Easy Fund-in Service (Interbank transfer)

Interbank Collection and Transfer of Large Fund Amounts at Any Time

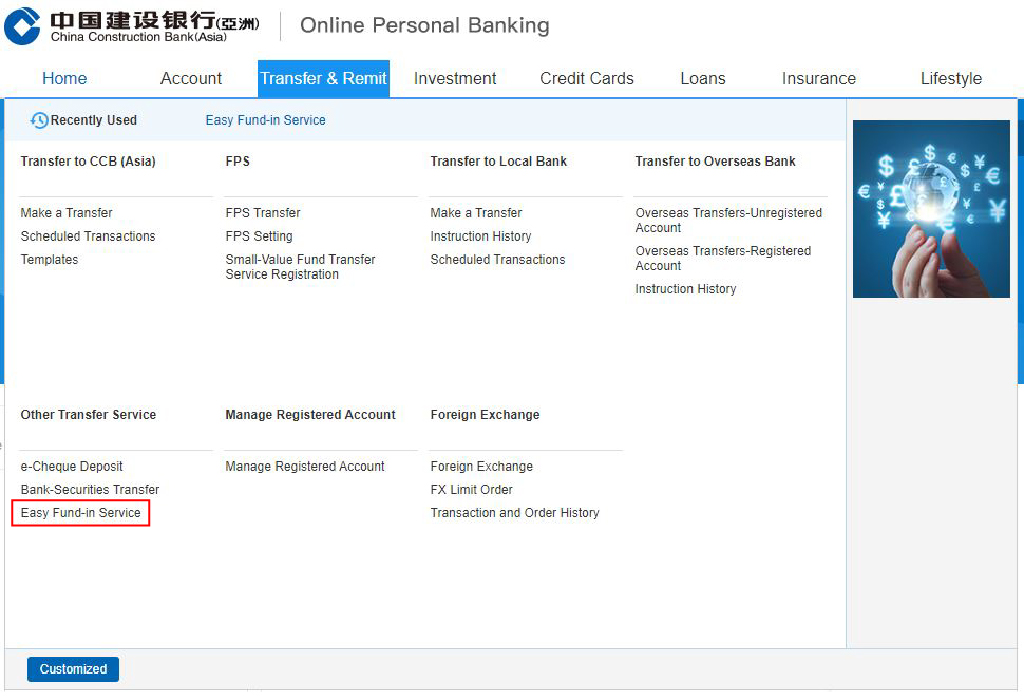

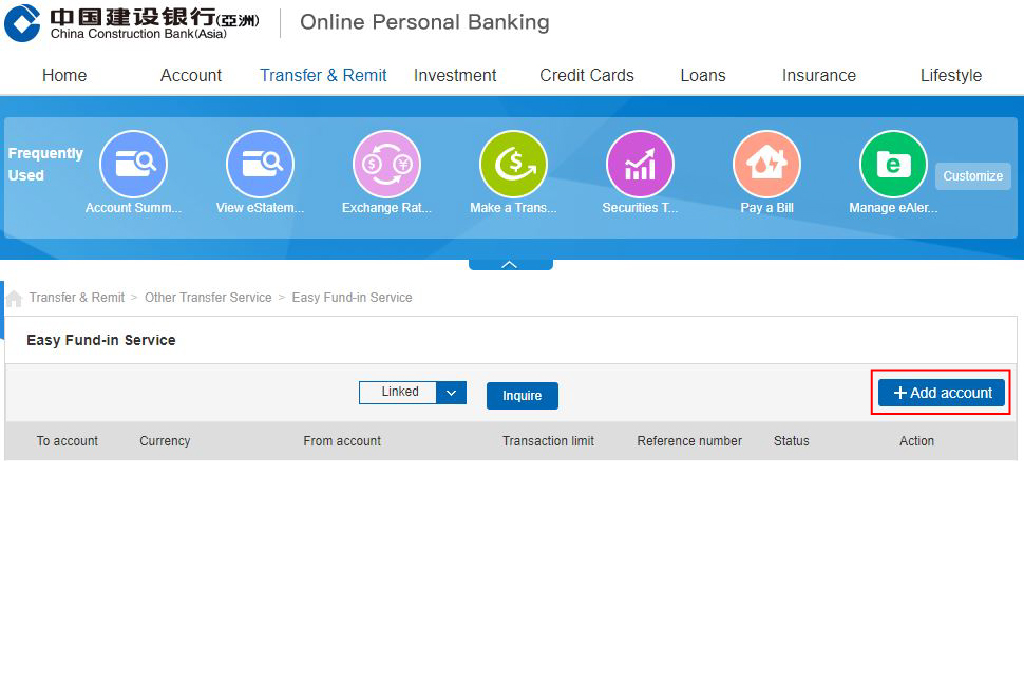

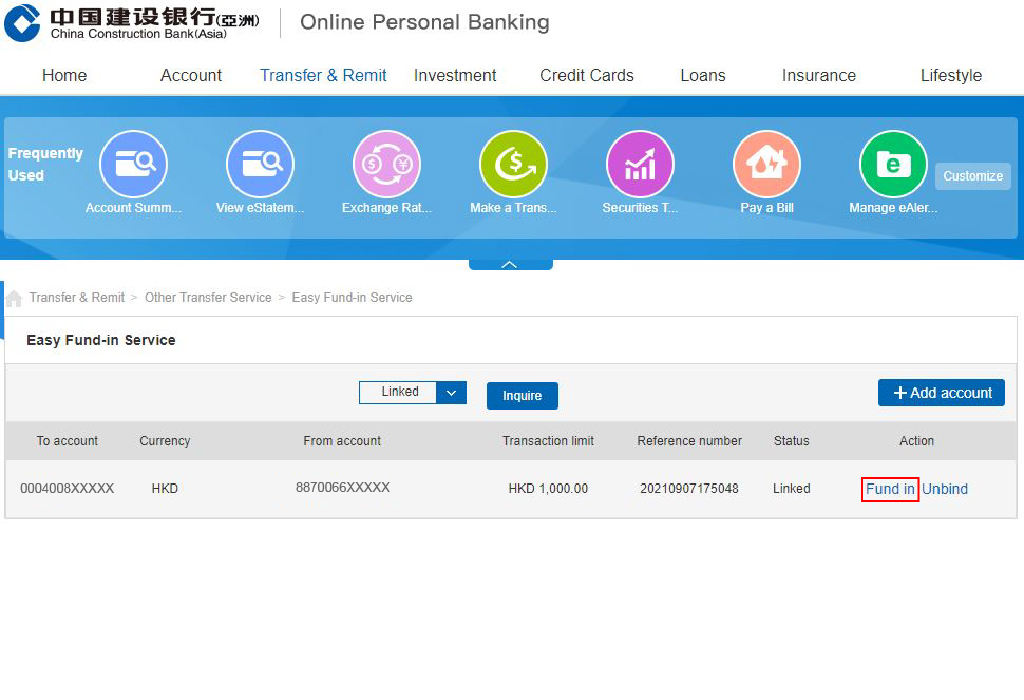

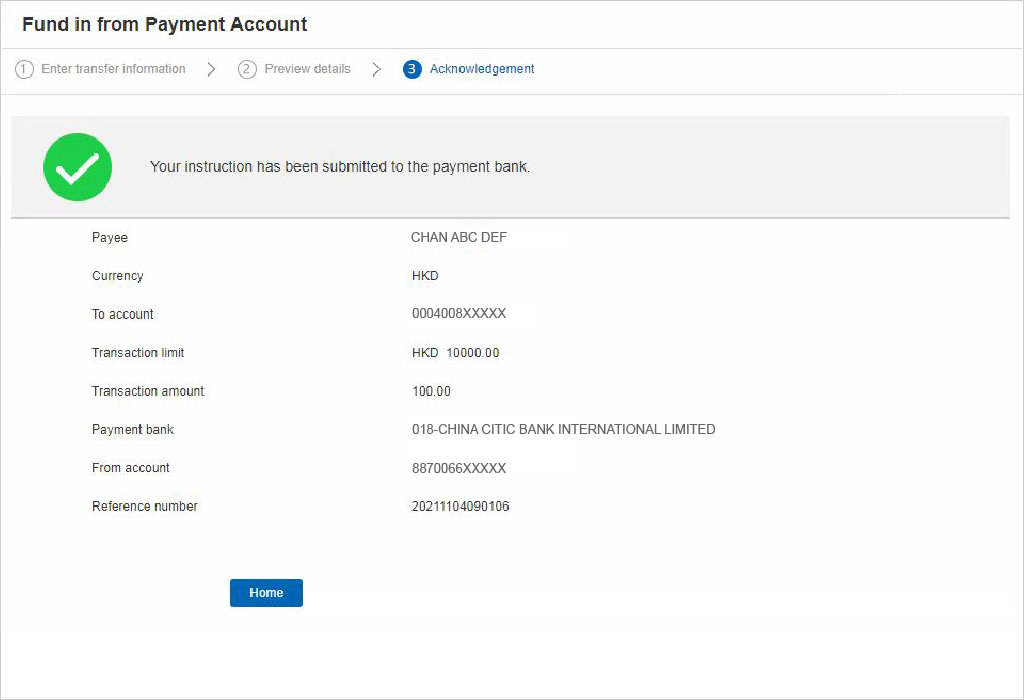

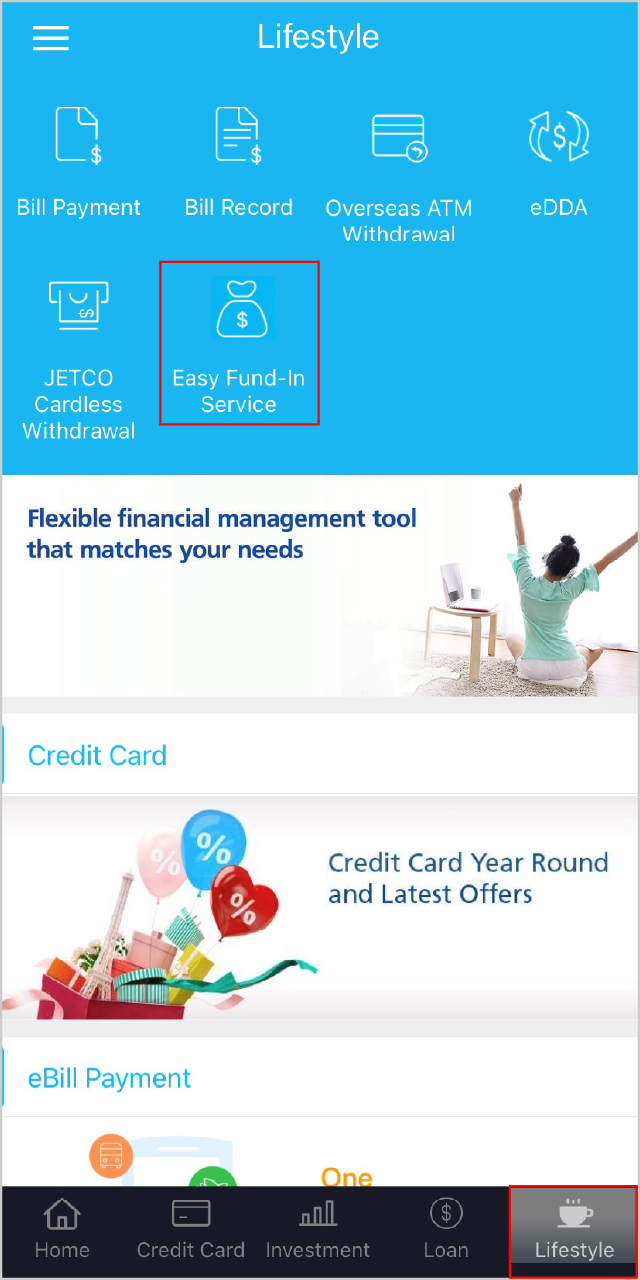

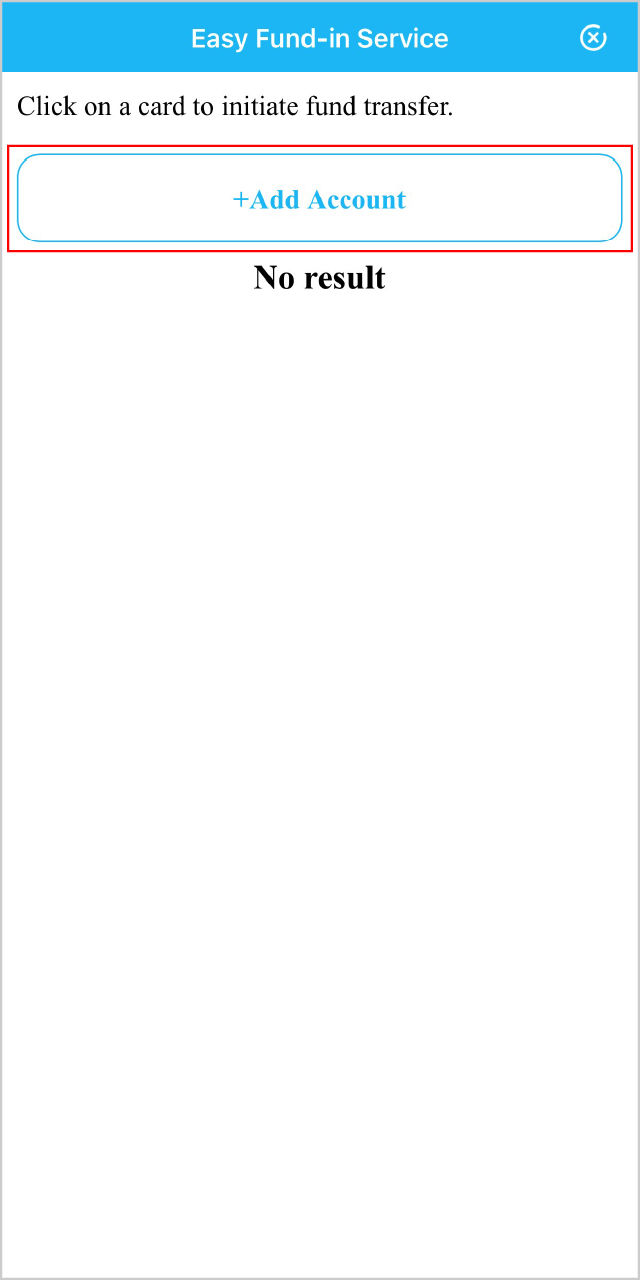

