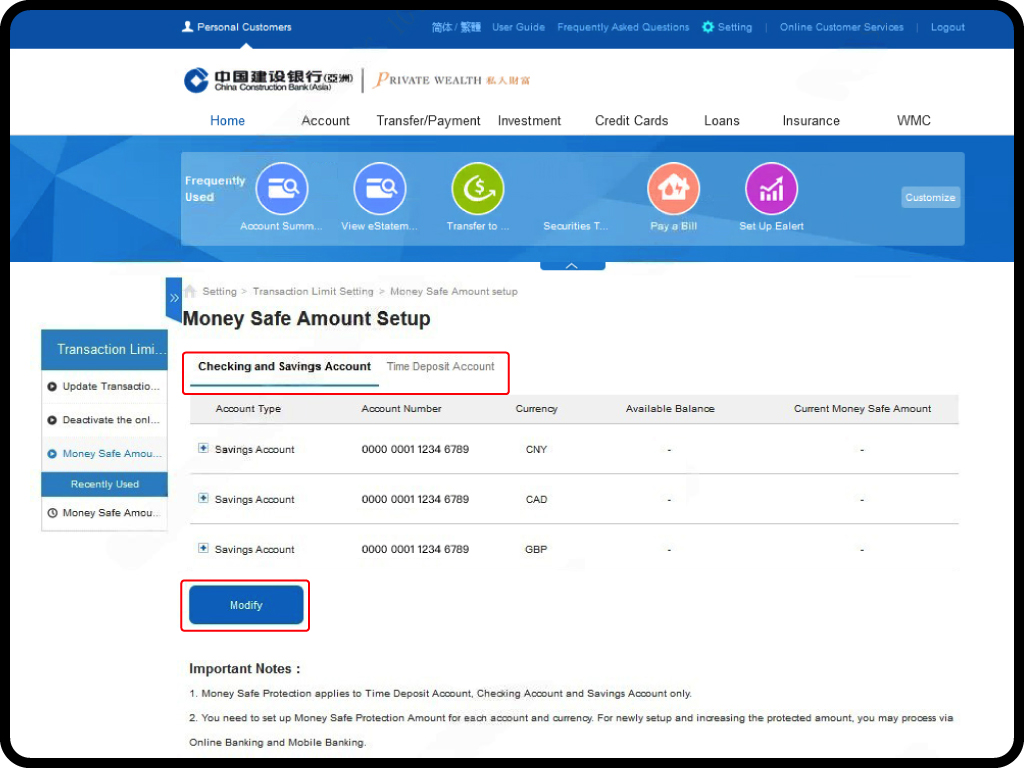

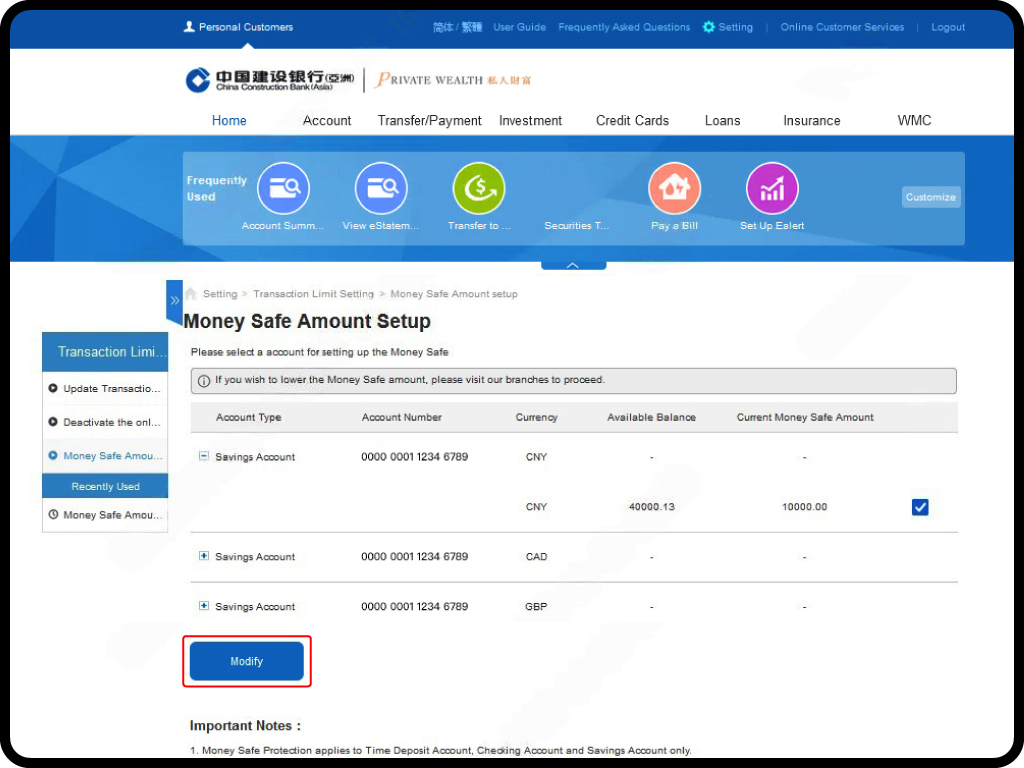

- You can activate or increase the funds subject to Money Safe via online banking, mobile banking or visit branch in person.

- Providing extra protection as you must visit the branch for verification in person to unlock or reduce the Money Safe amount.

