Frequently Asked Questions

Bond Trading

- What is Bond?

- Types of Bond

- Pros and Cons of Bond Investment

- The Relationship of Bond Yield, Bond Price and Time to Maturity

FX Limit Order

- What is FX Limit Order?

- Who is eligible to use FX Limit Order?

- Is there any extra charge for using FX Limit Order?

- What is the service hour of FX Limit Order?

- How many types of currency are supported?

- How to access FX Limit Order?

- Can the “Expiry Date” of FX Limit Order fall on public holiday?

- What is the maximum and minimum trading amount for FX Limit Order?

- Why the Target Exchange Rate is reached in the day but my order was not executed?

- Is there any notification after the order is executed?

- What is the maximum number of FX Limit Order instructions can be set up?

- Is there any restriction on the Target Exchange Rate when placing a new order?

- What are the possible order statuses?

Mutual Fund Investment

- Can I trade mutual fund online?

- Can I subscribe/redeem/switch investment funds via Online Mutual Fund Services?

- Which funds can I subscrible online?

- What is the minimum investment amount?

- Which currency can I use to subscribe fund(s)?

- How do I know the Bank has accepted my order?

- Can I amend/cancel my instruction online?

- What kind of information can I find online?

- How do I search for the fund(s) I want?

- Where can I obtain a copy of the funds' offering document for reference?

- Apart from the trade related fee as specified in the fund’s offering document and the bank’s Schedule of fees and charges, are there any additional fees charged for using the Online Mutual Fund Services to subscribe/redeem/switch funds?

- Which type of fund switching order I can submit via Online Mutual Fund Services?

Regular Mutual Fund Investment Plan

- Apply for/ modify / terminate the Regular Mutual Fund Investment Plan

- Transaction execution

- Eligible mutual funds

- Others

Securities Trading

- After enrolling in the Online Securities Trading Services, can I still place order through other channel(s)?

- What are the benefits of using Online Securities Trading Services?

- How can I trade through Online Banking?

- How do I place an order?

- Does the Bank accept price orders that are different from current market prices?

- How do I know the Bank has received my order?

- How can I check the status of my order?

- Can I amend or cancel my order?

- How am I notified of the execution results?

- How can I keep track of the stock?

- What is "All-or-Nothing"?

- What is "Limit Order"?

- What is "Enhanced Limit Order"?

- What is "Special Limit Order"?

- What is "At auction Limit Order"?

- What is "Stop Loss Order"?

- What is Stop Loss Price?

- What is Lowest Selling Price?

- Can I place a multiple-day Stop Loss Order?

- What is "Market Order"?

- Can I place an instruction during non-trading hour or non-trading day?

- What is "Good-till-date" Instruction?

- Which order types can set "Good-till-date" Instruction?

- I have placed a "Good Till Date" order. If the order cannot be fully executed on same day and is partially executed on different days, will all the execution results be consolidated for calculating the charges?

- Will my order be valid if there is any corporate action of the company?

- Can I sell the stocks I have bought before its settlement?

- Can I use the funds from selling a stock to buy a new stock before its settlement?

- What is total purchasing power?

- Will the transaction I perform today be reflected in my ”Portfolio”?

- What is Streaming Quote?

- What are Personalized Latest News and Research Reports?

- If I placed an order via the manned channel and subsequently modified the order on Online Banking or placed an order on Online Banking and subsequently modified the order via manned channel, which channel rate will be used to calculate the commission?

- Can I choose to receive eStatement for Securities Trading service?

- Why I need further identity verification when I access Online Securities Trading Services?

- How to register or update the mobile phone number for receiving the One-time-password (OTP)?

- Why am I unable to request or receive the SMS One-time-password (OTP)?

- Can I purchase crypto/virtual asset ETFs?

Investor Identification Regime (“HKIDR”)

- What is HKIDR?

- What is “BCAN” and “CID”?

- Under HKIDR, what CID shall a bank provide to SEHK and SFC?

- How does HKIDR work?

- Under HKIDR, what shall clients do?

- How shall individual client provide the consent to CCB (Asia)?

- What if the client doesn’t provide the positive consent after the Effective Date?

- How long does it take before the consent being effective?

- Do I need to update my personal data for HKIDR?

- What if my previously submitted identification document(s) is/are expired / going to expire?

- Do I need to provide consent to CCB (Asia) again if I have already provided consent to other banks?

Open an Investment Account Online

Securities Monthly Investment Plan

- How to apply/set up the Securities Monthly Investment Plan (“SMIP”)?

- How many Securities can be selected?

- How to terminate my existing SMIP?

- Is there a minimum amount for the Monthly Contribution?

- Under what circumstances would the Bank terminate my SMIP?

- When will the Bank execute the instructions for customers?

- How is the average price of a security under the Plan determined?

- How many shares/units of the selected security will be allocated to each customer?

- How does the Bank calculate the “Average Purchase Cost” in the Contribution History page in Online/Mobile Banking?

- What happens if I do not have sufficient funds in my designated Settlement Account on the Hold Fund Date in a calendar month?

- What happens if the stock market is closed on the Execution Date due to bad weather conditions?

- What happens if trading is suspended for an eligible security under the SMIP on the Execution Date?

- What will happen if the security I selected is removed from the eligible list of securities under my SMIP?

- What securities are available for selection under the SMIP?

- How can I check the transaction details of my SMIP?

- Can I sell securities under the SMIP at any time?

- Can SMIP customers enjoy the same rights as normal shareholders?

Shanghai - Hong Kong Stock Connect / Shenzhen - Hong Kong Stock Connect

- Special arrangement on unsettled fund

- Is there any cut off time for Securities Settlement Instruction on transfer in / out of SSE and SZSE securities?

Securities Margin Trading

- What is Securities Margin Trading?

- How does the leverage work for Securities Margin Trading?

- Can I purchase stocks without utilizing the overdraft in my Securities Margin Trading Account?

- If I deposit more cash than it is required for my cash margin, can I utilize the unused overdraft for the subsequent purchases in the future?

- How is the mechanism of margin fund transfer in / out?

- What are the ways to withdraw cash from the margin trading account?

- Will the fund transfer details be displayed in my statement?

- Will there be automatic funds transfer from settlement account to margin account if there is insufficient fund for my purchase transaction? If so, under what condition will it happen?

- Can I open both Securities Cash Trading account and Securities Margin Trading account in same account entity? If so, can I use the same settlement account for both?

- Can I have more information on the mechanism of margin call or liquidation or calculation of financing interest of Securities Margin Trading?

RMB Denominated Stock Trading

- Should I use my existing securities account to trade RMB denominated stock? Is it required to set up a new settlement account for RMB stock trading?

- Are the stamp duty, transaction fees and charges for trading RMB denominated stock in RMB or HKD?

- Can I trade RMB denominated stock with my margin trading account?

Pre-Opening Session

- Pre-Opening Session

- Price limit during Pre-Opening Session

- Why is my instruction being rejected by the system during the "Random Matching Period"?

Closing Auction Session

- Which types of securities are eligible for Closing Auction Session (CAS)?

- What is the trading hours for CAS?

- How does CAS works?

- How does the order matching mechanism works?

- How the outstanding orders in CTS will be handled?

- How the unfilled / partially filled orders will be handled after CAS?

Volatility Control Mechanism

- Which types of securities / derivatives are covered by the Volatility Control Mechanism (VCM)?

- Which trading session(s) that VCM will be triggered?

- How does the VCM work?

- How the reference price of VCM being determined?

Severe Weather Arrangement

- What is the scope of operations of the securities and derivatives market at HKEx during severe weather conditions?

- Can I trade HK stock during severe weather conditions?

- Apart from securities trading, will Bank provides other investment services during severe weather conditions?

- Will Bank accepts physical securities deposit?

- What are the payment-related services arrangement during severe weather conditions?

