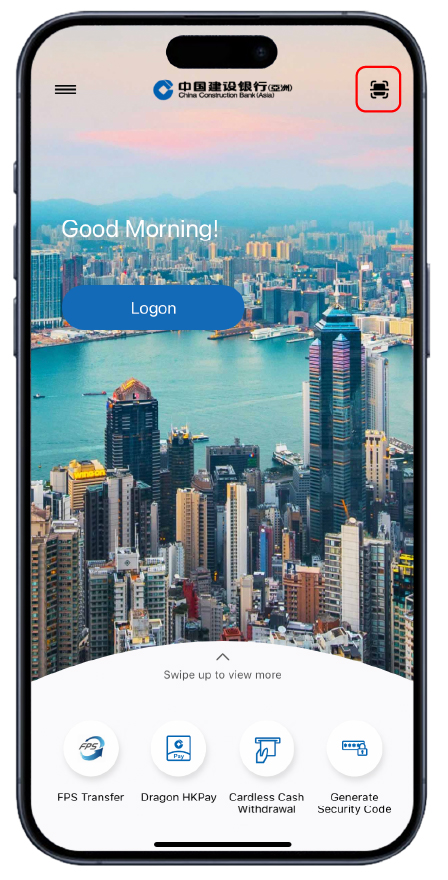

Mobile Token and Biometric Credential Authentication Service

Comprehensive Protection for Your Online Banking Account

![]()

More secure and faster e-Banking service experience

![]()

Not required for carrying additional physical device

![]()