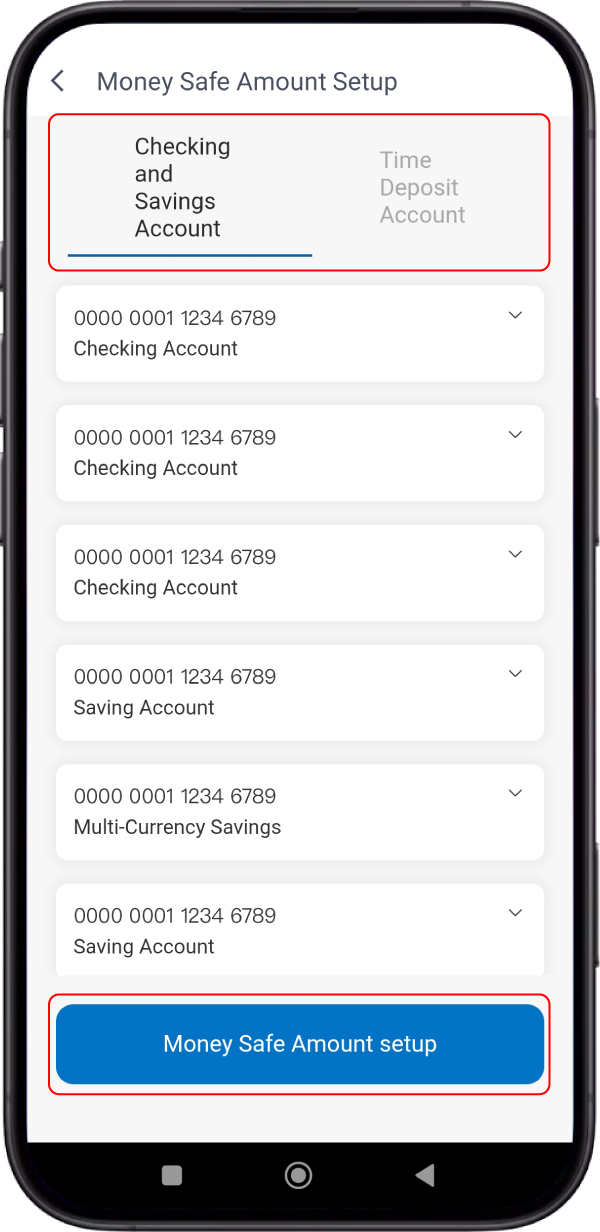

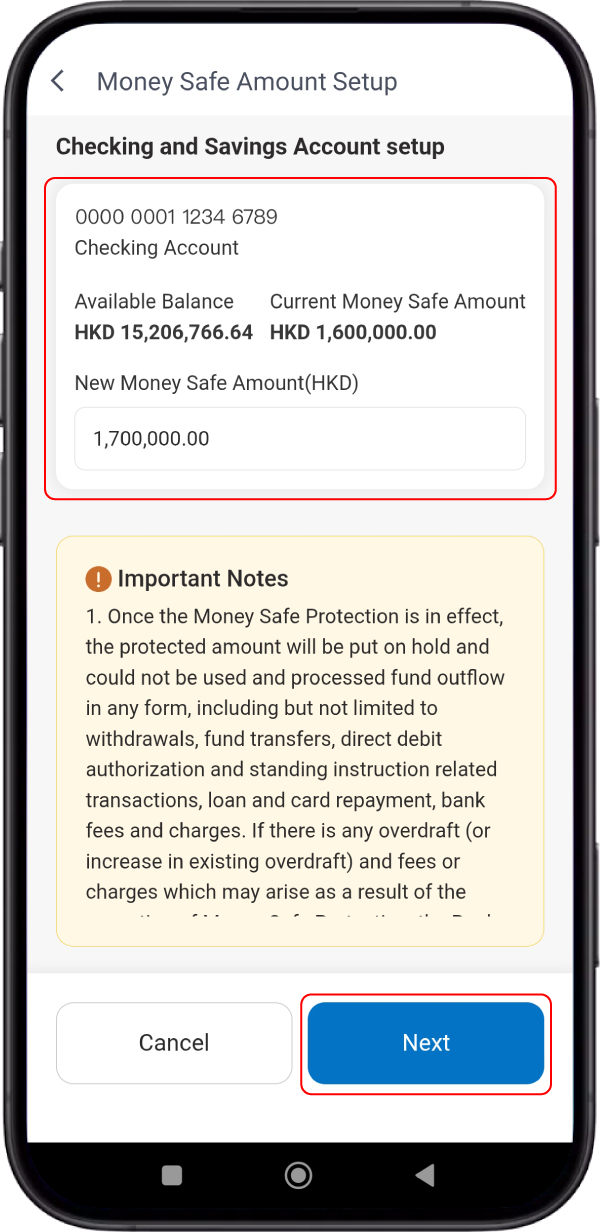

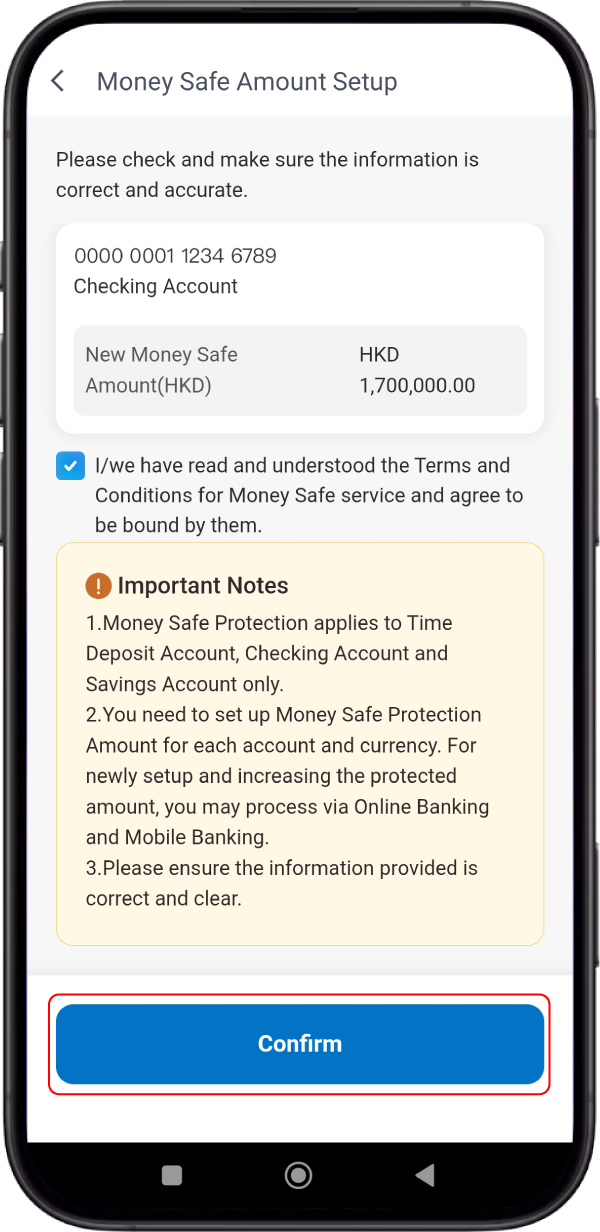

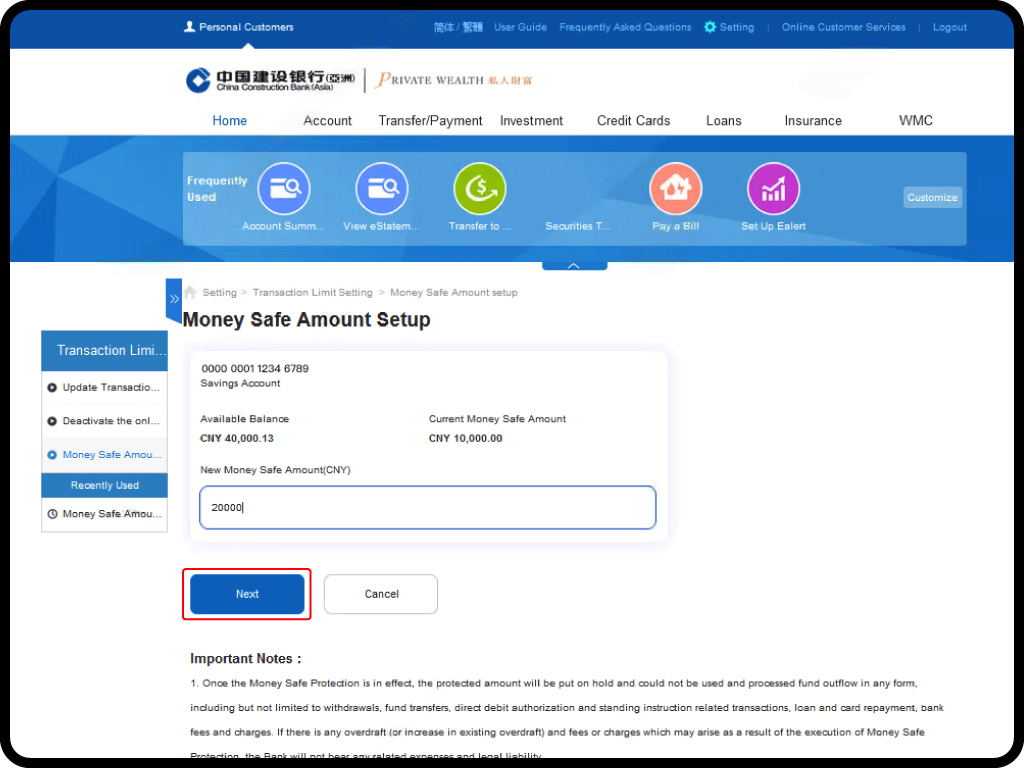

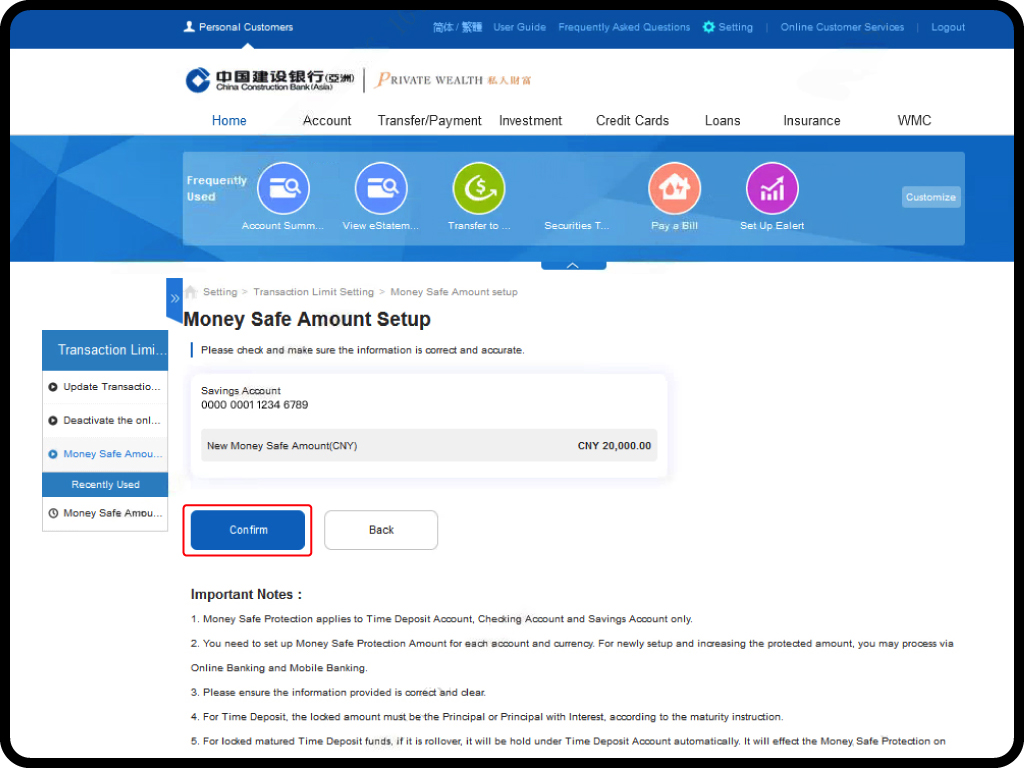

by Just Few Simple Steps

- What types of accounts will Money Safe apply to?

- Is Money Safe for HKD only?

- Could I raise one request and set up Money Safe amount for all my accounts?

- How could I set up the Money Safe amount?

- How could I release Money Safe?

- Could I release the Money Safe by Online Banking, Mobile Banking, ATM, Smart Teller Machine or Hotline?

- When will it be effective after submitting the Money Safe application?

- Will there be any alert after the Money Safe has been set up?

