Frequently Asked Questions

CCB (Asia) Mobile Banking

- What is CCB (Asia) Mobile Banking?

- How do I access CCB (Asia) Mobile Banking?

- What devices does CCB(HK&MO) Mobile App support?

- What are the service hours of CCB (Asia) Mobile Banking?

- Can I access Mobile Banking overseas?

- Are there any additional service charges of using Mobile Banking services?

- Why will I be logged out of the service without tapping the "Logoff" button?

- If my mobile devices crashes or I get disconnected from the network halfway through, how would I know if my transactions have been effected?

- How to terminate CCB (Asia) Online Banking and Mobile Banking Services?

- Why can't I receive One-Time Password (OTP) / eAlert email from CCB (Asia)?

- What is “Disable the setting up of Mobile Banking and Online Banking Service“?

- How to disable CCB (Asia) Mobile Banking and Online Banking Services?

- How to re-activate CCB (Asia) Mobile Banking and Online Banking Services after disabling?

- What is “Deactivate the online registration of new account service”?

- How to deactivate the online registration of new account service?

- How to re-activate the online registration of new account service?

- What is “Deactivate the online increase of transfer limits service”?

- How to deactivate the online increase of transfer limits service?

- How to re-activate the online increase of transfer limits service?

About Logon to Mobile Banking

How to Register for / Activate Online Banking and Mobile Banking Services- How can I register for CCB (Asia) Online Banking and Mobile Banking Services?

- How do I log in to Online Banking?

- I received a set of Username and Password for Online Banking and Mobile Banking Services given by the Bank, what should I do?

- How can I logon to Mobile Banking?

- What is Verification Code?

- Why a Verification Code is needed?

- How about if the Verification Code is unreadable?

- How about if the Verification Code image cannot be shown?

- What is Mobile Token?

- What is Mobile Token Password?

- Is Mobile Token free of charge?

- Which mobile phone models are compatible with Mobile Token?

- Can I use Mobile Token in a rooted/ jailbroken device?

- How do I apply Mobile Token Service?

- Can I use Mobile Token to log on Mobile Banking and authenticate Online Banking/ Mobile Banking transactions immediately after applied Mobile Token Service?

- Can I log in to Online Banking through the "QR Code Login" function immediately after applied Mobile Token Service?

- Upon activation of Mobile Token, do I need to use it every time when I log on to Mobile Banking?

- Upon activation of Mobile Token, do I need to use it every time when I log on to Online Banking?

- How to use Mobile Token to authenticate designated Mobile Banking transactions?

- How to use Mobile Token to authenticate designated Online Banking transactions?

- Can I activate Mobile Token on multiple devices?

- If I have to change a mobile device, how do I transfer Mobile Token in the new device?

- Can I continue to use Mobile Token after reinstalled CCB(HK&MO) Mobile App?

- Can I use Mobile Token and physical Security Token at the same time?

- If my physical Security Token is lost, can I apply for Mobile Token?

- How to deal with my existing physical Security Token after activated Mobile Token?

- If my Mobile Token activated device is lost or stolen, what should I do?

- If my Mobile Token Service is locked or deactivated by entering invalid Mobile Token Password or One-Time Security Code/Transaction Confirmation Code repeatedly in Mobile Banking/Online Banking, what should I do?

- How to deactivate the Mobile Token?

- How to change my Mobile Token Password in Mobile Banking?

- If I forget my 6-digit Mobile Token Password, what should I do?

- What is Biometric Credential Authentication Service?

- Which operating systems and mobile devices are Biometric Credential Authentication Service available on?

- How to activate the Biometric Credential Authentication Service?

- Can I use Biometric Credential Authentication Service before activation of Mobile Token?

- How to use biometric credential to authenticate designated Mobile Banking transactions?

- Can I activate Biometric Credential Authentication Service on more than one mobile device?

- How to deactivate Biometric Credential Authentication Service?

- What if my Biometric Credential Authentication Service enabled mobile phone is lost or stolen?

- Will CCB(HK&MO) Mobile App store my biometric credential information?

- If I have more than one biometric credential stored on my mobile device, can any of the biometric credentials be used for Biometric Credential Authentication Service?

- If I changed the biometric credential setting in my mobile device, can I continue to use the Biometric Credential Authentication Service?

- Under what situation would the Biometric Credential Authentication Service be deactivated?

- If my Biometric Credential Authentication Service is deactivated by the repeated failures of Biometric Credential recognition in Mobile Banking, what should I do?

- If my biometric credential is not recognized, can I still log on Mobile Banking using my Online Banking Username and Password?

- Can I use Biometric Credential Authentication Service if someone else’s biometric credential is stored on my mobile device?

- If I re-install CCB(HK&MO) Mobile App, do I need to activate the Biometric Credential Authentication Service again?

- How can I update my email address / mobile phone number?

- How can I update my correspondence records with CCB (Asia)?

- Do I, as customer of CCB (Asia), need to register or do other things to enjoy and be protected by the SMS Sender Registration Scheme?

- How do I know if CCB (Asia) and my mobile company have participated in the SMS Sender Registration Scheme?

- I received a SMS from CCB (Asia) but it is not sorted under the same thread as before. Should I be alarmed?

- I received an SMS from CCB (Asia) but its sender ID does not have a “#” sign. Does it mean that it must be fraudulent?

- I have registered for the SMS-forwarding service. How would the SMS Sender Registration Scheme affect me?

- I receive SMS from CCB (Asia) with a local mobile number but I am currently not in Hong Kong. Will I be benefited by the SMS Sender Registration Scheme?

- I receive SMS from CCB (Asia) with a Mainland/overseas mobile number but I am currently living in Hong Kong. Will I be benefited by the SMS Sender Registration Scheme?

- I am using Single-Card-Multiple-Numbers (SCMN) / 1-Card-2-Number service. How would the SMS Sender Registration Scheme affect me?

- I use a e-SIM card. How would the SMS Sender Registration Scheme affect me?

- I receive an SMS with the “#” sign (#CCB Asia, #CCBA SMS, #CCBA Alert, #CCBA Card, or #CCBASIA) but it is not truly originated from CCB (Asia). What should I do?

About Banking Services in Mobile Banking

Account Enquiry Fund Transfer- What are the different types of fund transfer available?

- How far in advance can I instruct a transfer to be made?

- How long do transfers take?

- Are there any daily limits for fund transfer?

- Are there any cut-off time for transfer within CCB (Asia) account or to other local banks?

- Is there any cut-off time for Funds Transfer in foreign currency?

- How many registered account can I register?

- If I want to add or delete a registered account, what can I do?

- If I want to update the transfer limit of the registered account, what should I do?

- Which banks are applicable for Express Transfer?

- What will happen if there is insufficient fund in my account on the effective date?

- When can I transfer money overseas?

- When can I send a RMB remittance?

- What is the daily transfer limit?

- Do I need to pay for making a transfer to an overseas account?

- What should I do if I delete my registered overseas account by mistake?

- Can I modify my registered overseas account online?

- What is Activity Log?

- How do I access Activity Log on CCB (Asia) Mobile Banking?

- What kind of transaction records and information can I review on activity log?

- If I find my recipient’s FPS proxy ID / account number is being flagged by the scam prevention alert, how can I remove it?

- Will Bank be able to help to remove my FPS proxy IDs / account numbers from the scam prevention alert?

- If I want to report a suspicious FPS proxy ID / account number, what should I do?

- If there is no scam prevention alert message relating to my recipient, does it guarantee it is safe to transfer to him/her?

- Why is my recipient’s FPS proxy ID / account number previously not tagged in the scam prevention alert but now being tagged?

- What is the source of the scam prevention alert and how is my private information being protected?

- Why I found my FPS proxy ID / account number on the scam prevention alert when doing FPS transfer? I did not commit any crime!

- I discovered my recipient's mobile number / account number has been flagged in Scameter. How come the bank did not alert me when I now try to make payment to this FPS proxy ID / account number?

- I discovered my recipient's mobile number / account number has been flagged in Scameter. How come the bank did not alert me when I previously made payment to this FPS proxy ID / account number?

