New Customer Exclusive Offer: Open account via e-Account Service to Enjoy Amazing Rewards!

Up to 6.68% p.a. Preferential HKD Time Deposit Interest Rate or up to HK$1,000 Welcome Rewards

Complete Simple Tasks to Enjoy Below Offers

Deposit HKD $50,000 or above to enjoy:

| Tenor | Preferential HKD Time Deposit Interest Rate (p.a.) |

| 1-month | 6.68% |

| 3-month | 4.08% |

- The first HKD $50,000 (fixed amount) of the deposit will be entitled to one of the preferential time deposit interest rates (p.a.) above.

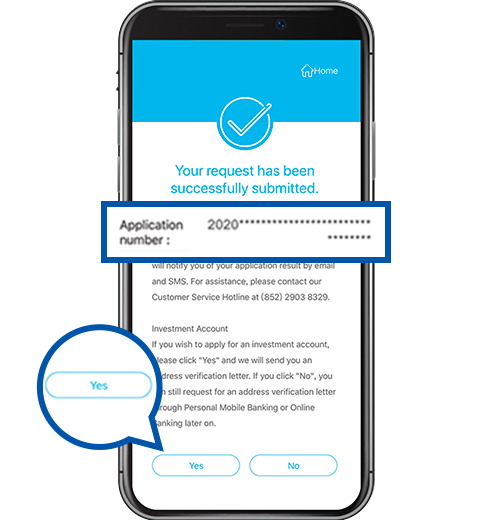

- Within 2 business days after completing all required tasks, the bank will automatically execute the placement of the corresponding time deposit based on your chosen tenor.

Maintain the Daily Average Deposit Balance HKD $10,000 equivalent or above in Savings Account for the first 2 calendar months subsequent to the Account Opening Date and activation to enjoy HKD $200 Cash Reward

- The abovementioned Daily Average Deposit Balance must be maintained in the HKD Statement Savings Account and/or Multi-Currency Savings Account.

- The Offer of the Program is limited to a quota of 4,000 and is offered on a first-come-first-served basis while quota lasts.

Notes: Offers are bound by terms and conditions. Please refer to "Terms and Conditions of eye Credit Card Welcome Gifts for New Cardmembers" for details.

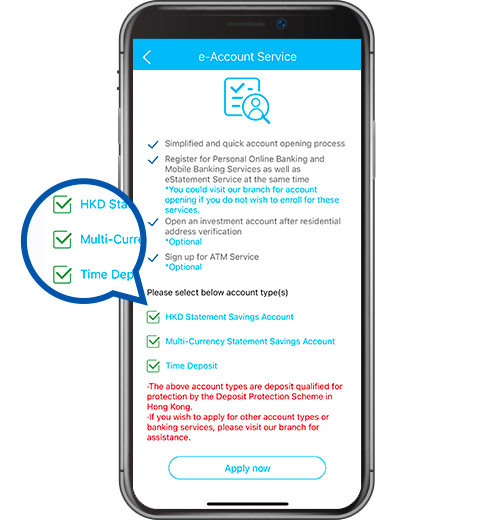

unlock offers!

June 1 to June 30, 2025

June 1 to June 30, 2025

June 1 to July 15, 2025

Deposit HKD $50,000 or above into the designated account via channels such as "FPS" (Faster Payment System) or ATMs in order to place a time deposit

From Deposit Account Activation Date to July 31, 2025

Maintain a Daily Average Deposit Balance of HK$10,000 equivalent or above in your HKD Statement Savings Account and/or Multi-Currency Statement Savings Account for the first 2 calendar months following account opening and activation.

Enquiry Hotline: (852) 2903 8308

To borrow or not to borrow? Borrow only if you can repay!

Don't be tempted by quick money. Don't lend your bank account to anyone to launder money.

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investment products are not equivalent to or alternative of time deposits. They are not protected deposits, and are not protected by the Deposit Protection Scheme in Hong Kong. Some investment products may involve derivatives. Certain investment products may not be available in all jurisdictions and/or may be subject to restrictions. The investment decision is yours, but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should not invest based on this promotion material alone. Before making any investment decision, customers should consult their own independent professional financial, tax or legal advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products. The information is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

Disclaimer

This promotion material is intended to be distributed in the Hong Kong Special Administrative Region (“Hong Kong”) for reference only, and shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any investment product in or outside Hong Kong. The promotion materials are issued by China Construction Bank (Asia) Corporation Limited which is a licensed bank regulated by the Hong Kong Monetary Authority, an approved insurance agent under the Insurance Ordinance (Chapter 41, Laws of Hong Kong) and a Registered Institution (CE No. AAC155) under the Securities and Futures Ordinance to carry on Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) Regulated Activities. This promotion material has not been reviewed by any regulatory authorities in Hong Kong.

p.a. Preferential HKD Time Deposit Interest Rate

p.a. Preferential HKD Time Deposit Interest Rate

Welcome Rewards

Welcome Rewards