Bond Trading

Bonds

Bonds are credit notes issued by governments, corporations or other entities to raise funds. Bondholders are extending credit to the issuer and in return, the issuer commits to redeem the bond upon maturity and to pay a specified rate of interest (excluding zero-coupon bond) during the life of the bond.

Types of Bond

Classified by the type of issuers:

Government Bond

It is a bond issued by a government. Examples of these types of bonds are Hong Kong Exchange Fund Notes and US Treasury Bonds.

Quasi-government Bond

It is a bond issued by corporations wholly-owned by government or corporations with government as the major shareholder, such as the MTR and the Airport Authority.

Corporate Bond

It is a bond issued by corporations like Hutchison Whampoa and Cheung Kong Holdings.

Supranational Bond

It is a bond issued by an entity which comprises a number of central banks or government financial authorities, for example, the World Bank and the Asian Development Bank.

Classified by the type of interest payment:

Fixed Rate Bond

A bond that offers a fixed rate of interest, which remains unchanged throughout the life of the bond.

Floating Rate Bond

A bond that offers a coupon rate that is adjusted periodically along with changes in a benchmark yield such as HIBOR or LIBOR.

Zero-coupon Bond

A bond that offers no coupon interest. It is sold at a discount to par value. Investors earn capital gain as the bond price moves towards par over time.

Pros and Cons of Bond Investment

Pros:

Steady Return

Similar to bank deposits, bonds generally offer a designated interest income and repayment of principal. Bond prices also have the potential to increase.

Risk Diversification

Owing to its steady return and low risk characteristics, trading in bonds is a good way to diversify investment risks

Complete Investment Portfolio

Bonds provide a stable return. Investors can complement bonds to other investment tools (for example equities) within their investment portfolio according to their needs and risk acceptance levels.

Cons:

Risk

Early redemption of the bonds may result in a loss of bond prices drop.

The Relationship of Bond Yield, Bond Price and Time to Maturity

Bond Yield

The issuer will designate a fixed interest rate called coupon rate; the annual total interest amount is calculated based on the coupon rate and the face value of the bond. However, as the bond price may be different from the face value, bond yield - which takes the bond price and the coupon rate into consideration, is adopted as the measure of return on bond investment.

Bond Price

Bond prices will fluctuate based on the issuer's credit ratings assigned by international rating companies. Moreover, the bond price and the yield move in opposite direction. When the bond price increases, the yield drops, or when the bond price drops, the yield increases. In general cases, bond yield and interest rate level move in the same direction.

Time to Maturity

Usually the longer the time to maturity, the higher the risk and bond yield.

FX Limit Order

What is FX Limit Order?

With FX Limit Order, you can pre-set a Target Exchange Rate and the currencies will be automatically converted once the target rate is reached. All these handy functions enable you to keep up with the trend and invest easily.

Who is eligible to use FX Limit Order?

All customers who have successfully registered for our Online Banking service and holding a valid foreign currency account are eligible.

Is there any extra charge for using FX Limit Order?

There is no extra charge for using FX Limit Order.

What is the service hour of FX Limit Order?

| Service hour of Order placement/Rate matching/Order Execution |

Every Mon 09:00 to Sat 05:00 in Hong Kong Time (Except: 25th December and 1st January). |

| Order expiration time |

|

How many types of currency are supported?

11 major currencies are supported, including HKD, CNH, USD, SGD, EUR, AUD, NZD, GBP, CAD, CHF and JPY.

How to access FX Limit Order?

FX Limit Order is available on our Online Banking and Mobile Banking.

Can the “Expiry Date” of FX Limit Order fall on public holiday?

The Expiry Date can be any day from Mon to Sat, except December 25th and January 1st. For other Hong Kong public holidays, FX Limit Order will operate as usual.

What is the maximum and minimum trading amount for FX Limit Order?

The current maximum trading amount per transaction under the FX Limit Order Service is HKD 5,999,999.99 or its equivalent in another currency.

The current minimum trading amount per transaction under the FX Limit Order Service is set with reference to the currency to be sold, as follows:

| Currency | Min Amount |

| AUD | 100 |

| CAD | 100 |

| JPY | 10,000 |

| NZD | 100 |

| SGD | 100 |

| CHF | 100 |

| GBP | 100 |

| USD | 100 |

| EUR | 100 |

| CNH | 1,000 |

| HKD | 1,000 |

Why the Target Exchange Rate is reached in the day but my order was not executed?

Although the Target Exchange Rate is reached, it may still not reach the execution rate (the exchange rate after deducting bank costs). The instruction will be executed once the market reaches such rate.

Is there any notification after the order is executed?

When your order is placed, executed, expired and/or unexecuted for any reason, you will receive relevant SMS notifications (A valid mobile phone number must be registered with the bank before using the service) .

What is the maximum number of FX Limit Order instructions can be set up?

You can have up to 15 active FX Limit Orders per account at any one time.

Is there any restriction on the Target Exchange Rate when placing a new order?

The target exchange rate cannot be too close to or deviate from the current market exchange rate. When it comes to accepting the rate instruction on the FX Order Watch from customers, the Bank will consider several factors. Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly.

What are the possible order statuses?

| Submitted | The FX Limit Order instruction has been submitted successfully. When the Target Rate is met, the FX Limit Order will be executed automatically. |

| Executed | The FX Limit Order has been executed successfully. You will receive two SMS sent from the Bank to notify you of the latest order status and the transaction details. |

| Expired | The FX Limit Order could not be executed before its Expiry Date. |

| Cancelled | Your request to cancel a FX Limit Order has been accepted. |

| Transaction failed | The Bank has refused or failed to process your FX Limit Order instruction. This may be due to one or more reasons. You may contact the Customer Service Hotline +852 2779 5533 for enquires. |

Mutual Fund Investment

Can I trade mutual fund online?

Yes, you can trade mutual fund online immediately if you are our mutual fund customer and have also registered to use our Online Mutual Fund Service. If you have not yet opened a mutual fund account, you can apply through any of our Branches. Customers can also register to become an Online Banking customer through our Branches, Bank By Phone or Web site.

Can I subscribe/redeem/switch investment funds via Online Mutual Fund Services?

You can subscribe/redeem/switch mutual funds online.

Which funds can I subscribe online?

You can subscribe any funds online which have Prospectus and relevant Offering Document provided by the respective fund houses. Learn more.

What is the minimum investment amount?

The minimum investment amount is HK$10,000 or its equivalent.

Which currency can I use to subscribe fund(s)?

You can use the currency denominated in your account holding to subscribe fund(s). For example, if you have a USD savings account, you can use USD to subscribe.

How do I know the Bank has accepted my order?

After you placed an order, you will receive an Order Reference Number. You can use this Order Reference Number to check your order status through the “order status” function. Once a transaction has been settled, you can check the transaction details by using the “Transaction History” function. Moreover, a notification letter will be sent to you by mail to confirm your transaction details. The Transaction Reference Number shown in the “Transaction History” screen will also be marked in this notification letter for your reference.

Can I amend / cancel my instruction online?

No, you cannot make any amendment / cancellation through Online Mutual Fund Service.

What kind of information can I find online?

You can obtain comprehensive fund information online. They include:

- Prospectus, key facts statement, fund factsheet as well as interim &annual reports; and

- Latest fund price, currency, return, risk etc.; and

- Updated market commentary and analysis.

How do I search for the fund(s) I want?

You can search fund(s) by entering fund house, asset class, region and/or currency etc. You can also use the "Fund Search" function to access detailed fund information.

Where can I obtain a copy of the funds’ offering document for reference?

You can obtain the document at any of our Branches or through Bank by Phone service at +852 2779 5533.

Apart from the trade related fee as specified in the fund's offering document and the bank's Schedule of fees and charges, are there any additional fees charged for using the Online Mutual Fund Services to subscribe/redeem/switch funds?

No, there is no extra cost for using Online Mutual Fund Services.

Which type of fund switching order I can submit via Online Mutual Fund Services?

