Set Up HKD Time Deposit Through e-Channels

Enjoy 0.10% Bonus Interest Rate (p.a.)

Simply follow a few easy steps to make your money grow! From December 1, 2023 to December 31, 2023, CCB (Asia) customers who successfully set up a new eligible time deposit1 via the Bank’s e-Channels (including Mobile Banking or Online Banking)2, can enjoy Bonus Interest Rate. Act now!

| Time Deposit Currency | Deposit Tenor | Time Deposit Amount | e-Channels Time Deposit Bonus Interest Rate (p.a.)3 |

| HKD | 1 month | Below HKD1,000,000 | +0.10% |

Remarks:

- NOT applicable to Time Deposit renewals, including Renewal (Principal and Interest), Renewal (Renew Principal Only), Renewal (Change Principal Amount) and Renewal (Change Tenor).

- Customer must hold a Time Deposit Account with the Bank in order to place time deposits via the Bank’s e-Channels (including Mobile Banking or Online Banking). For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank's branches for account opening.

- The e-Channels time deposit bonus interest rate (p.a.) is included in the time deposit interest rate (p.a.) published in the aforesaid e-Channels (“e-Channels Time Deposit Preferential Interest Rate”). The above time deposit bonus interest rate is quoted as of November 30, 2023 which is for reference only and subject to change. The relevant interest rate will be subject to the rate quoted by the Bank in the aforesaid e-Channels from time to time.

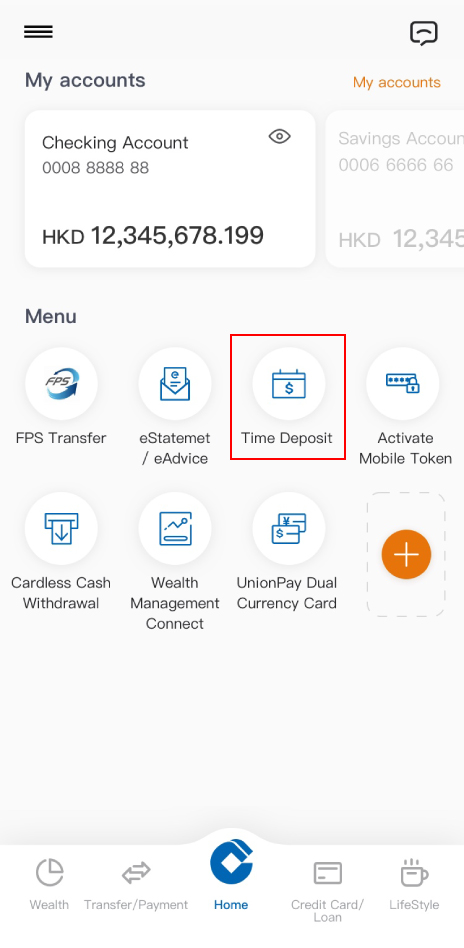

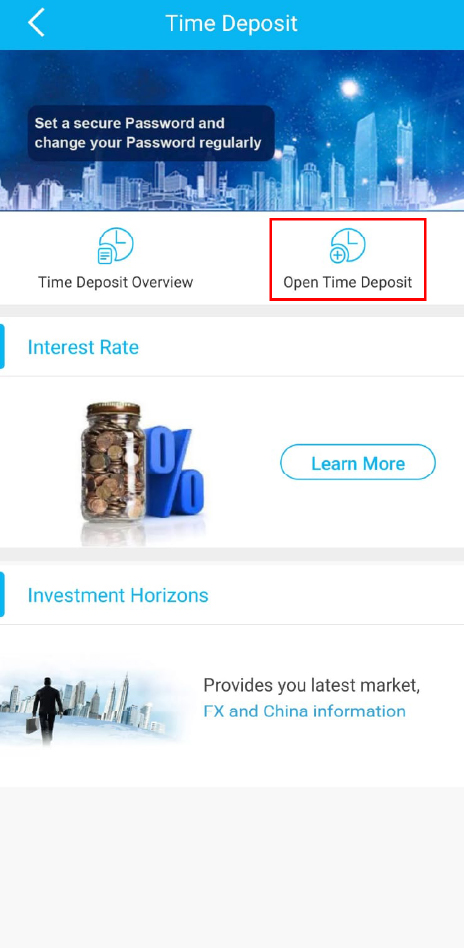

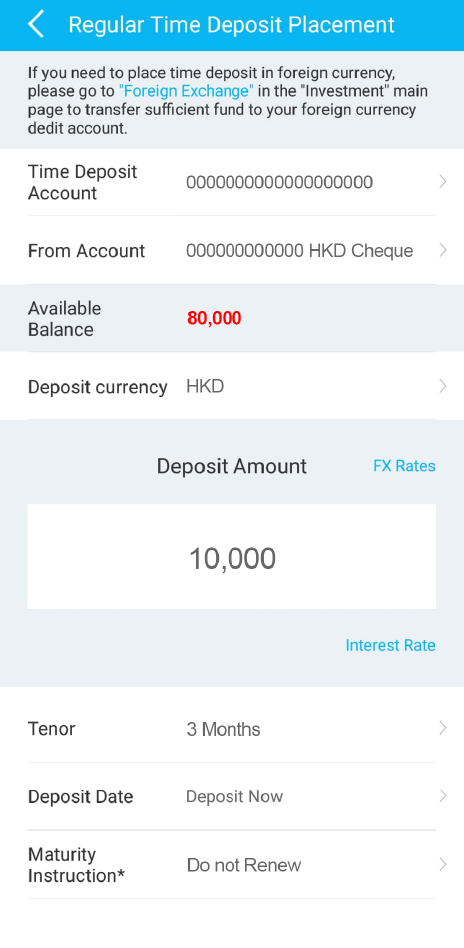

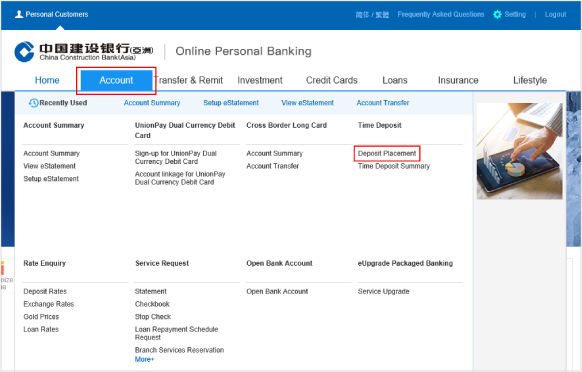

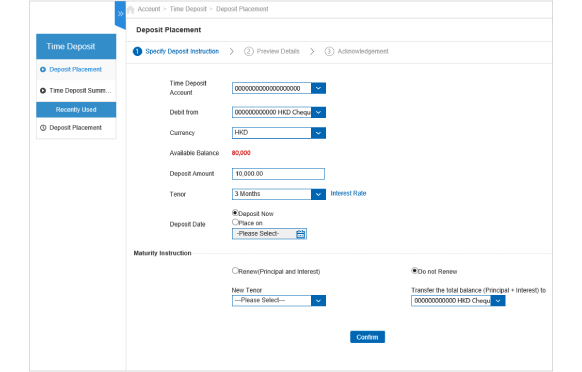

Demo of Placing a Time Deposit via e-Channels of Just Clicks Away

- Time Deposit set up service hours:- Mobile Banking and Online Banking: 9am to 6pm, Mondays to Fridays

Act Now and Enjoy Preferential Interest Rate!

Existing customers who hold a Time Deposit Account with the Bank

Set up a Time Deposit

via Online Banking Now

via Online Banking Now

If you have not yet registered for Online Banking/ Mobile Banking?

Register for Online Banking /

Mobile Banking Now

Mobile Banking Now

Warm Reminder

Customer must currently hold a Time Deposit Account with the Bank in order to place time deposits via Online Banking or Mobile Banking. For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank’s branches for account opening.

Customer must currently hold a Time Deposit Account with the Bank in order to place time deposits via Online Banking or Mobile Banking. For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank’s branches for account opening.

The above offers and services are bound by related terms and conditions, please refer to the following terms and conditions.

Enquiry Hotline : 2903 8303

Terms & Conditions

Terms and Conditions for e-Channels Time Deposits Promotion (the “Promotion”):

- The promotion period is from December 1, 2023 to December 31, 2023 (both dates inclusive) (“Promotion Period”).

- The Promotion is only applicable to personal banking customers of China Construction Bank (Asia) Corporation Limited (the “Bank”), but not applicable to the corporate customers, Commercial Banking customers and Capital Investment Entrant Scheme customers of the Bank.

- During the Promotion Period, Eligible Customer who successfully set up a new Eligible Time Deposit as specified in the table below by single name account through Online Banking or Mobile Banking (“e-Channels”) of the Bank can enjoy the following bonus interest rate (p.a.) (“e-Channels Time Deposit Bonus Interest Rate”).

Time Deposit Currency Deposit Tenor Time Deposit Amount e-Channels Time Deposit

Bonus Interest Rate (p.a.)HKD 1 month Below HKD1,000,000 +0.10% - Eligible Customer must currently hold a Time Deposit Account with the Bank in order to set up time deposit via the e-Channels. For customers who do not hold the Time Deposit Account, please call our Relationship Managers or visit the Bank’s branches for account opening.

- The e-Channels Time Deposit Bonus Interest Rate is included in the time deposit interest rate shown in the e-Channels (“e-Channels Time Deposit Preferential Interest Rate”). The relevant interest rate will be subject to the rate quoted by the Bank in e-Channels from time to time.

- For any time deposit which is set up through any channel of the Bank other than the e-Channels (e.g. by calling our Relationship Managers, branches or Phone banking etc.) will not be eligible for the e-Channels Time Deposit Bonus Interest Rate.

- The e-Channels Time Deposit Preferential Interest Rate is calculated based on the amount of each individual time deposit transaction. No aggregation of deposit amounts will be applied.

- The Promotion is not eligible to Time Deposit renewals, including Renewal (Principal and Interest), Renewal (Renew Principal Only), Renewal (Change Principal Amount) and Renewal (Change Tenor).

- Any withdrawal or partial withdrawal of a time deposit prior to maturity of the time deposit without sufficient prior notice shall only be permitted at the discretion of the Bank. The Bank may levy a charge and/or forfeit the interest accrued on the deposit in whole or in part in such instances.

- If the maturity date of the time deposit period falls on a day which is not a Business Day (as defined below), the maturity date of the time deposit and / or the automatic roll-over instruction of the time deposit will be deferred to the following Business Day without prior notice. The Bank will not be responsible to any person for the deferral of the time deposit maturity date and/or the automatic roll-over instruction. “Business Day" means a day on which the Bank is open for business in Hong Kong, but excluding Saturdays, Sundays, public holidays and the day which the Bank is unable to open for business due to extreme weather or sudden event.

- The Promotion cannot be used in conjunction with any other promotions.

- The Bank reserves the right to vary, modify and terminate the Promotion and to amend any of these terms and conditions from time to time without prior notice. In case of dispute, the decision of the Bank shall be final and binding.

- If there is any inconsistency or conflict between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

Time Deposit with tenor not more than 5 years is a deposit qualified for protection by the Deposit Protection Scheme in Hong Kong.