FX Limit Order

Convert currencies automatically and easily at preset target rates

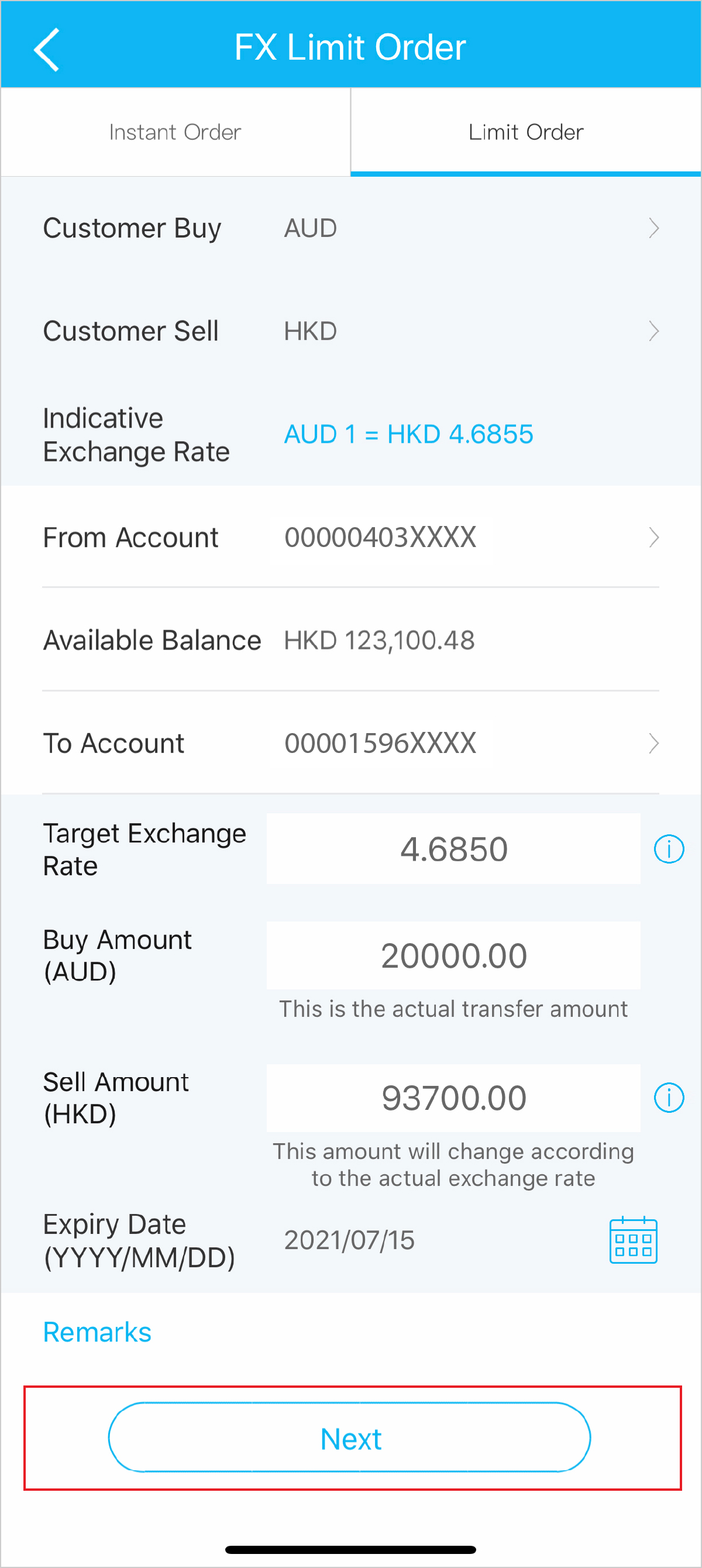

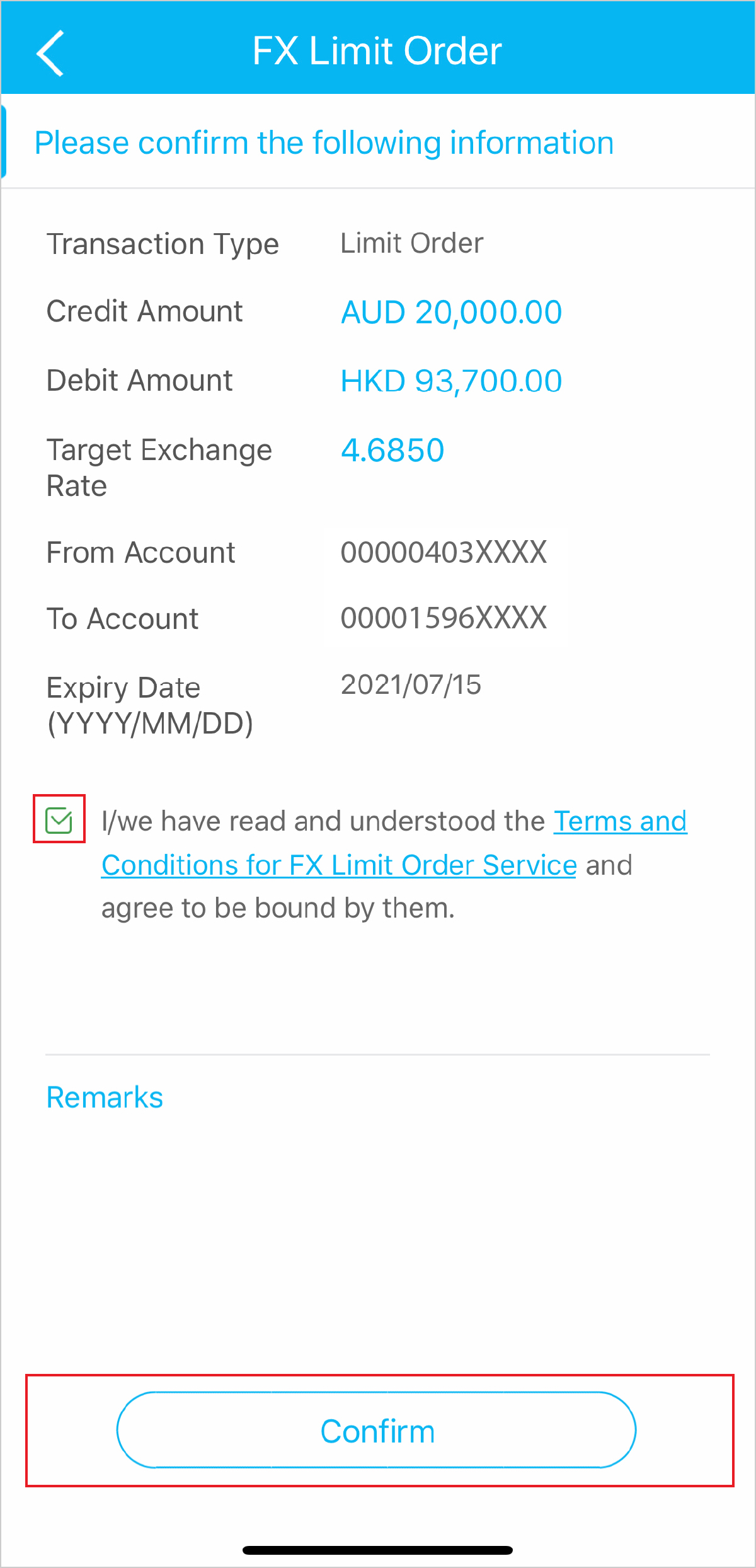

With FX Limit Order, you can preset a target exchange rate and trading amount. The currencies will be automatically converted once the target exchange rate is reached. All these handy functions enable you to keep up with the trend and invest easily.