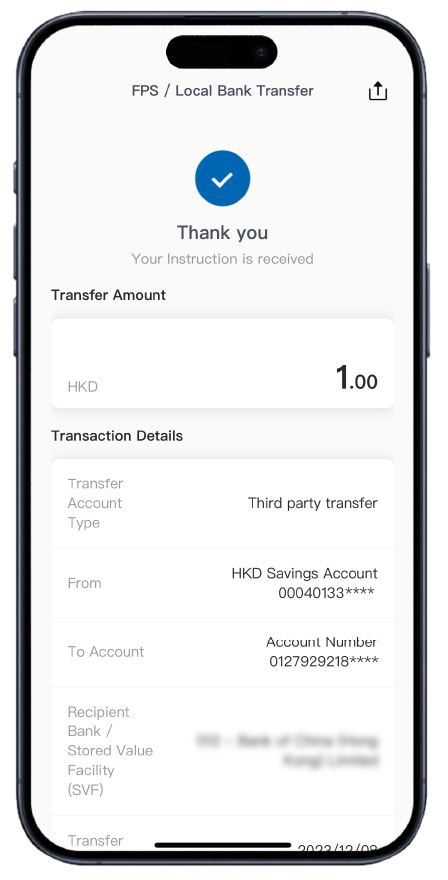

Mobile in-app notification for e-transactions*

- How to activate

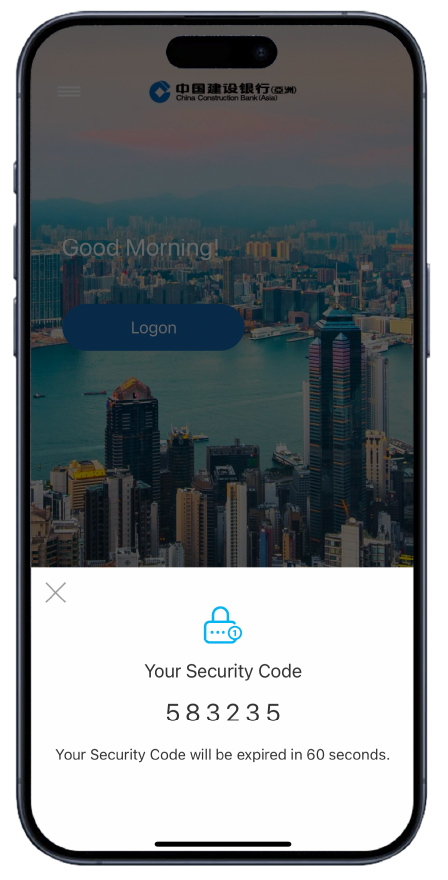

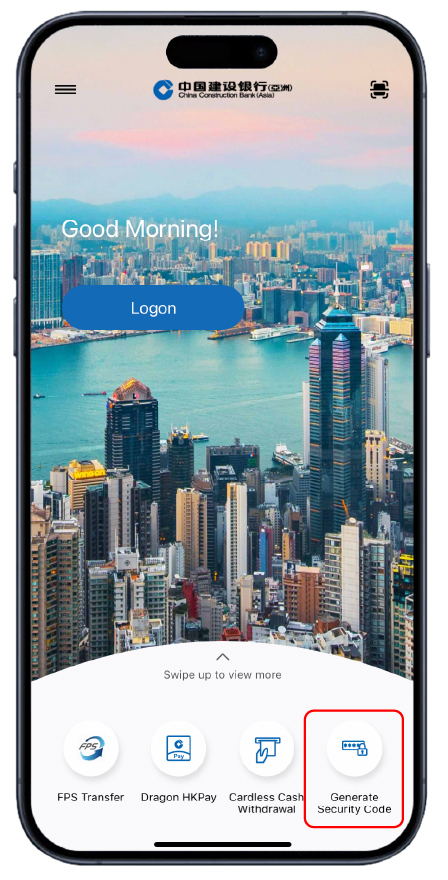

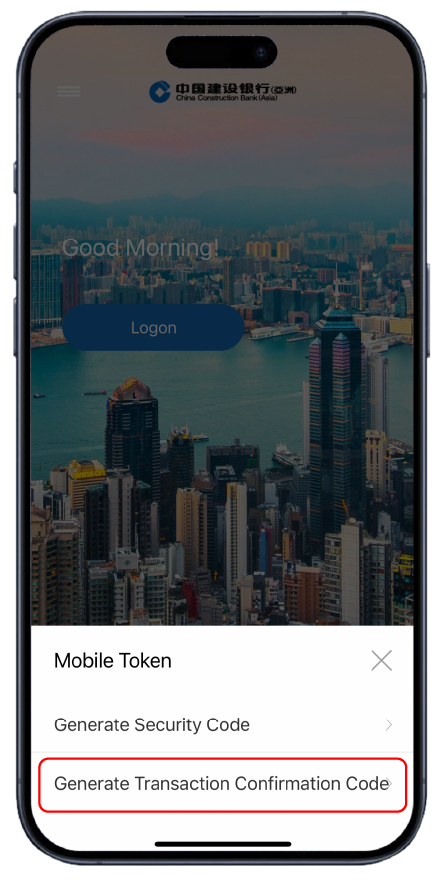

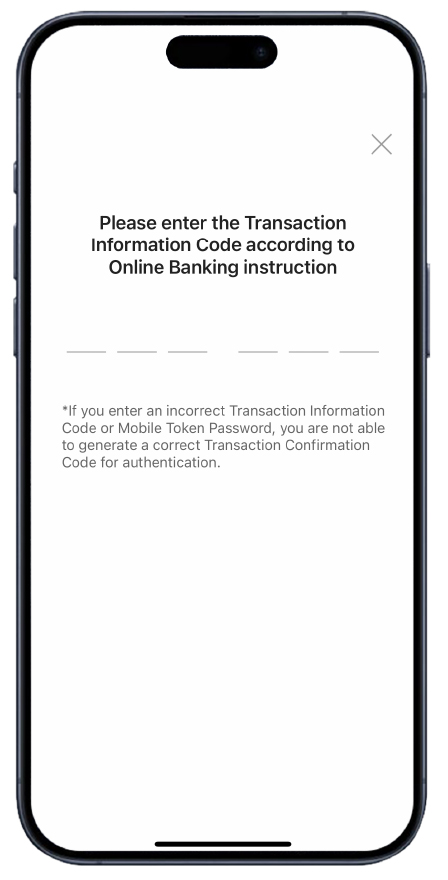

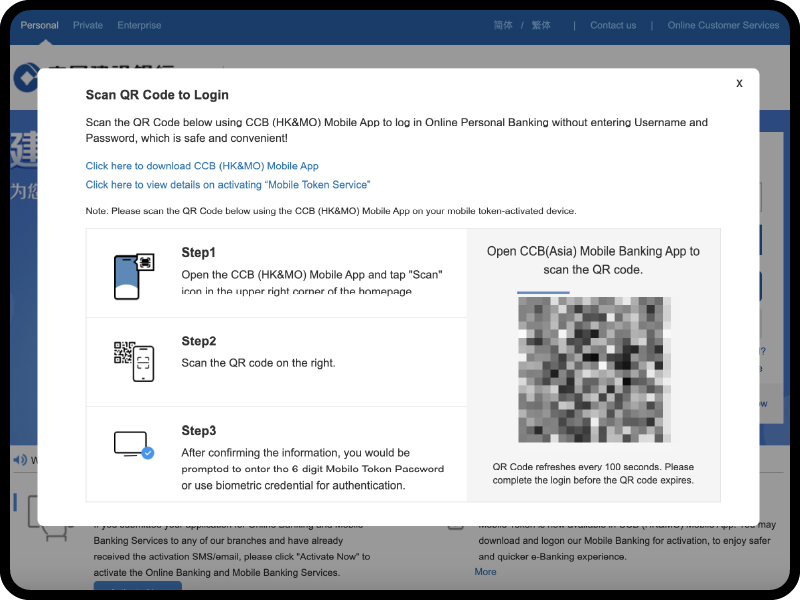

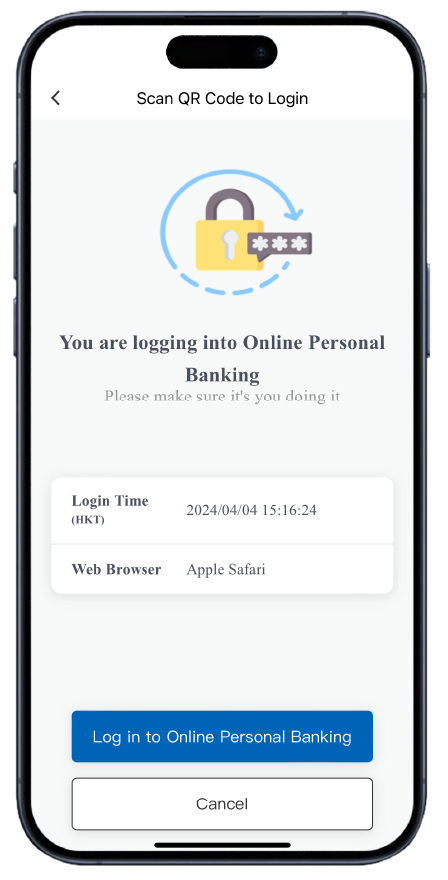

- How to use (Online Banking)

