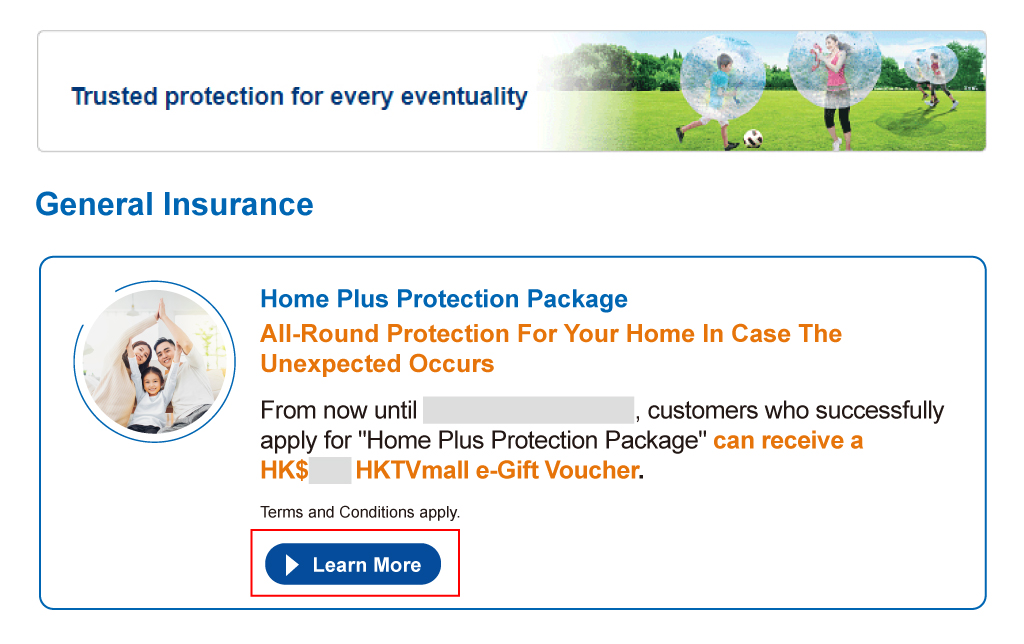

Home Plus Protection Package

All-round Protection For Your Home In Case The Unexpected OccursApply now to receive up to HK$200 HKTVmall e-Gift Voucher

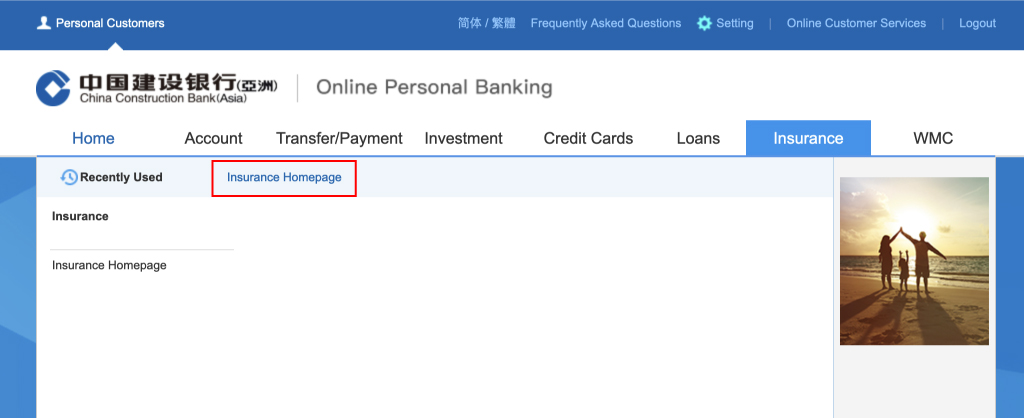

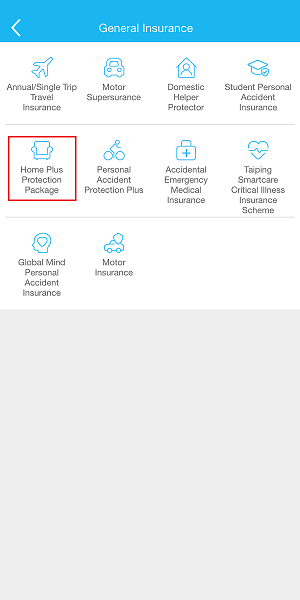

Login to Online Banking now and experience cross-platform online insurance application

Terms and Conditions apply, and more designated General Insurance plan(s) offers are available, please click here to learn more.

- The applicant must be aged 18 or above

- The insurance contract is for Hong Kong resident who normally residing in Hong Kong

- The insured premises must be built of concrete, stone or brick and/or cement

- For the details of the coverage, premium and major exclusions, please refer to the product brochure