Customer can submit two types of switching orders:

- "Same Fund House Switching" involves the switching of your investment from one fund to another fund of the same class under the same series offered by the same fund house.

- "Cross Fund House Switching" involves the switching of your investment from one fund to another fund of different fund houses or under the situations other than those being categorized as "Same Fund House Switching"

Please note that "Cross Fund House Switching" order involves the use of cash proceeds received from the redemption of the currently-held fund (i.e. a redemption transaction) to purchase the new fund that selected (i.e. a subscription transaction); therefore, the subscription transaction can only be executed after the Bank has received the proceeds of the redemption transaction and consequently the resulted time gap may expose the investor to the market risk due to the fund price fluctuation. The redemption and subscription orders are subject to the acceptance by the Bank and/or the relevant fund house(s). Notification will be made to the affected customer if the redemption and/or subscription order(s) is/are not accepted by the Bank or the relevant fund house(s) for any reasons.

For the "Cross fund House Switching", the transaction may be subject to both a redemption fee and a subscription fee charged by the respective fund house(s) depending on the prevailing terms and conditions at the time of processing the respective redemption and subscription orders, and the resulted fees may be higher than the fee charged for the switching transaction for the funds under the same fund house.

Regular Mutual Fund Investment Plan

Apply for/ modify / terminate the Regular Mutual Fund Investment Plan

How to apply for/set up a Regular Mutual Fund Investment Plan?

You can apply for a Regular Mutual Fund Investment Plan (the “Plan

”) through any of our branches or our Online Banking or Mobile Banking platforms; however, you will need to go to one of our branches if you want to modify or terminate the Plan. The transaction instruction must be submitted at least four working days before the monthly payment date under the Plan; or otherwise the transaction instruction will only be effective on the monthly payment date under the Plan in the following month. The monthly investment amount(s) the Plan must be in units of HK$1,000. You may change your monthly investment amount(s) under the Plan from time to time in accordance to your investment strategy.

How to terminate my existing Regular Mutual Fund Investment Plan (the “Plan

”)?

You can visit any of our branches to terminate the Plan. The termination instruction must be submitted at least four working days before the monthly payment date under the Plan, or otherwise the termination instruction will only be effective on the monthly payment date under the Plan in the following month.

Among others, under what circumstances will the Bank terminate my Regular Mutual Fund Investment Plan (the “Plan

”)?

If any part of the required monthly investment amount remain unsettled on the monthly payment date for three consecutive months under the Plan, the Bank reserves the right to terminate your Plan without providing any further notice.

Transaction execution

When will the Bank execute my purchase instruction to purchase the mutual fund(s) for me?

The Bank will purchase the mutual fund(s) for its customers within 7 business days after each of the monthly payment date under the Regular Mutual Fund Investment Plan.

How will the purchase instruction be handled if my settlement account has insufficient funds on the monthly payment date?

If there are insufficient funds in your settlement account (whether in part or in whole) on a monthly payment date, the Bank will not execute your purchase instruction(s) for any of the sub-plan(s) under your Regular Mutual Fund Investment Plan in that corresponding month. The Bank will not and hold no responsibility to provide you any notice before the monthly payment date, and customers must bear the relevant risks.

Eligible mutual funds

What kind of mutual funds can be selected under the Regular Mutual Fund Investment Plan?

You may view the list of eligible mutual funds under the Regular Mutual Fund Investment Plan under “Investment” >“Funds” >“Apply Regular Investment Plan" after logging on to Online Banking or under “Investment” >“Mutual Fund” >“Apply Regular Investment Plan” after logging on to Mobile Banking.

Others

Where can I check the details of my Regular Mutual Fund Investment Plan?

You can check the transaction records of the Regular Mutual Fund Investment Plan under “Investment” >“Funds” >“My Regular Investment Plan” after logging on to Online Banking or under “Investment” >“Mutual Fund” >“My Regular Investment Plan” after logging on to Mobile Banking. You can also find relevant transaction records in the mutual fund subscription confirmation(s) or the monthly statement(s) issued to you by the Bank.

Can I sell the mutual funds in the Regular Mutual Fund Investment Plan at any time?

Yes. All mutual funds purchased through the Regular Mutual Fund Investment Plan will be deposited in your mutual fund account and you may sell them according to your needs.

Can customers of the Regular Mutual Fund Investment Plan enjoy the same rights and interests as ordinary fund holders?

Yes. Customers of the Regular Mutual Fund Investment Plan can enjoy the same rights and interests as ordinary fund holders, including but not limited to receiving dividend

Securities Trading

After enrolling in the Online Securities Trading Services, can I still place order through other channel(s)?

You can still place order through Securities Trading Hotline at +852 2903 8488 or Mobile Banking.

What are the benefits of using Online Securities Trading Services?

With China Construction Bank (Asia) Online Securities Trading Services, you can:

- enjoy preferential brokerage commission rate

- access to real time stock quotes and real time streaming price chart

- view personalized latest market news and research reports

- check your order status, transaction history and portfolio

- set up your own watch list

- receive order confirmation and stock price eAlerts via email/SMS

- place your order anytime, anywhere

How can I trade through Online Banking?

You have to be a China Construction Bank (Asia) Online Banking customer with a Securities Trading account.

How do I place an order?

On the Trading page:

- Select market

- choose order type

- choose your Securities Trading account

- select buy/sell

- enter stock code, price and quantity

- choose expiry date

You also have the opportunity to view stock quotes and broker queue right before you place order.

Does the Bank accept price orders that are different from current market prices?

Yes, but if the order with input price deviate 20 spreads or more than the current market price will be kept in our system. The order will only be sent out to market for queue until the spread deviation are less than 20 spreads.

How do I know the Bank has received my order?

After the Bank received your order, you will receive an order reference number. You can also check your order status in the "Order Status" section.

How can I check the status of my order?

You can go to the "Order Status" or "Order History" section to check the status of your order. You are allowed to cancel the instruction while the status is ”Queued”, ”Received” or ”Partially Executed”. You can also go to the "Order History" section to check the final status of your order.

Can I amend or cancel my order?

Yes. You can amend or cancel your Enhanced Limit Order, Special Limit Order and Limit Order when the order status is "Queued", "Received" or "Partially Executed". The order status will be shown in the "Order Status" section. For Stop Loss Order, you can cancel the order only. For Market Order, no amendment or cancellation is allowed.

How am I notified of the execution results?

You will be notified of the respective execution results via email and/or SMS if you have registered for our Stock Order Confirmation eAlert service, the notice will be sent to the email address you have provided in "Maintain My Details"; and the SMS notice will be sent to the mobile phone number you have provided via branch. Stock Order Confirmation eAlert service may be out of order or delayed due to unpredictable network traffic congestion and other reasons. You can also check your order status in "Order Status / History " section. You canclick here to understand the risk of Stock Order Confirmation eAlert service.

How can I keep track of the stock?

The Stock Watch function allows you to input the stocks you are interested in and will show information such as nominal, change, volume and P/E ratio for each stock you selected. Price alert function enables you to input the target price of your selected stocks in order to provide the updated information for your investment decision. This service only available if you have registered for our Stock Order Confirmation eAlert service and provided your email address and/or mobile phone number in "Maintain My Details".

What is "All-or-Nothing"?

All-or-Nothing binds your order to be either executed in full or rejected. The default setting in our Online Banking is “No” and cannot be changed.

What is "Limit Order"?

Limit Order allows your order matching only at the input price. The unfilled Limit Order will be put in the price queue of the input price. Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Limit Order will lapse and be cancelled at the end of that trading day (except Good-till-date instruction).

What is "Enhanced Limit Order"?

Enhanced Limit Order allows your order matching up to maximum 10 price queues at a time provided that the traded price is not worse than the input price. The unfilled Enhanced Limit Order will be converted to Limit Order and put in the price queue of input price. The default setting in our Online / Mobile Banking is "Enhanced Limit Order". Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Enhanced Limit Order will lapse and be cancelled at the end of that trading day (except Good-till-date instruction).