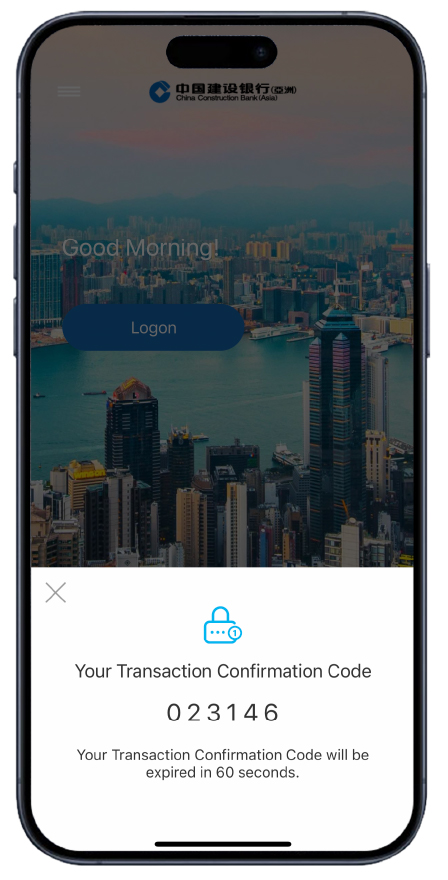

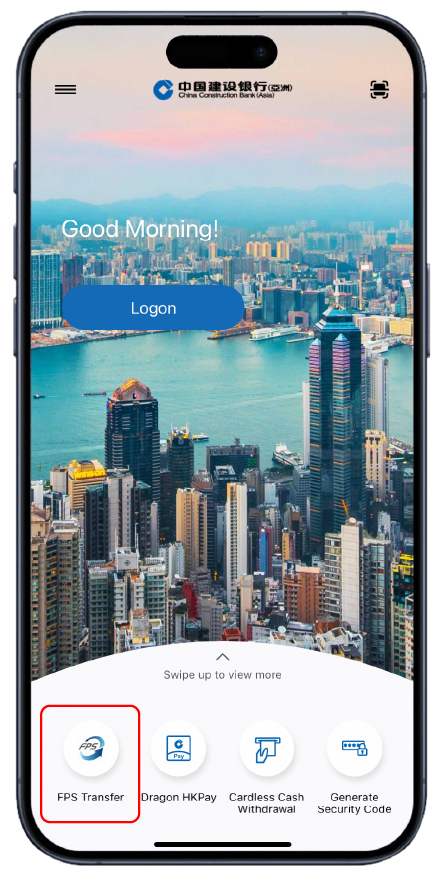

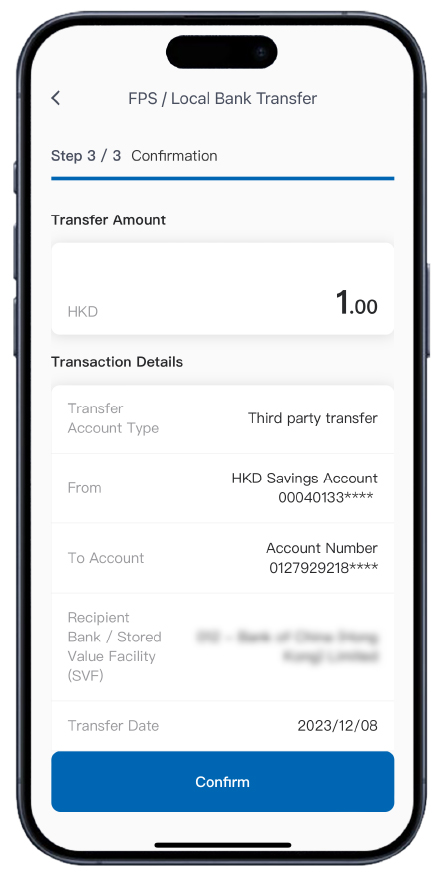

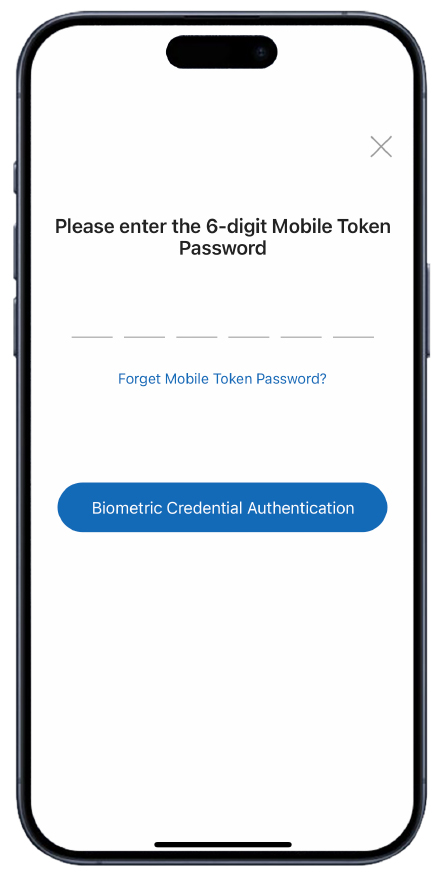

- How to use (Mobile Banking)