Questions on operation:

- How would I know if my recipient’s mobile number/email address/FPS Identifier/account number is flagged for scam prevention alert?

- If I confirm to the bank to proceed with a transfer with FPS proxy ID (i.e. mobile number/email address/FPS Identifier) / account number flagged as “High Risk” and subsequently realize being scammed, what should I do?

- If a recipient’s mobile number / account number is flagged as “High Risk”, will his/her email address or FPS Identifier also be flagged by the scam prevention alert?

- Can I confirm and accept the scam prevention alert message and make transfer to the FPS proxy ID / account number on the scam prevention alert?

- What is a bill type code?

- What is the largest payment that I can make?

- If I have made a wrong payment, what should I do?

- Can I change the date of payment, or even delay it?

- What if my Settlement Account does not have enough balance?

- What is the cut-off time for online bill payment?

- Is there any service fee involved in the bill payment services?

- What bills can I pay via Mobile Banking?

- What kind of deposit accounts can I open via Mobile Banking?

- I notice that some of my personal information has already been inserted. Can I update these details?

- I am holding a anyone-to-sign joint account, can I open the deposit account via Mobile Banking?

About eStatement/eAdvice Service

- Will I continue to receive the paper statement?

- How can I know a new eStatement/eAdvice is posted on Online Banking and Mobile Banking?

- When will I start receiving eStatement/eAdvice eAlert?

- How can I know a new eStatement/eAdvice is posted on Online Banking and Mobile Banking?

- What is eAlert?

- Who is eligible for using eAlert Services?

- What is the benefit of using eAlert Services?

- Is there a charge for using eAlert Services?

- How to setup the eAlert?

- Where can I change my e-mail address or mobile phone number?

- When will I receive eAlert?

- Does my mobile phone service provider charge on receiving eAlerts via SMS?

- What type of time deposit I can do via Mobile Banking?

- What are the deposit period available for different currencies?

- How much is the minimum initial deposit for HKD Time Deposit, Foreign Currency Time Deposit?

- When can I place a Time Deposit online?

- What are the types of maturity instructions available?

- Can I amend my maturity instructions at anytime I want?

- How far in advance can I set up a Time Deposit on Mobile Banking?

- If I am not renewing my time deposits upon maturity, how can I transfer the proceeds (principal and interest) to an account without having to consider currency exchange?

- If I have made a time deposit at a branch, can I change the maturity instruction on Mobile Banking?

- What kind of Cross Border Long Card account(s) I can enquire at CCB (Asia) Mobile Banking?

- How long does it take for HKD remittance from CCB (Asia) to CCB?

- Will there be any service charge for HKD real time remittance from CCB (Asia) to CCB?

- Is there any limit for HKD real time remittance?

- If I have RMB account in CCB (Asia), can I remit to CCB Cross Border Long Card RMB account?

- Will there be any service charge for RMB remittance?

- What is “JETCO Cardless Withdrawal” Service?

- How can I use the “JETCO Cardless Withdrawal Service”?

- What is the validity of the withdrawal instruction?

- How do I know which JETCO ATM supports this Service?

- Can I make cardless withdrawal outside Hong Kong?

- Is there a service charge for withdrawing under this channel?

- Is there any withdrawal limit?

- What can I do if no cash is dispensed from the ATM after making cash withdrawal?

- Can I withdraw RMB from my RMB account via “JETCO Cardless Withdrawal”?

- Do I need to sign up before using “JETCO Cardless Withdrawal”?

- Can I still use my ATM card for cash withdrawal?

- What is “UnionPay QRC Withdrawal” Service?

- How can I use this Service?

- When will the withdrawal instruction expire?

- Which type of account can use this Service?

- How can I start using this Service right away? Do I need to register?

- How do I know which ATMs support this Service?

- Can I make cardless withdrawal outside Hong Kong?

- Is there a service charge for withdrawing cash under this Service?

- Is there any withdrawal limit?

- What can I do if no cash is dispensed from the UnionPay QRC Withdrawal ATM after making cash withdrawal under the Service?

- Can I withdraw RMB from my RMB account via this Service?

- Can I withdraw MOP from my HKD account via this Service?

- Can I still use my UnionPay Dual Currency Debit Card for cash withdrawal?

- Can I check the withdrawal transaction history?

About Investments in Mobile Banking

Securities Trading- How do I place an order?

- Does the Bank accept price orders that are different from current market prices?

- How do I know the Bank has received my order?

- How can I check the status of my order?

- Can I amend or cancel my order?

- How am I notified of the execution results?

- How can I keep track of the stock?

- What is "All-or-Nothing"?

- What is "Limit Order"?

- What is "Enhanced Limit Order"?

- What is "Special Limit Order"?

- What is "At auction Limit Order"?

- What is "Stop Loss Order"?

- What is Lowest Selling Price?

- What is "Market Order"?

- Can I place an order during non-trading hour or non-trading day?

- What is "Good-till-date" Instruction?

- Can I place a Market Order during non-trading hour?

- What is "Good-till-date" Instruction?

- Which order types can set "Good-till-date" Instruction?

- I have placed a "Good Till Date" order. If the order cannot be fully executed on same day and is partially executed on different days, will all the execution results be consolidated for calculating the charges?

- Will my order be valid if there is any corporate action of the company?

- Can I sell the stocks I have bought before its settlement?

- Can I use the funds from selling a stock to buy a new stock before its settlement?

- What is total purchasing power?

- Will the transaction I perform today be reflected in my "Portfolio"?

- If I placed an order via the manned channel and subsequently modified the order on Mobile Banking or placed an order on Mobile Banking and subsequently modified the order via manned channel, which channel rate will be used to calculate the commission?

- Why I need further identity verification when I access Online Securities Trading Services?

- How to register or update the mobile phone number for receiving the One-Time Password (OTP)?

- Why am I unable to request or receive the SMS One-Time Password (OTP)?

- Can investors hold SSE or SZSE securities through Shanghai and Shenzhen Northbound Trading in physical form?

- How do investors obtain the latest company announcement?

- Can investors attend the relevant shareholder meetings in person or appoint more than one person to attend and act as proxy at the meetings on his/her behalf?

- Can customers cancel their submitted orders within the 5 minutes prior to the opening of each trading session?

- Can I involve in Shanghai and Shenzhen Northbound Trading?

- Special arrangement on unsettled fund

- Is there any cut off time for Securities Settlement Instruction on transfer in / out of SSE and SZSE securities?

- Should I use my existing securities account to trade RMB denominated stock? Is it required to set up a new settlement account for RMB stock trading?

- Are the stamp duty, transaction fees for trading RMB denominated stock in RMB or HKD?

- Can I trade RMB denominated stock with my margin trading account?

- Which types of securities are eligible for Closing Auction Session (CAS)?

- What is the trading hours for CAS?

- How does CAS works?

- How does the order matching mechanism works?

- How the outstanding orders in CTS will be handled?

- How the unfilled / partially filled orders will be handled after CAS?

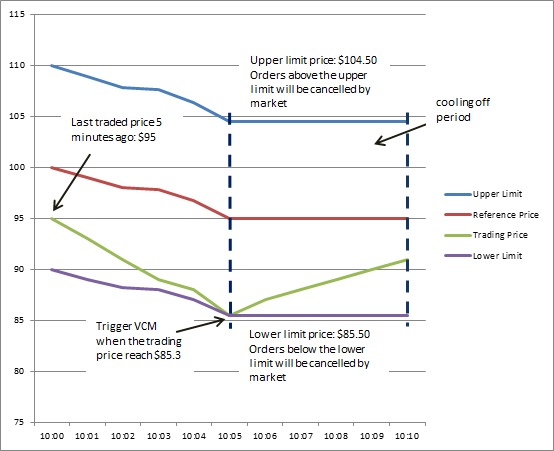

- Which types of securities / derivatives are covered by the Volatility Control Mechanism (VCM)?

- Which trading session(s) that VCM will be triggered?

- How does the VCM work?

- How the reference price of VCM being determined?

- What is eIPO Service?

- What are the benefits of eIPO?

