FX Linked Deposit - Principal Protected Deposit

Enjoy Higher Potential Interest Return With 100% Principal Protection

! Please read the Important Notes for FX Linked Deposit - Principal Protected Deposit.

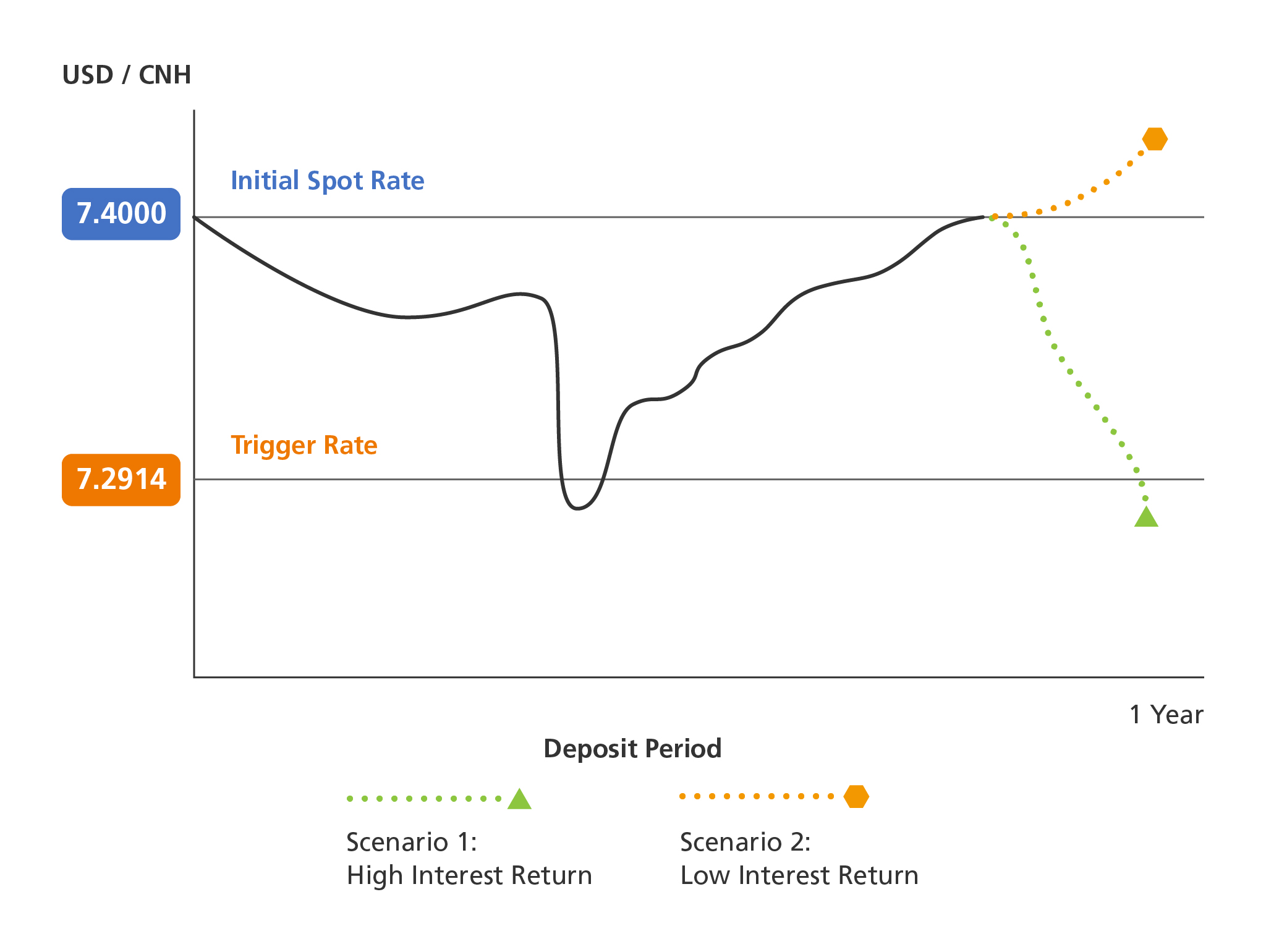

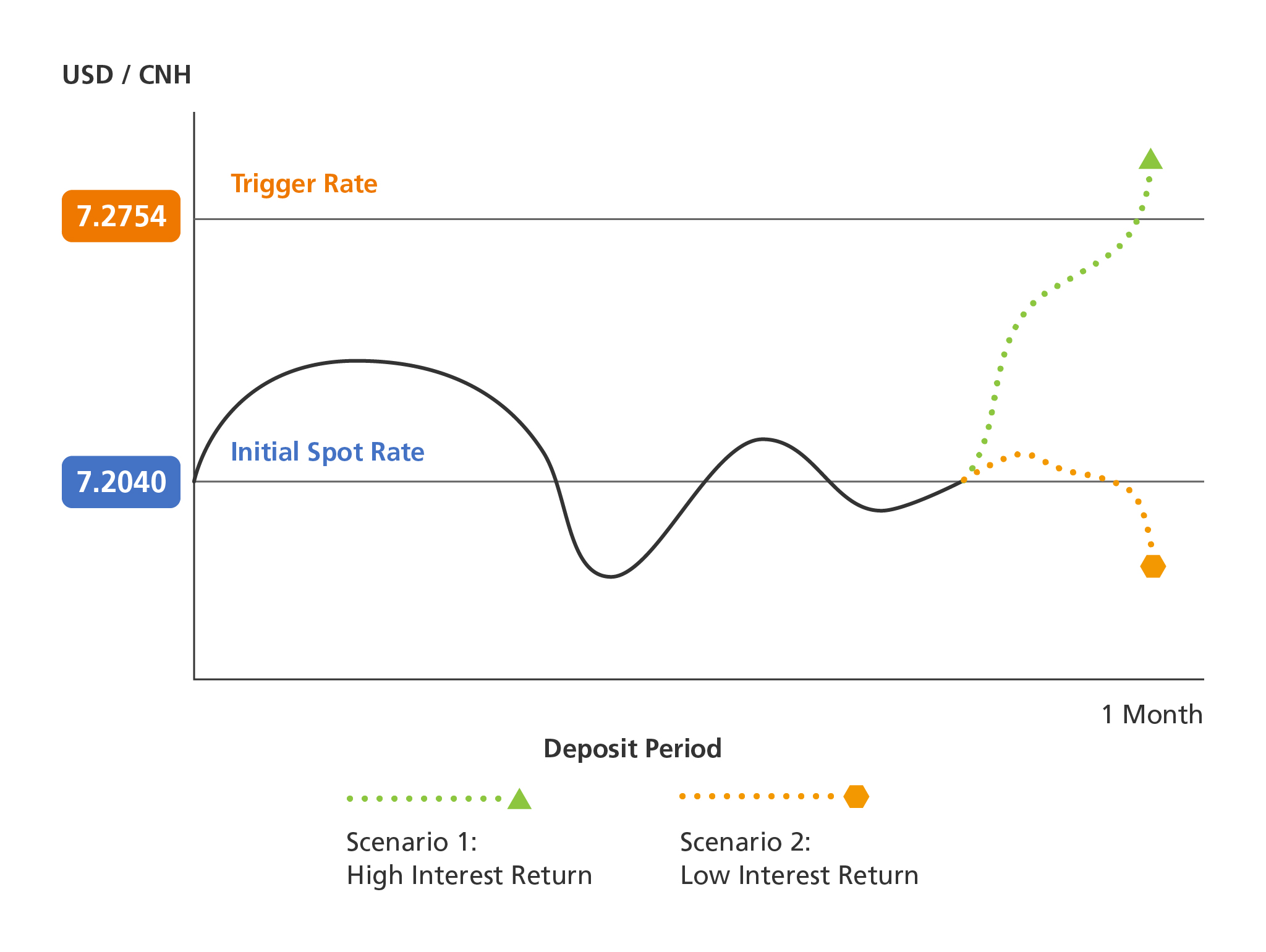

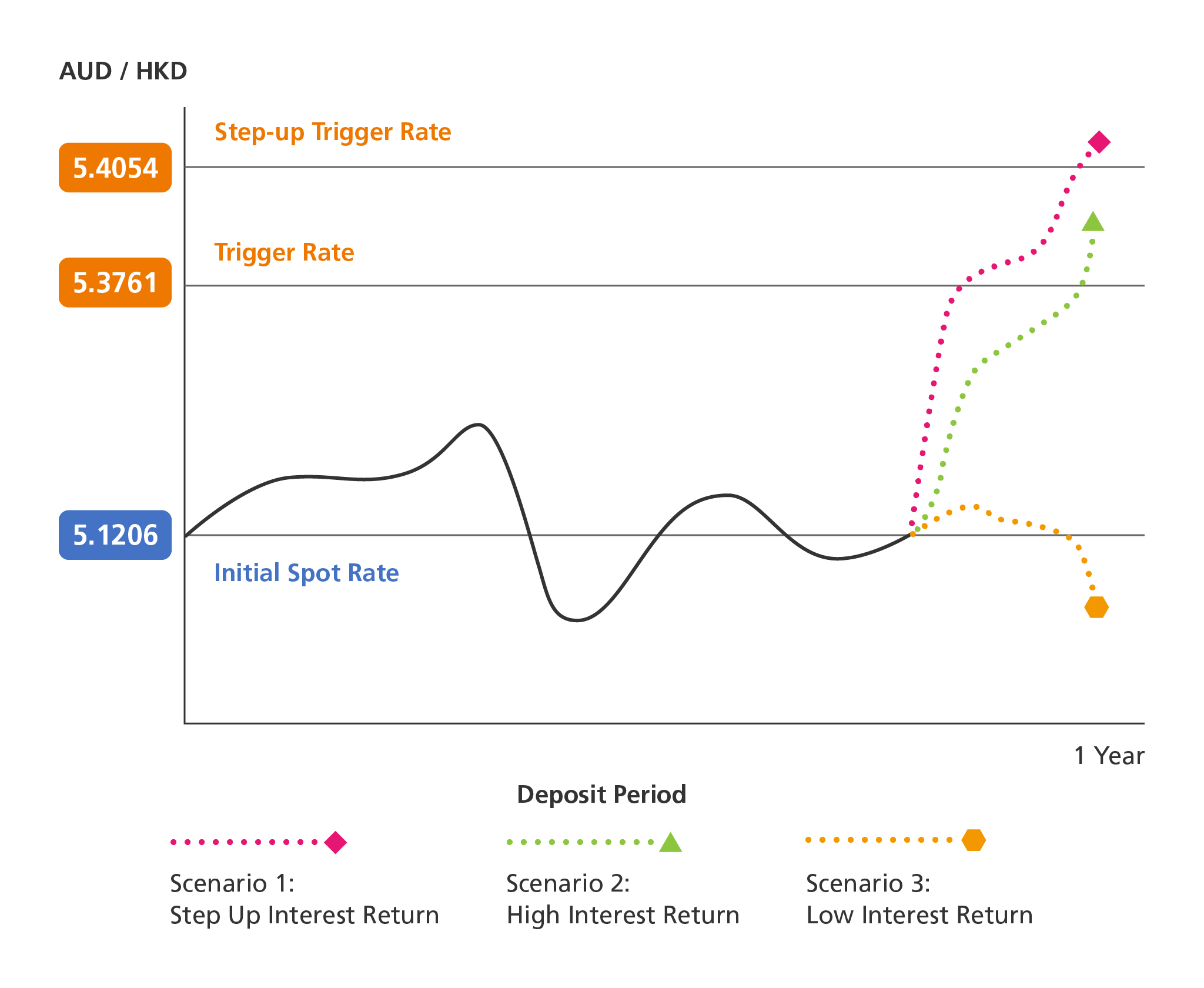

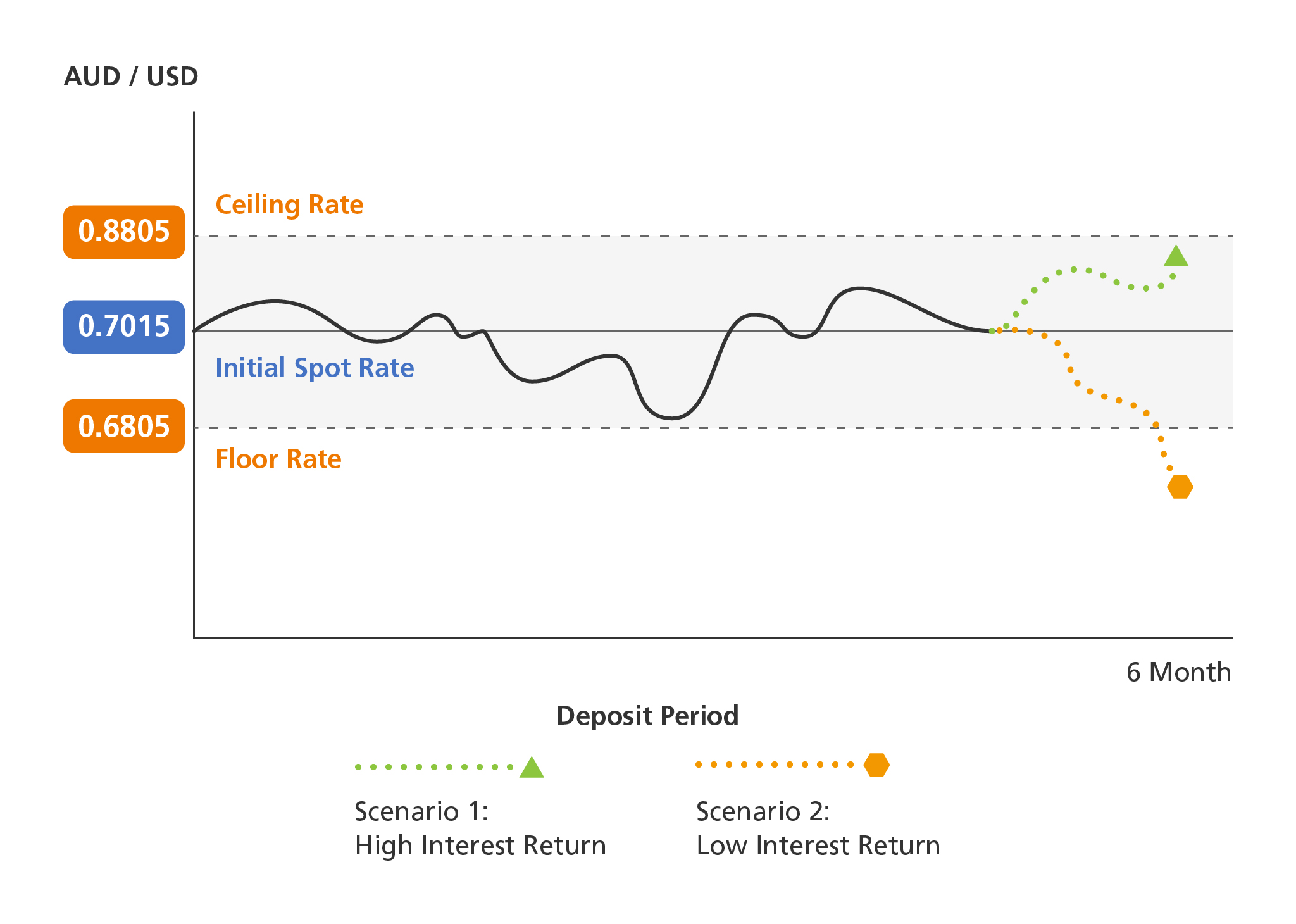

AUD / HKD moves along with expectation

(Trades at or above 5.2017)

100% Principal

HK$100,000

Interest Return in

High Interest Rate (3.95% p.a.) Approximately HK$1,028

AUD / HKD does not move along with expectation

(Trades below 5.2017)

100% Principal

HK$100,000

Interest Return in

Low Interest Rate (3.85% p.a.) Approximately HK$1,002

(Video in Chinese Only)

Enquiry Hotline: 2903 8343

Remarks:

- The principal protection rate for Swap Deposit will depend on whether Currency Event Designation by the bank has occurred during the deposit period. Currency Event refers to the occurrence of any event or existence of any condition (including but not limited to the imposition of exchange controls or monetary measures by a government, with little or no warning) such that the convertibility or transferability of the Deposit Currency and the Linked Currency becomes impossible, illegal or impracticable.