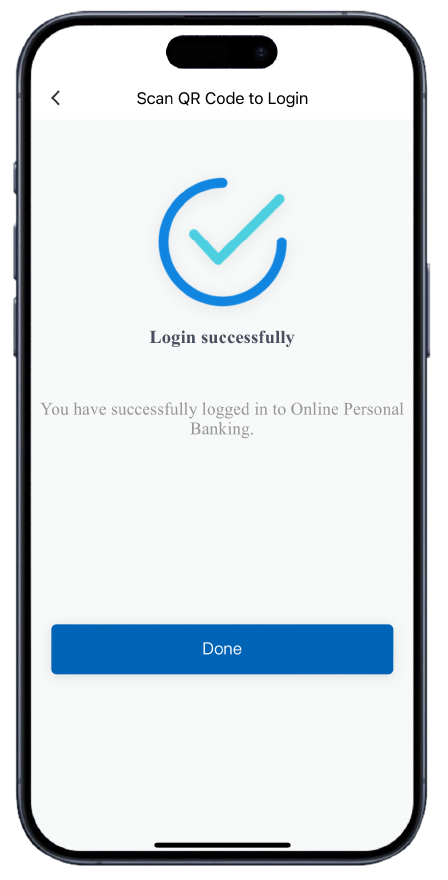

- QR Code Login

- FAQ

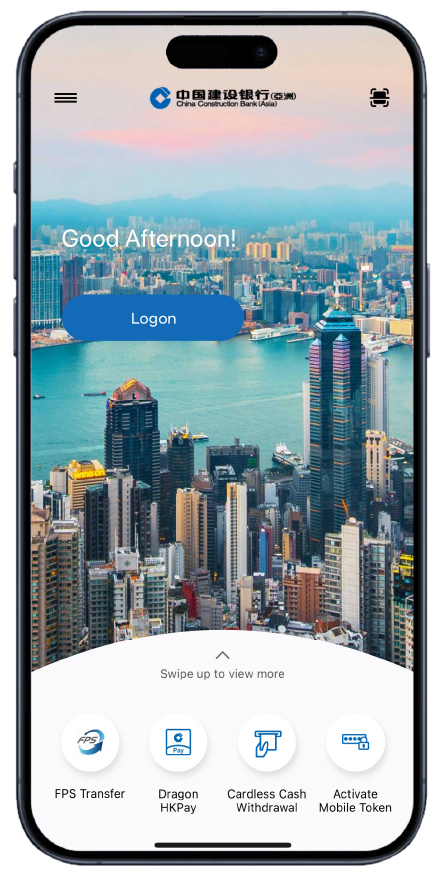

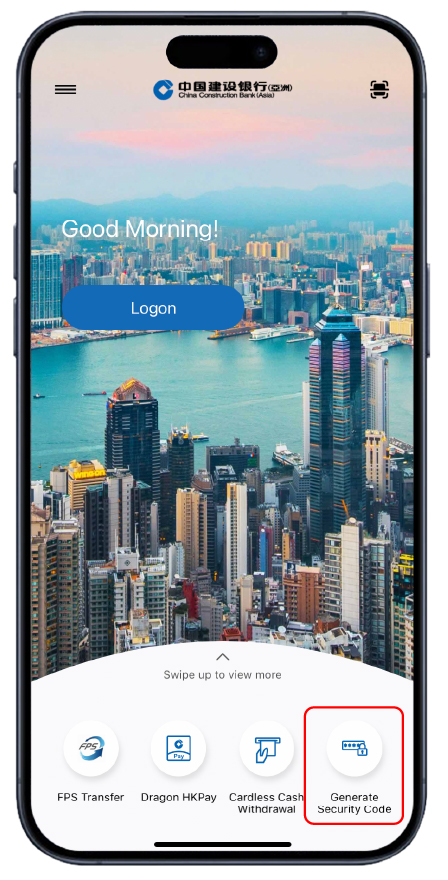

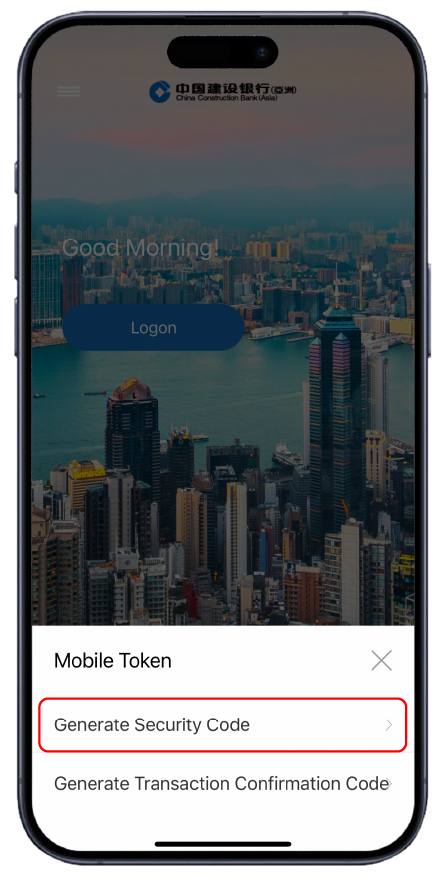

Please open CCB (HK &MO ) Mobile App and read the following instruction for activating the Mobile Token:

|

Step

1

|

Click “Activate Mobile Token” in the menu of main page.

|

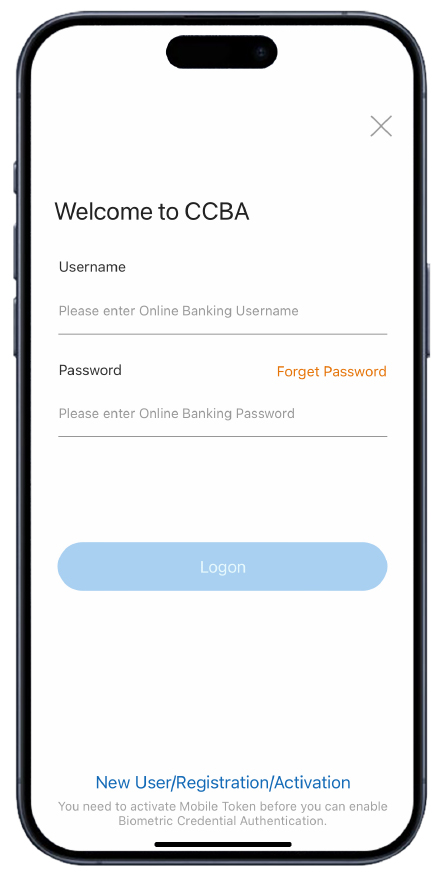

|

Step

2

|

Input your Online Banking Username and Password for logging on to Mobile Banking.