- Pre-registration is required for eIPO Service?

- How to make application payment?

- Is eIPO Service available 24 hours a day?

- What are the steps of using eIPO Service?

- Can I submit more than one application for the same IPO?

- Which applications form eIPO Service is like?

- How do I know if my application instruction has been submitted successfully?

- Can I amend or cancel my eIPO application?

- How do I know whether the securities are allotted to me?

- How will I be refunded?

- Can I trade mutual fund online?

- Can I subscribe/redeem/switch investment funds via Online Mutual Fund Service?

- Which funds can I subscribe online?

- What is the minimum investment amount?

- Which currency can I use to subscribe fund(s)?

- How do I know the Bank has accepted my order?

- Can I amend/cancel my instruction online?

- What kind of information can I find online?

- How do I search for the fund(s) I want?

- Where can I obtain a copy of the funds' offering document for reference?

- Apart from the trade related fee as specified in the fund’s offering document and the bank’s Schedule of fees and charges, are there any additional fees charged for using the Online Mutual Fund Services to subscribe/redeem/switch funds?

- Which type of fund switching order I can submit via Online Mutual Fund Services?

- What are the service hours of Mutual Fund online services?

- What is the minimum deposit amount?

- What is the maximum deposit amount?

- What currency pair combinations are available?

- Is there any subscription charge for FX Linked Deposit displacement online?

- What are the service hours for FX Linked Deposit displacement through Mobile banking?

- How do I place FX Linked Deposit?

- How can I cancel the deposit after booking?

- How do I know the repayment amount and currency of the FX Linked Deposit booking on maturity date?

- Will I receive an advice for FX Linked Deposit online booking?

- How long will my placement history be available?

- When will the fixing exchange rate will updated in "Placement History" under "FX Linked Deposit"?

- Why can't I see the FX Linked Deposit placed today in "Portfolio" under "FX Linked Deposit"?

- What is the minimum trading unit?

- Are there any trading limits?

- Are there any service charges for Gold Trading?

- What are the service hours for online Gold Trading?

- How do I trade Gold?

- How can I check my order status?

- Will I receive an advice for online Gold Trading?

About Credit Cards in Mobile Banking

About Security of Mobile Banking

- How secure is CCB (Asia) Mobile Banking?

- Why do I need to conduct an additional authentication when using "Mobile Banking App"?

- What can be done if I suspect unauthorized access to my account?

- Why do I see a message that asks me to secure my mobile device while I am accessing CCB (HK&MO) Mobile App?

About CCB (Asia) Mobile Banking

What is CCB (Asia) Mobile Banking?

CCB (Asia) Mobile Banking services allows you to stay on top of your finances whenever you want to by banking through mobile with us. Efficiently manage your assets through our simple and convenient Mobile Banking. Our enhanced security measures ensure that your experience with us is safe and secure.

For the details of CCB (Asia) Mobile Banking services, please tap here.

How do I access CCB (Asia) Mobile Banking?

For iPhone users, you can download CCB (HK&MO) Mobile App by searching "CCB Asia" or “CCB HK&MO” at the App Store.

For Android users, you can get CCB (HK&MO) Mobile App by searching "CCB Asia" or “CCB HK&MO” at Google Play, or download via our Bank's website. For details, please tap here.

What devices does CCB(HK&MO) Mobile App support?

CCB(HK&MO) Mobile App supports iOS and Android devices

- iOS 14.0 or above

- Android 8.0 or above

In order to protect your online security, the Mobile App will not run on any devices which are "jailbroken" (iOS) or "rooted" (Android). The Bank shall not be responsible for any loss or damage suffered by you if you attempt to use the Mobile App on such devices.

What are the service hours of CCB (Asia) Mobile Banking?

It is a 7x24 round-the-clock service for you. However, some functions (such as Fund Transfer, Securities Trading Market Order and etc.) can only be processed during corresponding service hours.

Can I access Mobile Banking overseas?

You can access your finances anywhere, anytime via the network of either local or overseas telecommunication service providers.

Are there any additional service charges of using Mobile Banking services?

No, no additional charges are required to use Mobile Banking.

Why will I be logged out of the service without tapping the "Logoff" button?

As long as there is activity, you will not be logged out. For security reason, you will be automatically logged out after 10 minutes of inactivity, to prevent unauthorized viewing of your account.

If my mobile devices crashes or I get disconnected from the network halfway through, how would I know if my transactions have been effected?

Don't panic. All you have to do is to re-log to check your account balance in Account Enquiry or re-initialize the transaction, if required. But if you do have any doubt or questions, simply call upon our Customer Service Hotline at +852 2779 5533 during operating hours to check the status.

How to terminate CCB (Asia) Online Banking and Mobile Banking Services?

Please visit any of our branches during the office hours to request for the service termination. Upon the effective of termination, you are not able to manage your assets through CCB (Asia) Online Banking, Mobile Banking and “FortuneLink” Mobile App.

Why can't I receive One-Time Password (OTP) / eAlert email from CCB (Asia)?

Please check whether the email is received in your Spam Folder or other non-inbox folders. If the email is located in non-inbox folders, you are advised to click “Report as not spam” to avoid our further email will be classified as spam. You may also logon our Mobile Banking/Online Banking to ensure your email address correctly and update your email address via Mobile Banking/Online Banking (required for activation of Security Token or Mobile Token) or visit any of our branches.

What is “Disable the setting up of Mobile Banking and Online Banking Service”?

This function allows you to deactivate our Mobile Banking and Online Banking services, which is one of the emergency measures to prevent fraud and strengthen the security of e-banking channels:

- You will not be able to register Mobile Banking and Online Banking Services;

- You will not be able to log on to Mobile Banking and Online Banking to conduct any transactions;

- You will not be able to use eStatements. If you have registered for eStatement Service in respect of your sole account(s) and choose to "Disable the setting up of Mobile Banking and Online Banking Service", the Bank will send paper statement of your sole account(s) by post from the next statement date after your instruction has been processed and a fee will be charged. Please refer to the Bank's Terms and Fees.

- To re-activate Mobile Banking and Online Banking services, only branches are supported for processing.

How to disable CCB (Asia) Mobile Banking and Online Banking Services?

Please click “Disable the setting up of Mobile Banking and Online Banking Service” under “Security Center” Menu in the Left Menu after you have logged in Mobile Banking, to disable CCB (Asia) Mobile Banking and Online Banking Services. When you submit the "Disable the setting up of Mobile Banking and Online Banking Service" instruction, it will take effect within 2 working days. Before the effective date, you can still login to Mobile Banking and Online Banking services normally. After the effective date, you will not be able to login Mobile Banking and Online Banking to conduct any transactions.

Or you can visit any of our branches to disable CCB (Asia) Mobile Banking and Online Banking Services.

How to re-activate CCB (Asia) Mobile Banking and Online Banking Services after disabling?

If you need to re-activate Mobile Banking and Online Banking services, please visit any of our branches. After your re-activation, you will be allowed to register for Mobile Banking and Online Banking Services. If you have registered for Mobile Banking and Online Banking services previously, please login to the Mobile Banking and Online Banking services with your original User ID and Password to conduct transactions.

What is “Deactivate the online registration of new account service”?

This function allows you to deactivate our online registration of new account services, which is one of the emergency measures to prevent fraud and strengthen the security of e-banking channels:

- You will not be able to use the online registration of new account service through Mobile Banking and Online Banking, and you can visit any of our branches for this service;

- The type of registered new account includes: Third Party Account with CCB (Asia), Other Local Bank Account, Overseas Bank Account, and Payment Connect (FPS/Mainland Account);

- To re-activate services, you must visit a branch in person.

How to deactivate the online registration of new account service?

Online Banking: After logging in, click “Deactivate the online registration of new account service” under “Transfer/Payment” Menu.

Mobile Banking: After logging in, click “Deactivate the online registration of new account service” under “Setting” Page in the “Transfer/Payment” Menu.

When you submit the "Deactivate the online registration of new account service" instruction, it will take effect immediately. Once deactivated, you will not be able to use the online registration of new account service through Mobile Banking and Online Banking, and you will need to visit any of our branches for this service.

