Insurance Financing Service

Insurance Financing Service

To provide greater flexibility in your wealth management, China Construction Bank (Asia) is providing an Insurance Financing Service, which includes "Premium Financing" and "Policy Financing" for eligible customers^ and certain eligible life insurance products*.

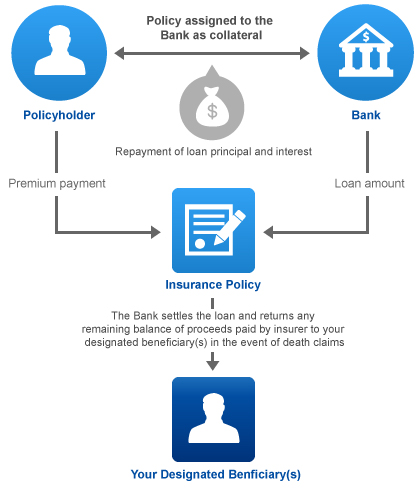

Generally, "Premium Financing" involves a facility granted to customers for paying the premium of his/her insurance application (i.e. a certain percentage of the premium of the insurance policy). And the lending will be secured by the life insurance policy as a collateral.

"Policy Financing" involves a facility granted to customers and secured by the life insurance policy as a collateral to provide customers with the flexibility on the financial situation to obtain extra cash for personal expenses or investments after purchasing the life insurance policy.

Key Facts Statement (KFS)

Note: The above sample diagram of premium financing workflow is for reference only

^ Eligible customers refer to the customers who meet our Bank's related requirements which involve assessment of customers' past credit history, financial status, customer background, etc.

* Eligible life insurance products refer to the selected insurance products of either AIA or FWD Life distributed by China Construction Bank (Asia) as the life insurance agency.

Risk Disclosure relating to Insurance Financing

- Interest rate risk:

The interest rate applicable to the Loan is based on the 3-Month Hong Kong Interbank Offering Rate (HIBOR) plus a pre-determined rate. Loan product linked to HIBOR involves risk as HIBOR will be affected by the currency demand and supply in the market. Regardless of whether the HIBOR currently stays at a relatively low level or not, it may be increased substantially if there is unbalance in the currency demand and supply in the market. Customer may suffer higher interest payment due to the increase in HIBOR.

In case of Premium Financing, please note that the increase in HIBOR could increase costs of serving the loan, and therefore reduce the overall rate of return of the insurance policy under this arrangement. In the worst case, the financing interest rate may be higher than the returns received from the life insurance policy and customer may be subject to significant financial loss. You should take into account of this factor when considering whether this arrangement is suitable for you. - Collateral top-up risk:

If the outstanding loan amount is higher than the Credit Limit granted to you by the Bank (as stated in the Facility Letter), the loan will be charged at the Default Interest Rate. The Default Interest Rate may be substantially higher than the interest rate charged on the loan amount within the Credit Limit. Borrowers may also be asked to provide additional cash to lower the outstanding loan amount below the Credit Limit. - Counterparty risk:

If the relevant credit rating of the insurance company of the issued insurance policy is downgraded, the Bank shall reserve the right to review the Credit Limit and to call for additional collateral if required. - Exchange rate risk:

Exchange rate exposure arises when the borrower chooses a loan currency different to the policy currency. For instance, in case of premium financing, the borrower is required to convert the premium loans (e.g. HKD loans) into the policy currency (e.g. USD) in the form of a separate FX transaction with the Bank for premium settlement. Similarly, any proceeds (denominated in e.g. USD) received under the policy are required to be converted into the loan currency (e.g. HKD) before being used for the loan repayment. Ongoing mark-to-market monitoring will take into account the currency conversion of the policy's surrender value against the premium loan using prevailing market rate, and the borrower may be required to top-up in case of shortfall. - Loan recall risk:

Please note that the Bank reserves the right to increase, reduce or cancel the Facility or any part of it at any time by notice to the borrower. However, if it occurs an event or a series of events which in the Bank's opinion that might have a material and adverse effect on the financial condition of the borrower, the Facility may be modified, reduced or cancelled by the Bank without prior notice. - Assignment of Insurance Policy:

With Premium Financing / Policy Financing loan, the insurance policy will be assigned to the Bank via a Deed of Assignment. You have to ensure that the policy has been assigned from policyholder and beneficiary and the policy rights have been transferred to the Bank. This means that all proceeds payable under the insurance policy are to be paid to the Bank first, and any changes or amendment to the insurance policy are subject to the Bank's approval.

In case the policyholder passes away (in case of individual policyholder) or is wound up (in case of corporate policyholder), the Bank reserves the right to surrender the policy and use the surrender value to repay the outstanding loan. Please note that any early termination of the arrangement which result in early surrender of the insurance policy may result in you not achieving your desired financial goal of increasing the estate to be left to your designated beneficiaries. - Risks specific to Premium Financing

- No guarantee of Profit:

There are many factors affecting the returns generated from the insurance policy and the interest payment for the facility (including but not limiting to prevailing interest rate fluctuation, market condition, investment outlook, investment return of insurance company, cost of insurance, etc). For instance, Cost of Insurance will increase with the age of the insured. There is no historical support for deriving a long term profit from the difference between a loan rate and the return from a life insurance policy. - Conflicts of Interest:

Customers should note that potential and actual conflict of interest may arise from the different roles played by the Bank in connection to the offering of the Facility and the Insurance Product.

- No guarantee of Profit:

Disclaimer

Customers should not rely on the information on this webpage alone to make any investment and/or insurance decisions. The information on this webpage is not a contract of insurance and is for reference only. The specific details, terms and conditions applicable to all insurance plans are set out in the respective Insurance Policies to be issued by relevant insurance companies. Customers should also read other relevant documents relating to Premium and/or Policy Financing in order to fully understand the risks involved. If you have any inquiries, please seek independent professional advice prior to accepting the Facility available to you. This webpage does not constitute advice to buy or sell, or an offer with respect to any insurance products, premium and/or policy financing products.