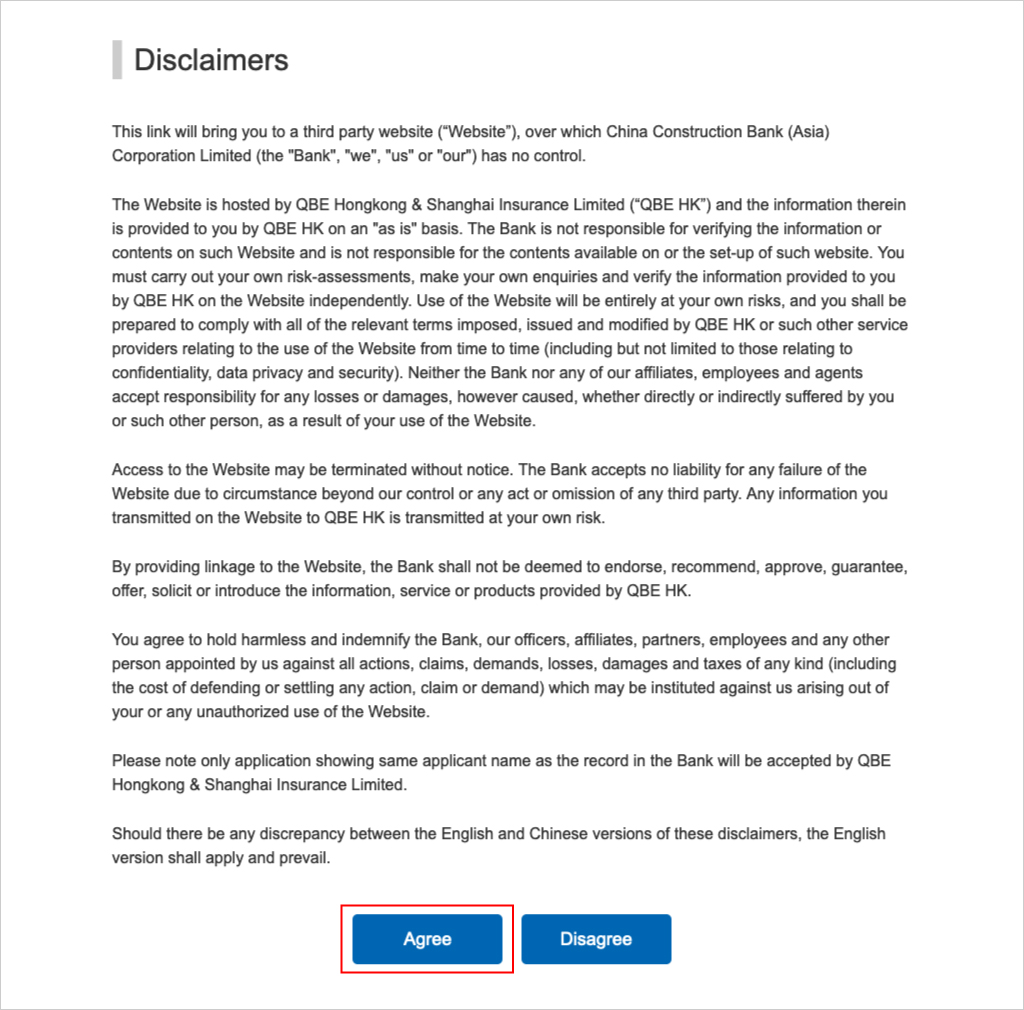

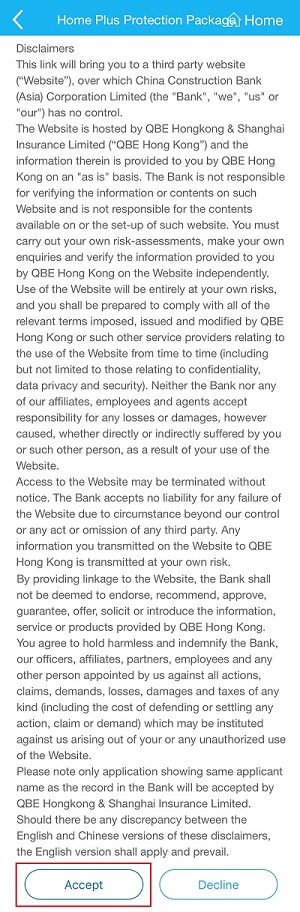

Disclaimers

China Construction Bank (Asia) Corporation Limited (Insurance Intermediary License No: FA3132) (“the Bank”) is the appointed insurance agency of QBE Hongkong & Shanghai Insurance Limited (“QBE Hong Kong”) and China Taiping Insurance (HK) Company Limited (“CTPI(HK)”), to distribute general insurance products in Hong Kong Special Administrative Region. Relevant general insurance products are the products of the insurance companies but not the Bank. The above general insurance products are issued and underwritten by QBE Hong Kong or CTPI(HK). QBE Hong Kong and CTPI(HK) are authorized and regulated by the Insurance Authority (“IA”) to carry on general insurance business in the Hong Kong Special Administrative Region. Please refer to the sales documents, including product brochure, benefit illustration (if applicable), policy documents and provisions issued by QBE Hong Kong or CTPI(HK) for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, important notes, policy costs and fees) of the general insurance products. QBE Hong Kong and CTPI(HK) reserve the right to decide at each of their sole discretion to accept or decline any application for general insurance product according to the information provided by the customer at the time of application. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the general insurance product should be resolved between QBE Hong Kong or CTPI(HK) and the customer directly. Information on this website is intended to be distributed in Hong Kong Special Administrative Region (“Hong Kong”) for reference only, and shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any insurance product in or outside Hong Kong.

Pursuant to the Insurance (Levy) Regulation (Cap. 41I) and the Insurance (Levy) Order (Cap. 41J) under the Insurance Ordinance (Cap. 41), the IA collects levies for insurance premiums from policyholders with effect from 1 January 2018. For further details, please visit the website of IA. For the latest information about the IA, please visit https://www.ia.org.hk. For the latest information about The Insurance Complaints Bureau, please visit https://www.icb.org.hk.

Risk Disclosure

Customers should read the sales documents, including product brochure, benefit illustration (if applicable) and policy documents and provisions issued by relevant insurance company to understand the details of the insurance plan (including but not limited to detailed terms, conditions, coverage, exclusions, fees and product risks) and consider whether the insurance product meets their personal needs before application. Policyholders are subject to the credit risk of relevant insurance company.