Alternatively, you can visit any of our branches to deactivate the online registration of new account service.

How to re-activate the online registration of new account service?

To re-activate the service, you need to visit any of our branches.

What is “Deactivate the online increase of transfer limits service”?

This function allows you to deactivate our online increase of transfer limits service, which is one of the emergency measures to prevent fraud and strengthen the security of e-banking channels:

- You will not be able to use the online increase of transfer limits service through Mobile Banking and Online Banking, and you can visit any of our branches for this service;

- The type of transfer limits includes: Registered Accounts with CCB (Asia) and Other Local Banks, Unregistered Accounts with CCB (Asia) and Other Local Banks, Registered Overseas Account, and Unregistered Overseas Account;

- To re-activate services, you must visit a branch in person.

How to deactivate the online increase of transfer limits service?

Online Banking: After logging in, click “Deactivate the online increase of transfer limits service” under “Setting” Menu.

Mobile Banking: After logging in, click “Deactivate the online increase of transfer limits service” under “Setting” Page in the “Transfer/Payment” Menu.

When you submit the "Deactivate the online increase of transfer limits service" instruction, it will take effect immediately. Once deactivated, you will not be able to use the online increase of transfer limits service through Mobile Banking and Online Banking, and you will need to visit any of our branches for this service.

Alternatively, you can visit any of our branches to deactivate the online increase of transfer limits service.

How to re-activate the online increase of transfer limits service?

To re-activate the service, you need to visit any of our branches.

About Logon to Mobile Banking

How to Register for / Activate Online Banking and Mobile Banking Services

How can I register for CCB (Asia) Online Banking and Mobile Banking Services?

1. Application through Website or Mobile App

If you hold an ATM Card/Credit Card/Cross Border Long Card/Bank by Phone Service account, you can register for Online Banking and Mobile Banking Services online. A One-Time Password will be sent to your mobile phone number in our record during the process, please have your mobile phone ready before you begin the registration. You can set up your own Username and Password, and register for the eStatement Services for your account(s) at the same time.

Afterward, you can logon to our Online Banking and Mobile Banking with your customized Username and Password immediately *. click here or use our CCB(HK&MO) Mobile App to register for the service now.

2. Application through our Branch

If you apply for Online Banking and Mobile Banking Services through our branch, you will receive a SMS and an email for online activation after your application is processed. You can set up your own Username and Password, and register for the eStatement Services for your account(s) upon activation of your Online Banking and Mobile Banking Services via our Website or CCB(HK&MO) Mobile App.

Afterward, you can logon to our Online Banking and Mobile Banking with your customized Username and Password immediately*. Please complete your activation of Online Banking and Mobile Banking Services within 60 days after receiving the SMS and email, otherwise, please call our Customer Service Hotline at +852 277 95533 or Mainland IDD Toll Free Hotline at 4001 995533 for further assistance.

How do I log in to Online Banking?

Method 1: QR Code Login

You can scan the QR Code displayed on the Online Banking Login page with your mobile token-activated device, and enter the Mobile Token Password or use biometric credential for authentication, to login Online Banking.

Method 2: Login by entering your Username and Password

You can enter your Online Banking Username and Password for logging in to Online Banking.

I received a set of Username and Password for Online Banking and Mobile Banking Services given by the Bank, what should I do?

If you already have a set of Username and Password given by the bank, you may logon to Online Banking and Mobile Banking Service with the given Username and Password and complete the first time logon process online.

How can I logon to Mobile Banking?

- Download "CCB (HK&MO)" Mobile App via App Store, Google Play or Bank’s website

- Open the app and tap "LOGON" button

- Enter your Online Banking Username, Password and Verification Code

- Enjoy our Mobile Banking services

Username / Password Related Issues

What if I forgot my Password?

If you forgot your Password, go to the Mobile App, click "LOGON", then click "Forget Password". Enter your ID number and related account information. A SMS One-Time Password will be sent to your mobile phone number registered with the Bank via branch for verification. And then you can reset the Password.

You should contact Customer Service Hotline at +852 2779 5533 during service hours or visit any of our branches for assistance.

For credit card customers, please call our Credit Card Service Hotline at +852 3179 5533.

What should I do if I want to change the Username / Password?

| Username | Cannot be changed after registration/activation of Online Banking and Mobile Banking Services. |

| Password | Please go to Mobile Banking and logon, choose “Security Center” on the left menu, then choose “Update Password”, enter your existing Password and New Password twice to proceed. New Password should meet the following complexity requirements:

|

Verification Code

What is Verification Code?

Verification code is a 5-digit code with random alphabetic and numeric characters, it is show in a specifically designed image. User may be required to enter the verification code when they login to our Online Banking service with instruction provided.

Why a Verification Code is needed?

Verification Code is able to increase security level of our system by preventing automated posting from spyware.

How about if the Verification Code is unreadable?

If you find the Verification Code hard to read or unreadable, please tap the Verification Code image to refresh. If the problem still exists, please contact our Customer Service Hotline at +852 2779 5533.

How about if the Verification Code image cannot be shown?

If the Verification Code image cannot be shown, you may refresh the image by tapping on the Verification Code image. If the problem still exists, please restart the mobile app and try again or contact our Customer Service Hotline at +852 2779 5533.

Mobile Token

What is Mobile Token?

Mobile Token is a new feature within CCB(HK&MO) Mobile App ("Mobile Banking"). Upon activation of Mobile Token, you will no longer need physical security token and SMS One-Time Password for 2-factor authentication of designated Online Banking and Mobile Banking services in a safe and convenient way.

What is Mobile Token Password?

Mobile Token Password is a 6-digit security code at your choice. By entering the Mobile Token Password, you can easily log on to Mobile Banking and authenticate designated Online Banking/ Mobile Banking transaction.

Is Mobile Token free of charge?

Yes. The Mobile Token Service is free of charge.

Which mobile phone models are compatible with Mobile Token?

iPhone - iOS 14.0 or above

Android - Android 8.0 or above

Can I use Mobile Token in a rooted/ jailbroken device?

The use of rooted/ jailbroken device may vulnerable to security loopholes. For security reasons, you will not allow to use both CCB(HK&MO) Mobile App and Mobile Token Service.

How do I apply Mobile Token Service?

Please follow the following steps for activation:

- After opening CCB (HK&MO) Mobile App, click “Activate Mobile Token” in the menu of main page.

- Input your Online Banking Username and Password for logging on to Mobile Banking.

- Read and accept the Terms and Conditions.

- If your registered identity document with the bank is a Hong Kong Identity Card, you are required to complete the scanning of your Hong Kong Identity Card and/or facial recognition; if your registered identity document is a non-Hong Kong Identity Card, an SMS with 6-digit One-Time Password will be sent to your registered mobile phone number. Input the One-Time Password to proceed.

- Set up a 6-digit Mobile Token Password. Input the Password again to confirm.

- The application of Mobile Token service is completed. For security reason, Mobile Token will be effective in about 6 hours. We will notify you by email and SMS once it is effective. Then you can use your 6-digit Mobile Token Password with the Mobile Token activated device to log on to Mobile Banking or use Mobile Token Password/generate One-Time Security Code to authenticate designated Mobile/Online Banking services.

Why is it necessary to activate Mobile Token Service when logging into mobile banking?

Activating Mobile Token Service binds the device to your mobile/online banking account, enhancing security measures for e-banking channels.

Why is Hong Kong ID and/or facial recognition scanning required when activating Mobile Token Service?

The Hong Kong ID and/or facial recognition scanning during activation strengthens identity verification, providing greater confidence for authenticating designated transaction services in mobile/online banking.

What should I do if I fail the Hong Kong ID scan?

Ensure your Hong Kong ID is valid and matches the registered document with our bank. Follow the mobile banking guidelines during scanning, keeping the image clear and visible. The guidelines include:

- Align with the standard frame

- Avoid placing it outside the frame

- Prevent shaking to avoid blurring

- Ensure consistent and sufficient lighting

If the scan still fails, you may call our Customer Service Hotline at (852)2779 5533 during office hours or visit any of our branches for assistance.