Highlights of FX Limit Order

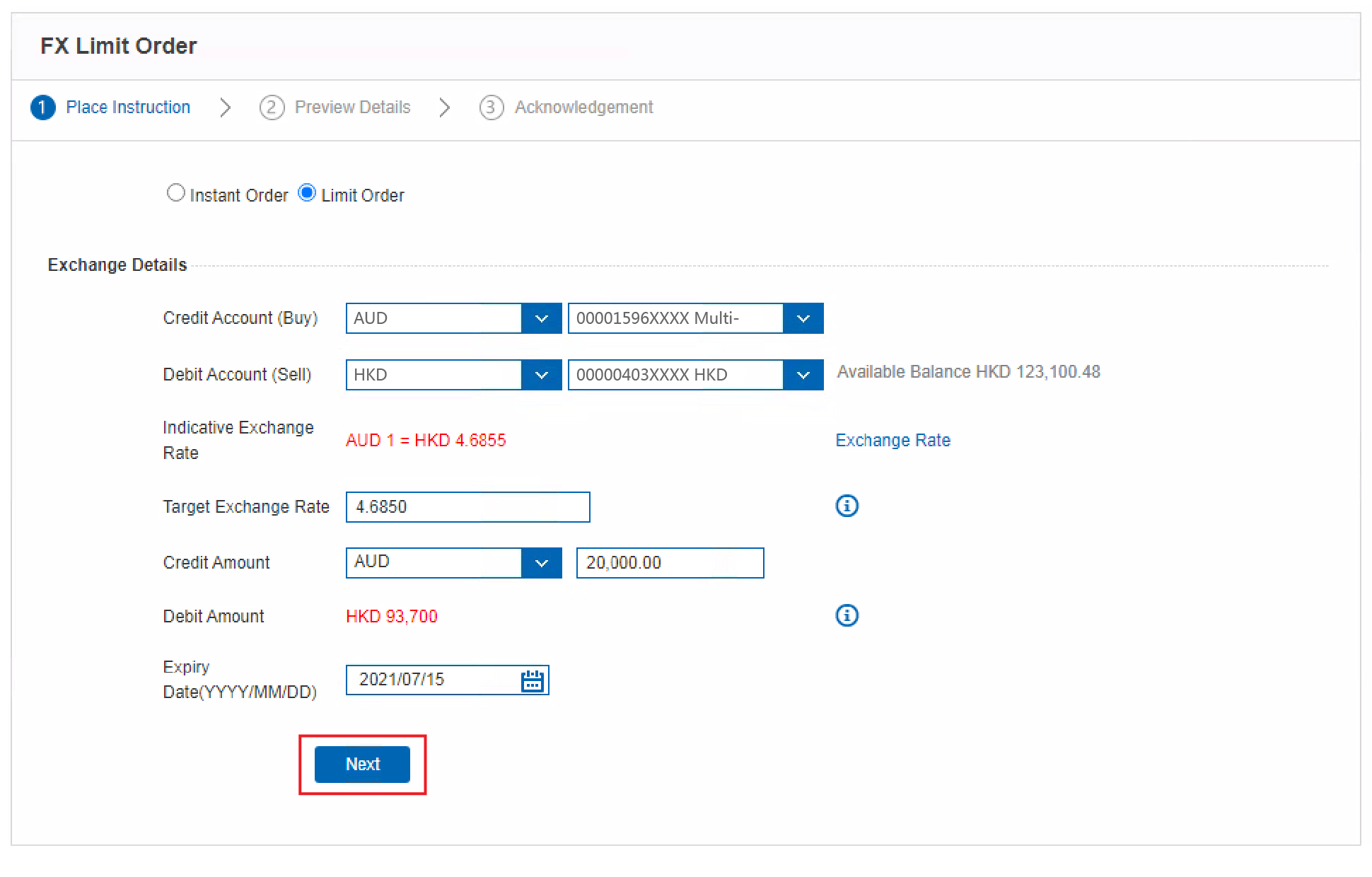

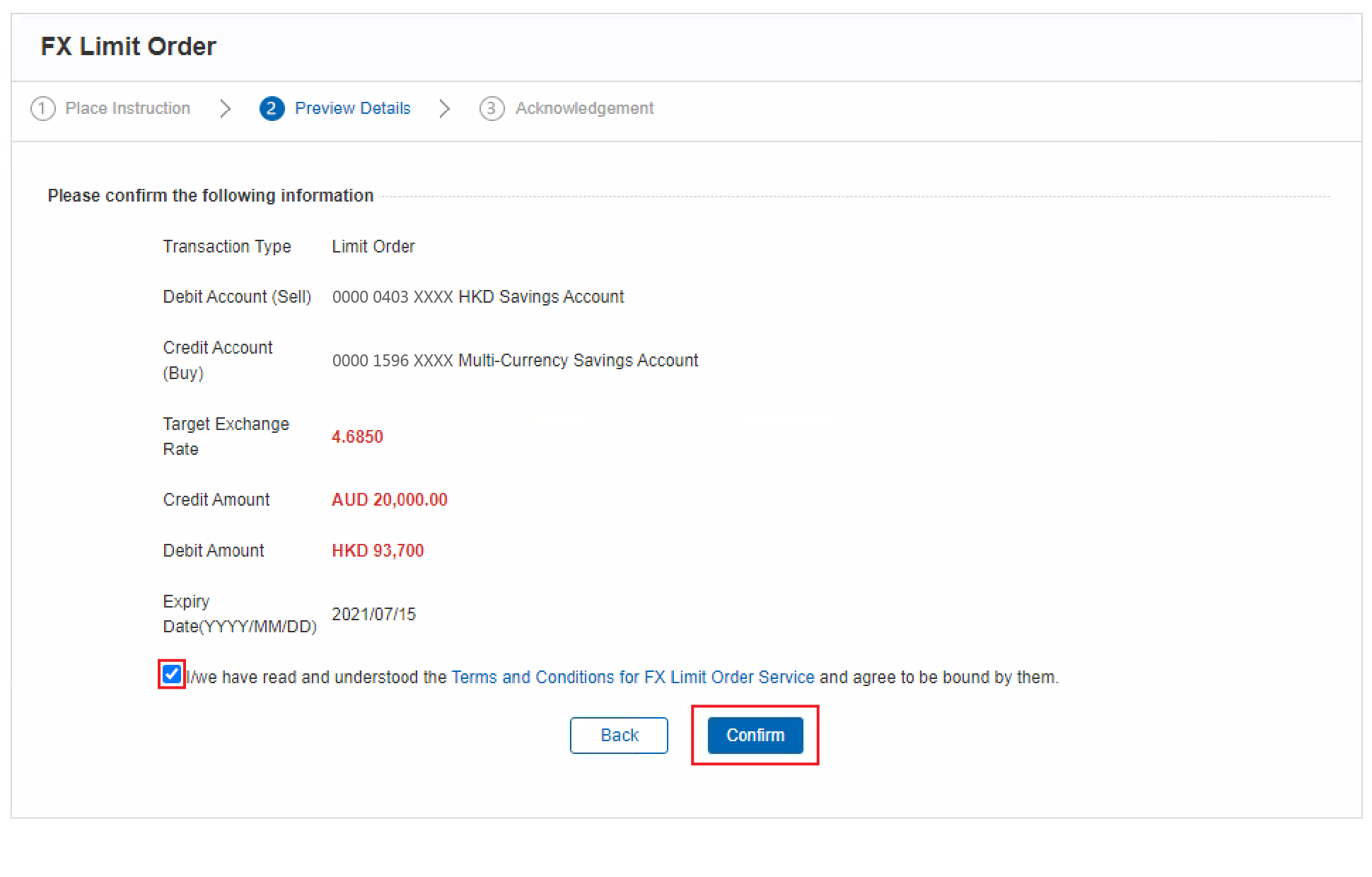