The brand-new “Easy Fund-in Service” enables our customers to transfer money from their accounts with another bank to their designated CCB (Asia) accounts just in a few simple steps, thus saving customers from the trouble of switching back and forth between different banking apps when making fund-in transfers to CCB (Asia). This much more convenient and seamless money transfer solution is now available on both CCB (Asia)’s online banking and mobile banking!

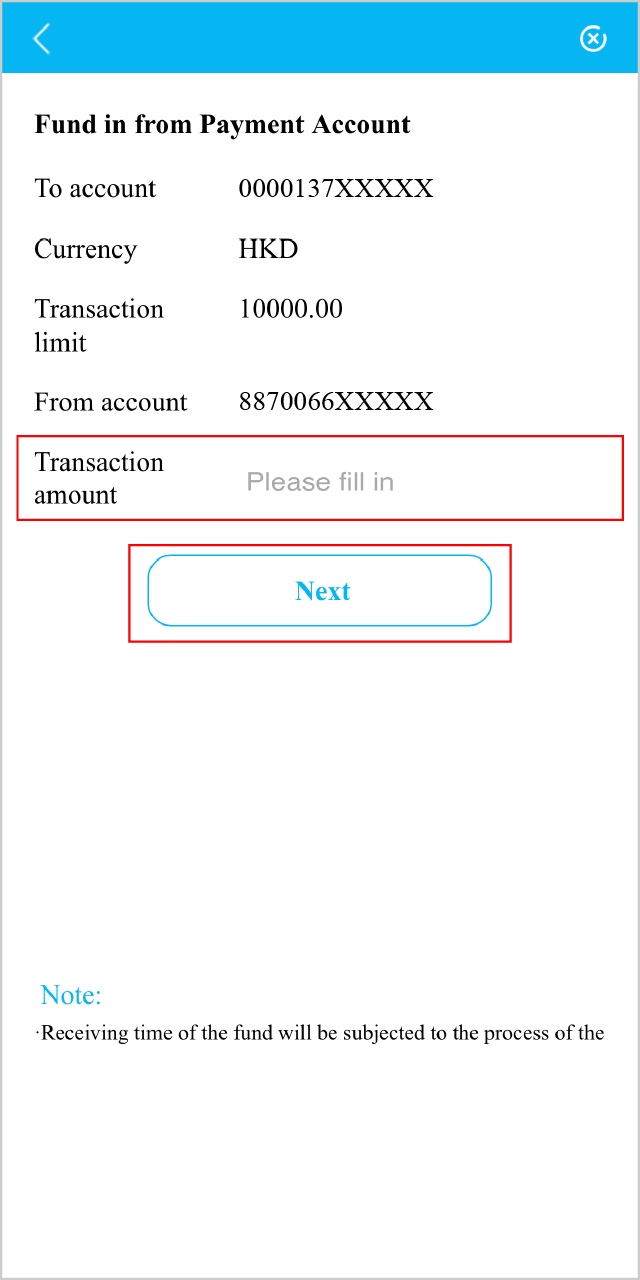

Through logging onto CCB (Asia)’s online banking or mobile banking, customers may easily register and link their bank accounts with another bank and may transfer money to their designated CCB (Asia) bank accounts real-time under the Easy Fund-in Service, making their money transfer experience faster, safer and more convenient!