Can I use Mobile Token to log on Mobile Banking and authenticate Online Banking/ Mobile Banking transactions immediately after applied Mobile Token Service?

For security reason, Mobile Token will be effective in about 6 hours upon the successful application. Then you can use your 6-digit Mobile Token Password with the Mobile Token activated device to log on Mobile Banking, and use Mobile Token Password/generate Security Code/Transaction Confirmation Code to authenticate designated Mobile/Online Banking transactions.

Can I log in to Online Banking through the "QR Code Login" function immediately after applied Mobile Token Service?

For security reason, Mobile Token will be effective in about 6 hours upon the successful application. Then you can scan the QR Code displayed on the Online Banking Login page with your mobile token-activated device, and enter the Mobile Token Password or use biometric credential for authentication, to login Online Banking.

Upon activation of Mobile Token, do I need to use it every time when I log on to Mobile Banking?

No. If your mobile device has activated Mobile Token, you can choose to use Mobile Token Password or Online Banking Username and Password for logging on to Mobile Banking.

Upon activation of Mobile Token, do I need to use it every time when I log on to Online Banking?

Yes. If you have activated Mobile Token service, the system will require you to complete mobile token authentication in accordance with the instructions during login. You may also choose to scan the QR code displayed on the Online Banking login page for logging in to Online Banking.

How to use Mobile Token to authenticate designated Mobile Banking transactions?

When you are conducting the designated Mobile Banking high risk transactions, you would be prompted to enter the Mobile Token Password for authentication if you have activated the Mobile Token Service.

How to use Mobile Token to authenticate designated Online Banking transactions?

When you are conducting the designated Online Banking high risk transactions after activating Mobile Token, you can go to CCB (HK&MO) Mobile App (not required for logon). Follow the instruction to click “Generate Security Code” or “Generate Transaction Confirmation Code” on homepage menu and enter your “Transaction Information Code” and/or Mobile Token Password. The One-Time Security Code/Transaction Confirmation Code will be shown immediately. Please enter the code on Online Banking to complete your transaction/ instruction.

Can I activate Mobile Token on multiple devices?

For security reason, you can only activate Mobile Token on one device.

If I have to change a mobile device, how do I transfer Mobile Token in the new device?

Please call our Customer Service Hotline at (852) 277 95533 during operating hours, or visit any of our branches to request for deactivating Mobile Token. Upon the effective of deactivation, you may activate Mobile Token in your new device again.

Can I continue to use Mobile Token after reinstalled CCB(HK&MO) Mobile App?

No, the Mobile Token will be unbound with the device once the Mobile Banking is uninstalled. You may login to our Mobile Banking with your Online Banking Username and Password to reactivate Mobile Token Service.

Can I use Mobile Token and physical Security Token at the same time?

No, you can only use either one of them at the same time. When you activate Mobile Token, your physical Security Token in hand will be deactivated automatically, vice versa.

If my physical Security Token is lost, can I apply for Mobile Token?

Yes, you can log on to Mobile Banking with your Online Banking Username and Password and select Left Menu > Security Center > Manage Mobile Token to activate Mobile Token Service.

How to deal with my existing physical Security Token after activated Mobile Token?

The existing physical Security Token will be deactivated automatically once you have activated Mobile Token. You can return it to any of our branches or dispose it by yourself.

If my Mobile Token activated device is lost or stolen, what should I do?

You are advised to call upon our Customer Service Hotline at (852) 2779 5533 during operating hours, or visit any of our branches to report the case, and apply to deactivate the Mobile Token Service. You may change your Online Banking Password in Mobile Banking or Online Banking immediately to prevent anyone else from accessing your accounts.

You are required to activate the Mobile Token Service again on a new mobile device in order to continue to use the Service for logon or transaction authentication in our Mobile Banking.

If my Mobile Token Service is locked or deactivated by entering invalid Mobile Token Password or One-Time Security Code/Transaction Confirmation Code repeatedly in Mobile Banking/Online Banking, what should I do?

You can log on to Mobile Banking with your Online Banking Username and Password and select Left Menu > Security Center > Manage Mobile Token to reactivate Mobile Token Service.

How to deactivate the Mobile Token?

You can deactivate Mobile Token by the following ways:

- Log on to Mobile Banking, select Left Menu > Security Center > Manage Mobile Token to deactivate Mobile Token; or

- Call upon Customer Service Hotline at (852) 277 95533 during operating hours to request for deactivating Mobile Token; or

- Visit any of our branches to request for deactivating Mobile Token.

How to change my Mobile Token Password in Mobile Banking?

You can log on to Mobile Banking and select Left Menu > Security Center > Manage Mobile Token to deactivate Mobile Token, then reactivate Mobile Token Service with setting up a new Mobile Token Password.

If I forget my 6-digit Mobile Token Password, what should I do?

You can go to Mobile Token Logon page in CCB(HK&MO) Mobile App and click “Forgot Mobile Token Password” to reset Mobile Token Password.

Read More for security tips of Mobile Token Service.

Biometric Credential Authentication Service

What is Biometric Credential Authentication Service?

Biometric Credential Authentication Service is a convenient and secure alternative that allows you to use your biometric credential stored on your mobile device for logon to CCB(HK&MO) Mobile App ("Mobile Banking")/Online Banking or authentication to designated Mobile Banking services.

Which operating systems and mobile devices are Biometric Credential Authentication Service available on?

Biometric Credential Authentication Service is applicable on Apple iPhone 5s or later models with Touch ID/Face ID function and operation system on iOS 14.0 or above; and for biometric credential enabled compatible android devices with operation system on v8.0 or above.

How to activate the Biometric Credential Authentication Service?

Biometric Credential Authentication Service will be available to activate upon the effective of Mobile Token in Mobile Banking. You may continue to apply for Biometric Credential Authentication Service after applied for activating Mobile Token; or follow below steps for activation of the Service if Mobile Token is effective.

- After logging on to Mobile Banking, you can go to "Left Menu" > "Security Center" > "Manage Biometric Credential Authentication" to activate the Service.

- Verify your biometric credential.

- Read and accept the Terms and Conditions of Biometric Credential Authentication Service.

- Input the SMS One-Time Password sent to your mobile phone number registered with the Bank via branch.

- The activation of Biometric Credential Authentication Service is completed. Upon the effective of Mobile Token, you can use your biometric credential with the activated device to log on to Mobile Banking and/or to authenticate designated Mobile Banking services; Or scan the QR Code displayed on the Online Banking Login page with your mobile token-activated device, and use biometric credential for authentication, to login Online Banking.

Can I use Biometric Credential Authentication Service before activation of Mobile Token?

No, Biometric Credential Authentication Service will be available to activate upon the effective of Mobile Token in Mobile Banking. You may continue to apply for Biometric Credential Authentication Service after applied for activating Mobile Token; or activate the Service once your Mobile Token is effective.

How to use biometric credential to authenticate designated Mobile Banking transactions?

When you are conducting the designated Mobile Banking high risk transactions, you would be prompted to enter the Mobile Token Password or use your biometric credential for authentication if you have activated the Mobile Token and Biometric Credential Authentication Service.

Can I activate Biometric Credential Authentication Service on more than one mobile device?

No. You can only activate the Biometric Credential Authentication Service for Online Banking Account on one mobile device. If you activate the Biometric Credential Authentication Service for a new device, the Service in the old device will be deactivated automatically.

How to deactivate Biometric Credential Authentication Service?

You may go to "Left Menu" > "Security Center" > "Manage Biometric Credential Authentication" to deactivate the Service.

What if my Biometric Credential Authentication Service enabled mobile phone is lost or stolen?

You are advised to call upon our Customer Service Hotline at (852) 2779 5533 during operating hours, or visit any of our branches to report the case, and apply to deactivate your Mobile Token with Biometric Credential Authentication Service. You may change your Online Banking Password in Mobile Banking or Online Banking immediately to prevent anyone else from accessing your accounts.

You are required to activate the Mobile Token and Biometric Credential Authenticate Service again on a new mobile device in order to continue to use the Service for logon or transaction authentication in our Mobile Banking.

Will CCB(HK&MO) Mobile App store my biometric credential information?

The Bank’s Mobile Apps or internal systems will not store customers’ biometric credential information. The Biometric Credential Authentication Service uses the biometric credential stored in the mobile devices for authentication.

If I have more than one biometric credential stored on my mobile device, can any of the biometric credentials be used for Biometric Credential Authentication Service?

You can use any biometric credentials stored on your mobile device for Biometric Credential Authentication Service.

If I changed the biometric credential setting in my mobile device, can I continue to use the Biometric Credential Authentication Service?

If you changed the biometric credential setting in your mobile device, due to security reason, the Biometric Credential Authentication Service will be deactivated and you are required to activate the Service again in order to continue to use your Biometric Credential Authentication Service.

Under what situation would the Biometric Credential Authentication Service be deactivated?

- Your Online Banking Username or Password has been updated

- The biometric credential setting in your mobile device has been changed

- The biometric credential authentication of the mobile device is deactivated

- Your biometric credential cannot be recognized by the mobile device for three times consecutively

- Your Mobile Token Service is deactivated

If my Biometric Credential Authentication Service is deactivated by the repeated failures of Biometric Credential recognition in Mobile Banking, what should I do?

After logging on to Mobile Banking, you can go to "Left Menu" > "Security Center" > "Manage Biometric Credential Authentication" to reactivate the Service.

If my biometric credential is not recognized, can I still log on Mobile Banking using my Online Banking Username and Password?

You can always switch to using Mobile Token or Online Banking Username and Password for logging on Mobile Banking.

Can I use Biometric Credential Authentication Service if someone else’s biometric credential is stored on my mobile device?

When you activate Biometric Credential Authentication Service, any biometric credentials stored on your mobile device can be used to log on Mobile Banking. Therefore, you are strongly recommended to store your own biometric credential only on your mobile device.

If I re-install CCB(HK&MO) Mobile App, do I need to activate the Biometric Credential Authentication Service again?

Yes, you need to reactivate Biometric Credential Authentication Service by activating Mobile Token in Mobile Banking first.

Read More for security tips of Biometric Credential Authentication Service.

Contact Numbers and Email

How can I update my email address / mobile phone number?

For updating your email address, please logon and go to "Left menu" > "Security Center" > ”Update Customer Information” > "Update Contact Information”, input the new email address and tap "Update", Mobile Banking will ask for a 6-digit security code from your security token, then click “Confirm”. Your email address will be updated accordingly.

For updating your mobile phone number, please visit any of our branches for the update.

How can I update my correspondence records with CCB (Asia)?

To update your personal correspondence records, please visit any of our branches.

FAQ for SMS Sender Registration Scheme

Do I, as customer of CCB (Asia), need to register or do other things to enjoy and be protected by the SMS Sender Registration Scheme?

No. There is no prior registration, app installation, or phone setting changes required to be benefited by the SMS Sender Registration Scheme.

How do I know if CCB (Asia) and my mobile company have participated in the SMS Sender Registration Scheme?

For the banking and telecommunications sectors, customers may visit the SMS Sender Registry available at the following OFCA’s webpage to check the participating banks and telecommunications service providers, together with their respective registered sender IDs: www.ofca.gov.hk/ssrs

CCB (Asia) has joined the "SMS Sender Registration Scheme," and will only send SMS messages to Hong Kong mobile phone users with the following Sender IDs: #CCB Asia, #CCBA SMS, #CCBA Alert, #CCBA Card, or #CCBASIA.

I received a SMS from CCB (Asia) but it is not sorted under the same thread as before. Should I be alarmed?

Under the SMS Sender Registration Scheme, CCB (Asia) starts to use sender IDs that start with “#” to send SMS to customers. It is normal that these SMS appear to be from senders different from before. Please contact us when in doubt.

I received an SMS from CCB (Asia) but its sender ID does not have a “#” sign. Does it mean that it must be fraudulent?

CCB (Asia) might continue using regular sender ID when sending SMS to customers (for 2-way SMS or due to operational need). Customers should always remain vigilant when receiving any SMS that claims to be sent by CCB (Asia) and contact us when in doubt.

I have registered for the SMS-forwarding service. How would the SMS Sender Registration Scheme affect me?

Except for a change of Sender ID that CCB (Asia) will be used to send SMS to you, your SMS-forwarding service shall in general not be affected.

I receive SMS from CCB (Asia) with a local mobile number but I am currently not in Hong Kong. Will I be benefited by the SMS Sender Registration Scheme?

You will be able to receive SMS with prefix “#” in the registered sender ID in general if you have activated the roaming service of your mobile service provided by local telco subject to the regulation of the place you are roaming.

I receive SMS from CCB (Asia) with a Mainland/overseas mobile number but I am currently living in Hong Kong. Will I be benefited by the SMS Sender Registration Scheme?

Customers that receive SMS from CCB (Asia) with a mobile number issued by non-Hong Kong operators (regardless of their physical location) would not be benefited. Fraudulent SMS might be delivered by overseas SMS service providers. Customers should remain vigilant.

I am using Single-Card-Multiple-Numbers (SCMN) / 1-Card-2-Number service. How would the SMS Sender Registration Scheme affect me?

The Single-Card-Multiple-Numbers (SCMN) / 1-Card-2-Number SIM cards (1C2N) issued by Hong Kong operators should be able to receive SMS with prefix “#” in the registered sender ID under normal circumstances.

Those SCMN/1C2N SIM cards issued by non-Hong Kong operators may have issue in receiving SMS with prefix “#” in the registered sender ID in a place which does not support Sender ID with alphanumeric characters.

I use a e-SIM card. How would the SMS Sender Registration Scheme affect me?

Customers using e-SIM cards provided by local telcos would in general be able to receive SMS with prefix “#” in the registered sender ID.

I receive an SMS with the “#” sign (#CCB Asia, #CCBA SMS, #CCBA Alert, #CCBA Card, or #CCBASIA) but it is not truly originated from CCB (Asia). What should I do?

Once you have checked the authenticity of the SMS, you should report that to us or mobile service company.

About Banking Services in Mobile Banking

Account Enquiry

What kind of accounts can I enquire on Mobile Banking?

You may check the account balances of all your accounts, including deposits, loans, investments and credit cards account with the Bank.

For account details, you may enquire:

Deposits Account

- Savings / Checking Account

- Multi-currency Savings Account

- Time Deposits Account

Loans Account

- Personal Loan

- Cross Border Loan

- Value-Added Mortgage

- e-loan

- Mortgage Loan

- Car Park Loan

Investments Account

- Securities Trading Account

- Gold Trading Account

- FX Linked Deposit Account

Credit Cards Account

- Credit Cards Account

Local Funds Transfer

What are the different types of fund transfer available?

Four types of fund transfer are available to you through our Mobile Banking:

- Transfer between your accounts or to the third-party CCB (Asia) accounts

- Transfer to other bank accounts in Hong Kong

- Transfer to other overseas bank accounts

- Scheduled & Recurrent Transfer

How far in advance can I instruct a transfer to be made?

You can schedule a fund transfer up to 45 days in advance.

How long do transfers take?

Please refer to the Fund Transfer in Online Banking Service Time Table.

Are there any daily limits for fund transfer?

There is no limit for transfers within your own CCB (Asia) accounts. However there is daily limit for third party transfers:

| Transfer Type | Limit |

|---|---|

| Transfer within own CCB (Asia) accounts | Nil |

| Small-Value Fund Transfer | HKD10,000 |

| Transfer to registered accounts (include transfer within CCB(Asia) and other banks in Hong Kong)* | HKD1,000,000 or its equivalent |

| Transfer to unregistered accounts (include transfer within CCB(Asia) and other banks in Hong Kong)* | HKD200,000 or its equivalent |

*With effect from 06 Dec 2024, the limit of ‘Transfer to registered accounts (include transfer within CCB (Asia) and other banks in Hong Kong)’ has been adjusted to HKD1,000,000 or its equivalent. The Limit set by existing customers before the Effective Date will also remain unchanged.

*With effect from 14 Nov 2025, the limit of ‘Transfer to unregistered accounts (include transfer within CCB (Asia) and other banks in Hong Kong)’ has been adjusted to HKD200,000 or its equivalent. The Limit set by existing customers before the Effective Date will also remain unchanged.

Are there any cut-off time for transfer within CCB (Asia) account or to other local banks?

Please refer to the Fund Transfer in Online Banking Service Time Table.

Is there any cut-off time for Fund Transfer in foreign currency?

Please refer to the Fund Transfer in Online Banking Service Time Table.

How many registered account can I register?

The maximum number of registered accounts is 20.

If I want to add or delete a registered account, what can I do?

If you want to add a registered account, you can logon and go to "Transfer/Payment" > "Register New Account" in Mobile Banking. You'll need your Mobile Token/ Security Token to complete the account registration instructions. For security reasons, the registration instruction will be effective after 6 hours. We will notify you via email and SMS after it becomes effective.

If you want to delete a registered account, you can logon and go to "Transfer/Payment" > Click the Function key in the upper right corner > "Manage Registered Account" in Mobile Banking and select the registered account to be deleted.

Remarks: Registered accounts can only be deleted after they become effective.

You can also submit a maintenance form to our Branch.

If I want to update the transfer limit of the registered account, what should I do?

After logon to Mobile Banking, you may update your daily transfer limit online by going to "Transfer/Payment" > Click the Function key in the upper right corner > "Transaction Limit Setting". You'll need your Mobile Token/ Security Token to do it.

You can also submit a maintenance form to any of our branches in person.

Which banks are applicable for Express Transfer?

Please tap here for the Express Transfer banks list.

What will happen if there is insufficient fund in my account on the effective date?

It is not necessary to have sufficient fund in your account when you make a pending transfer. However, your instruction will be rejected if there is insufficient fund in your account on the effective date of the transfer.

Read More for details of Faster Payment System.

Overseas Fund Transfer

When can I transfer money overseas?

Please refer to the Online Banking Service Time Table (Fund Transfer – To an Account Overseas) for our service available hours.

Applications for same day transfer are subject to cut-off times related to the geographical location of the transfer destination and/or the funding arrangement requirements of the settlement banks. This mean that the Applicant's account may be debited before the day the beneficiary receives the money and we will not be responsible for any interest expense or loss as a result.

When can I send a RMB remittance?

Please refer to the Online Banking Service Time Table (Fund Transfer – To an Account Overseas) for our service available hours.

Please note the service is also subject to the operation and practice adopted by the RMB clearing bank. It will not be processed by the RMB clearing bank during public holidays in Mainland China.

What is the daily transfer limit?

| Transfer Type | Limit |

|---|---|

| Transfer to registered accounts maintained overseas | HKD2,000,000 or its equivalent |

| Transfer to unregistered accounts maintained overseas | HKD50,000 or its equivalent |

| Transfer RMB to same name account in Mainland China | RMB80,000 |

Do I need to pay for making a transfer to an overseas account?

Yes, local charges of HK$80 or HK$100 (If the local currency of the receiving bank is not the same as remittance currency) will be charged per transaction. Overseas Charges (including charges levied by the recipient bank and any correspondent banks) can be debited from either the recipient (Debit from remittance amount) or yourself (Debit from the same account as local charges).

An additional charge of HK$150 will be charged if the remittance details are in Chinese.

What should I do if I delete my registered overseas account by mistake?

You must register the account again. You can logon and go to "Transfer/Payment" > "Register New Account" in Mobile Banking. You'll need your Mobile Token/ Security Token to complete the account registration instructions. For security reasons, the registration instruction will be effective after 6 hours. We will notify you via email and SMS after it becomes effective.

You can also submit a maintenance form to our Branch.

Can I modify my registered overseas account online?

No. You can add or delete registered accounts online, but you cannot change registered overseas account information.

Activity Log

What is Activity Log?

Activity log is one of the electronic banking services, allows you to stay on top of your accounts whenever you want to by banking through mobile with us. You can review past 3 months Online Banking and Mobile Banking designated transaction records ensure that your account secure and may prevent anyone else from accessing your accounts.

If you suspect any suspicious transactions, please contact our 24 hours Customer Service Hotline +852 2779 5533 or visit any of our branches and report the matter immediately.

How do I access Activity Log on CCB (Asia) Mobile Banking?

You have to log on to Mobile Banking, select Left Menu > Security Center > Activity Log Enquiry to review designated transaction records.

What kind of transaction records and information can I review on activity log?

Activity Log provides CCB (Asia) Online Banking, Mobile Banking and “FortuneLink” Mobile App login date and time, geographical location and device information as well as below transaction records:

- Login

- Binding Security Token

- Binding Mobile Token

- Activate Biometric Credential Authentication

- Binding WeChat Bank

- Reset Password

- Reset Username

- Reset Phone Banking Password

- Update Customer Information

- Transfer to CCBA Account

- FPS/Local Bank Transfer

- Express Transfer/Overseas Transfer

- Manage Registered Account

- Amend Transaction Limit

- FPS Setting

Questions related to scam prevention alert

If I find my recipient’s FPS proxy ID / account number is being flagged by the scam prevention alert, how can I remove it?

The scam prevention alert is generated based on information collected from scam reports and recorded in the Scameter of the Hong Kong Police Force. Please contact them at enquiry@cyberdefender.hk if you think the FPS proxy IDs / account numbers are not tagged correctly.

Will Bank be able to help to remove my FPS proxy IDs / account numbers from the scam prevention alert?

No, the Bank cannot do the deletion. The scam prevention alert is generated based on information collected from scam reports and recorded in the Scameter of the Hong Kong Police Force. Please contact them at enquiry@cyberdefender.hk if you think the FPS proxy IDs / account numbers are not tagged correctly.

If I want to report a suspicious FPS proxy ID / account number, what should I do?

The scam prevention alert is generated based on information collected from scam reports and recorded in the Scameter of the Hong Kong Police Force. If you suspect a crime case has occurred, please report to the Hong Kong Police Force at a police station or via Hong Kong Police Force e-Report Centre (https://www.police.gov.hk/ppp_en or https://www.police.gov.hk/ppp_tc).

If there is no scam prevention alert message relating to my recipient, does it guarantee it is safe to transfer to him/her?

No, it is not guaranteed. The scam prevention alert message will only be shown if the recipient’s FPS proxy ID / account number is included in the scam reports provided by the Hong Kong Police Force. If there has not been any report to the Police against a particular FPS proxy ID / account number, the proxy ID / account number will not be included in the scam prevention alert.

You are advised to always verify the payment details (including the recipient’s identity) of every single transaction before making payment.

Why is my recipient’s FPS proxy ID / account number previously not tagged in the scam prevention alert but now being tagged?

The FPS proxy IDs / account numbers flagged as "High Risk" in Scameter and included in the scam prevention alert are based on information collected from scam reports provided by the Hong Kong Police Force. If there has not been any report to the Police against a particular FPS proxy ID / account number, the proxy ID / account number will not be included in the scam prevention alert.

What is the source of the scam prevention alert and how is my private information being protected?

The scam prevention alert is generated based on information collected from scam reports and recorded in the Scameter of the Hong Kong Police Force. Please visit the webpage of Scameter (https://cyberdefender.hk/en-us/scameter/) for more details.

Why I found my FPS proxy ID / account number on the scam prevention alert when doing FPS transfer? I did not commit any crime!

According to the record provided by the Hong Kong Police Force, your FPS proxy ID / account number is related to a scam report. Please contact them at enquiry@cyberdefender.hk if you think the FPS proxy ID / account number is not tagged correctly.

I discovered my recipient's mobile number / account number has been flagged in Scameter. How come the bank did not alert me when I now try to make payment to this FPS proxy ID / account number?

The scam prevention alert is generated based on information collected from scam reports provided by the Hong Kong Police Force and updated from time to time on a daily basis. Please check again that the payee is trustworthy before you proceed with the transaction.