- Will there be any minimum or maximum Money Safe amount?

Checking and Savings account:

Minimum amount: HKD10,000 or equivalent.

Maximum amount: up to the account balance at that time you make the request.

Time Deposit:

Only Principal (P) or Principal + Interest (P+I).

If you are going to branch for Money Safe setup, please make sure the account balance is sufficient.

- I may not be able to visit branch in person in coming couple of months to release the Money Safe amount, but I may need to use the funds. What should I do?

- I am very old and may not be able to go to branch by myself. If I have set up Money Safe and need to get it released, what should I do?

- Is Money Safe applicable to joint account?

- What will be the difference after I set up Money Safe in my Checking or Savings Account(s)?

- If there is any penalty induced for unsuccessful Autopay due to insufficient balance as part of the fund is locked by Money Safe under the particular account, will I be compensated?

- Will there be any change of interest rate for the account after setting up Money Safe?

- How to deal with the Checking account with overdraft?

- Time Deposit has locked the fund. How could it be protected by Money Safe?

- Will Time Deposit with Money Safe be released automatically on maturity?

- If only the principal is to be rolled over, the principal will be auto locked in Time Deposit account.

- If it is Principal and Interest to roll over, the principal and interest in full will be auto locked in Time Deposit account. If the matured Time Deposit is transferred to Checking or Savings account, the fund will be locked in that Checking or Savings account.

- However, if the Checking account has been approved for overdraft line, the subject amount will be hold and bear the lowest savings interest rate as determined by the Bank from time to time and customer should contact the branch and transfer the fund to another account for setting up Money Safe amount.

- If the Time Deposit maturity instruction is to transfer the Principal and Interest to the Checking account with approved overdraft, what will my matured Time Deposit go to?