|

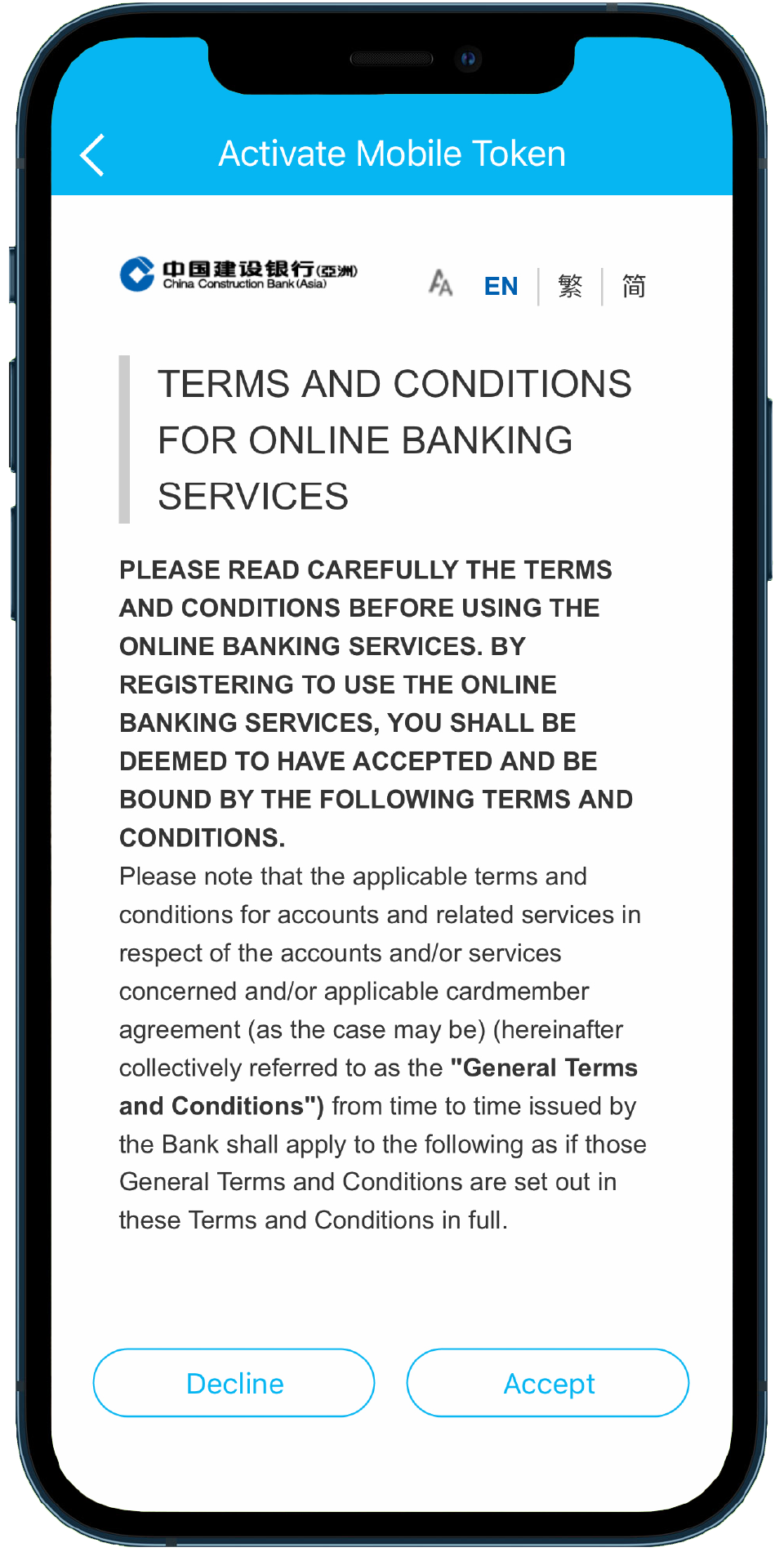

|

Step

3

|

Read and accept the Terms and Conditions.

|

|

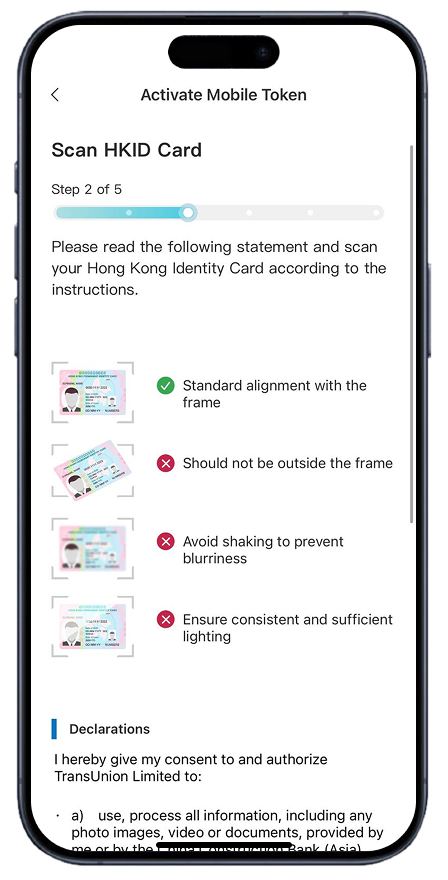

Step

4a

|

For Hong Kong ID holders: If your registered document with the bank is a Hong Kong ID, follow the instructions to scan your Hong Kong ID. (Applicable for first-time application only)

|

|

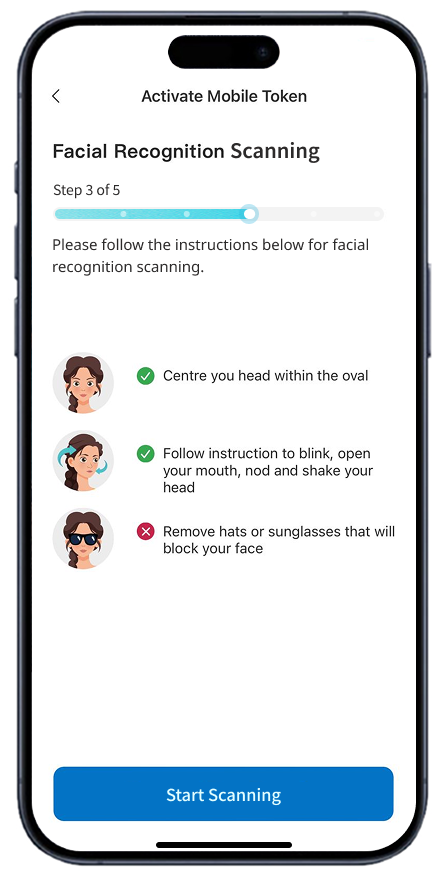

Step

4a

|

For Hong Kong ID holders: Follow the instructions to complete facial recognition scanning. (Applicable for both first-time and subsequent applications)