I discovered my recipient's mobile number / account number has been flagged in Scameter. How come the bank did not alert me when I previously made payment to this FPS proxy ID / account number?

The FPS proxy IDs / account numbers flagged as "High Risk" in Scameter and included in the scam prevention alert are based on information collected from scam reports provided by the Hong Kong Police Force. If there has not been any report to the Police against a particular FPS proxy ID / account number, the proxy ID / account number will not be included in the scam prevention alert.

Questions on operation:

How would I know if my recipient’s mobile number/email address/FPS Identifier/account number is flagged for scam prevention alert?

You can check Scameter (cyberdefender.hk) to see if it is flagged as “High Risk”. When performing an FPS transaction with use of FPS proxy ID (i.e. mobile number, email address, or FPS Identifier) / account number via internet banking or mobile banking app, the Bank will display a scam prevention alert message for those FPS proxy IDs / account numbers flagged in the scam reports provided by the Hong Kong Police Force. You are advised not to make any transactions to the recipient unless you have carefully verified the recipient’s identity and ensure that the recipient is trustworthy.

If I confirm to the bank to proceed with a transfer with FPS proxy ID (i.e. mobile number/email address/FPS Identifier) / account number flagged as “High Risk” and subsequently realize being scammed, what should I do?

If you suspect you have been scammed, you may visit a police station or the Hong Kong Police Force e-Report Centre (https://www.police.gov.hk/ppp_en or https://www.police.gov.hk/ppp_tc) to file a report. In tandem, please report the case to the Bank.

If a recipient’s mobile number / account number is flagged as “High Risk”, will his/her email address or FPS Identifier also be flagged by the scam prevention alert?

The FPS proxy IDs / account numbers flagged as "High Risk" in Scameter and included in the scam prevention alert are based on information collected from scam reports provided by the Hong Kong Police Force. If there has not been any report to the Police against a particular FPS proxy ID / account number, the proxy ID / account number will not be included in the scam prevention alert.

Can I confirm and accept the scam prevention alert message and make transfer to the FPS proxy ID / account number on the scam prevention alert?

Yes, you can, but please be reminded that the transaction has high risk of fraud. You are advised to always verify the payment details (including the recipient’s identity) of every single transaction before making payment.

Bill Payment

What is a bill type code?

Some of the payees have special codes for different types of bills. Should a bill type code be requested, simply check the payee's statement and you should be able to find the bill type code.

What is the largest payment that I can make?

The daily maximum limit of Online Bill Payment is HK$50,000. The combined daily maximum limit for Tax Payment and White Form eIPO Payment is HK$999,999. The daily maximum limit for AIA Insurance is HK$999,999 or available credit limit, whichever is lower.

If I have made a wrong payment, what should I do?

If you have made a scheduled payment that has not yet been processed, you can access "Bill Record" to amend or delete your payment. If the payment is processed, please contact the relevant merchant directly.

Can I change the date of payment, or even delay it?

Unless you have selected Pay on Today in the first place, you can change the payment date before the payment transaction is processed.

What if my Settlement Account does not have enough balance?

Your transaction will not be proceeded.

What is the cut-off time for online bill payment?

Please refer to the Online Banking Service Time Table for details.

To make a payment for White Form eIPO application (which is the subscription applied via White Form eIPO Service website www.eipo.com.hk), please complete the payment transaction BEFORE 6:00 a.m. of the last day of the Offer Period.

Is there any service fee involved in the bill payment services?

No, it is free.

What bills can I pay via Mobile Banking?

Please refer to the Bill Payment Merchant List.

Deposit Account Opening

What kind of deposit accounts can I open via Mobile Banking?

- HKD Statement Savings Account

- HKD Checking Account

- USD Checking Account

- Multi-Currency Statement Savings Account

- RMB Statement Savings Account.

I notice that some of my personal information has already been filled. Can I update these details?

To facilitate your application, some of the fields are filled in according to your record retained in our system. For the sake of security, the data is protected and cannot be amended online, you are required to visit our branches to submit the relevant form for amendment.

I am holding an anyone-to-sign joint account, can I open the deposit account via Mobile Banking?

No, the service is available for individual accounts only.

eStatement/eAdvice Service

About eStatement/eAdvice Service

Will I continue to receive the paper statement?

No, once you have opted for the eStatement/eAdvice Service, you will no longer receive the paper monthly statement via mail.

How can I know a new eStatement/eAdvice is posted on Online Banking and Mobile Banking?

You will receive eStatement/eAdvice eAlert via email everytime a new eStatement/eAdvice is available. You can also register for receiving additional eAlert via SMS in "Left Menu" > "Notifications" > "Setup/Amend Notifications" > "New Service" > "eStatement for Banking Account" after logon to Mobile Banking.

When will I start receiving eStatement/eAdvice eAlert?

Once the registration is completed in Mobile Banking and takes effect, you will start receiving eStatement/eAdvice eAlert on your coming statement generation date.

How can I know a new eStatement/eAdvice is posted on Online Banking and Mobile Banking?

You may need to have the latest version of Acrobat Reader to view the eStatement/eAdvice provided in the service. The software can be downloaded from http://www.adobe.com.

eAlert

What is eAlert?

eAlert is one of the electronic banking services. Setting up the eAlert services via our Mobile Banking, you can choose to be notified of any banking and personal matters through email and/or Short Messaging Service(SMS).

Who is eligible for using eAlert Services?

All Mobile Banking customers could setup the alerts by choosing the preferred channel and periodicity at their own choice. Pre-registration is not required.

What is the benefit of using eAlert Services?

With China Construction Bank (Asia) eAlert services, you can:

- Monitor every ATM withdrawal transaction or EPS / China Unionpay payment, giving you greater peace of mind

- Capture any investment opportunity

- Manage your banking including:

- Renew time deposit at maturity;

- Pay periodic bills;

- Pay loan installment on due date;

- Account overdrawn;

- Any inward remittance;

- Any returned check;

- Account balance below the minimum level;

- Manage your personal matters.

Is there a charge for using eAlert Services?

During the promotional period, customers can enjoy free eAlert services. If a service fee is required for particular types of eAlert in the future, the Bank will notify customers accordingly.

How to setup the eAlert?

To setup the eAlert, simply log on Mobile Banking and follow the following steps:

- Go to “Left menu”->”Notification”;

- Select "Setup/Amend Notification";

- Choose the "eAlert" you would like to enroll

Where can I change my e-mail address or mobile phone number?

Please see “How can I update my email address / mobile phone number?”.

When will I receive eAlert?

It depends on which types of eAlert to be received and the network performance of internet or mobile phone services providers.

Does my mobile phone service provider charge on receiving eAlerts via SMS?

Please check with your mobile phone service provider for details.

| ATM Cash Withdrawal Alert |

|---|

| Description |

| This type of Alert reminds you any successfully cash withdrawal made from your selected account by any ATM at anywhere. |

| Who is eligible? |

| Any Online/Mobile Banking customers with Dual Currency Debit Card and ATM Remittance card. |

| When will be sent out? |

| This alert will be sent out whenever cash was successfully withdrawn from your selected account by ATM. |

| Scheduled/Recurrent Funds Transfer Alert |

|---|

| Description |

| This alert notifies you when a scheduled/recurrent Funds Transfer set up via Online/Mobile Banking is executed. |

| Who is eligible? |

| All Online/Mobile Banking customers. |

| When will be sent out? |

| This alert will be sent once the scheduled/recurrent Funds Transfer has been processed. |

| Interbank Funds Transfer Alert |

|---|

| Description |

| This alert notifies you when a Funds Transfer of any specified amount is made from your account to a third party account of another local bank. |

| Who is eligible? |

| All Online/Mobile Banking customers. |

| When will be sent out? |

| This alert will be sent when a Funds Transfer to a third party account of another local bank has been made. |

| Time Deposit Maturity Alert |

|---|

| Description |

| This alert reminds you to renew any Time Deposit on maturity date. |

| Who is eligible? |

| Any Online/Mobile Banking customers with Time Deposit and its tenor is more than 7 days. |

| When will be sent out? |