- If I could not recall that I have set up Money Safe for a Time Deposit. How could I check?

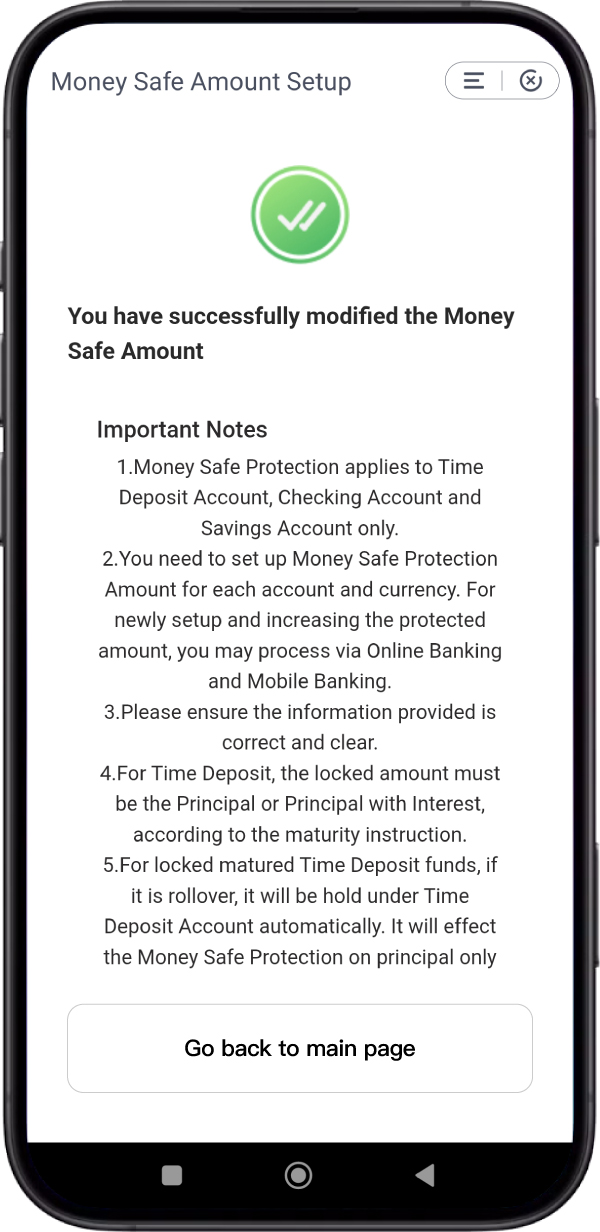

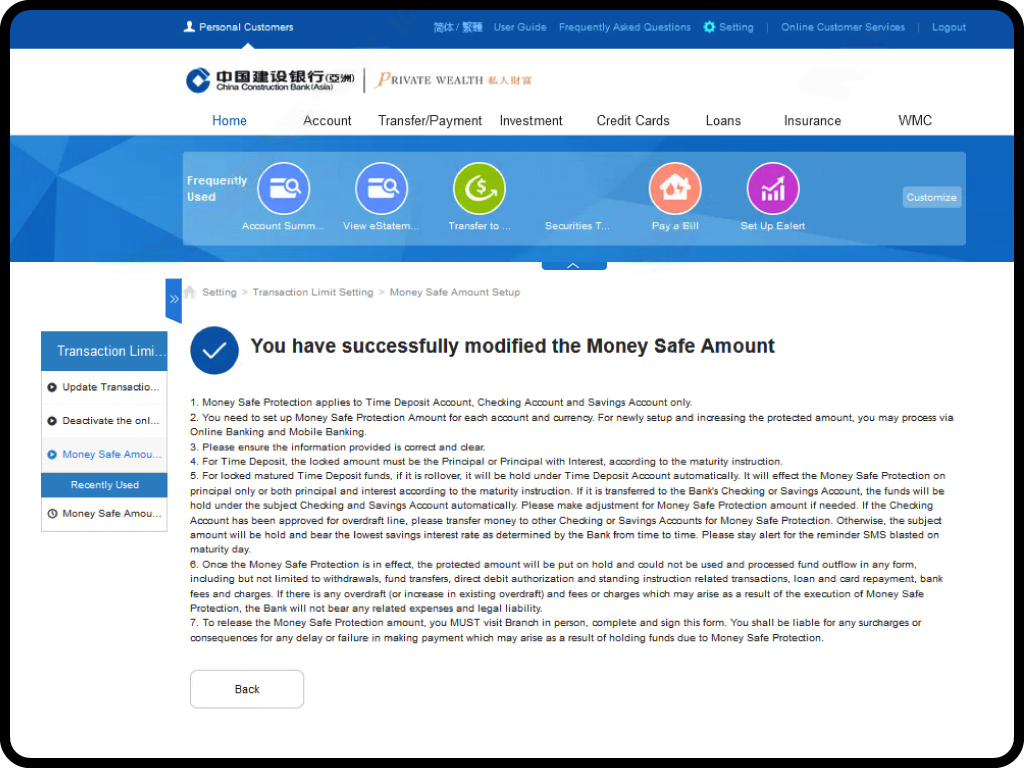

- Money Safe Protection applies to Time Deposit Account, Checking Account and Savings Account only.

- You need to set up Money Safe amount for each account and currency. For newly setup and increasing the protected amount, you may process via Online Banking and Mobile Banking.

