Faster Payment System

One of the Pioneering Banks Launches “Payment Connect”

Real-time Currency Exchange and Fund Transfer between Mainland and Hong Kong

Without Service Charges

Real-time Currency Exchange and Fund Transfer between Mainland and Hong Kong Without Service Charges

CCB (Asia) is one of the pioneering banks in Hong Kong to launch the “Payment Connect”1, which enables customers using Faster Payment System (FPS) to conduct real-time RMB fund transfers to Mainland designated bank accounts2, as well as receive RMB or HKD fund transfers from Mainland bank accounts, without service charges. What’s more, we are the pioneer of providing real-time currency exchange service, which allows customers to make RMB exchanges directly from HKD accounts and complete fund transfers to Mainland banks via “Payment Connect” seamlessly, even if they do not have RMB account. This provides greater convenience for business people as well as personal users who travel frequently between the Mainland and Hong Kong. Henceforth, CCB (Asia) customers can make both local and cross-border fund transfers via FPS much easier!

Remarks:

- Please update the CCB (HK&MO) Mobile App to version 2.3.7.001 or above to use “Payment Connect”.

- Northbound payment from Hong Kong to the Mainland via “Payment Connect” are only applicable to Hong Kong Identity Card Holders. Southbound payment (from the Mainland to Hong Kong) via “Payment Connect” are only applicable to Mainland Identity Card Holders.

During the promotion period, eligible customers who complete the following tasks via the Bank’s Online Banking/ Mobile Banking can enjoy a HK$100 cash reward:

Task

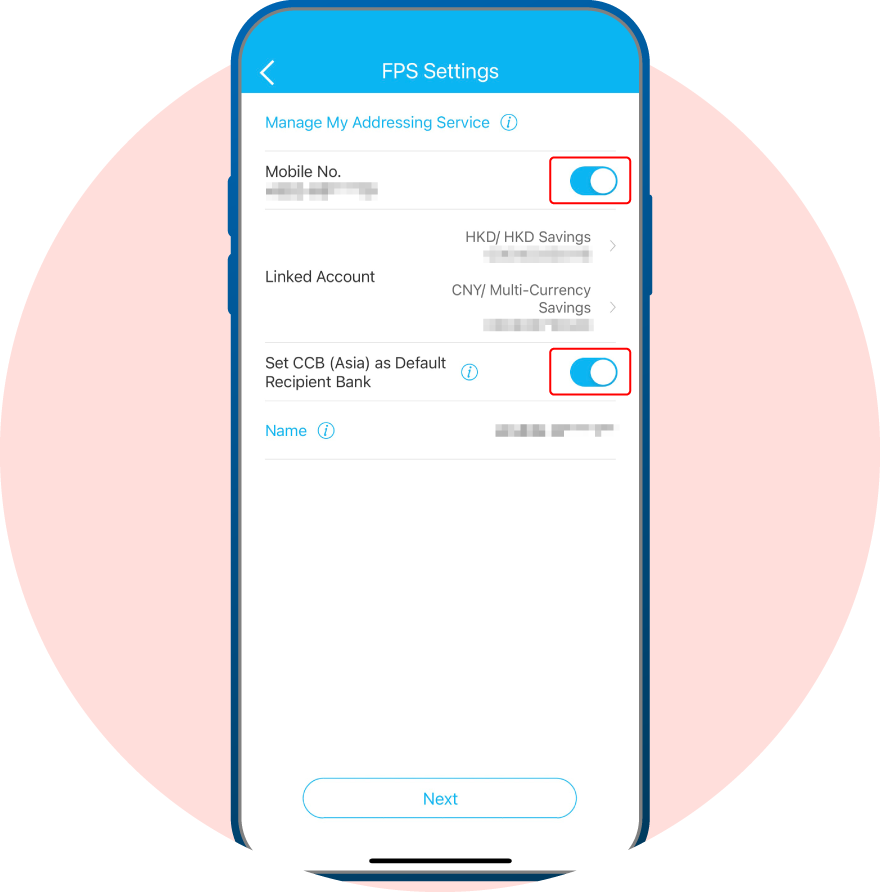

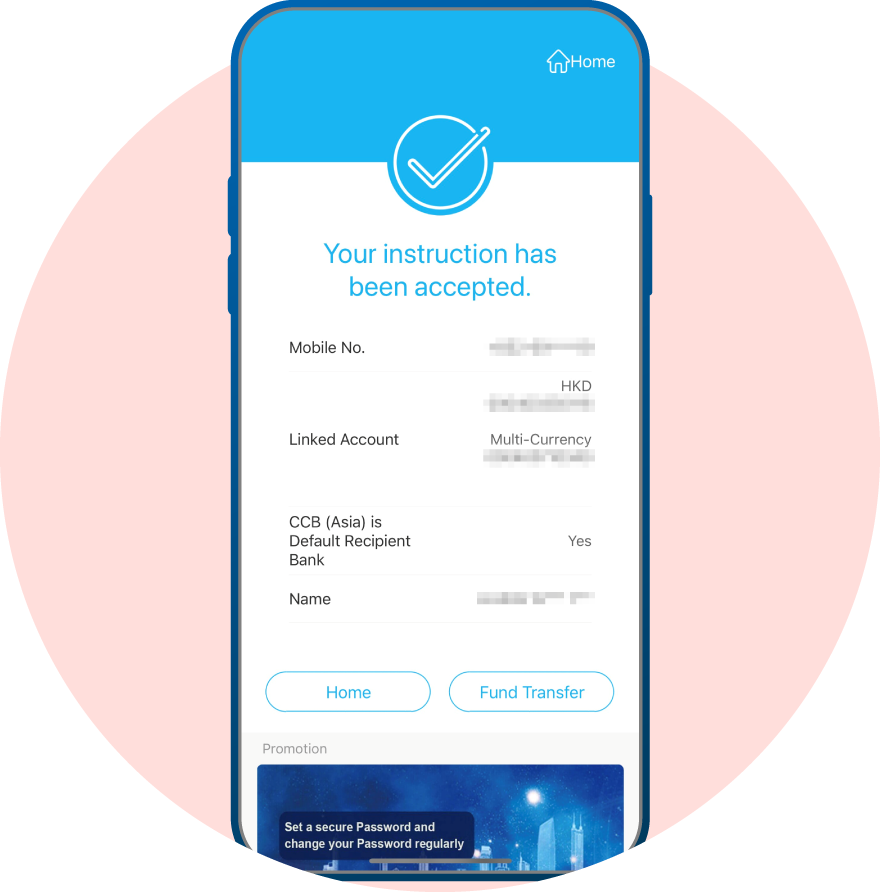

Set CCB (Asia) as the FPS default recipient bank, and

Task

Complete at least one FPS transfer of HKD/RMB 1,000 or above

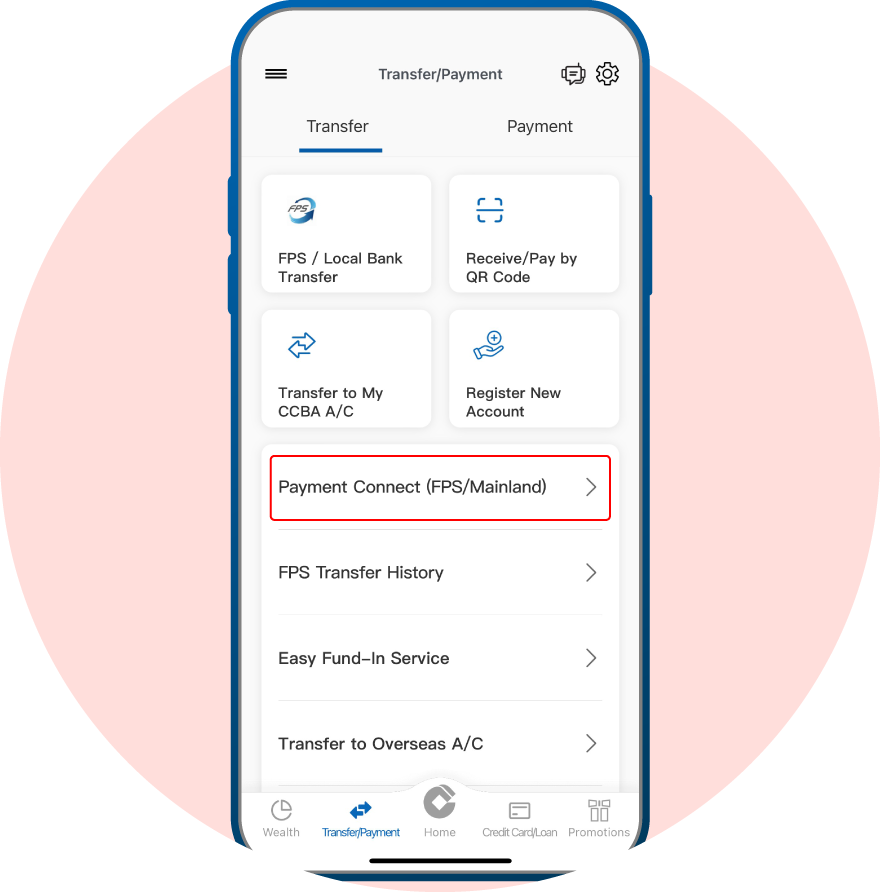

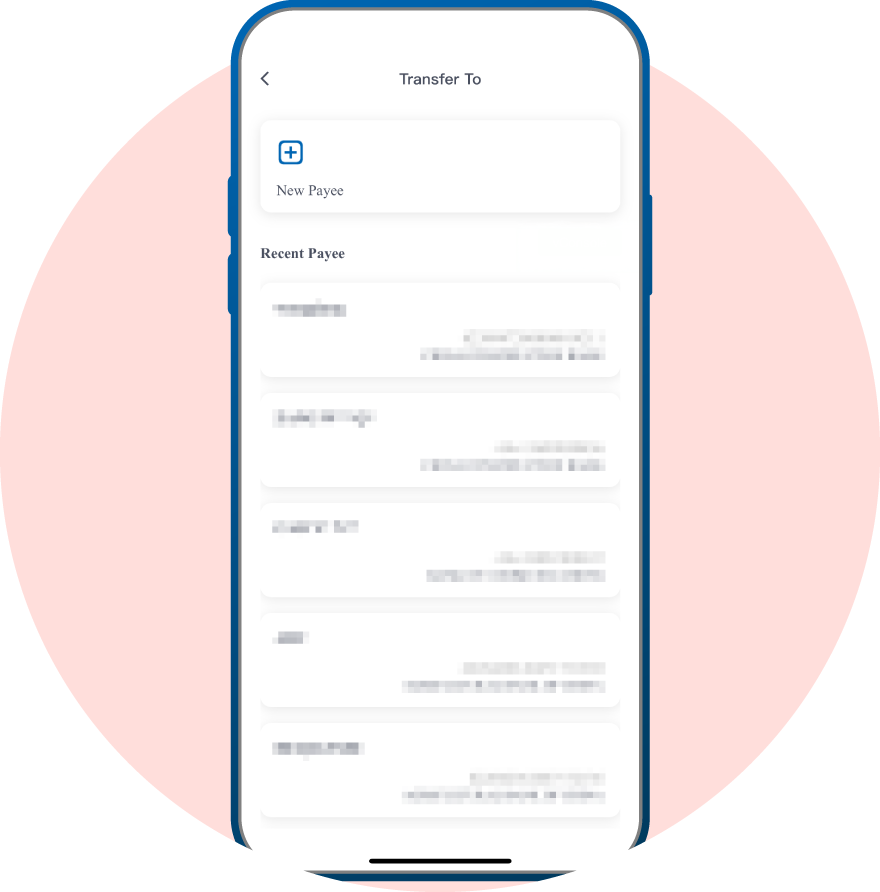

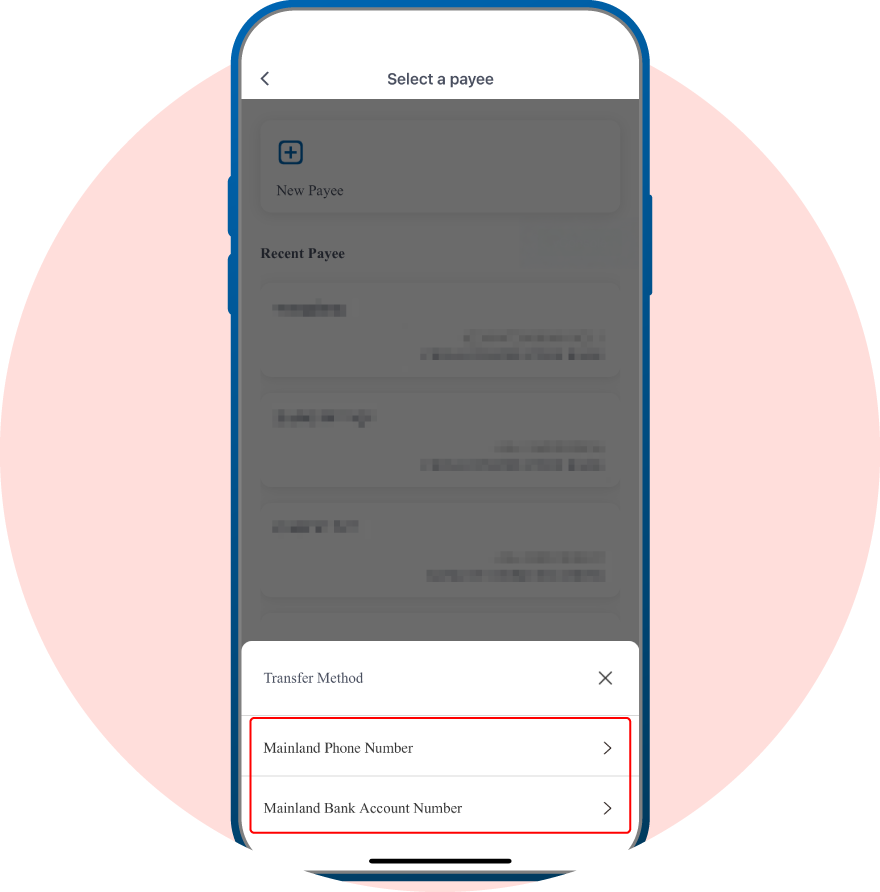