|

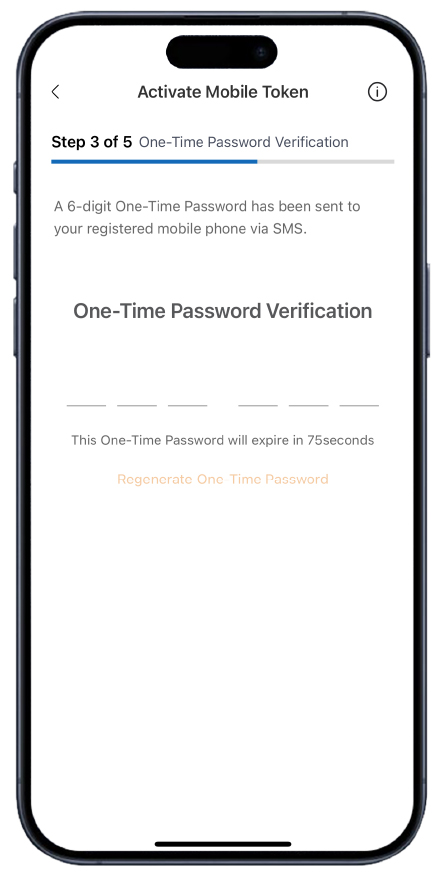

|

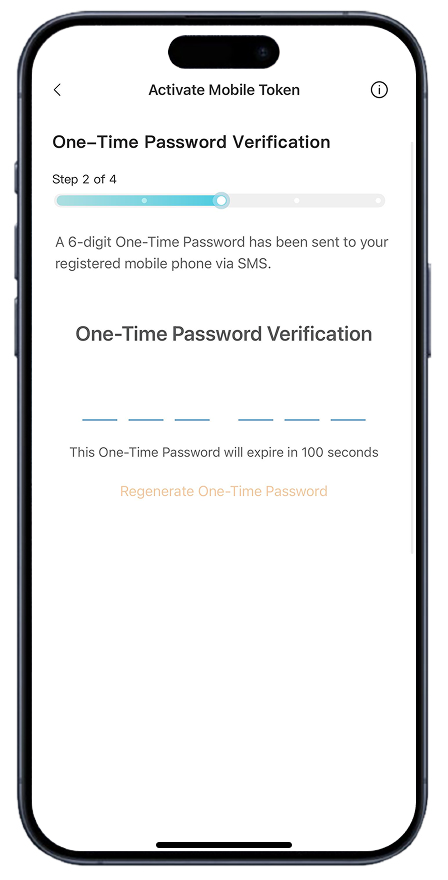

Step

4b

|

For non-Hong Kong ID holders: A SMS with 6-digit One-Time Password will be sent to your registered mobile phone number. Input the One-Time Password to proceed.