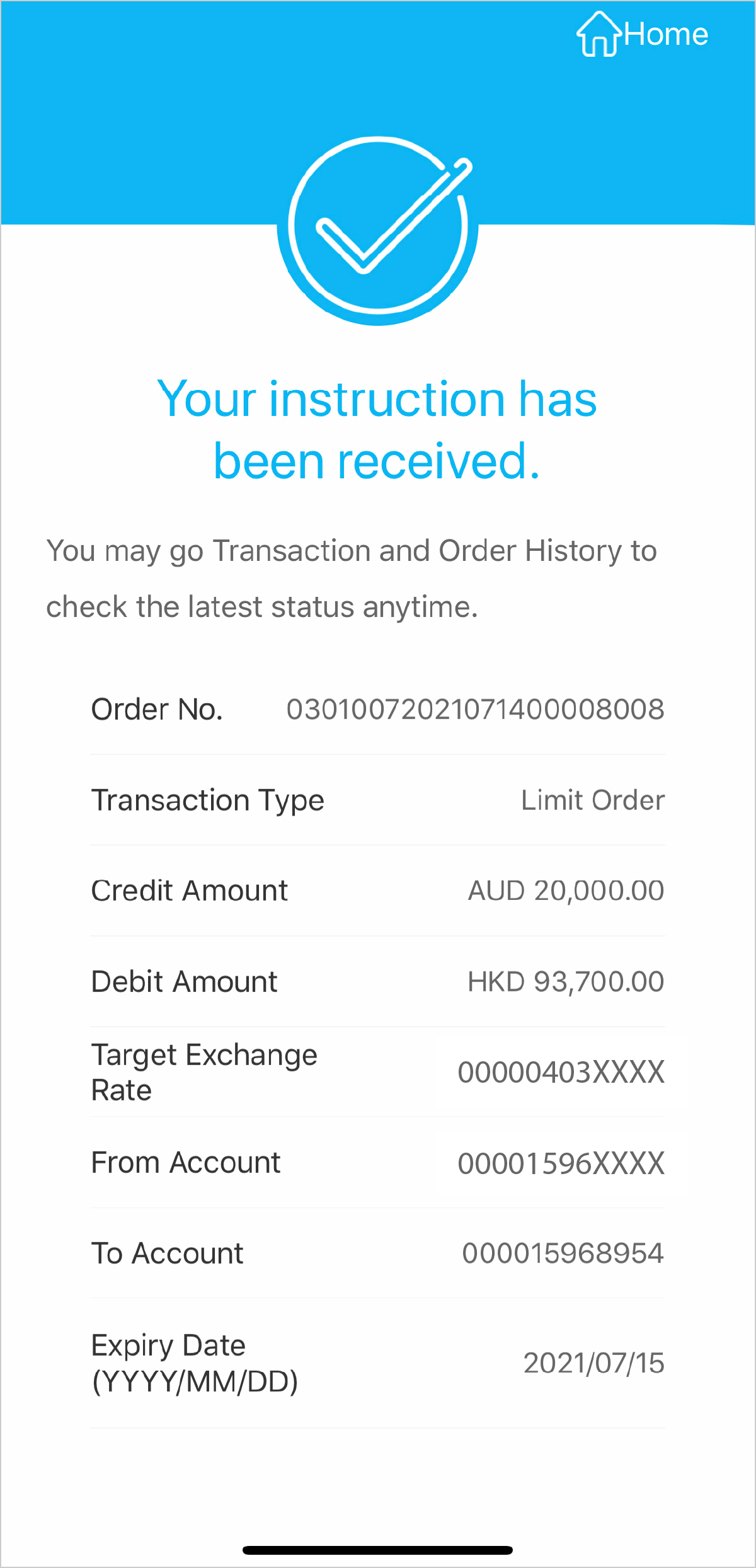

- Preset target exchange rate, trading amount and expiry date, the currencies will be automatically converted once the target rate is reached.