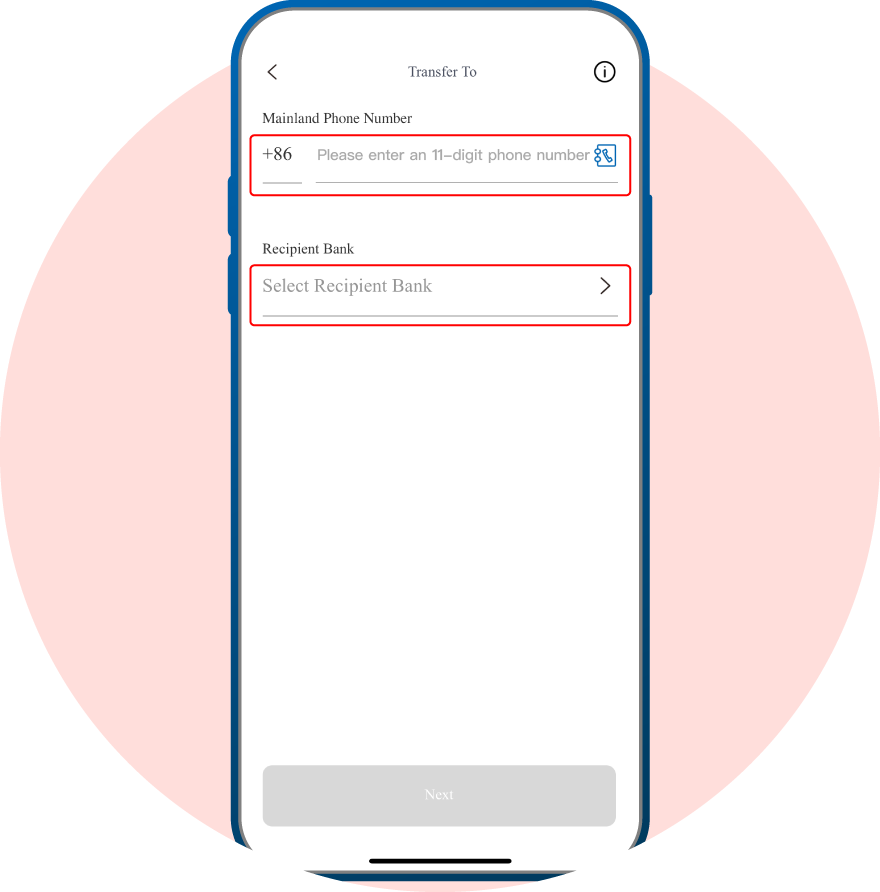

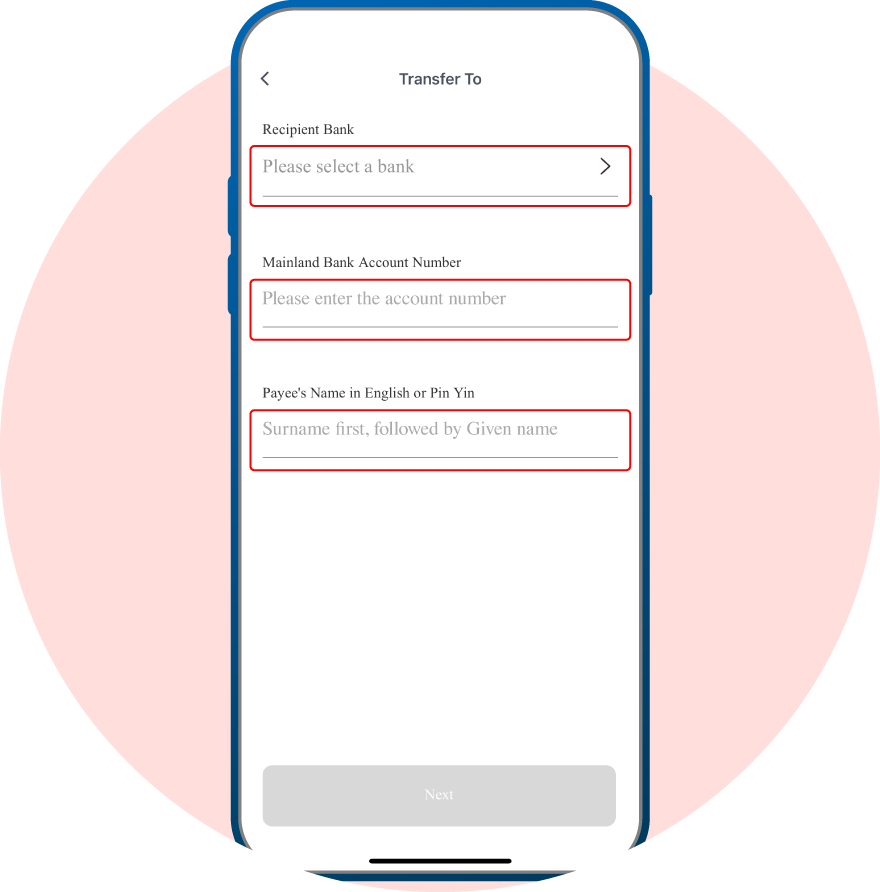

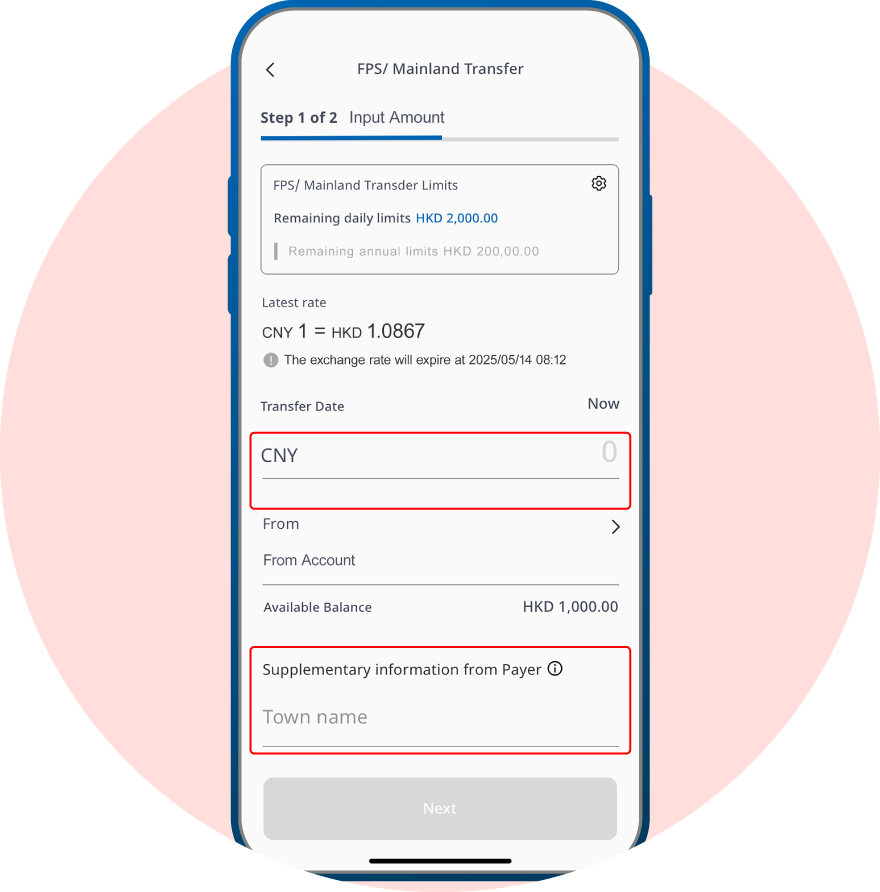

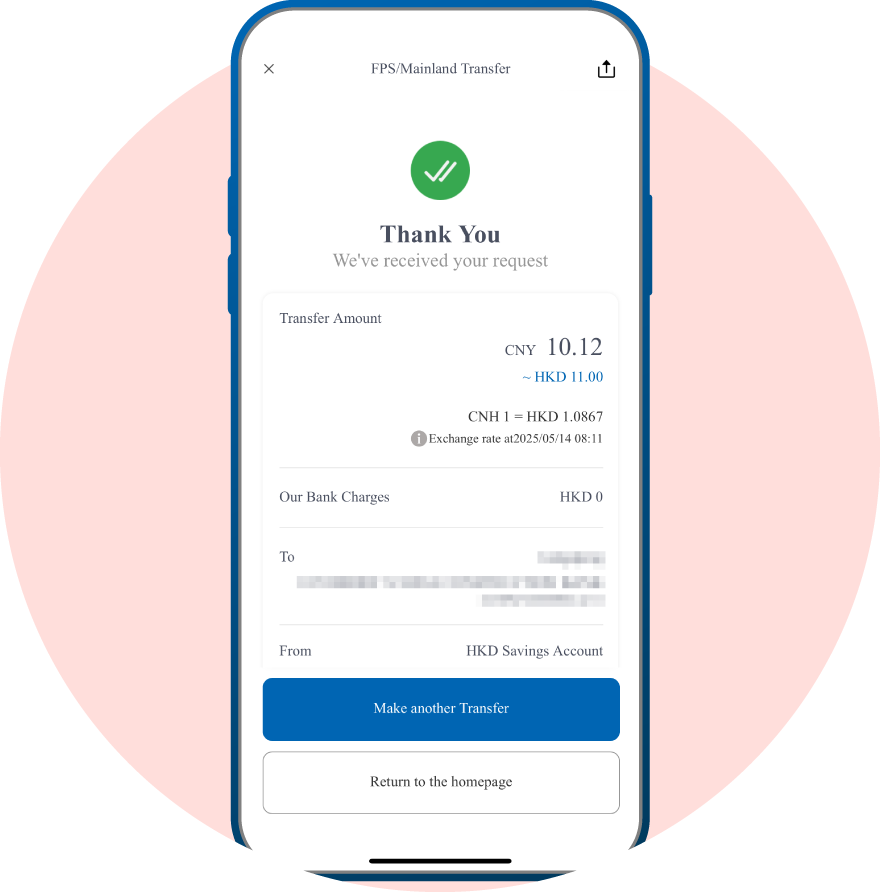

Demonstration of “Payment Connect”

Reminder: Please update the CCB (HK&MO) Mobile App to version 2.3.7.001 or above to use “Payment Connect”.