What is "Special Limit Order"?

Special Limit Order allows your order matching up to maximum 10 price queues at a time provided that the traded price is not worse than the input price. A Special Limit Order has no restriction on the input price as long as the order input price is at or below the best bid price for a sell order or at or above the best ask price for a buy order. Any unfilled Special Limit Order will be cancelled by the market immediately after matching.

What is "At auction Limit Order"?

At-auction Limit Order is a limit order with a specified price of which input is allowed only during Pre-opening session. The Bank only accept the At-auction Limit Order with input price does not deviate 200 spreads or 9 times from the prevailing nominal price or previous closing price (whichever is lower). The unfilled At-auction Limit Orders in pre-opening session will be converted to Limit Order at the input limit price and carried forward to the continuous trading session.

What is "Stop Loss Order"?

A Stop Loss Order can only be given to the Bank during Continuous Trading Session on a trading day.

The Stop Loss Price and the Lowest Selling Price could only be specified within the price ranges determined by the Bank.

A Stop Loss Order will only be triggered if the nominal price of the relevant stock is equal to or lower than the specified Stop Loss Price during trading hour on the relevant trading day. Please be reminded that the Stop Loss Order may be fully executed, partially executed or unexecuted by one time at a price not lower than the Lowest Selling Price on the relevant trading day. Market conditions may make it impossible to execute your Stop Loss Order.

Regardless of the final execution result (the order is partially executed or unexecuted), any unfilled Stop Loss Order will lapse and be cancelled at the end of that trading day.

The Stop Loss order may be rejected by market due to market fluctuation.

What is Stop Loss Price?

It is the selling price of a stock specified by you and must be set below the nominal price. Stop Loss Order will be triggered and placed to the market once Stop Loss Price is reached.

What is Lowest Selling Price?

It is the lowest selling price (which must be a price lower than the relevant Stop Loss Price) specified by you to sell your specified stock in the Stop Loss Order.

Can I place a multiple-day Stop Loss Order?

No. the Stop Loss Order is only valid for 1 trading day.

What is "Market Order"?

Please note that Market Order cannot be amended or cancelled after the order is placed.

A Market Order shall only be given to the Bank during Continuous Trading Session on a trading day.

Market order is an order which you do not set a limit price. Such order will be executed at prevailing market price at time of execution. Please be reminded that the executed price may deviate (mildly, significantly or dramatically) from your expected price due to market fluctuation.

The Bank will submit your Market Order to the market (in a number of tranches) for auto-matching and execution by matching it up to a maximum of 30 spreads from the prevailing nominal price (as the case may be). Any unfilled quantity of your market order will be cancelled immediately. You can also enquire your order status in “Order Status” or “Order History” section.

Can I place an instruction during non-trading hour or non-trading day?

Yes. If the instruction is inputted during non-trading hour or non-trading day, it will be treated as an instruction given to the Bank on the next relevant trading day. Under this circumstance, your instruction may be rejected at the inception of the pre-opening session if the price you inputted exceed the limit set by the HKEX. For Northbound Trading, instruction can only be placed during the trading hours of Shanghai Market.

What is "Good-till-date" Instruction?

"Good-till-date" Instruction enables you to place an instruction to buy or sell stock and the instruction will remain valid up to 10 trading days.

Which order types can set "Good-till-date" Instruction?

Good-till-date instruction is only available for Enhanced Limit Order and Limit Order.

I have placed a "Good Till Date" order. If the order cannot be fully executed on same day and is partially executed on different days, will all the execution results be consolidated for calculating the charges?

No, only the execution results of every order executed on same day will be consolidated for charge calculation otherwise the charge will be calculated separately.

Will my order be valid if there is any corporate action of the company?

Due to any corporate action (including but not limited to stock split or consolidation) that will impact your original instruction (including but not limited to the price and quantity), the relevant buy/sell order may be cancelled. If the trading of the relevant stock is suspended during trading hours and the status is unchanged on the next trading day, the relevant Good-till-date instruction will be cancelled. You should keep watching for any corporate action related to your stock for which you have placed order.

Can I sell the stocks I have bought before its settlement?

Yes.

Can I use the funds from selling a stock to buy a new stock before its settlement?

Yes. However if a sell transaction of Callable Bull Bear Contracts (CBBC) is cancelled by the HKEx due to the mandatory call, the pending receivable trade settlement amount will be deducted after market close on the mandatory call day. Under this situation, if you utilize the pending receivable trade settlement amount for stock purchase, you will be liable and required to deposit sufficient fund for the transaction settlement. For details on the mechanism of CBBC’s mandatory call, you may refer toHKEx’s web site.

What is total purchasing power?

For Securities Cash Trading Account, total purchasing power refers to aggregate of the available cash balance and net proceeds of unsettled purchase and sale orders. For Securities Margin Trading Account, available cash balance including available overdraft facilities and net proceeds of unsettled purchase and sale orders and available cash in the secondary settlement account linked to the Securities Margin Trading Account.

Will the transaction I perform today be reflected in my ”Portfolio”?

Yes, once your order is executed, the transaction you performed will be reflected in your “Portfolio”. Partially executed orders will be reflected in your “Portfolio” after the market is closed.

What is Streaming Quote?

Streaming Quote is a chargeable stock quote service, you must open our Securities Trading account,Online Banking Service and apply for this service at our Branches. For the plan and fee of Streaming Quote, please refer to the latest Schedule of Service Fees for Securities Trading Services.

What are Personalized Latest News and Research Reports?

Upon your logon to Online Banking, Personalized Latest News and Research Reports will bring you the related latest market information based on your Portfolio and Watch Lists of the previous day. If you do not have any securities holdings or do not have any stocks maintained in your watch list, general Latest News and Research Reports will be displayed.

You may also subscribe our Latest News and Research Reports eAlert service to receive related market information via email, free of charge.

These services are available for securities trading customers only.

If I placed an order via the manned channel and subsequently modified the order on Online Banking or placed an order on Online Banking and subsequently modified the order via manned channel, which channel rate will be used to calculate the commission?

If it involves more than one channel for placement and modification for the same order, the commission will be calculated based on the priority pre-set by the Bank. For the above cases, the manned channel brokerage commission rate will be applied. Please note that the priority is subject to review and change by the Bank from time to time without prior notice.

Can I choose to receive eStatement for Securities Trading service?

Yes, please click here for more details about the eStatement Service for Securities Trading Account.

Why I need further identity verification when I access Online Securities Trading Services?

To further strengthen the security of the Online Banking and Online Securities Trading Services, when you access Securities Trading Service in our Online Banking, other than the Username and Password used in Logon process, you will also be required to input Security Code displayed on your Security Token/SMS One-Time Password (OTP) via your mobile phone for further identity verification.

How to register or update the mobile phone number for receiving the One-time-password (OTP)?

The One-Time Password (OTP) will be sent to your mobile phone number registered with the Bank via branch. If you wish to register or update your mobile phone number, please visit any of our branches.

Why am I unable to request or receive the SMS One-time-password (OTP)?

If you cannot request or receive the One-Time Password (OTP), it may be due to any of the following reasons:

- You have not registered any mobile phone number with the Bank. Please visit any of our branches to register your mobile phone number.

- You have registered an invalid mobile phone number , please visit any of our branches to update your mobile phone number or call our Customer Service Hotline at +852 2779 5533 to confirm your mobile phone number

- If you are using overseas mobile phone number, the number displayed would include country code, area code (exclude prefix, which is not required when calling from overseas) and telephone number without any space, letters or special characters, e.g. 86101234567.The One-Time Password (OTP) can only be received by the registered mobile phone number. Please switch on your phone to receive the One-Time Password (OTP). Please note that SMS One-Time Password will not be forwarded to other mobile phone numbers even if you have activated SMS forwarding service provided by your telecommunication service provider.

Can I purchase crypto/virtual asset ETFs?

With effect from Apr 4, 2023, our Bank has suspended the acceptance of securities purchase instruction of FA CSOP BTC (3066.HK), FA CSOP ETH (3068.HK) and FA SAMSUNG BTC (3135.HK). Should you have any queries, please contact our Securities Trading Hotline at 2903 8488.

Investor Identification Regime (“HKIDR”)

What is HKIDR?

The Securities and Futures Commission (“SFC”) has introduced the Investor Identification Regime (“HKIDR”) for stock trading to facilitate the Stock Exchange of Hong Kong ("SEHK”) and relevant regulators to enhance their market supervision and surveillance. The launch date of HKIDR is Mar 20, 2023 (the “Effective Date”).

Under HKIDR, a bank may, among others, (i) collect, store, process, use clients’ personal data (including Client Identification Data (“CID”) and Broker-to-Client Assigned Number (“BCAN”(s)) as required for the bank to provide services to clients in relation to securities listed or traded on the SEHK and (ii) disclose and transfer clients’ personal data (including CID and BCANs) to SEHK and/ or the SFC for complying with the rules and requirements of SEHK and the SFC in effect from time to time.

What is “BCAN” and “CID”?

- “BCAN” means a “Broker-to-Client Assigned Number”, being a unique identification code in the format prescribed by the SEHK, generated by a licensed or registered person for the client in accordance with the requirements of the SEHK; and

- “CID” means any of the information in relation to a client to whom a BCAN is assigned, including: (i) the full name of the client as shown in the client’s identity document, (ii) the issuing country or jurisdiction of the identity document, (iii) the identity document type, and (iv) the identity document number.

Under HKIDR, what CID shall a bank provide to SEHK and SFC?

Under HKIDR, a bank shall disclose and transfer CID to SEHK and SFC:

i. For an individual client, his or her:

- full name as shown on his or her identity document;

- identity document’s issuing country or jurisdiction;

- identity document type: (1) HKID card; (2) national identification document; (3) passport); and

- identity document number on the identity document.

ii. For a corporate client, its:

- full name as shown on its identity document;

- identity document’s issuing country or jurisdiction;

- identity document type: (1) LEI registration document; (2) certificate of incorporation; (3) business registration certificate; (4) other equivalent documents); and

- identity document number on the identity document.

You may also refer to the FAQs on the collection of CID published on SFC’s website

How does HKIDR work?

Under HKIDR, a bank will disclose and transfer the CID and the BCAN to a secured data repository of Hong Kong Exchanges and Clearing Limited (“HKEx”). Every stock transaction or order will then be tagged with a BCAN to identify the investor who places it.

Under HKIDR, what shall clients do?

To comply with requirements under Personal Data (Privacy) Ordinance and the SFC’s requirements, individual client shall provide to the bank with his/her positive consent for the transfer of their personal data to SEHK and the SFC under the HKIDR; and client shall promptly update his/her identity document information; but there is no such requirement for corporate clients.

How shall individual client provide the consent to CCB (Asia)?

Individual client can provide his/her positive consent to CCB (Asia) through:

- Logging onto CCB (Asia) Online Banking/ Mobile Banking / Fortunelink; or

- Visiting any of our branches or referring to relationship manager to get and sign back “Client Consent on Investor Identification Regime (HKIDR) and Over-the-counter Securities Transaction Reporting Regime (OTCR) in Hong Kong” (the “Consent Form ”).

What if the client doesn’t provide the positive consent after the Effective Date?

If the individual client does not react to the “Consent Form" or choose not to provide the positive consent to CCB (Asia); after the Effective Date, CCB (Asia) would not be able to, without your signed consent, submit your CID to HKEx and the SFC. CCB (Asia) would also not be able to buy or deposit stocks for you. After the Effective Date, you would only be able to sell, or withdraw the stocks you hold.

How long does it take before the consent being effective?

- Through logging onto Online Banking/ Mobile Banking/ Fortunelink: if the positive consent is submitted by the client before 12:00 noon on each trading day, it will be effective on the next trading day; but if the positive consent is submitted by the client after 12:00 noon, it will only take effective after 2 trading days.

- Through completing and signing back the Consent Form: under normal circumstances, after receiving the Consent Form, it will take 2-4 trading days for CCB (Asia) to process the instruction.

Do I need to update my personal data for HKIDR?

Under HKIDR, there is a specific requirement on the priority of identification document(s). The priorities of the types of personal identification documents are the Hong Kong Identify Card, the national identification document and the passport. If you have obtained a new identification document with a higher priority, you should promptly update your identity document information with us.

You may also refer to the investor education video produced by the SFC on the requirement for identification documents

What if my previously submitted identification document(s) is/are expired / going to expire?

If your previously submitted identification document(s) is/are expired / going to expire, or fail to meet relevant requirements set out by HKEx, you shall bring along your latest and eligible identification documents to any of CCB (Asia) branches to update the record. Otherwise this may impact your securities dealing in CCB (Asia) and you would only be able to sell, or withdraw the stocks you hold.

Do I need to provide consent to CCB (Asia) again if I have already provided consent to other banks?

Yes, you need to provide your consent to CCB (Asia).

Open an Investment Account Online

Why am I unable to open an investment account online?

The Bank can only provide online investment account opening services for individual customers who only hold Hong Kong Permanent Resident Identity card currently. If you are not the one who fall into this category, please visit our branch to open the investment account in person.

Securities Monthly Investment Plan

How to apply/set up the Securities Monthly Investment Plan (“SMIP”)?

You are required to have a valid Securities Cash Trading Account with the Bank for the application of SMIP. You can apply or amend the SMIP at any of our branches or via Online/Mobile Banking. If you submitted your application at any of our branches 3 trading days before the Hold Fund Date, the relevant instruction will be effective on that calendar month. If the relevant instruction is submitted after such date, it will be effective in the next calendar month. If you submit your application via Online/Mobile Banking, the effective date will be displayed on screen. The Monthly Contribution for each Plan under the SMIP must be in units or multiples of HKD 1,000. You can amend your Monthly Contribution of the selected Security or delete the Plan according to your investment strategy.

How many Securities can be selected?

Only one SMIP may be set up under each Securities Cash Trading Account. However you may set up more than one Plan under each SMIP in which only one eligible Security can be selected for each Plan.

How to terminate my existing SMIP?

If you submitted your termination instruction at any of our branches 3 trading days before the Hold Fund Date, the relevant instruction will be effective on that calendar month. If the relevant instruction is submitted after such date, it will be effective in the next calendar month. If you submit your termination request via Online/Mobile Banking, the effective date will be displayed on screen.

Is there a minimum amount for the Monthly Contribution?

The minimum Monthly Contribution is HKD1,000 per Security and it must be increased in multiples of HKD1,000. The maximum amount for Monthly Contribution is HKD10,000 per Plan.

Under what circumstances would the Bank terminate my SMIP?

If the Bank is unable to hold any of the required Monthly Contribution on a Hold Fund Date from the designated Settlement Account due to insufficient fund for 3 consecutive months, the Bank has the right to immediately terminate your SMIP in the Securities Cash Trading Account without prior notice.

When will the Bank execute the instructions for customers?

The Bank will execute purchase instructions on behalf of customers during trading hours on the every 10th of each calendar month (“Execution Date ”). Hold Fund Date is 2 days before the Execution Date, and if the Hold Fund Date is not a trading day, both the Hold Fund Date and the Execution Date will be postponed to the next trading day. If only the Execution Date is not a trading day, the Execution Date will be postponed to the next trading day while the Hold Fund Date will remain unchanged.

How is the average price of a security under the Plan determined?

The average price of a Security is determined by the average purchase price of such specified Security for all customers, these transactions may include board lots or odd lots. For example, if the Bank purchases 2,000 shares of stock Z at HKD10.00 and another 1,000 shares at HKD10.60, the average price of stock Z would be HKD10.20.