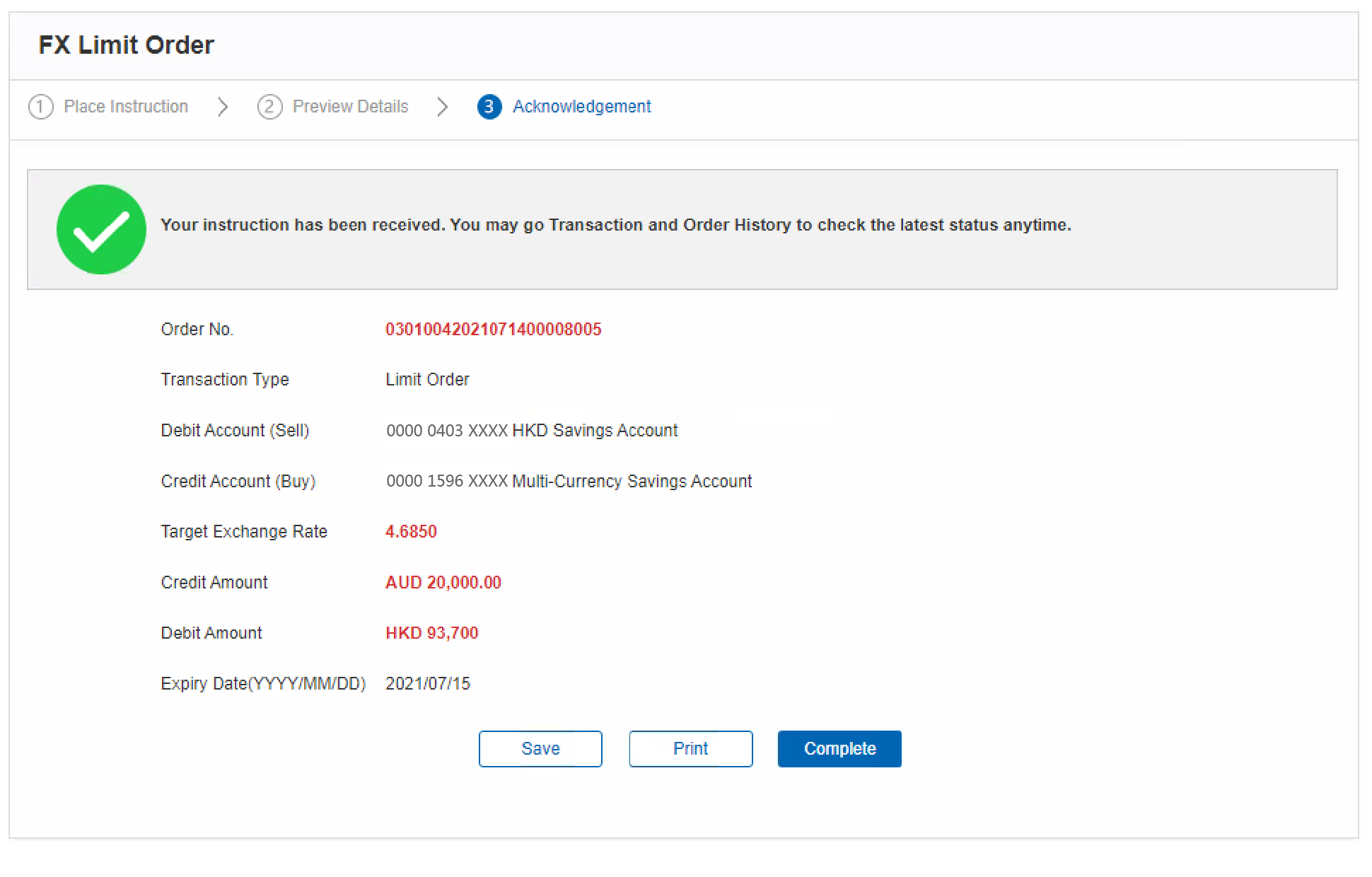

- Receive SMS notification after the instruction is successfully set, and get informed with the latest transaction status.

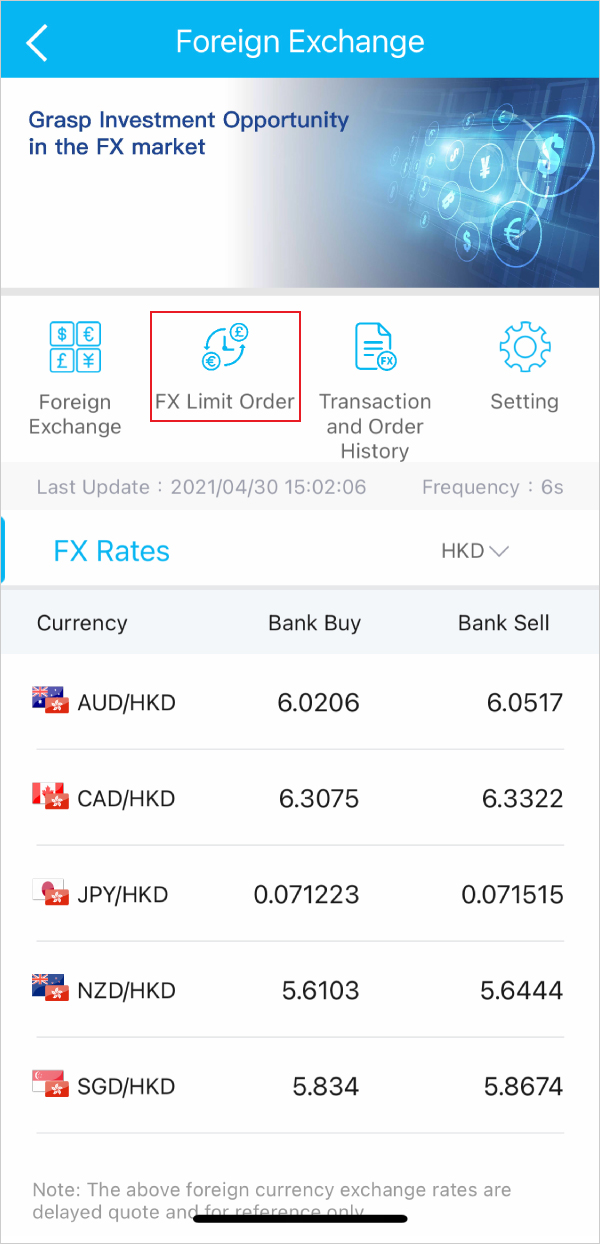

- A choice of up to 11 major currencies: HKD, RMB, USD, SGD, EUR, AUD, NZD, GBP, CAD, CHF and JPY.