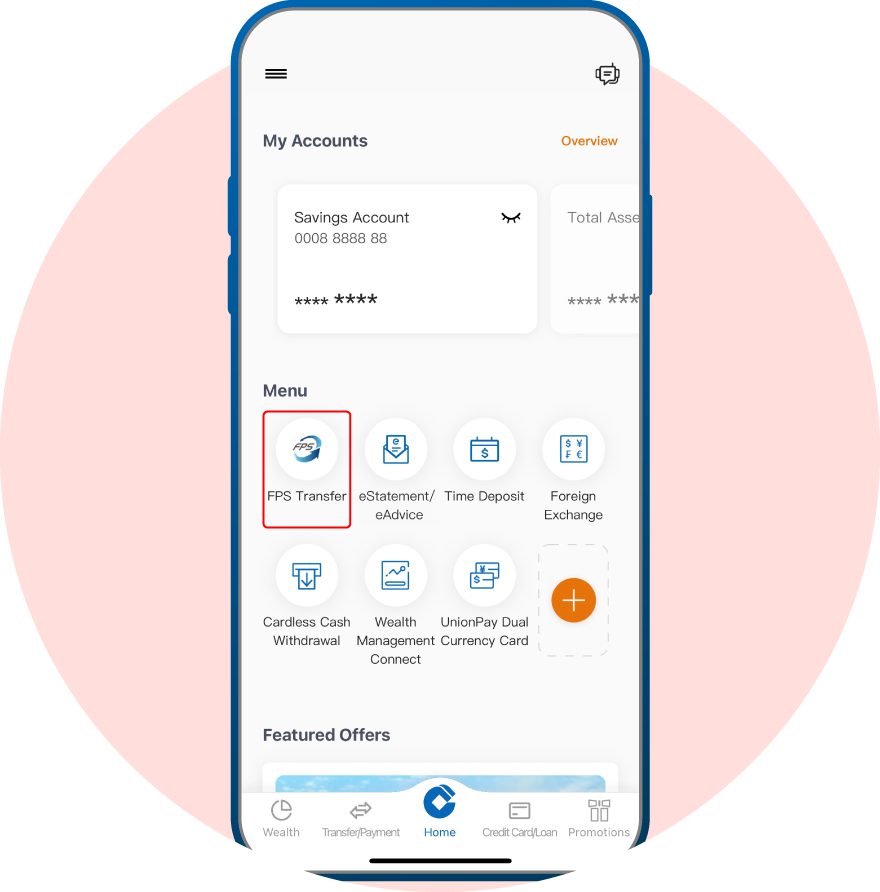

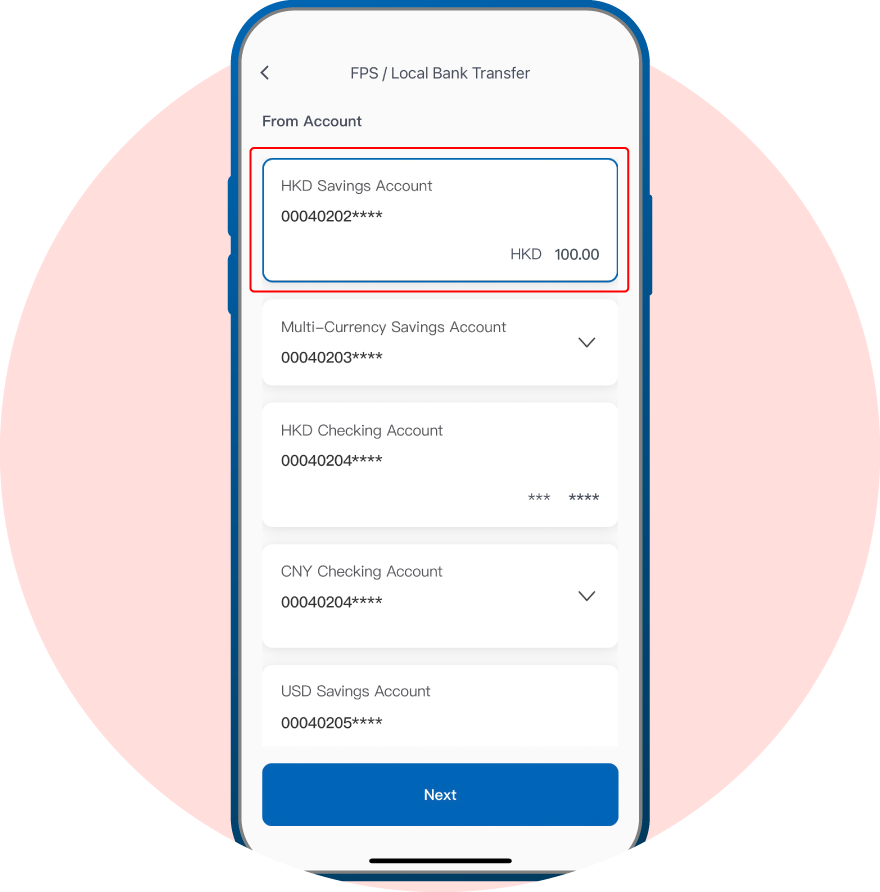

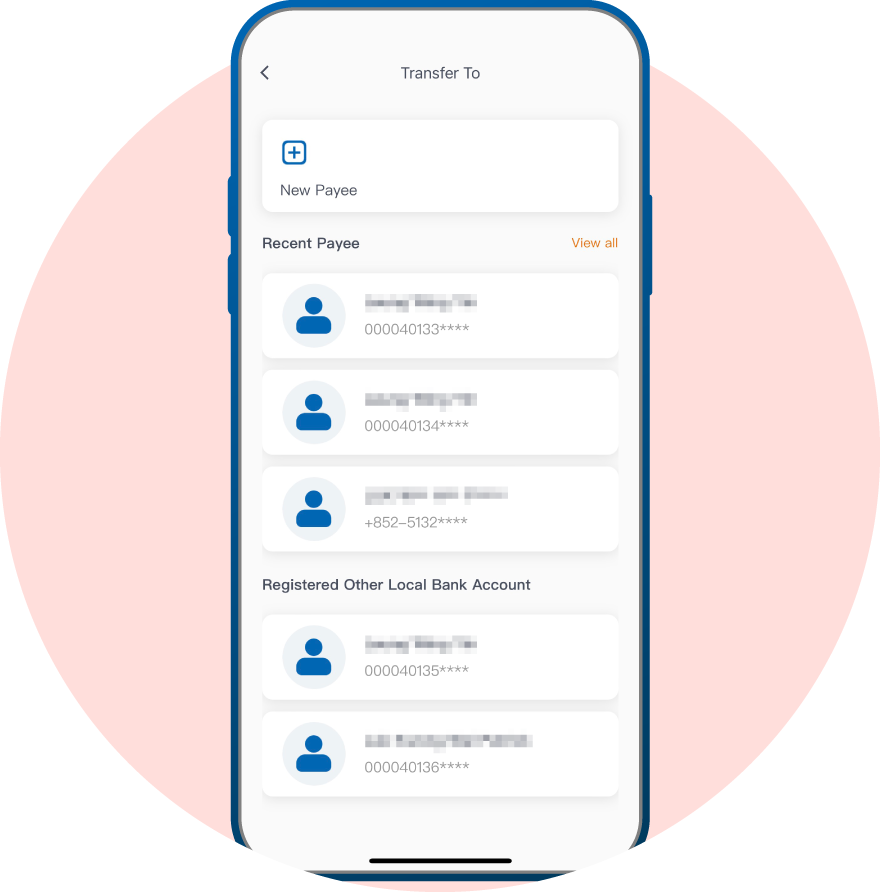

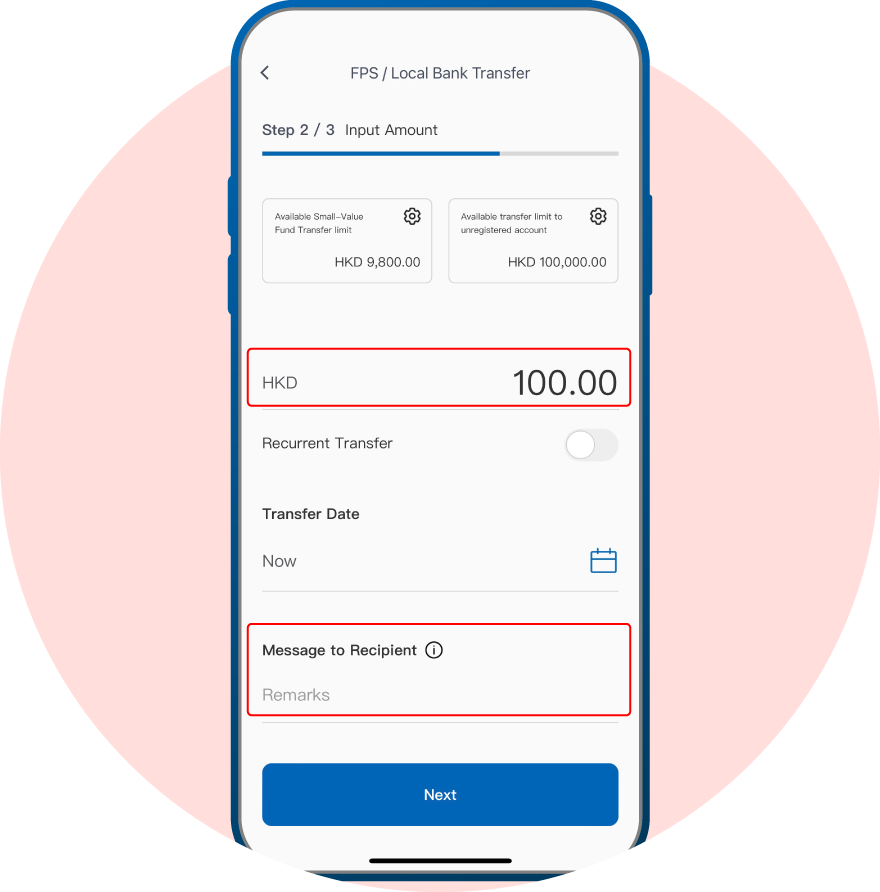

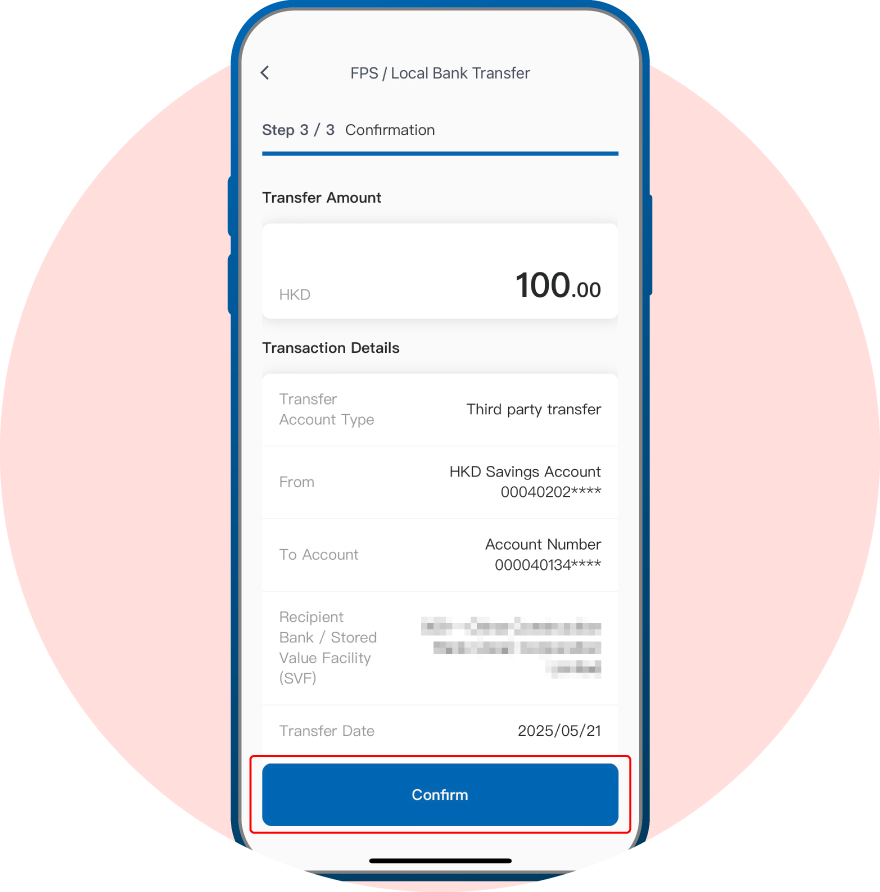

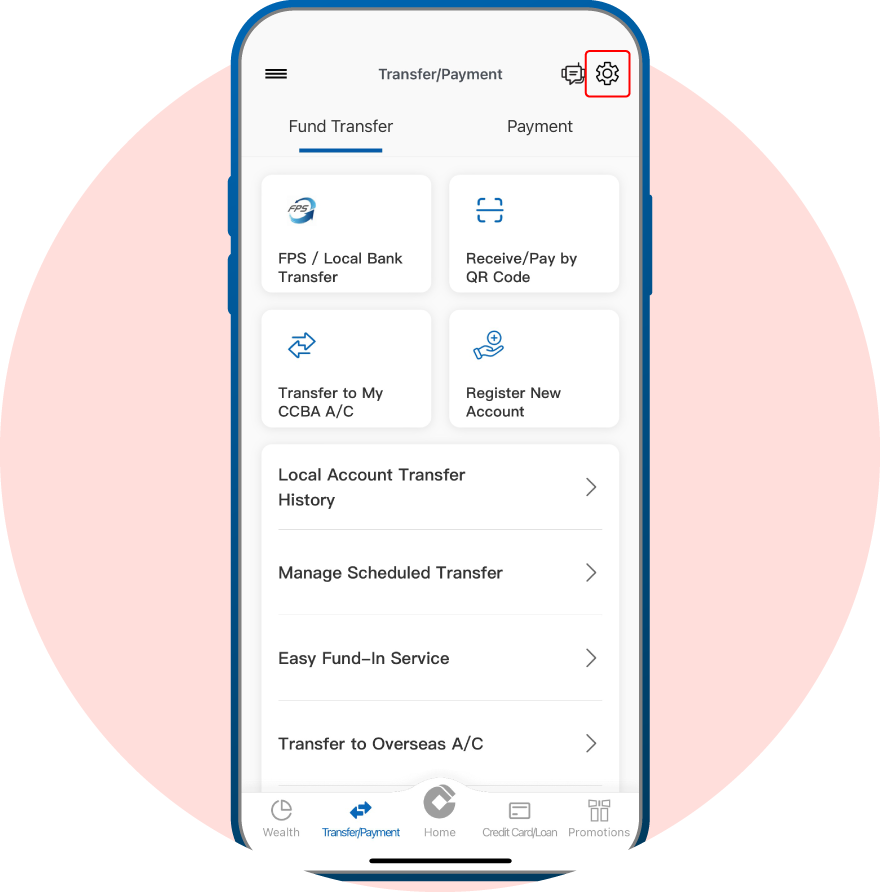

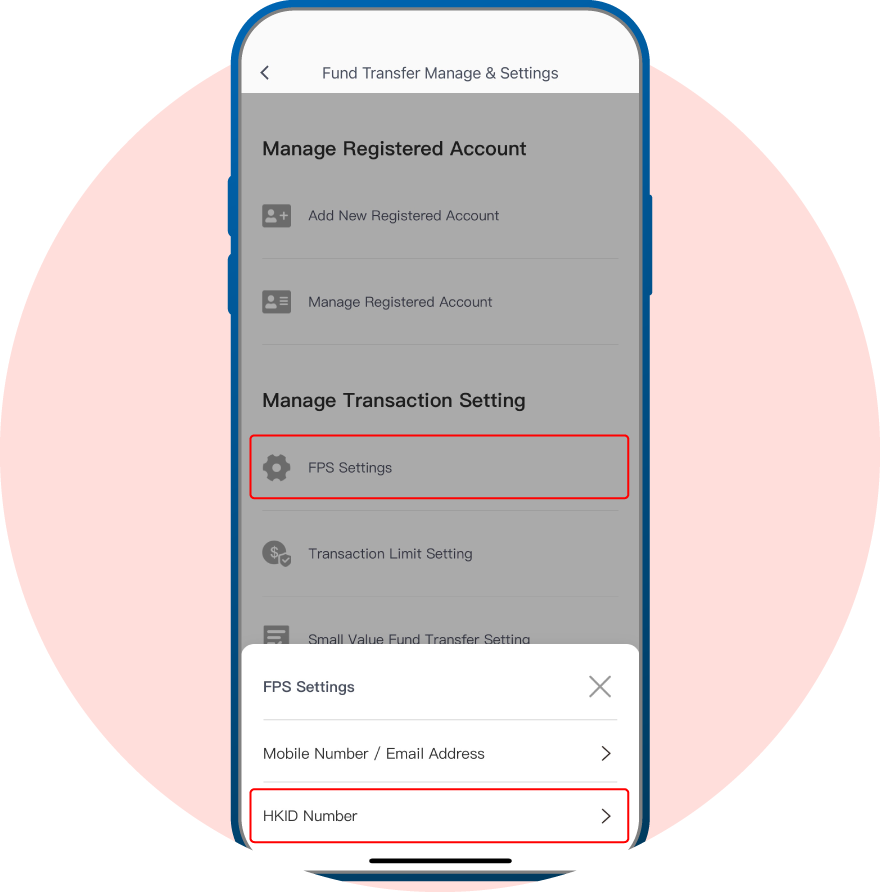

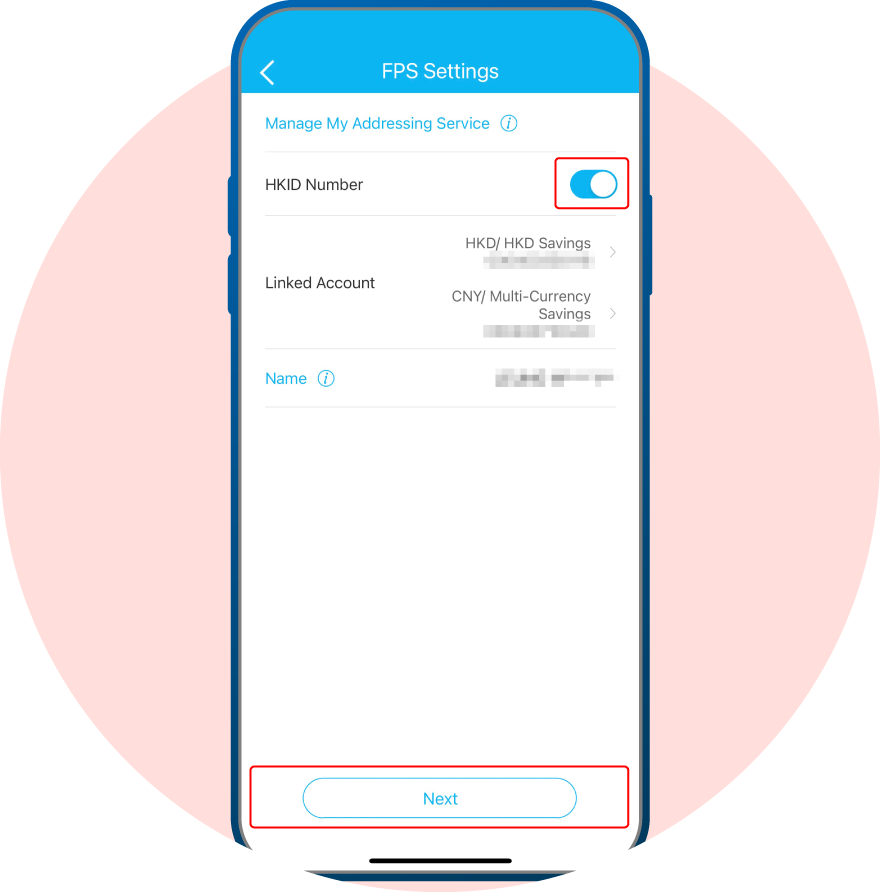

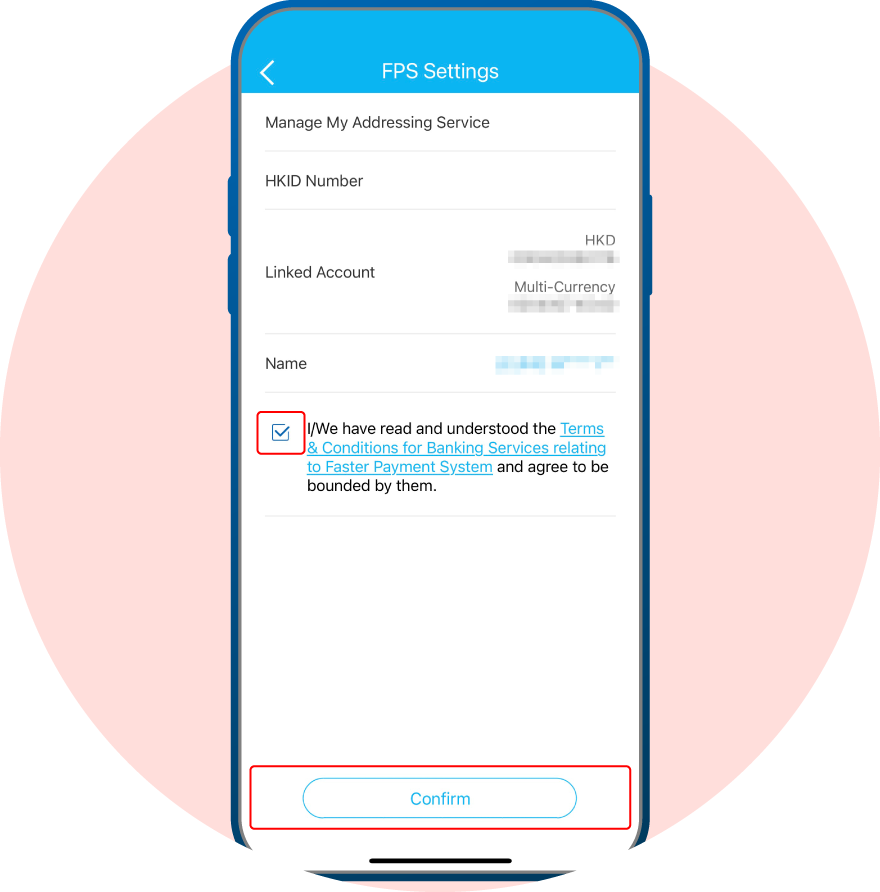

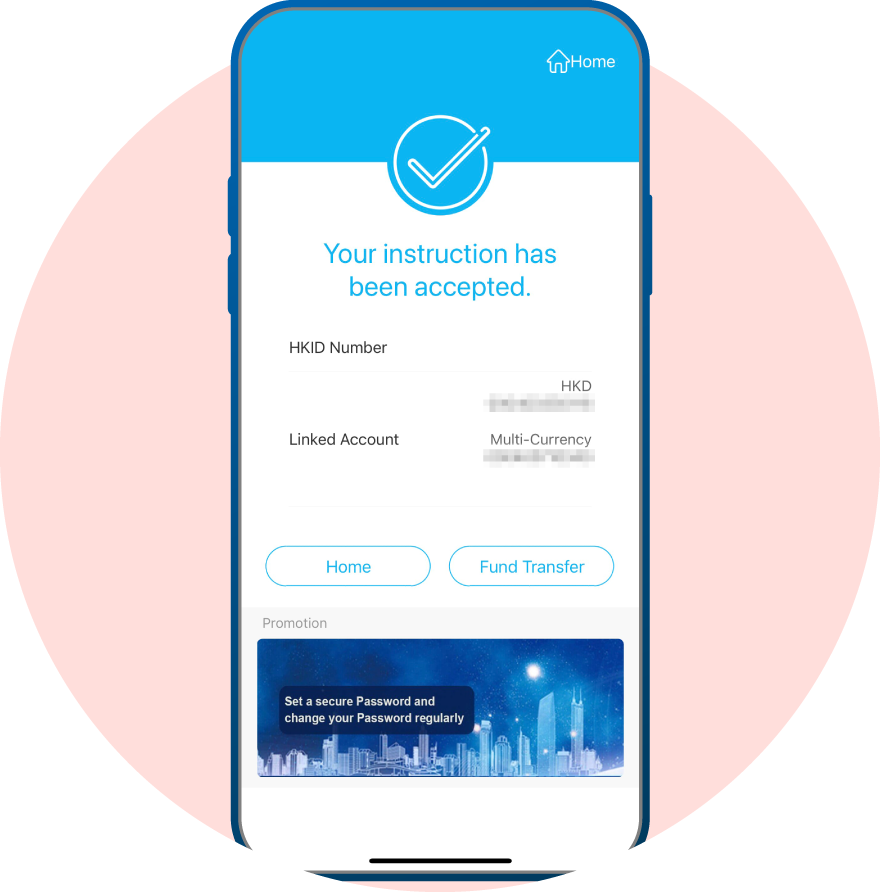

1. How to complete “Payment Connect” Fund Transfer

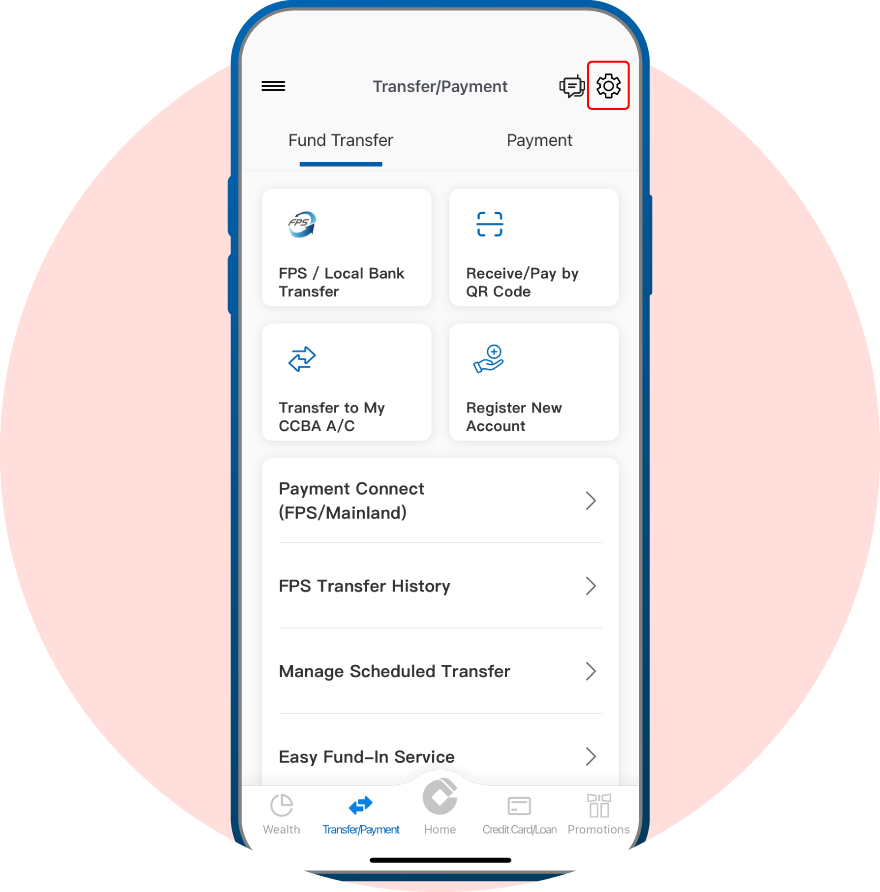

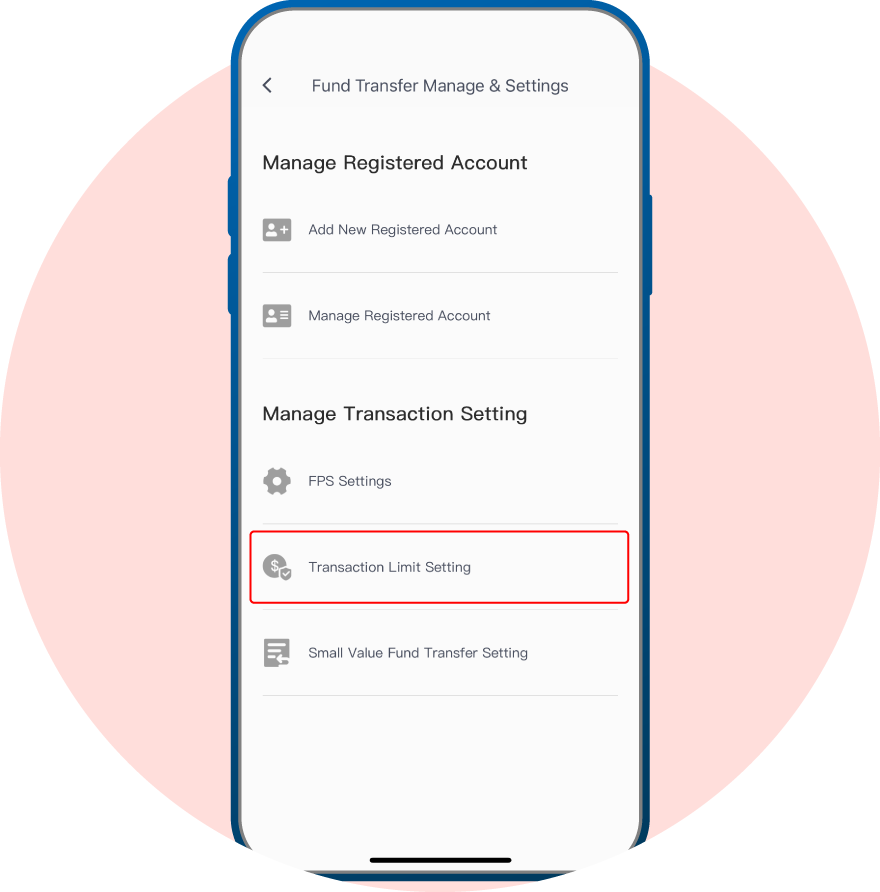

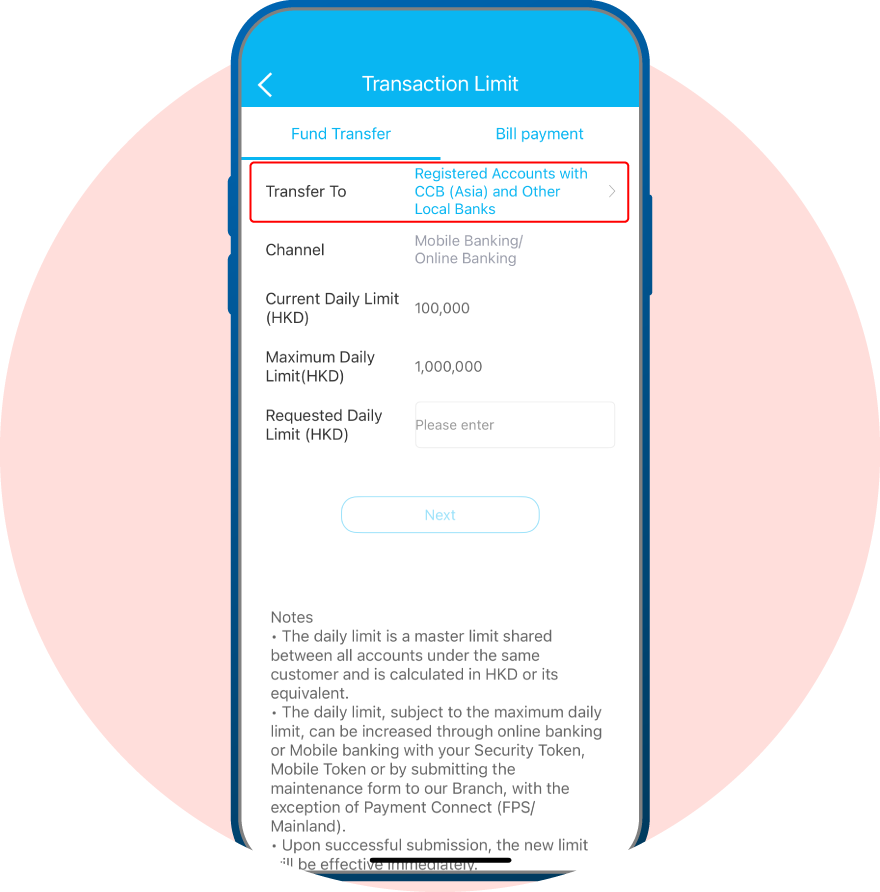

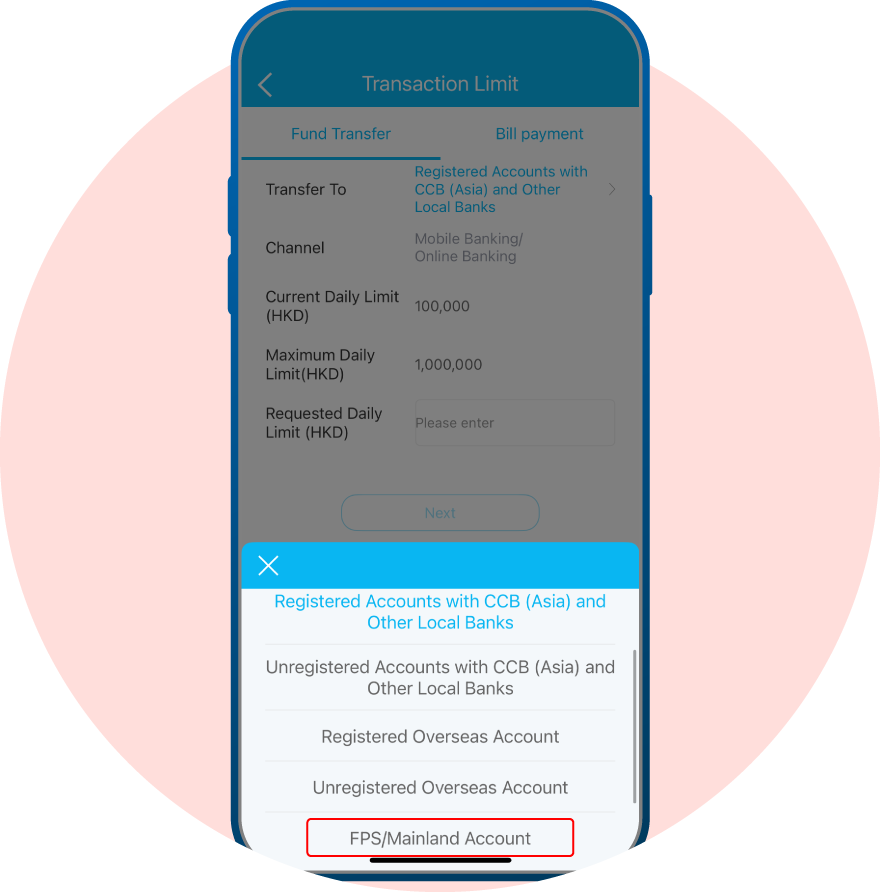

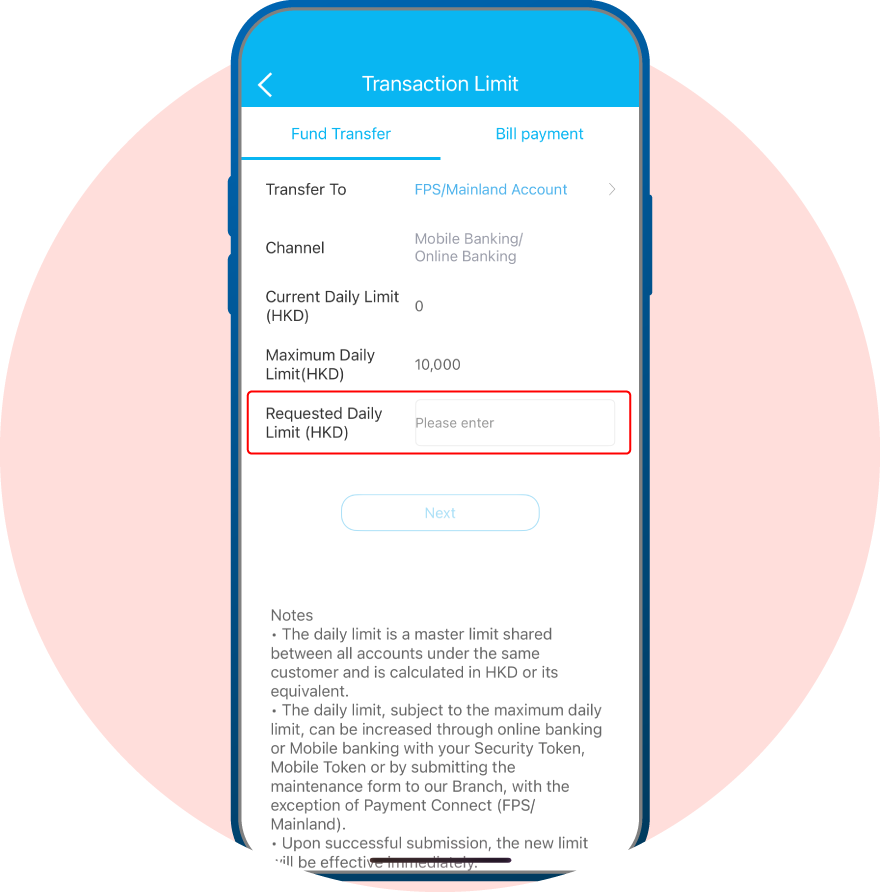

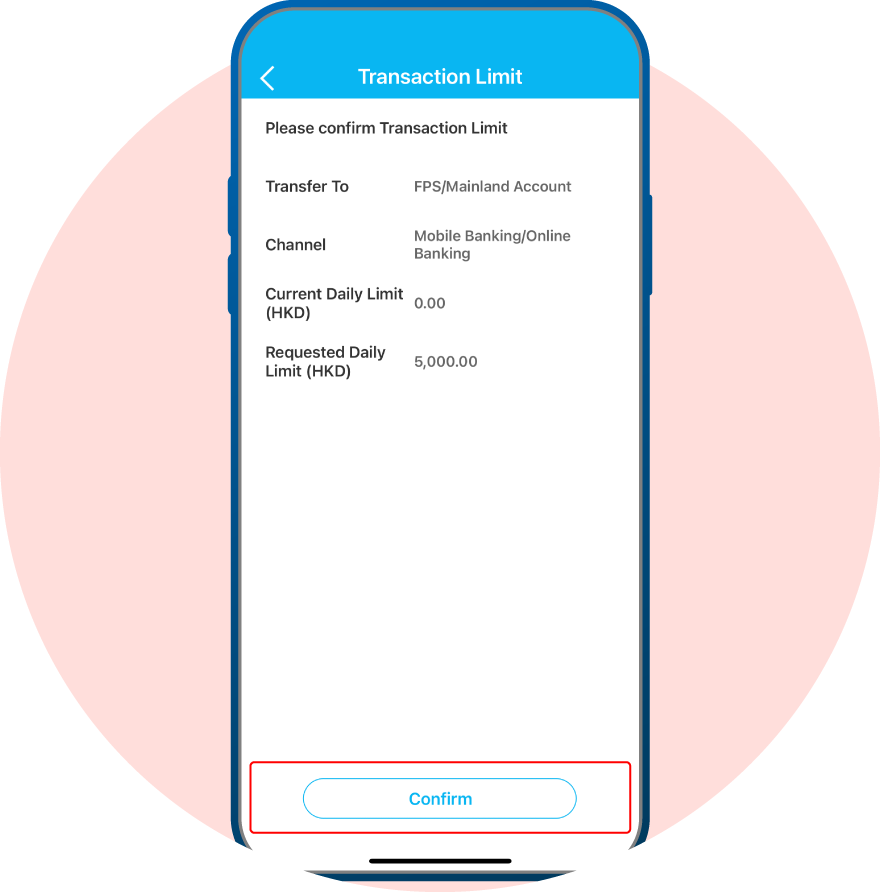

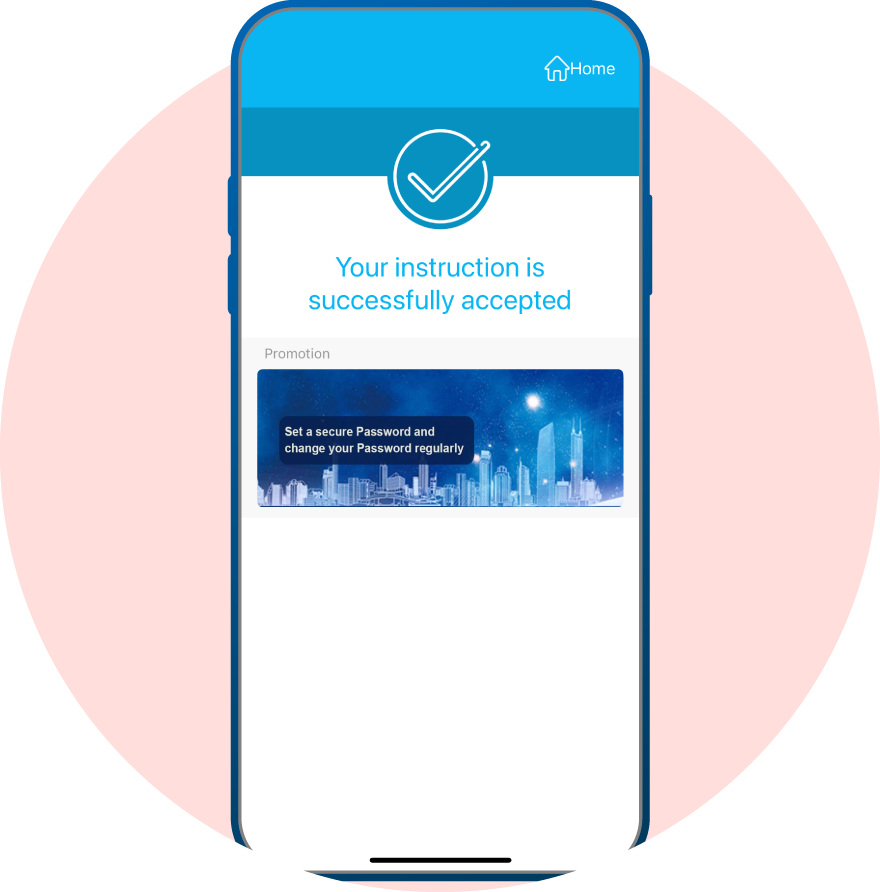

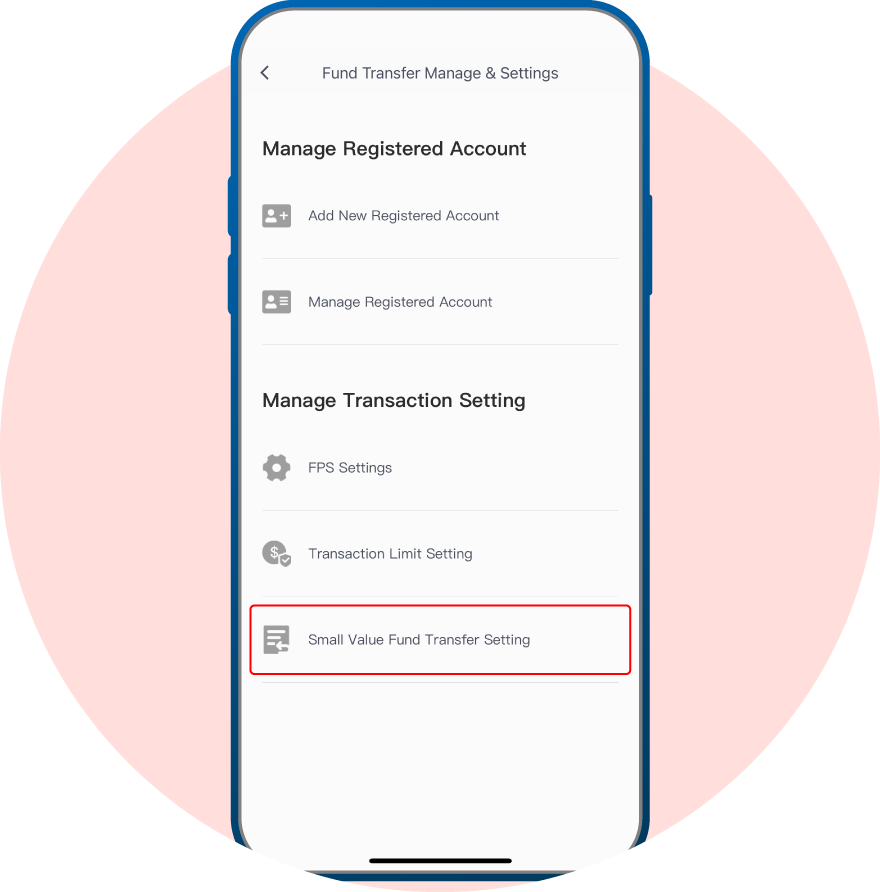

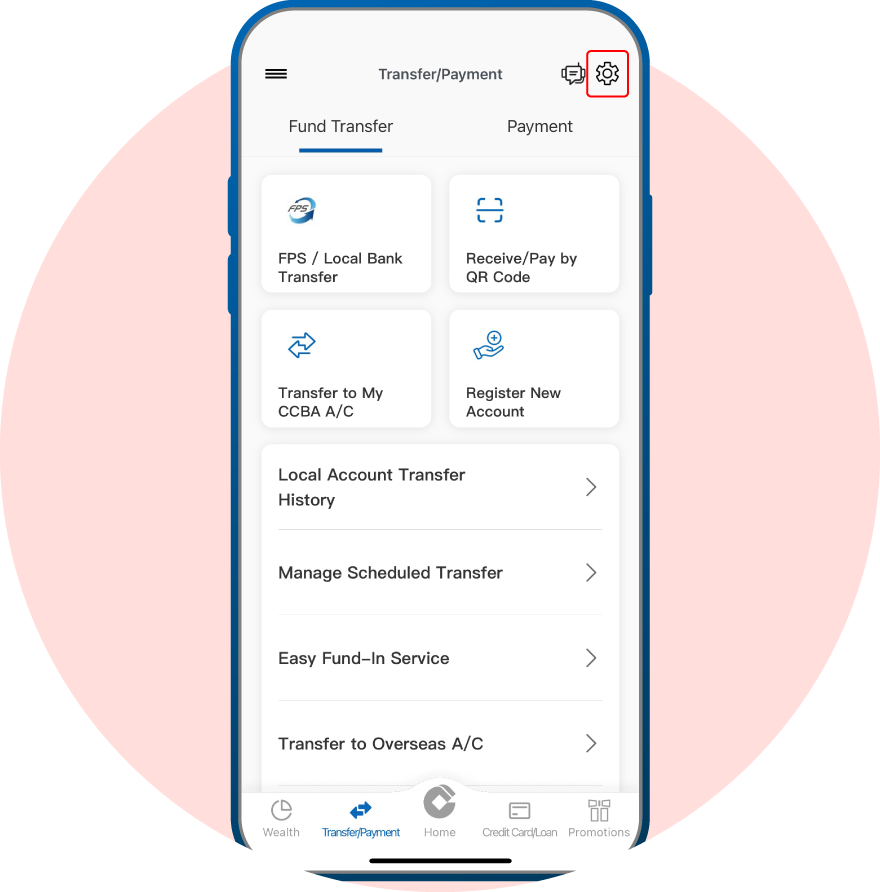

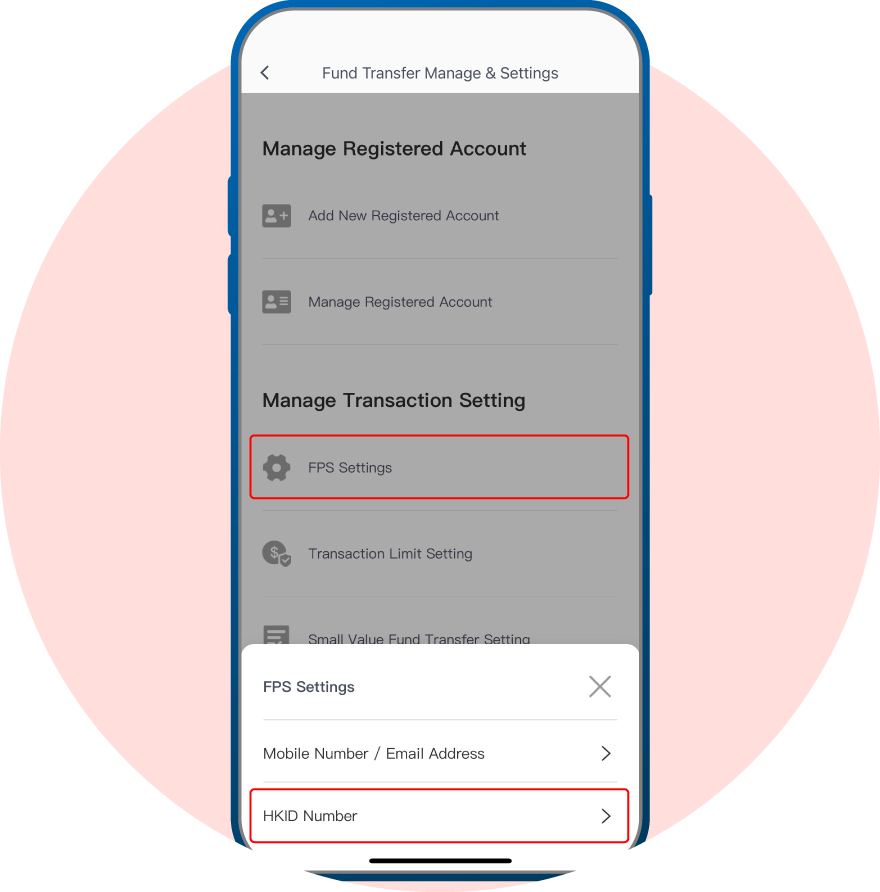

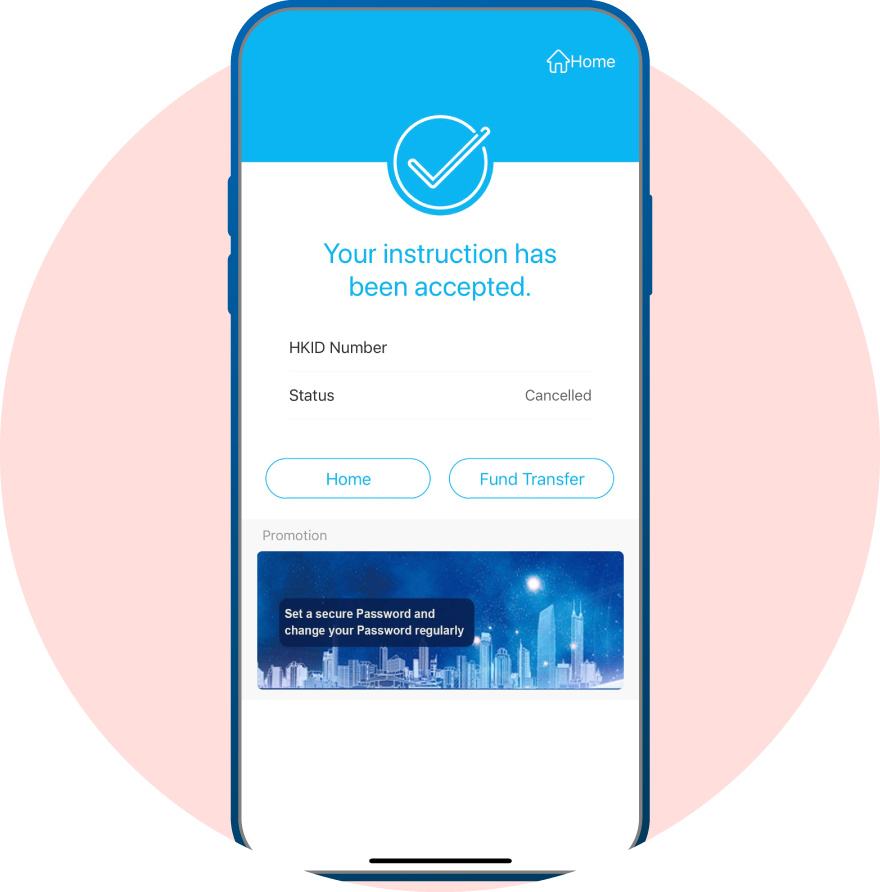

2. How to set “Payment Connect” Transaction Limit

FAQ of “Payment Connect”

- What types of remittance does our “Payment Connect” support?