- 7 x 24, real-time, free-of-charge inter-bank fund transfer, integrated money transfer experience

- Supports both HKD and CNY

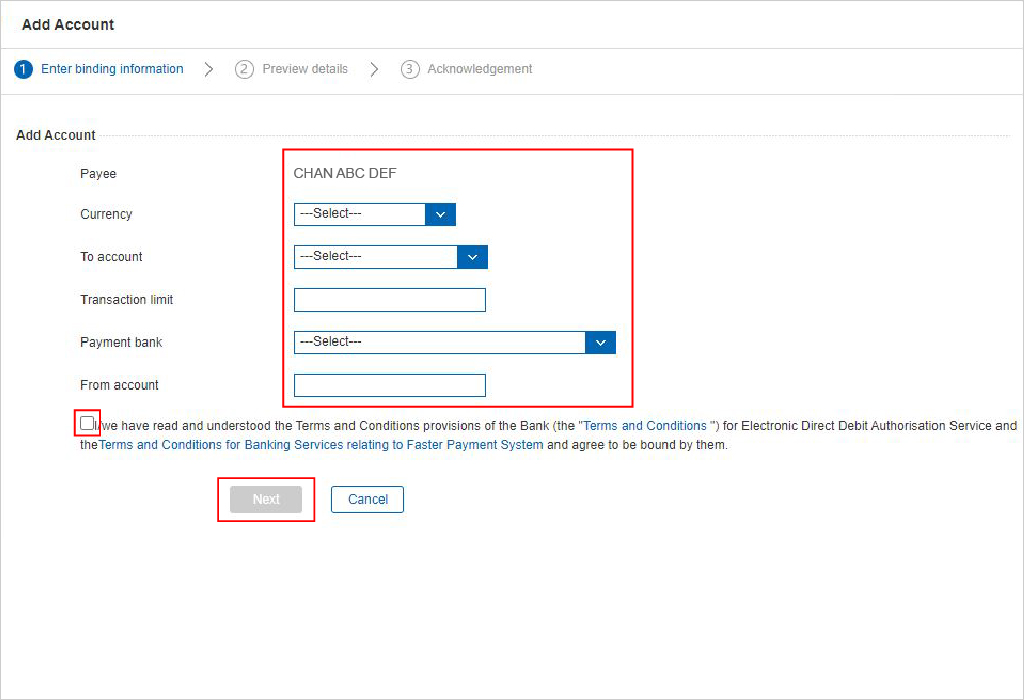

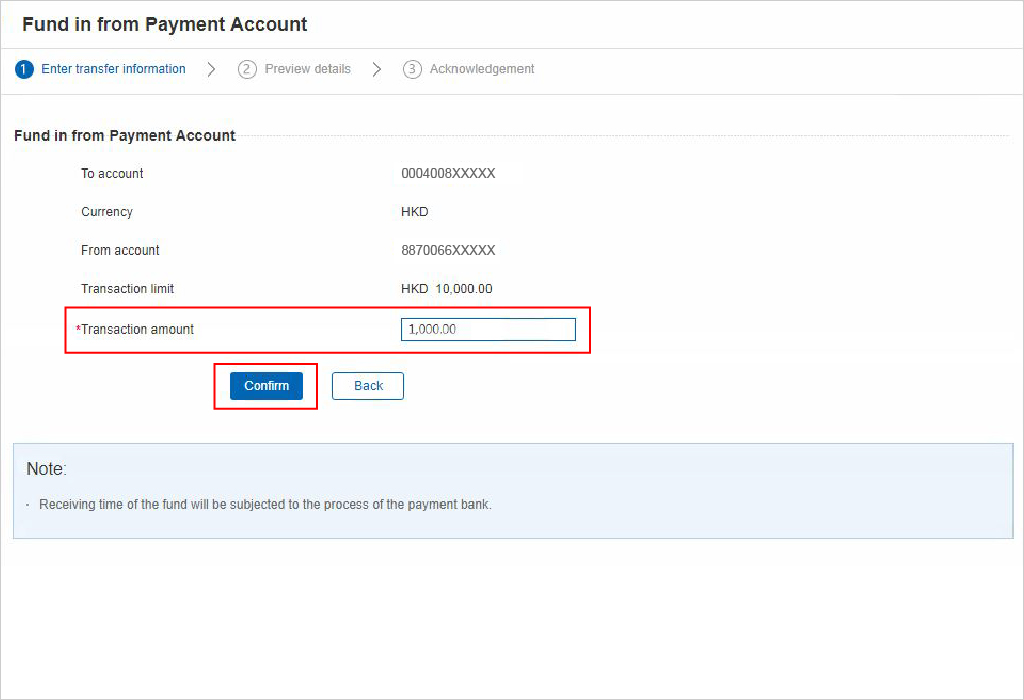

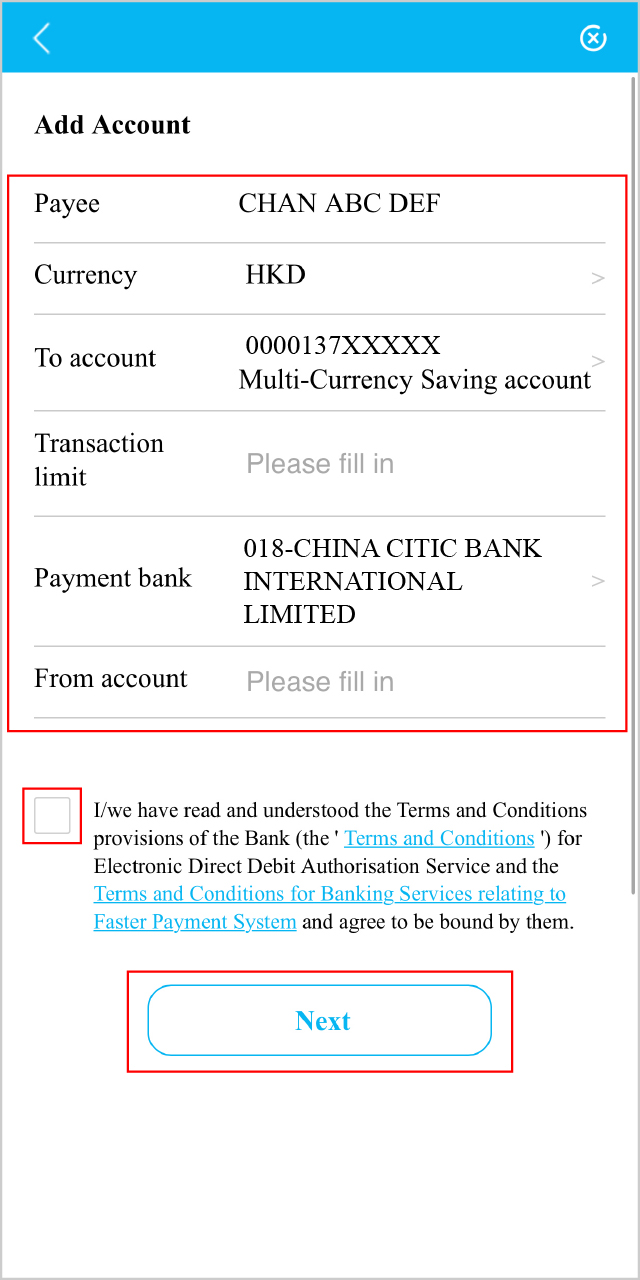

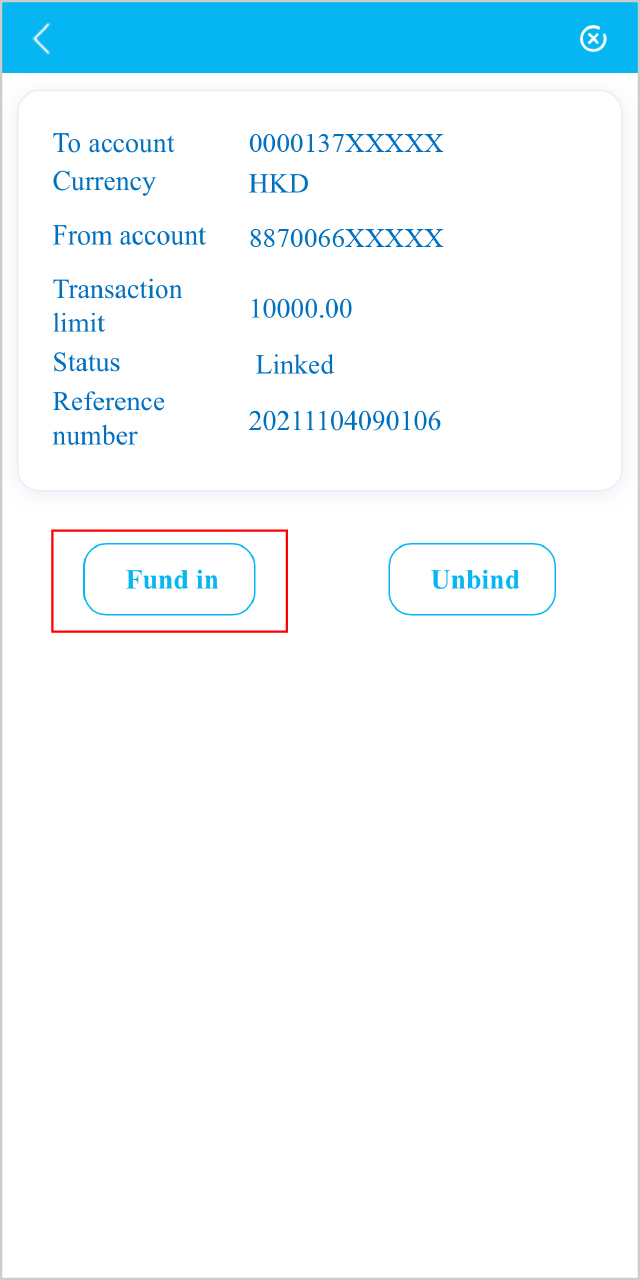

- You can set an appropriate Transaction Limit2 of your choice when setting up an eDDA in the Easy Fund-in Service.

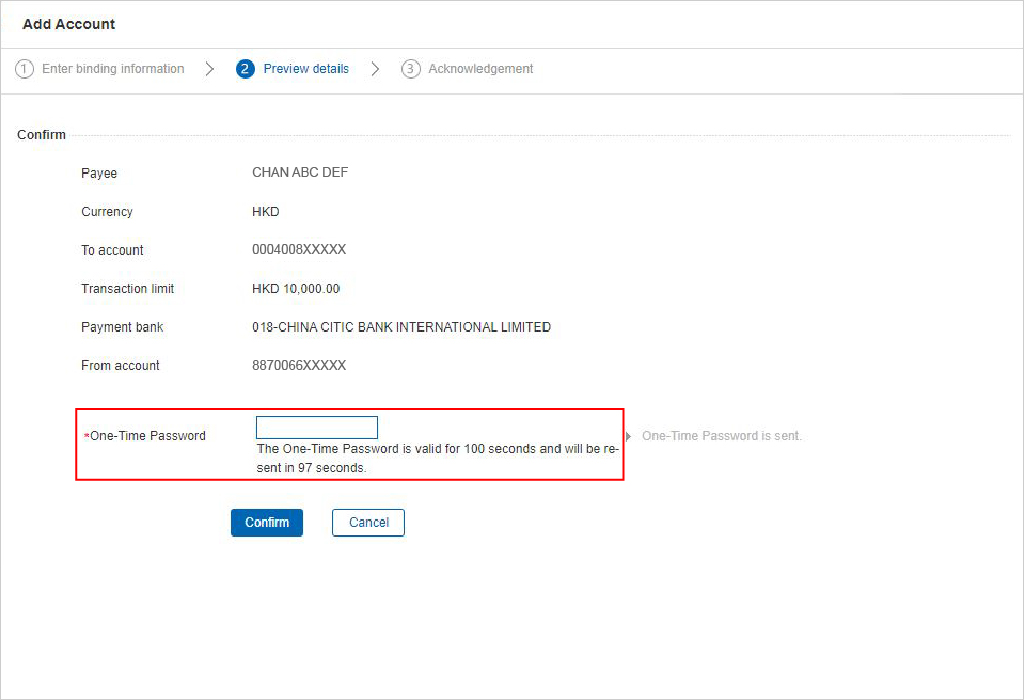

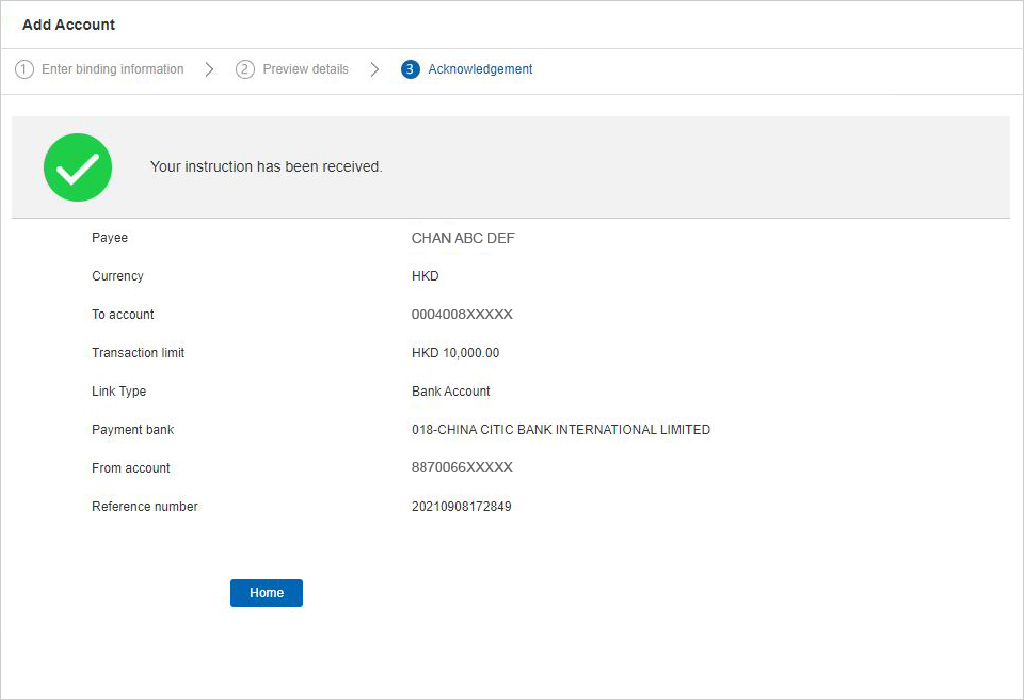

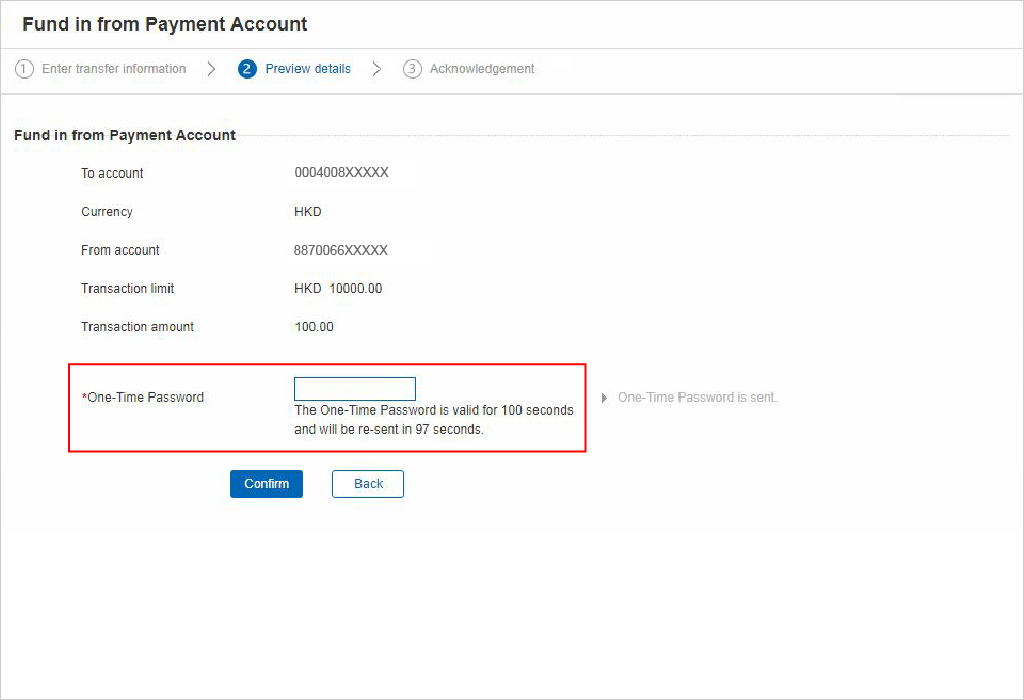

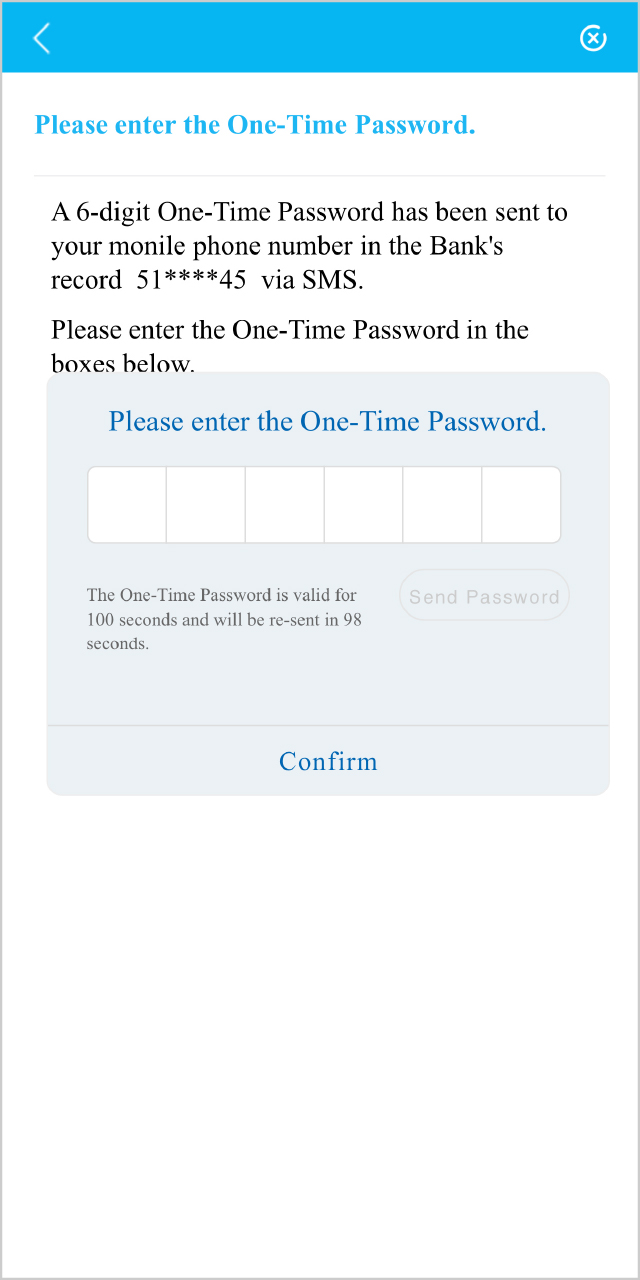

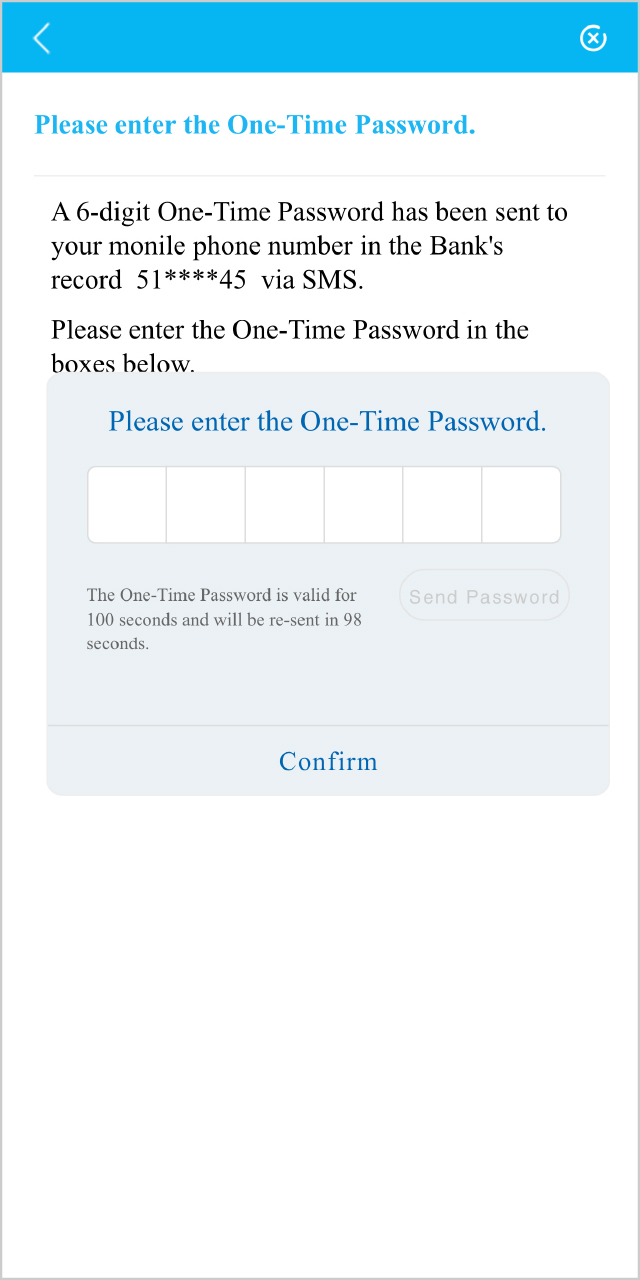

- For verification purpose, you will receive an One-Time Password3 on your registered phone number each time when you bind a new eDDA and each time when you submit an Instruction (through the Bank) to the Account Bank.