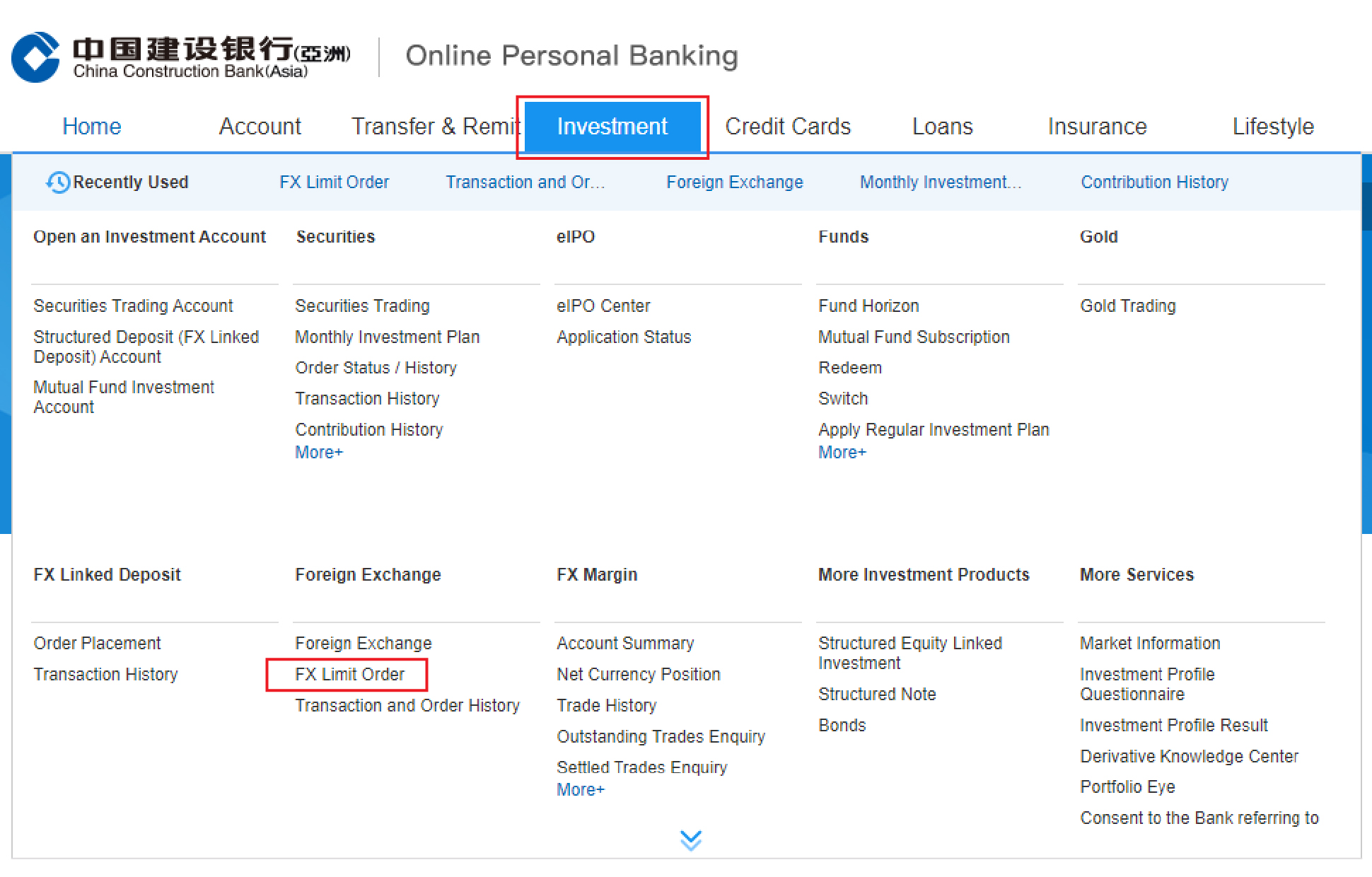

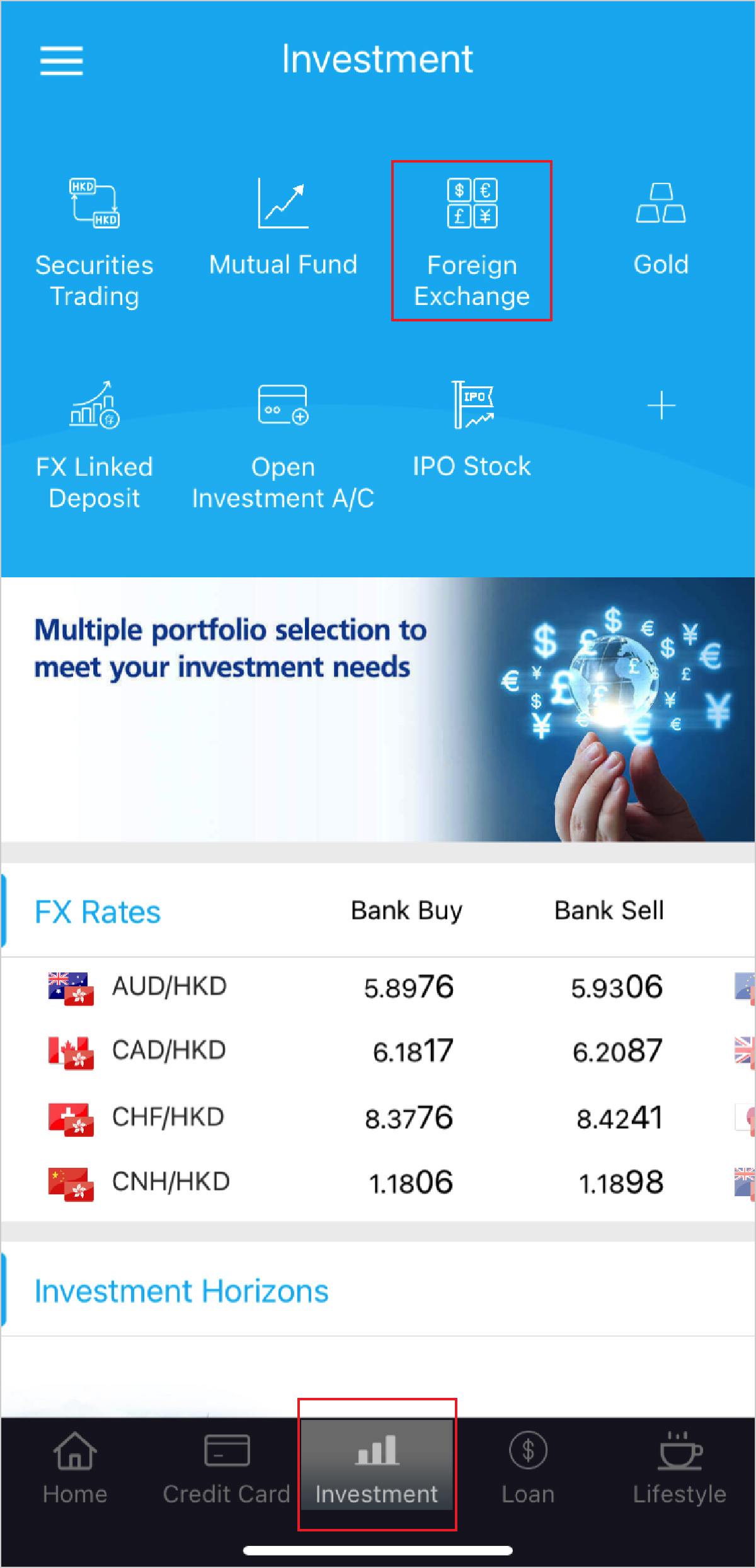

- Set up, view or cancel instructions through our Online Banking and Mobile Banking, and enjoy the benefit of one-stop management.

For more information about FX Limit Order, please click here for the FAQ.

Note:

The maximum amount per transaction via Online Banking, Mobile banking and Phone Banking involving foreign exchange is HK$5,999,999.99 or equivalent, and the service hour of FX Limit Order placement is 9:00 a.m. on Monday to 05:00 a.m. on Saturday. As for December 25 and January 1, the closing time is 5:00 a.m., and will be opened again at 9:00 a.m. on December 26 and January 2 (except Sundays and Public Holidays on Saturdays).

Risk Disclosure

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly.