Serve the needs on foreign currency |

Higher potential interest over ordinary time deposit |

Flexible Deposit Period |

A chance to buy foreign currency below the spot price |

| Strategy |

Anticipate that the price of AUD will be stable in long term, opt for a low-risk investment tool.

|

| Strategy |

Foreseeing AUD will rise gradually in medium term, capture the chance to buy in the currency below the spot price.

|

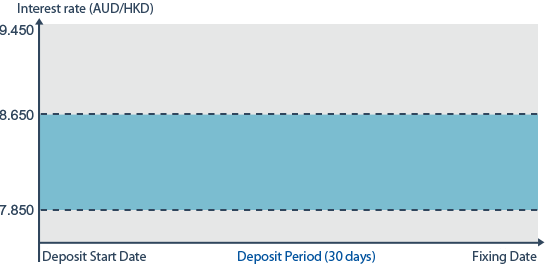

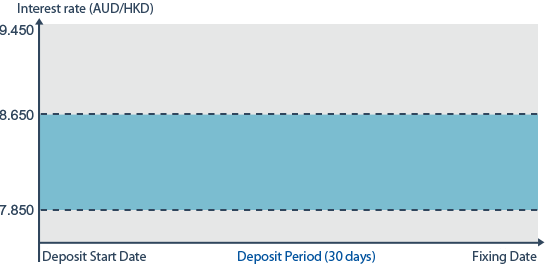

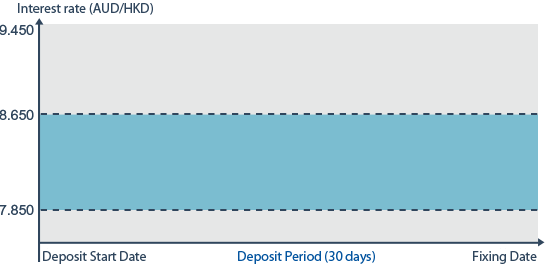

Your interest return will be depended on whether the exchange rate has fluctuated outside the range.

|

Anthony’s Outsmarting Strategy

|

|

| Deposit Currency | AUD |

| Linked Currency | HKD |

| Principal Amount | AUD 1,000,000 |

| Deposit Period | 1 month (30 days) |

| Stipulated Range (AUD/HKD) |

7.850-8.650 |

| Highest Interest Rate (per annum) | 6.25% |

| Lowest Interest Rate (per annum) | 1.5% |

foreign currencies against HKD. Official exchange

rate of AUD is the highest among G7 countries.

6.25% (which is normally around 3% for AUD time deposit)

Principal and interest received on Maturity Date:

AUD 1,000,000 + AUD 1,000,000 x 6.25% x 30/360

= AUD 1,005,208.33 (in Deposit Currency)

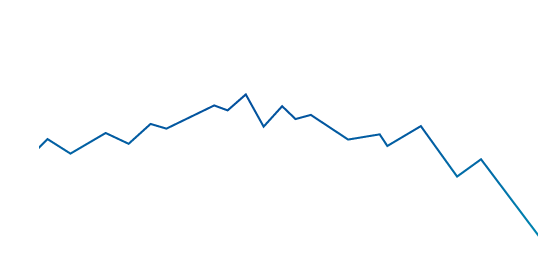

Movement of AUD/HKD exchange rate:

Within 7.850 – 8.650

to US dollars for risk aversion, which will push up

the US dollar index.

1.5% (which is normally around 3% for AUD time deposit)

Principal and interest received on Maturity Date:

AUD 1,000,000 + AUD 1,000,000 x 1.5% x 30/360

= AUD 1,001,250 (in Deposit Currency)

wild fluctuationthroughout the deposit period.

Movement of AUD/HKD exchange rate:

At or outside 7.850 – 8.650

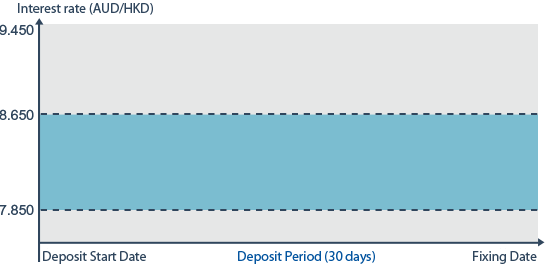

On the fixing date, this will be compared with the relevant market rate, which will determine

whether the principal and interest will be repaid in the deposit currency or the linked currency.

|

Wynne’s Outsmarting Strategy

|

|

| Deposit Currency | AUD |

| Linked Currency | HKD |

| Principal Amount | HKD300,000 |

| Deposit Period | 1 month (30 days) |

| Initial exchange rate | 8.3538 |

| High Interest Rate (per annum) | 10% p.a. |

latest retail sales volume has increased rapidly,

there is an expectation of a rebound in economic activities.

Principal and interest received on Maturity Date:

HKD 300,000 + HKD 300,000 x 10% x 30/360

= HKD 302,500 (in Deposit Currency)

strengthens / remains constant

against HKD on the Fixing Date

debt crisis. AUD/USD exchange rate remains steady.

Principal and interest received on Maturity Date:

HKD 302,500 / 8.3538 = AUD 36,211.07

(in Linked Currency)

Convert to HKD with the exchange rate on Fixing Date:

AUD 36,211.07 x 8.312 = HKD 300,986.37

weakens slightly

against HKD on the Fixing Date

leads to a pessimistic economic outlook

Principal and interest received on Maturity Date:

HKD 302,500/8.3538 = AUD 36,211.07

(in Linked Currency)

Convert to HKD with the exchange rate on Fixing Date:

AUD 36,211.07 x 6.265 = HKD 226,856.89

weakens significantly

against HKD on the Fixing Date

You can set up your brilliant investment strategy according to your needs and risk tolerance,

in order to earn a higher potential interest return, and open the door to a prosperous future.

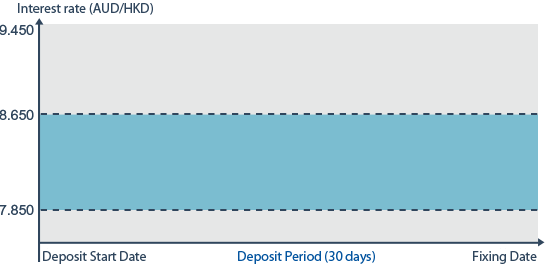

| Deposit Currency | |

| Linked Currency | |

| Principal Amount | USD |

| Tenor | |

| Ceiling Rate | |

| Floor Rate | |

| Interest Rate (trade within ceiling rate and floor rate) |

%p.a. |

| Interest Rate (trade at or outside ceiling rate and floor rate) |

%p.a. |

| Calculate | |

* Please use numbers only, do not use commas or any symbols.

* The above exchange rate, interest rate and return/loss are for reference only. The actual investment environment and circumstances may be different.

Redemption amount upon maturity: USD USD 1,004,166.67

Redemption amount upon maturity: USD 1,000,166.67

| Deposit Currency | |

| Selected Currency Pair | |

| Principal Amount | USD |

| Initial Exchange Rate | |

| Tenor | |

| Interest Rate | %p.a. |

| Calculate | |

* Please use numbers only, do not use commas or any symbols.

* The above exchange rate, interest rate and return/loss are for reference only. The actual investment environment and circumstances may be different.

Currency Pair Fixing FX Rate: USD JPY FIXED AT79.80

Redemption amount upon maturity: USD 100,233.33

Currency Pair Fixing FX Rate: USD JPY FIXED AT81.10

Redemption amount upon maturity: JPY 8,068,783

Risk Disclosure

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Before making any investment decisions, customers are encouraged to consult their own independent financial advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products.

The return on FX Linked Deposit is limited to the nominal interest payable, which will be dependent, to at least some extent, on movements in some specified currency exchange rates. Whilst the possible return may be higher than conventional time deposits, it is normally associated with higher risks. When the fluctuation of the currency exchange rates differs from what the customer expects, the customer may have to bear the consequential losses. The relative losses may reduce the return and the principal amount of the FX Linked Deposit which the customer may get back. Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effects of normal market forces may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and prices linked to such rates, may rise or fall rapidly.

Disclaimer

This webpage does not constitute advice to buy or sell, or an offer with respect to any investment products. Any offer, invitation or recommendation to any customers to enter into any investment transaction does not constitute any prediction of likely future movements in prices of any investment products. This webpage is issued by China Construction Bank (Asia) Corporation Limited, and has not been reviewed by the Securities and Futures Commission or any other regulatory authorities in Hong Kong.