|

|

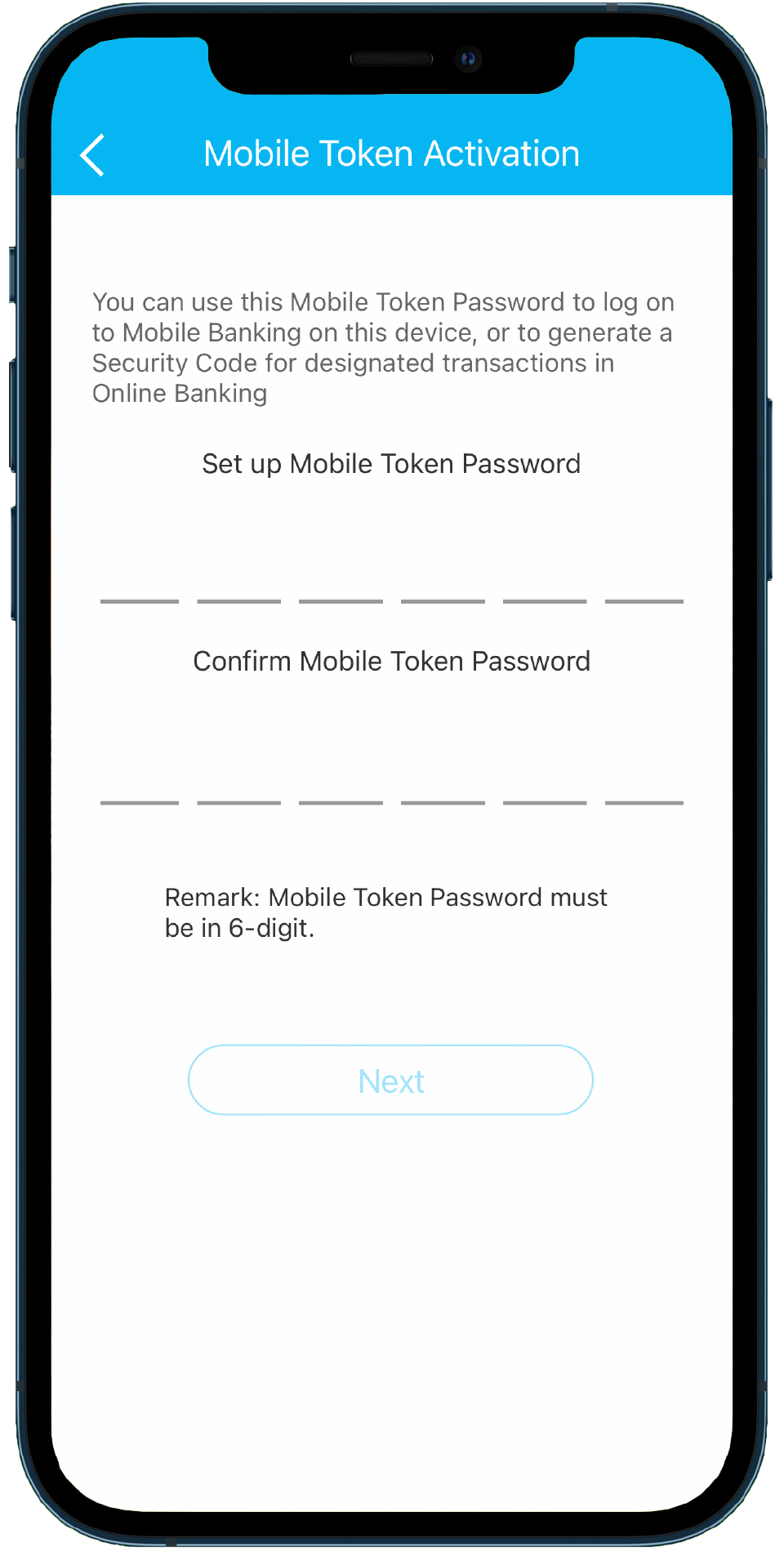

Step

5

|

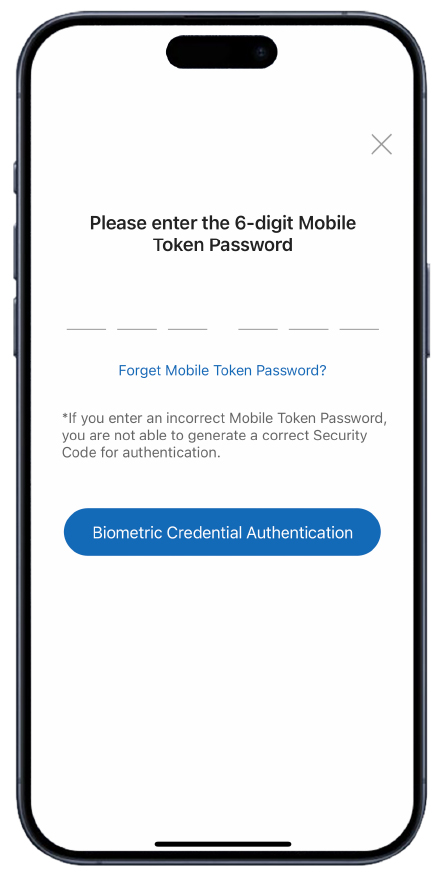

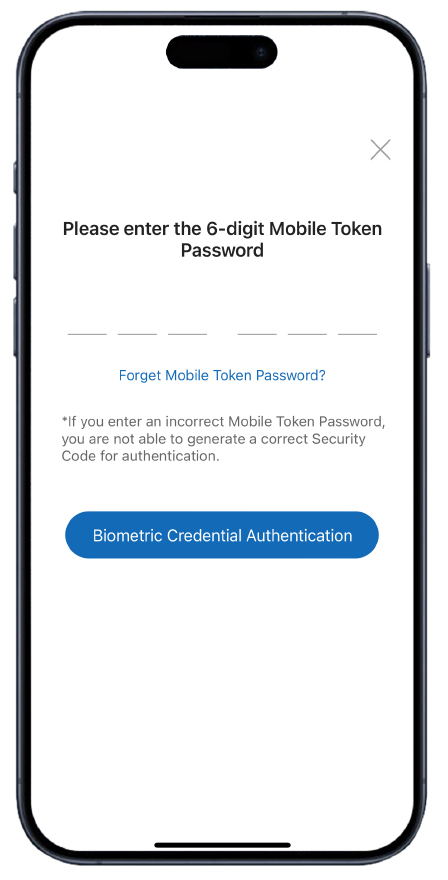

Set up a 6-digit Mobile Token Password. Input the Password again to confirm.

|

|

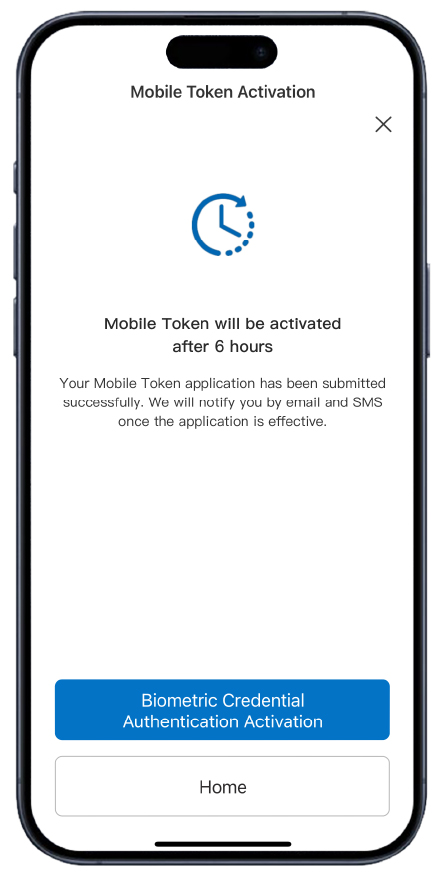

Step

6

|

The application of Mobile Token service is completed. For security reason, Mobile Token will be effective in about 6 hours. We will notify you by email and SMS once it is effective. Then you can use your 6-digit Mobile Token Password with the Mobile Token activated device to log on to Mobile Banking or use Mobile Token Password/generate one-time Security Code to authenticate designated Mobile/Online Banking services.