[(HKD10.00 X 2,000) + (HKD10.60 X 1,000)] ÷ (2,000 + 1,000)

= (HKD20,000+HKD10,600) ÷ 3,000

= HKD10.20

How many shares/units of the selected security will be allocated to each customer?

The Monthly Contribution after deducting the handling fee will be used by the Bank to purchase the Security you selected on a reasonable effort basis under the Plan. The number of shares/units allocated to each customer will be rounded down to the nearest integral number, and the actual Monthly Contribution, including the handling fee, will be debited from the customer’s designated settlement account. The amount will be shown on the securities trading consolidated daily statement and monthly statement.

Example – Stock Z (in HKD, assuming the handling fee is HKD50):

| Contribution Month | Monthly Contribution set up by Customer (will be held from your Settlement Account on the Hold Fund Date) (HKD) | Monthly Contribution after handling fee is deducted (HKD) | Average price per share (HKD) | Quantity of shares bought | Monthly Contribution (excluding handling fee) (HKD) | Actual Monthly Contribution (including handling fee) (HKD) |

| January | 1,000 | 950 | 10.300 | 92 | 947.60 | 997.60 |

| February | 1,000 | 950 | 11.650 | 81 | 943.65 | 993.65 |

| March | 1,000 | 950 | 12.100 | 78 | 943.80 | 993.80 |

How does the Bank calculate the “Average Purchase Cost” in the Contribution History page in Online/Mobile Banking?

“Average Purchase Cost” is calculated by the sum of actual Monthly Contribution (including handling fee) divided by the accumulated quantity of shares bought for a specified Security under a Plan.

Average Purchase Cost (using the example – Stock Z of above question for calculation):

= (HKD997.60 + HKD993.65 + HKD993.80) ÷ (92 + 81 + 78)

= HKD2,985.05 ÷ 251

= HKD11.89

What happens if I do not have sufficient funds in my designated Settlement Account on the Hold Fund Date in a calendar month?

The Bank will not execute the purchase instructions under any of your Plans for that calendar month if any of your required contribution amount cannot be held from your designated Settlement Account on a Hold Fund Date. The Bank will not and has no obligation to send a reminder to you before the Hold Fund Date.

What happens if the stock market is closed on the Execution Date due to bad weather conditions?

If the stock market is closed on any day between the Hold Fund Date and the Execution Date (both dates inclusive) due to bad weather conditions, the Hold Fund Date will remain unchanged while the Execution Date will be postponed to the next trading day.

What happens if trading is suspended for an eligible security under the SMIP on the Execution Date?

If trading of an eligible Security under SMIP is suspended on the Execution Date, all customers’ instructions for purchasing that Security under SMIP will be cancelled for that calendar month; the relevant Monthly Contributions (together with the relevant fees and charges under the Plan) will not be debited from your designated Settlement Account.

What will happen if the security I selected is removed from the eligible list of securities under my SMIP?

The Bank will regularly review and vary the list of eligible securities under the SMIP. If the security you have selected under SMIP is subsequently removed from list of the eligible securities, the Plan(s) of the relevant security will be terminated without prior notice.

What securities are available for selection under the SMIP?

Please click here to view the list of eligible securities under the SMIP.

How can I check the transaction details of my SMIP?

You can check the transaction details of your SMIP by clicking on “Investment” and then “Contribution History” after you have logged in to Online Banking. The relevant transaction details will also be stated in the securities trading consolidated daily statement and monthly statement provided to you by the Bank.

Can I sell securities under the SMIP at any time?

Yes, all Securities purchased through the SMIP will be kept in the Securities Cash Trading Account, and you may sell them as you wish. If you need to sell securities in odd lots, please call our Securities Trading Hotline 2903-8488 during the trading hours.

Can SMIP customers enjoy the same rights as normal shareholders?

Yes. SMIP customers can enjoy the same rights as other shareholders, including but not limited to corporate action events, such as receiving dividend payments and bonus shares.

Shanghai - Hong Kong Stock Connect / Shenzhen - Hong Kong Stock Connect

Can investors hold SSE or SZSE securities through Shanghai and Shenzhen Northbound Trading in physical form?

Since SSE and SZSE securities are issued in scripless form, physical form is not available.

How do investors obtain the latest company announcement?

All approved corporate actions on SSE

and SZSE

securities will be announced by the issuers through the SSE and SZSE website and officially appointed newspapers (both the printed paper and their websites: the Shanghai Securities News

, Securities Times, China Securities Journal,Securities Daily) and the website www.cninfo.com.cn

.

Hong Kong and overseas investors can also visit HKEx website’sChina Stock Markets Web

for the company announcements of SSE and SZSE securities issued on the previous trading day.

Please note that the corporate announcements will only be provided in Simplified Chinese.

Can investors attend the relevant shareholder meetings in person or appoint more than one person to attend and act as proxy at the meetings on his/her behalf?

As HKSCC is the shareholder on record of SSE/SZSE-listed companies (in its capacity as nominee holder for Hong Kong and overseas investors), it can attend shareholders’ meeting as shareholder. Where the articles of association of a listed company do not prohibit the appointment of proxy/multiple proxies by its shareholder, HKSCC will make arrangements to appoint one or more investors as its proxies or representatives to attend shareholders’ meetings when instructed.

Can customers cancel their submitted orders within the 5 minutes prior to the opening of each trading session?

Customer can submit their cancellation instruction to the Bank within the 5 minutes prior to the opening of each trading session. However, the instruction is only received by the Bank and will be processed until the market is open for trading. Customers should be aware that the pervious order may be executed before the cancellation instruction is processed.

Can I involve in Shanghai and Shenzhen Northbound Trading?

For existing securities trading customer in our Bank: Customers can sign up the service and open a RMB settlement account at any of our branches.

For new securities trading customer: Customers can open a securities trading account via any of our branches or Online Banking. Please be reminded that RMB Settlement Account should be set up for the securities trading account in order to be eligible for trading in RMB denominated stock listed on SEHK, SSE and SZSE.

Special arrangement on unsettled fund

Due to the difference in cash settlement cycles of SEHK, SSE and SZSE, customer’s purchasing power with the unsettled fund in different markets will be different. Below is the illustration example:

| RMB (“¥”) | Trade Day - 1 | Trade Day | Trade Day + 1 | Trade Day + 2 | |

| RMB denominated securities listed in SEHK | Customer Sell | ¥20,000 | |||

| SSE or SZSE securities | Customer Buy | ¥5,000 | |||

| Cash Balance of RMB settlement Account at the beginning of trading day | ¥10,000 | ¥10,000 | ¥10,000 | ¥25,000 | |

| Held fund for purchased transaction | 0 | 0 | ¥5,000 | 0 | |

| Unsettled fund from the RMB sold transaction | 0 | ¥20,000 | 0 | 0 | |

| Customer's purchasing power in RMB for SEHK | ¥10,000 | ¥30,000 | ¥25,000 | ¥25,000 | |

| Customer's purchasing power RMB for SSE or SZSE | ¥10,000 | ¥10,000# | ¥25,000* | ¥25,000 | |

# Due to the cash settlement date in SEHK is Trade Day + 2

* The unsettled fund used in Northbound Trading on Trade Day + 1:

¥10,000 (cash balance) + ¥20,000 (unsettled fund from the sold transaction which settle in Trade Day + 2) - ¥5,000 (held fund for purchased transaction which settle in Trade Day + 1) = ¥25,000

Is there any cut off time for Securities Settlement Instruction on transfer in / out of SSE and SZSE securities?

Yes. The Securities Settlement Instruction should be submitted to the Bank at least 1 business day prior to the expected transfer in / out date stated in the instruction form. The securities settlement instruction can only be handled by the Bank in the condition that both the Bank and counterparty received the completed customer’s transfer in /out instruction.

Securities Margin Trading

What is Securities Margin Trading?

With Securities Margin Trading, you only need to pay for a portion of the total cost that you deposit is initial margin. As you have borrowed money from the Bank to buy securities, the securities will be treated as collateral for the Margin facility.

How does the leverage work for Securities Margin Trading?

Below please find the illustration example on the leverage work for Securities Margin Trading:

Assume:

Pledge Ratio of Stock A: 60%

No. of share that you are holding: 100

Price of Stock A: HK$100

Your Securities Asset Margin Value (Which indicates the current market value of your portfolio multiplied by their respective Pledge Ratio)

= HK$100 X 100X 60% = HK$6,000

(Fees, levies and other transaction costs are not included in the above example for simplicity. Please note that you still have the full amount of these fees, levies and other transaction costs under Securities Margin Trading arrangement)

Can I purchase stocks without utilizing the overdraft in my Securities Margin Trading Account?

Yes. You can continue to pay the purchase considerations in full cash.

If I deposit more cash than it is required for my cash margin, can I utilize the unused overdraft for the subsequent purchases in the future?

Yes.

How is the mechanism of margin fund transfer in / out?

- The margin account will also be used as the primary settlement account. If there is insufficient fund in the margin account, the cash account as the secondary settlement account will be debited for the fund shortage.

- Any surplus of cash in the margin account (usually after the stocks selling) will not be transferred back to the secondary settlement account (cash account) automatically. You will have to transfer the fund via our function “Margin Fund Transfer”.

What are the ways to withdraw cash from the margin trading account?

- Margin transfer via Online Banking, which operates from 8:00 a.m. to 7:00 p.m. from Monday to Friday (except public holidays);

- Visit our Securities Trading Center from 9:00 a.m. to 5:00 p.m. from Monday to Friday (except public holidays); or

- Call our Securities Service hotline at +852 2903 8488 from 9:00 a.m. to 6:00 p.m. from Monday to Friday (except public holidays)

Will the fund transfer details be displayed in my statement?

Yes.

Will there be automatic funds transfer from settlement account to margin account if there is insufficient fund for my purchase transaction? If so, under what condition will it happen?

Yes, it will happen when there is insufficient fund for initial margin upon buy order (i.e. the sum of margin value of stocks and cash in margin account is less than the purchase amount).

Can I open both Securities Cash Trading account and Securities Margin Trading account in same account entity? If so, can I use the same settlement account for both?

Yes, but separate set of settlement accounts are needed. The account open procedure for Securities Margin Trading only can be completed at branch.

Can I have more information on the mechanism of margin call or liquidation or calculation of financing interest of Securities Margin Trading?

Yes. You can click here and refer to the Securities Margin Trading Factsheet of the Bank.

RMB Denominated Stock Trading

Should I use my existing securities account to trade RMB denominated stock? Is it required to set up a new settlement account for RMB stock trading?

Yes, you may use your existing securities account to trade RMB, but a RMB saving or current account has to be set up as the settlement account first.

Are the stamp duty, transaction fees for trading RMB denominated stock in RMB or HKD?

The stamp duties and transaction fees (including but not limited to Trading Fee, Transaction Levy) are in HKD, and if the stock is denominated in RMB, the exchange rate provided by HKEx will be applied for the conversion and will be deducted from RMB settlement account.

Can I trade RMB denominated stock with my margin trading account?

No.

Pre-Opening Session

Pre-Opening Session

During the pre-opening session (POS), orders are accumulated over a certain period of time and matched at the pre-defined order matching period. Orders are matched in order type, price and time priority (at-auction orders carry a higher matching priority) at the final Indicative Equilibrium Price (IEP). In addition, HKEX has enhanced the POS auction mechanism on 19th October 2020. For details about POS, please refer to HKEX website .

Price limit during Pre-Opening Session

HKEX implemented a price limit during Pre-Opening Session. The upper/lower price limit on At-Auction limit orders will be ±15% of previous closing price. Your instruction may be rejected by HKEX if the price you inputted exceed the limit. For details please refer to HKEX Website.

Why is my instruction being rejected by the system during the "Random Matching Period"?

According to the Hong Kong Stock Exchange, 9:20 am to 9:22 am is the “Random Matching Period”. Since the matching procedure may be completed at any time point during the Random Matching Period, any instruction placed subsequent to the completion of the matching will be rejected by the system.

Closing Auction Session

Which types of securities are eligible for Closing Auction Session (CAS)?

CAS is rolled out in 2 phases. Below are the eligible securities in each phase.

| Phase | Phase I | Phase II |

| Scope |

i) Major index constituent

- Constituent stocks of Hang Seng Composite LargeCap and MidCap indexes H shares which have corresponding A shares listed on Mainland securities exchanges ii)All ETFS |

i) Remaining equity securities and funds - Covers all equities and funds - Excludes structured products and debt securities |

What is the trading hours for CAS?

| Full Day Trading | Half Day Trading | |

| Reference Price Fixing Period | 16:00 – 16:01 | 12:00 – 12:01 |

| Order Input Period | 16:01 – 16:06 | 12:01 – 12:06 |

| No Cancellation Period | 16:06 – 16:08 | 12:06 – 12:08 |

| Random Closing Period | 16:08 – 16:10 | 12:08 – 12:10 |

Typhoon arrangement:

If Typhoon Signal No. 8 or above is hoisted before 15:45 (for full day trading) or 11:45 (for half day trading), trading will terminate 15 minutes after the hoisting of the Signal. There will be no CAS for that trading day if trading has not been resumed by 15:45 (for full day trading) or 11:45 (for half day trading).

If Typhoon Signal No. 8 or above is hoisted at or after 15:45 (for full day trading) or 11:45 (for half day trading), trading for the day will continue as normal until the end of the CAS.

How does CAS works?

| 16:00 – 16:01 | 16:01 – 16:06 | 16:06 – 16:08 | 16:08 – 16:10 |

| Reference Price Fixing Period (1 min) |

Order Input Period (5 mins) |

No-Cancellation Period (2 mins) | Random Closing Period (2 mins) |

|

- Calculate &publish reference price

-Input new ALO in CCBA in this period is allowed, but it may be rejected by market when the relevant reference price is fixed. -The outstanding orders in Continuous Trading Session (CTS) which are within the allowable price limit (i.e. (+/- 5% from the reference price) will be automatically carried forward to CAS |

Price limit allowed: | ||

| +/- 5% of reference price | Within lowest ask &highest bid | ||

| Order type allowed in CCBA: | |||

| At-auction Limit order (ALO) | |||

| Order input, Cancellation &Amendment | |||

| Allowed input, cancel and amend | Input allowed, cancel and amend not allowed | ||

|

*Price spread checking on ALO in CAS: -Allowable price limit (if applicable ) or 200 spreads or 9 times from the nominal price (whichever is lower) |

|||

- Reference Price Fixing Period: The reference price is determined by HKEx by taking the median of 5 nominal prices in the last minute of the CTS. During this period, the reference price is not available. You can input your ALO through CCBA system but it will be stored in the Bank’s system and passed to the market during the Order Input Period.

- Order Input Period: Only At-auction Limit Order (ALO) within the +/-5% of the reference price can be input. The ALO which is input during the Reference Price Fixing Period will be delivered to market. However, the order may be rejected by market if the price is out of the allowable price limit (within the +/-5% of the reference price). Please be reminded to check the order status in “Order Status / Order History” section of Online Banking or Mobile Banking after order input. Outstanding orders can also be amended or cancelled during this period.

- No Cancellation Period: Only ALO with the price between the lowest ask and highest bid recorded at the end of Order Input Period can be input, and no orders can be amended or cancelled.

- Random Closing Period: Market closes randomly within the last 2 minutes of CAS. After the period, there’s order matching for all CAS securities.

(To know more about the CAS, you may also refer toHKEx website

How does the order matching mechanism works?

After the end of Random Closing Period, orders are matched according to order type (at-auction order with higher priority than at-auction limit order), price and time priority at the final Indicative Equilibrium Price (IEP) (i.e. Closing Price).

If final IEF cannot be determined at the end of the CAS, reference price will become the final IEP. In this case, at-auction orders and at-auction limit orders with price at or better than the reference price will be matched at the reference price.

If both IEP and reference price cannot be determined, then there will be no automatic order matching.

How the outstanding orders in CTS will be handled?

For orders with the order status 'queued' in "Order Status / Order History" section of our Online Banking or Mobile Banking and the order price falls within the allowable price limit ( +/-5% from reference price) , the orders will be automatically carried forward to CAS .

For the order with the order status 'queued' in "Order Status / Order History" section of our Online Banking or Mobile Banking whereas the order price falls outside the allowable price limit (+/-5% from reference price), the order will not be carried forward to CAS automatically unless the order price is modified and falls within allowable price limit by customer during Order Input Period (16:01 – 16:06) of CAS.

How the unfilled / partially filled orders will be handled after CAS?

For Day order: Order of CAS Securities which have not been filled / partially filled will lapse after CAS close.

For Good-till-date (GTD) order: Order of CAS Securities which is unfilled / partially filled during CAS will be automatically carried forward to the next trading day until it is triggered or cancelled or expired.

Volatility Control Mechanism

Which types of securities / derivatives are covered by the Volatility Control Mechanism (VCM)?

The scope of securities / derivatives in VCM covers Hang Seng Index (HSI) and Hang Seng China Enterprise Index (HSCEI) constituent stocks and the related index futures contracts.

Which trading session(s) that VCM will be triggered?

VCM is applicable during Continuous Trading Session (CTS) except the first 15 minutes of the morning and afternoon CTS and the last 15 minutes of the afternoon CTS. VCM will only last for 5 minutes and it will be triggered 1 time in each trading session for each stock / derivative and no VCM monitoring for the relevant stock / derivative within the same CTS. If morning session of CTS closes before the end of cooling off period, the remaining time of the cooling off period will not be brought forward to afternoon session of CTS. For market open is delayed due to typhoon signal No. 8 or above is hoisted or black rainstorm, first 15 minutes after market open will still not subject to VCM.

For early market close due to typhoon signal No. 8 or above is hoisted during the trading hour, VCM can still be triggered in the last 15 minutes before market close and continue until market close.

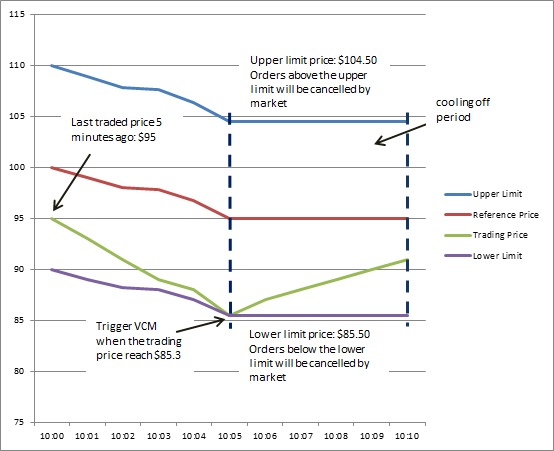

How does the VCM work?

If the market tries to trade VCM’s stocks at a price of more than 10% away from its last traded price 5 minutes ago (“Reference Price”), VCM is triggered (last for 5 minutes). During this cooling-off period, the affected stock will be only allowed to trade within a fixed band of +/- 10% from the Reference Price and only those orders with input price within the fixed band will be accepted.

When VCM is triggered, the orders which trigger the VCM and the outstanding orders which are queued in the market for matching (the order status of such order is ‘queued’ in the Bank) and the price is set outside the fixed band will be rejected by the market immediately. A SMS notification for rejection will be sent to customers’ mobile if the order is placed via our automated trading platform (e.g. Online Banking or Mobile Banking). Customer can also enquire the order status at “Order Status / Order History” section of Online Banking or Mobile Banking or via our Securities Trading Hotline.

(To know more about the VCM, please refer to the website of HKEx http://www.hkex.com.hk/vcm/en/index.htm)

How the reference price of VCM being determined?

The reference price should be the last price executed 5 minutes ago. If there is no trade execution 5 minutes before, system will further search backward for the latest last traded price as reference price. This search can go backward till market open where the auction price established during the Pre-opening Session will be used as reference price. If there is no trade execution from market open to 5 minutes before the start of VCM monitoring, system will use the first traded price as the reference price until there is subsequent execution.

Severe Weather Arrangement

What is the scope of operations of the securities and derivatives market at HKEx during severe weather conditions?

Hong Kong’s securities and listed derivatives markets, including Northbound and Southbound Trading under Stock Connect, derivatives holiday trading, and after-hours trading, will continue as normal during severe weather conditions. The trading, listing, clearing and settlement functions of these markets will remain operational as well.

Can I trade HK stock during severe weather conditions?

During the period of severe weather, the Bank maintains the trading and settlement of Hong Kong securities, Stock Connect and subscription of Initial Public Offer. Customers can enquire your account status and place orders through automated trading channels (including Online Banking, Mobile Banking and FortuneLink Mobile App) of the Bank or call the securities trading hotline. Personnel safety remains a key priority thus all branches will be closed on severe weather trading days.

Apart from securities trading, will Bank provides other investment services during severe weather conditions?

During the period of severe weather, the Bank maintains the trading and settlement of Hong Kong securities, Stock Connect and subscription of Initial Public Offer. Customers can enquire your account status and place order through automated trading channels (including Online Banking, Mobile Banking and FortuneLink of the Bank. Personal safety remains a key priority thus the Bank only provides e-Banking on severe weather trading days and all branches will be closed. Mutual Fund Investment1, Equity-linked Investments, FX Linked Deposit, Currency Switching, Bond Trading and Gold Trading are not available.

1Order received by the Bank under SWT will be forwarded to the relevant fund manager on the next business day for processing according to the relevant dealing procedures of the funds.

Will Bank accepts physical securities deposit?

Considering the personnel and investors’ safety, all branches will be closed during severe weather conditions. Customers can visit branch in person to manage physical deposit/withdrawal of stocks when branches open.

What are the payment-related services arrangement during severe weather conditions?

(1) Paper Cheque (including deposits via branches, cheque deposit machines or drop box) - When severe weather remains for the whole day, there will not be clearing service, relevant funds of cheques deposited before the cutoff time on the previous business day will usually be available for use or withdrawal on the severe weather day (excluding Saturday, Sunday or public holiday). When severe weather does not remain for the whole day, and bank branches had been opened for business (excluding Saturday, Sunday or public holiday), relevant funds of cheques deposited before the cut-off time on the same day will usually be available for use or withdrawal on the next business day; relevant

funds of cheques deposited before the cut-off time on the previous business day will usually be available for use or withdrawal on the severe weather day (excluding Saturday, Sunday or public holiday).

(2) E-Cheque - Service is available as usual, e-cheques deposited before the cut-off time of the severe weather day (excluding Saturday, Sunday or public holiday) will be processed on the same day and settled on the next business day. Relevant funds of e-cheques deposited before the cut-off time on the previous business day will usually be available for use or withdrawal on the severe weather day (excluding Saturday, Sunday or Public Holiday).

(3) Auto-Sweeping Service - When there is cheque clearing service, Auto Sweeping Service will be available on the following day.

To ensure customers can use the Bank’s services under severe weather, please be reminded to apply for online banking services in advance such as Internet Banking or Mobile Banking, and frequently check to ensure that the login and operation are in order. Please also ensure customers’ third-party fund transfer limits via electronic channels are adjusted to suit customers’ needs.

Note:

The information contained in these FAQs are for your information only. They are not intended to constitute legal or other professional advice, and you should not rely on any information in this document as an investment advice. CCB(Asia) assumes no responsibility for any errors, omissions or statements within these FAQs, or for any loss or damage (direct or indirect) which may arise from the use of or reliance on any information contained in these FAQs.