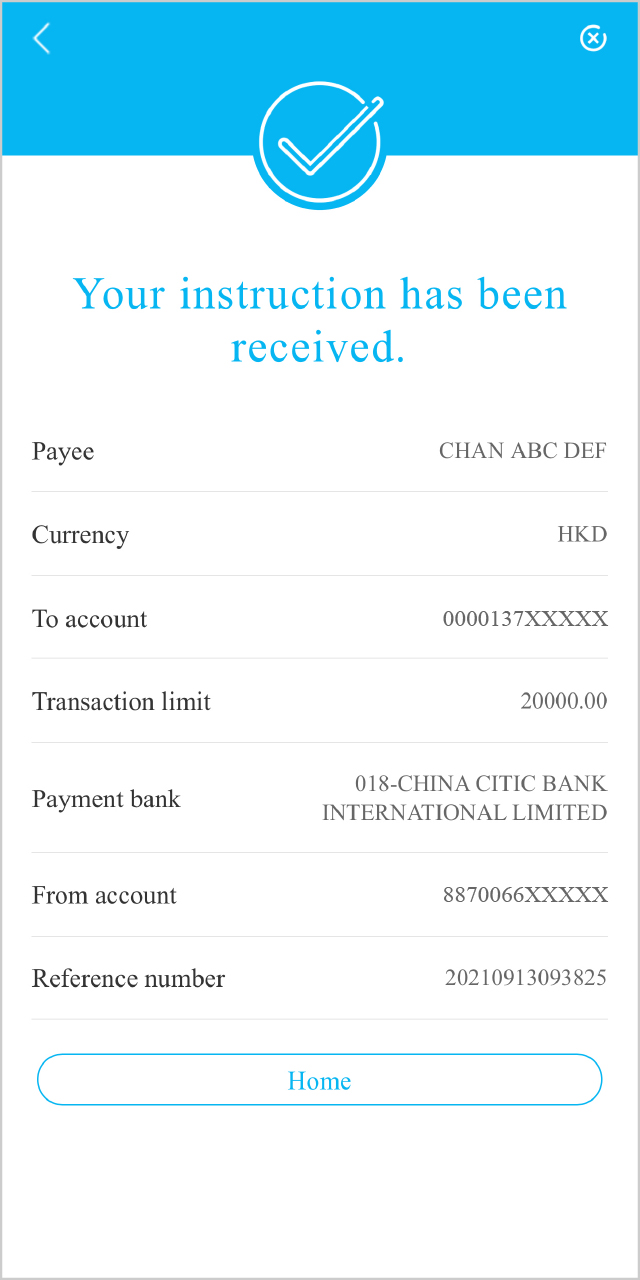

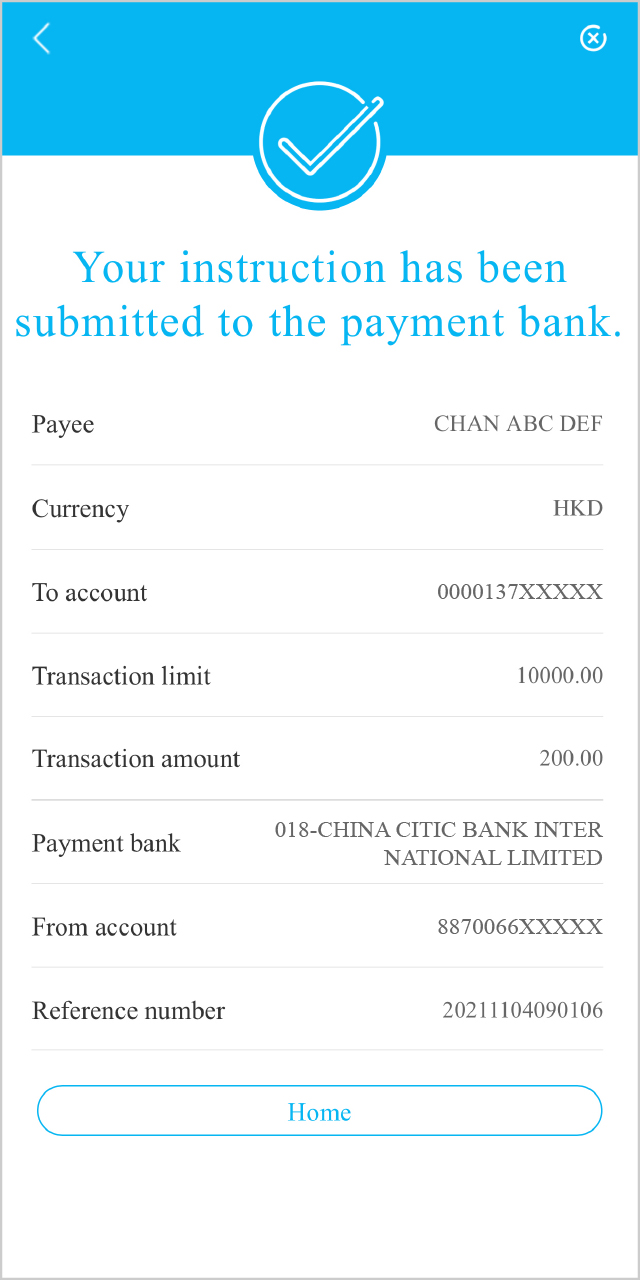

- You will receive an email confirmation and a SMS in relation to (i) the setup, (ii) the cancellation of the Easy Fund-in Service and (iii) the placement of an Instruction4.

- You may submit a request to cancel any of your eDDAs and/or any of your corresponding Instruction(s) by accessing the Easy Fund-in Service through the CCB (Asia) website or the Mobile App.

- For more information, please refer to the Terms and Conditions for Electronic Direct Debit Authorisation Service.

- CCB (Asia) does not guarantee that the payment bank will be able to effect an instruction or transfer or approve any request to setup, amend or cancel an eDDA as this depends on, amongst other things, the operation, functionality and reliability of the payment bank’s own systems and operation, which are beyond CCB (Asia)’s control.

- As part of the prescribed process, you must create an Instruction by selecting the Recipient Account, Transaction Currency, setting a Transaction Limit and providing details of the Designated Account and any other information prescribed by CCB (Asia) from time to time. The Transaction Limit may not be amended once approved by CCB (Asia). The Transaction Limit is to be designated by you, being an amount not exceeding 1,000,000 Hong Kong dollars or 1,000,000 Renminbi for each Transfer (depending on the currency used in the relevant Transfer), or such other transaction limit as may be imposed by CCB (Asia) from time to time.

- To confirm your request to setup, activate or cancel the Easy Fund-in Service: (a) CCB (Asia) may send to you a Security Code by way of short message service to your designated mobile phone number; and (b) you shall input the Security Code in the manner required by CCB (Asia) to authenticate your identity.

- Any request to setup or cancel the Easy Fund-in Service, and the corresponding Instruction, is subject to the Account Bank's approval or confirmation, which result will be communicated by CCB (Asia) to you via email or SMS which will be sent to your designated mobile phone number.

+852 317 95578