|

Biometric Credential Authentication Service will be available to activate upon the effective of Mobile Token in Mobile Banking. You may continue to apply for Biometric Credential Authentication Service after applied for activating Mobile Token; or follow below steps for activation of the Service if Mobile Token is effective:

|

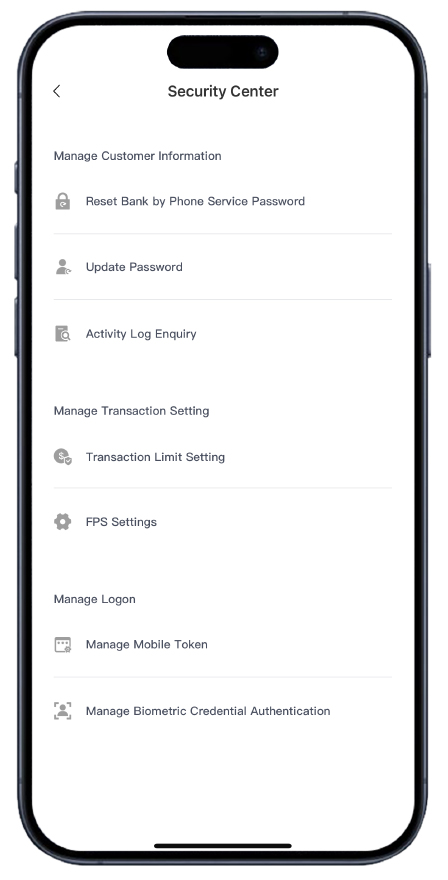

Step

1

|

After logging on to Mobile Banking, you can go to "Left Menu" >"Security Center" >"Manage Biometric Credential Authentication" to activate the Service.

|

|

Step

2

|

Verify your biometric credential.

|

|

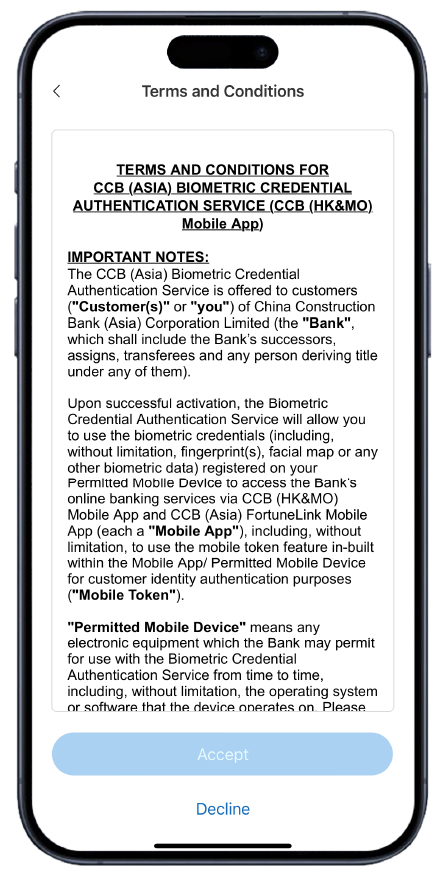

Step

3

|

Read and accept the Terms and Conditions of Biometric Credential Authentication Service.

|

|

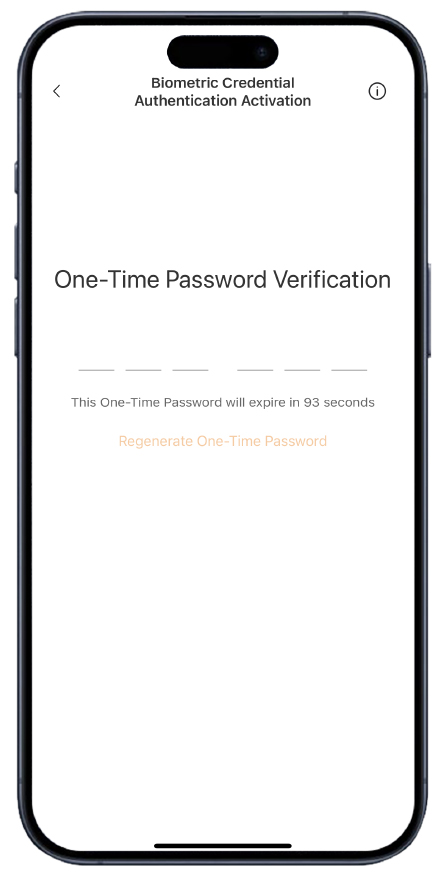

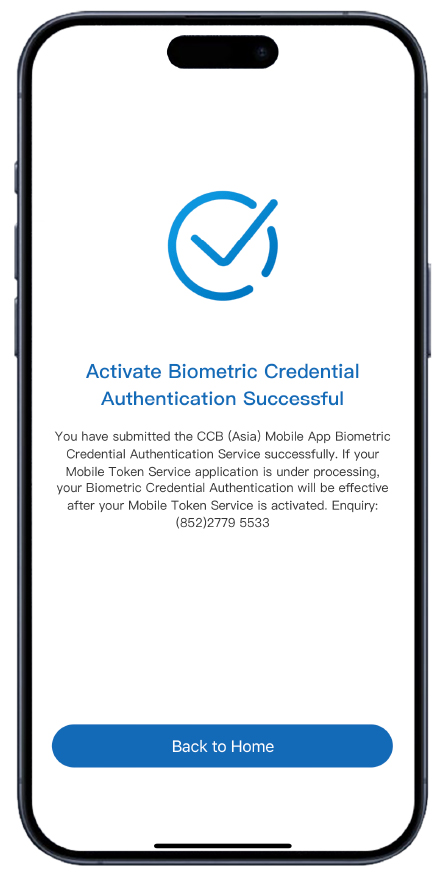

Step

4

|

Input the SMS One-Time Password sent to your mobile phone number registered with the Bank via branch.

|

|

Step

5

|

The Activation of Biometric Credential Authentication Service is completed. Upon the effective of Mobile Token, you can use your biometric credential with the activated device to log on to Mobile Banking and/or to authenticate designated Mobile Banking services.

|

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are the registered trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited. HUAWEI EXPLORE IT ON AppGallery and the HUAWEI EXPLORE IT ON AppGallery logo are the registered trademarks of Huawei Technologies Co., Limited.

The services listed above are eligible for Online Personal Banking customer only and subject to the related terms and conditions of the services.