Our “Payment Connect” supports real-time, two-way, small-value cross-boundary remittance between Mainland China and Hong Kong through a linkage between the Internet Banking Payment System (IBPS) and Faster Payment System (FPS).

- What currencies are supported under “Payment Connect”?

| Northbound (from Hong Kong to Mainland China) |

Southbound (from Mainland China to Hong Kong) |

|

| Debit currency | Debit from CCB (Asia) in Hong Kong:

|

Debit from designated banks in Mainland China:

|

| Credit currency | Credit to designated banks in Mainland China:

|

Credit to CCB (Asia) in Hong Kong:

|

- Any transfer limit on remitting funds to Mainland China through the “Payment Connect”?

Currently, P2P remittance to Mainland China without a specified purpose will be subject to a daily limit of HKD10,000 (or equivalent) and the annual limit of HKD200,000 (or equivalent).

- Will remittance to Mainland China under the “Payment Connect” be limited to same name transfer only?

No. “Payment Connect” supports P2P remittance from and to same name account(s) or non-same name account(s).

- Is there a fee for making use of the “Payment Connect”?

Currently, the fee for making use of the “Payment Connect” is waived, until our further notice.

- When will the funds arrive at the payee’s bank in Mainland China if a Northbound transfer request is submitted under the “Payment Connect”?

Funds are remitted on a real-time basis to Mainland China via the “Payment Connect”.

Please Click Here for Terms and Conditions for Bank Services relating to Faster Payment System

Risk Disclosure

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.