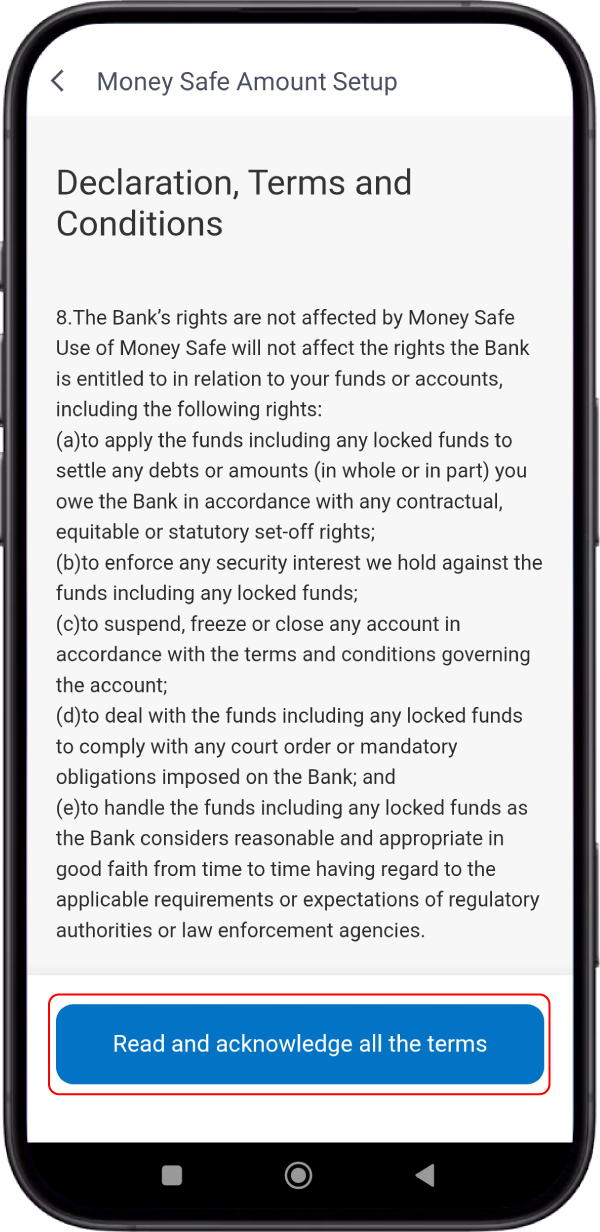

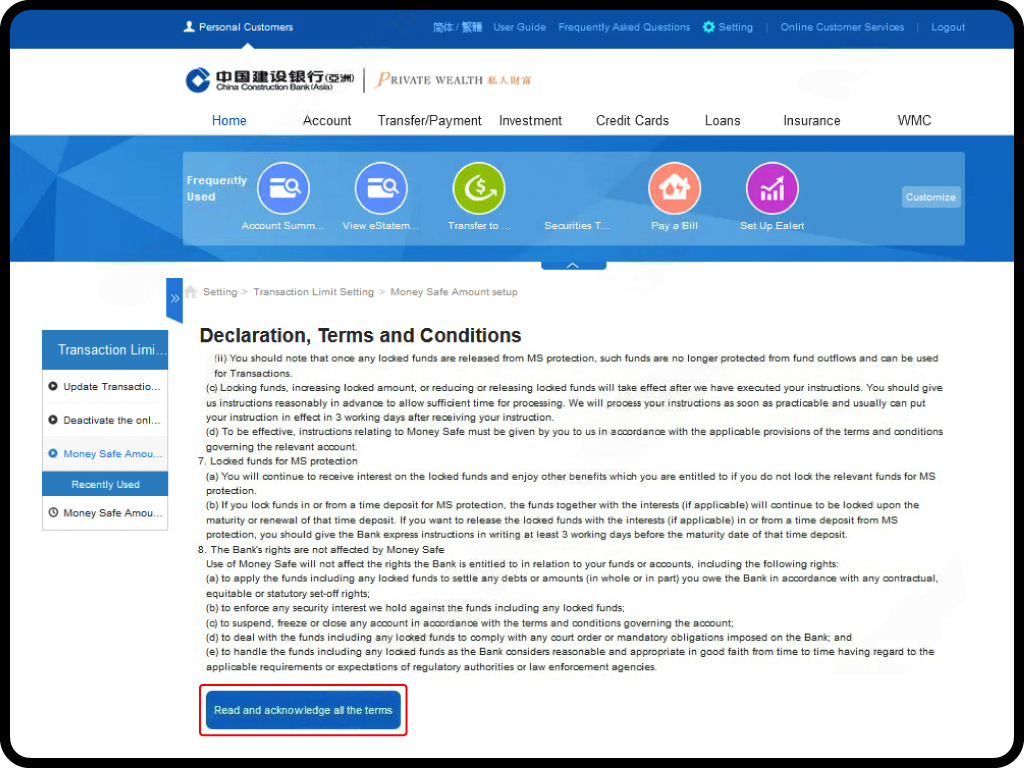

- Please ensure the information provided is correct and clear.

- For Time Deposit, the locked amount must be the Principal or Principal with Interest, according to the maturity instruction.

- Please input or state the amount for the designated account to be protected one by one directly for newly setup or adjustment. The minimum amount is HKD 10,000 or equivalent. If you would like to release Money Safe protection, please input of state "0".

- For locked matured Time Deposit funds, if it is rollover, it will be hold under Time Deposit Account automatically. The Money Safe will cover either the principal only or both principal and interest according to the maturity instruction. If it is transferred to the Bank's Checking or Savings Account, the funds will be hold under the subject Checking and Savings Account automatically. Please make adjustment for Money Safe amount if needed. If the Checking Account has been approved for overdraft line, please transfer money to other Checking or Savings Accounts for Money Safe Protection. Otherwise, the subject amount will be hold and bear the lowest savings interest rate as determined by the Bank from time to time. Please stay alert for the reminder SMS blasted on maturity day.

- Once the Money Safe Protection is in effect, the protected amount will be put on hold and could not be used and processed fund outflow in any form, including but not limited to withdrawals, fund transfers, direct debit authorization and standing instruction related transactions, loan and card repayment, bank fees and charges. If there is any overdraft (or increase in existing overdraft) and fees or charges which may arise as a result of the execution of Money Safe Protection, the Bank will not bear any related expenses and legal liability.

- To release the Money Safe Protection, you MUST visit Branch in person, complete and sign the form. You shall be liable for any surcharges or consequences for any delay or failure in making payment which may arise as a result of holding funds due to Money Safe Protection.