Get a 999.9 Pure Gold Ingot for Foreign Exchange

Get a 999.9 Pure Gold Ingot for FX reaching designated amounts and enjoy up to 16.8% p.a. Foreign Exchange Time Deposit Interest Rate

During the promotion period from now until March 31, 2026, eligible customers1 can enjoy the following FX offers!

Get a

or

or Cash Reward for FX reaching designated amounts

FX Transaction Amount (HKD or equivalent) |

|

| HK$6,000,000 | |

| HK$2,000,000 | |

| HK$300,000 |

Foreign Exchange Time Deposit Interest Rate

Foreign Exchange Time Deposit Interest Rate | Time Deposit Currency | 1-week Time Deposit Interest Rate (p.a.) Offer* | ||

| Customers who Fulfill the “Preferential Time Deposit Interest Rate” |

|||

| RMB / HKD / AUD / NZD / USD / GBP / JPY / EUR / CHF / CAD / SGD | GBP | 16.80% | 13.80% |

| NZD | |||

| AUD | |||

| CAD | 13.80% | 10.80% | |

| USD | 10.80% | 8.80% | |

| RMB | |||

| JPY | 4.80% | 2.80% | |

FX spread discount6 of up to 40% with no cap!

| FX Spread Discount | ||||

| Private Banking Customers | Premier Banking / Private Wealth Customers | Wise Banking Customers | ||

| Mobile Banking/ Online Banking | 40% | 30% | 20% | 10% |

| Others | 30% | 20% | 10% | N/A |

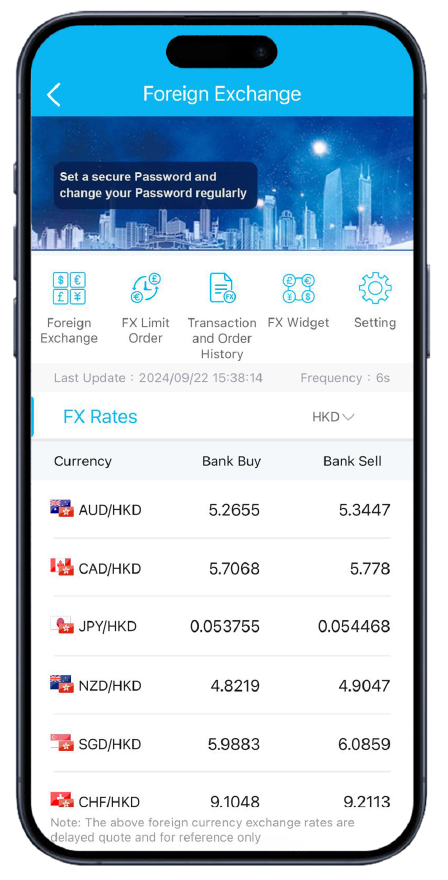

FX Price Alert: Receive SMS and/or email notifications immediately when your preset target exchange rate has been reached.

FX

- For the definition of eligible customer for each offer, please refer to the following terms and conditions.

- Only applicable to personal customers of Personal Banking, Private Wealth and Private Banking who have not conducted any FX transactions via any channels of the Bank in sole name or joint name account from January 1, 2025 to December 31, 2025.

- Exclude FX transactions between HKD and USD, and FX transactions made via remittance, mutual fund subscription, bill payment service and transfers via Cross Border Long Card.

- “New customers” refers to customers who become the Bank’s customers within the Promotion Period, and have not maintained any accounts in sole name or joint name and used any banking products or services (excluding credit card account and Wealth Management Connect “Southbound Scheme” account) of the Bank between January 1, 2025 and December 31, 2025 (both dates inclusive).

- “Preferential Time Deposit Interest Rate” is only applicable to customers who fulfill either one of the following criteria:

- During the Promotion Period, personal customers of Private Wealth or Private Banking of the Bank who place the Time Deposit with amount reaching HK$500,000 equivalent or above; or

- Personal customers of Personal Banking of the Bank who:

- do not hold any deposit of the time deposit currency on the Time Deposit placement date; or

- set up Direct Debit Authorization (DDA) payment instruction during the Promotion Period.

- "FX Spread Discount" refers to the percentage discount on FX profit spread normally charged by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived. The above FX Spread Discount is for reference only and may subject to changes from time to time without prior notice. When customers conduct FX transactions, the exchange rates will be automatically adjusted to preferential exchange rates with FX spread discount.

Terms and Conditions for Foreign Exchange (“FX”) Promotion (the “Promotion”)

A. General Terms and Conditions:

- Unless otherwise specified, the promotion period of this Promotion is from January 1, 2026 to March 31, 2026 (both dates inclusive) (the “Promotion Period”).

- China Construction Bank (Asia) Corporation Limited (the “Bank”) reserves the right to vary, suspend and terminate the Promotion and to vary or modify any of these Terms and Conditions from time to time without prior notice. In case of disputes, the decision of the Bank shall be final and binding.

- If there is any inconsistency between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

B. Terms and Conditions for Get a 999.9 Pure Gold Ingot for Foreign Exchange (“Offer 1”):

- Offer 1 is only applicable to personal customers of Personal Banking, Private Wealth and Private Banking of the Bank, but not applicable to staff of the Bank and the Bank’s affiliates, Corporate customers, Commercial Banking customers, Capital Investment Entrant Scheme customers and investors participated in the Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area of the Bank.

- For accounts in joint names, only the primary account holders will be eligible for Offer 1.

- Offer 1 is only applicable to the personal customers who have not conducted any FX transactions via any channels of the Bank in sole name or joint name accounts from January 1, 2025 to December 31, 2025 (“Offer 1 Eligible Customer(s)”).

- During the Promotion Period, Offer 1 Eligible Customers who have exchanged designated currencies (excluding FX transactions between HKD and USD, and FX transactions conducted via remittance, mutual fund subscription/ switching/ redemption, bill payment service and transfer via Cross Border Long Card) via the Bank’s Mobile Banking or Online Banking (“Eligible FX Transaction(s)”) and have fulfilled the designated cumulative Eligible FX Transaction amounts can enjoy Reward for FX transactions, details as follow:

Cumulative Eligible FX Transaction Amount (HKD or equivalent) Reward for FX transactions $6,000,000 A 5-gram 999.9 Pure Gold Ingot $2,000,000 A 1-gram 999.9 Pure Gold Ingot $300,000 HK$150 Cash Reward - “New customers” refers to customers who become the Bank’s customers within the Promotion Period, and have not maintained any accounts in sole name or joint name and used any banking products or services (excluding credit card account and Wealth Management Connect “Southbound Scheme” account) of the Bank between January 1, 2025 and December 31, 2025 (both dates inclusive).

- New Customers who entitle to the Reward for FX transactions mentioned in clause 4 above can enjoy an extra USD30 Cash Reward (“New Customer Reward”).

- If the Eligible FX Transaction does not involve HKD, the HKD equivalent cumulative transaction amount will be calculated based on the exchange rate of the currency bought by the customer determined by the Bank on the date of transactions. In case of any disputes, the decision of the Bank on calculation of the transaction amount shall be final.

- Each Offer 1 Eligible Customer can enjoy the Reward for FX transactions once during the promotion period, while the New Customer can entitle to both Reward for FX transactions and New Customer Reward at the same time.

- The “999.9 Pure Gold Ingot” cannot be transferred, refunded, or exchanged for cash or other prizes. The “999.9 Pure Gold Ingot” is provided by supplier and subject to relevant terms and conditions. The Bank shall not act as, or assume any liability of, a supplier or its agent. Any claim, complaint, or dispute concerning the prizes must be referred to and resolved directly between the supplier and the winner, which shall in no way relieve such customer from his/her obligations to the Bank (if any).

- If the Offer 1 Eligible Customers are entitled to a 999.9 Pure Gold Ingot, the Bank will notify the Offer 1 Eligible Customers about the reward redemption arrangement by June 30, 2026. Offer 1 Eligible customers must redeem their prize during the validity period at designated location, while any delay would be treated as forfeited and no reissue would be arranged.

- If the Offer 1 Eligible Customers are entitled to Cash Rewards, the Bank will credit the cash reward to the Offer 1 Eligible Customer’s Packaged Banking Settlement Account, the HKD and/or USD Savings / Checking account (excluding “Step Up Savings Account”) with the latest account opening date or Multi-Currency Savings account maintained with the Bank on or before 30 June, 2026. Such account must be valid at the time of crediting the cash reward, otherwise, the cash reward will be forfeited.

- Offer 1 Eligible Customers must maintain the Bank’s account at the time of receiving the Reward for FX transactions, otherwise, the Reward for FX transactions will be forfeited.

C. Terms and Conditions for Foreign Currency Exchange & Time Deposit Promotion (“Offer 2”):

- Offer 2 is only applicable to personal customers of Personal Banking, Private Wealth and Private Banking of the Bank (“Offer 2 Eligible Customer(s)”), but not applicable to Corporate customers, Commercial Banking customers, investors participated in the Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area and Capital Investment Entrant Scheme customers of the Bank.

- During the Promotion Period, Offer 2 Eligible Customers who exchange a designated currency in the amount ranging from HK$100,000 to HK$50,000,000 equivalent to any time deposit currency and simultaneously place a 1-week Time Deposit with the exchanged currency in its entire amount traded (“Eligible Time Deposit”) by visiting our branches or via phone call (“Designated Channels”), can enjoy below time deposit interest rate (p.a.)* offer (“Time Deposit Interest Rate Offer”). Offer 2 Eligible Customers who fulfill either one of the criteria mentioned in clause 2.1 below can enjoy bonus interest rate (p.a.) (the “Preferential Time Deposit Interest Rate”)* :

2.1Criteria to enjoy the “Preferential Time Deposit Interest Rate” include:

- During the Promotion Period, personal customers of Private Wealth or Private Banking of the Bank who place the Time Deposit with amount reaching HK$500,000 equivalent or above; or

- Personal customers of Personal Banking of the Bank who:

- do not hold any deposit of the time deposit currency on the Time Deposit placement date; or

- set up Direct Debit Authorization (DDA) payment instruction during the Promotion Period.

Designated Currency Time Deposit Currency 1-week Time Deposit Interest Rate (p.a.)* Offer Offer 2 Eligible Customers who Fulfill the “Preferential Time Deposit Interest Rate” Criteria Other Offer 2 Eligible Customers RMB / HKD / AUD / NZD / USD / GBP / JPY / EUR / CHF / CAD / SGD GBP 16.80% 13.80% NZD AUD CAD 13.80% 10.80% USD 10.80% 8.80% RMB JPY 4.80% 2.80% *The above Time Deposit Interest Rates (p.a.) are for reference only but not guaranteed and it will be subject to changes in rates quoted by the Bank from time to time. Before making the relevant transaction, please check with our Bank’s staff for the effective Time Deposit Interest Rate (p.a.) applicable to the transaction.

- The Time Deposit Interest Rate Offer is not applicable to the time deposits and exchange transactions conducted through channels other than the Designated Channels specified above, e.g. mobile banking, online banking, phone banking and/or Smart Teller Machine etc.

- The exchange rate will be the daily exchange rate as provided by the Bank’s branches from time to time, once the customer and the Bank agreed and confirmed the exchange rate, it will be binding and irrevocable, notwithstanding that the Bank may quote a different exchange rate through other channels.

- The Time Deposit Interest Rate Offer is calculated based on the transaction amount per deposit transaction. The transaction amount cannot be aggregated.

- Any withdrawal or partial withdrawal of a time deposit of Offer 2 Eligible Customers prior to maturity of the foreign currencies time deposit without sufficient prior notice shall only be permitted at the discretion of the Bank. The Bank may levy a charge and/or forfeit the interest accrued on the foreign currencies deposit in whole or in part in such instances.

- If a Typhoon No. 8 or above signal or a black rainstorm warning is hoisted on the (i) time deposit set-up date or maturity date with renewal instruction, the instruction will be processed on the next business day; (ii) maturity date with non-renewal instruction, the matured deposits will be credited into the designated account on the maturity date. The prevailing deposit rate and exchange rate on the time deposit set-up date or renewal date (at such time as the Bank determines) will apply.

- If the maturity date of the time deposit period falls on a day which is not a Business Day (as defined below), the maturity date of the time deposit and / or the automatic roll-over instruction of the time deposit will be deferred to the following Business Day without prior notice. The Bank will not be responsible to any person for the deferral of the time deposit maturity date and/or the automatic roll-over instruction. “Business Day" means a day on which the Bank is open for business in Hong Kong, but excluding Saturdays, Sundays, public holidays and the day which the Bank is unable to open for business due to extreme weather or sudden event.

- Offer 2 cannot be used in conjunction with other interest rate offers.

D. Terms and Conditions for Selected FX Spread Discount (“Offer 3”):

- Offer 3 is only applicable to personal customers of Personal Banking, Private Wealth and Private Banking, investors participated in the Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area and Capital Investment Entrant Scheme customers of the Bank (“Offer 3 Eligible Customer(s)”), but not applicable to Corporate customers and Commercial Banking customers of the Bank.

- During the Promotion Period, Offer 3 Eligible Customers who conduct real-time FX transactions via the Bank at Telegraphic Transfer (TT) exchange rates can enjoy below FX Spread Discount:

Channel FX Spread Discount Private Banking Customers Premier Banking / Private Wealth Customers Wise Banking Customers Other Personal Customers Mobile Banking/ Online Banking 40% 30% 20% 10% Others 30% 20% 10% N/A - "FX Spread Discount" refers to the percentage discount on FX profit spread normally charged by the Bank. Other mark-up applied to the exchange rate for operational reasons however will not be waived.

- The above FX Spread Discount is for reference only and may subject to changes from time to time without prior notice.

- When customers conduct FX transactions, the exchange rates will be automatically adjusted to preferential exchange rates with FX Spread Discount.

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investment products are not equivalent to or alternative of time deposits. They are not protected deposits and are not protected by the Deposit Protection Scheme in Hong Kong. Some investment products may involve derivatives. Certain investment products may not be available in all jurisdictions and/or may be subject to restrictions. The investment decision is yours, but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should not invest based on this promotion material alone. Before making any investment decision, customers should consult their own independent professional financial, tax or legal advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products. The information is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

FX Linked Deposit

FX Linked Deposit - High Yield Deposit

FX Linked Deposit - High Yield Deposit is a structured product involving derivatives. It is not equivalent to or an alternative of time deposits. It is not a protected deposit, and is not protected by the Deposit Protection Scheme in Hong Kong. This product is an unlisted investment product and is not protected by the Investor Compensation Fund, customer is subject to the credit and insolvency risk of the Bank. Investing in this product is not the same as buying the linked currency directly. Its return is limited to the interest payable, which will be dependent on movements in some linked exchange rate. Whilst the possible return may be higher than conventional time deposits, it is normally associated with higher risks. When the fluctuation of the linked exchange rates differs from what the customer expected, the customer may have to bear the loss. FX Linked Deposit - High Yield Deposit is designed to be held till maturity, customer does not have the right to early terminate this product. There is no secondary market for the FX Linked Deposit - High Yield Deposit and it is not collateralized. The Bank can early terminate this product.

FX Linked Deposit - Principal Protected Deposit

FX Linked Deposit - Principal Protected Deposit is a structured product involving derivatives. It is not equivalent to or an alternative of time deposit. It is not a protected deposit, and is not protected by the Deposit Protection Scheme in Hong Kong. This product is an unlisted investment product and is not protected by the Investor Compensation Fund. This product is principal protected conditionally and is subject to the credit risk of the Bank. Investing in FX Linked Deposit – Principal Protected Deposit is not the same as directly buying the relevant currencies. Its return is limited to the interest payable, which will be dependent on movements in some linked exchange rate. The principal amount and the interest will be paid in the Deposit Currency. Besides, whether or not you will receive the high interest, if the Deposit Currency is not in your home currency, you may suffer a loss due to the currency risk originated by the Deposit Currency’s exchange rate fluctuations, which may offset or even exceed any potential gain. FX Linked Deposit is designed to be held till maturity, customer does not have the right to early terminate this product. There is no secondary market for the FX Linked Deposit - Principal Protected Deposit and it is not collateralized. You should also pay attention to the relevant market risk and the risk of early termination by the Bank upon occurrence of certain events.

(Only applicable to Swap Deposit) If Currency Event Designation by the Bank (i.e. occurrence of any event or existence of any condition, such as the imposition of exchange controls or monetary measures, such that the convertibility or transferability of the Deposit Currency and the Linked Currency becomes impossible, illegal or impracticable) occurs, the Bank has the right to early terminate the Swap Deposit and will pay the Mandatory Redemption Amount in the Deposit Currency (instead of the Repayment Amount) only to the customer on the Mandatory Redemption Date. The Mandatory Redemption Amount may be substantially less than the Principal Amount and in the worst case, is zero.

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.

Disclaimer

This promotion material is intended to be distributed in the Hong Kong Special Administrative Region (“Hong Kong”) for reference only, and shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any investment product in or outside Hong Kong. The promotion materials are issued by China Construction Bank (Asia) Corporation Limited which is a licensed bank regulated by the Hong Kong Monetary Authority, an approved insurance agent under the Insurance Ordinance (Chapter 41, Laws of Hong Kong) and a Registered Institution (CE No. AAC155) under the Securities and Futures Ordinance to carry on Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) Regulated Activities. This promotion material has not been reviewed by any regulatory authorities in Hong Kong.