- Low interest return could be zero for certain Principal Protected Deposit. Please refer to the relevant Term Sheet for details.

- 10 currencies include USD, CNH, HKD, AUD, CAD, CHF, EUR, GBP, JPY and NZD.

- Principal Protected Deposit is available for subscription from 10:00 am – 4:15 pm on every business day in Hong Kong (subject to the Bank’s discretion, market disruption events, etc. And the product will not be available during the period of severe weather.)

- You need to have the latest version of Adobe Reader to view the file. The software can be downloaded from http://www.adobe.com. If you wish to obtain a printed copy, please visit our branches or contact your Relationship Managers.

Risk Disclosure of FX Linked Deposit - Principal Protected Deposit (“PPD”)

- Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investment products are not equivalent to or alternative of time deposits. They are not protected deposits and are not protected by the Deposit Protection Scheme in Hong Kong. Some investment products may involve derivatives. Certain investment products may not be available in all jurisdictions and/or may be subject to restrictions. The investment decision is yours, but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should not invest based on this promotion material alone. Before making any investment decision, customers should consult their own independent professional financial, tax or legal advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products. The information is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

- FX Linked Deposit - Principal Protected Deposit is a structured product involving derivatives. It is not equivalent to or an alternative of time deposit. It is not a protected deposit, and is not protected by the Deposit Protection Scheme in Hong Kong. This product is an unlisted investment product and is not protected by the Investor Compensation Fund. This product is principal protected conditionally and is subject to the credit risk of the Bank. Investing in FX Linked Deposit – Principal Protected Deposit is not the same as directly buying the relevant currencies. Its return is limited to the interest payable, which will be dependent on movements in some linked exchange rate. The principal amount and the interest will be paid in the Deposit Currency. Besides, whether or not you will receive the high interest, if the Deposit Currency is not in your home currency, you may suffer a loss due to the currency risk originated by the Deposit Currency’s exchange rate fluctuations, which may offset or even exceed any potential gain. FX Linked Deposit is designed to be held till maturity, customer does not have the right to early terminate this product. There is no secondary market for the FX Linked Deposit - Principal Protected Deposit and it is not collateralized. You should also pay attention to the relevant market risk and the risk of early termination by the Bank upon occurrence of certain events.

- (Only applicable to Swap Deposit) If Currency Event Designation by the Bank (i.e. occurrence of any event or existence of any condition, such as the imposition of exchange controls or monetary measures, such that the convertibility or transferability of the Deposit Currency and the Linked Currency becomes impossible, illegal or impracticable) occurs, the Bank has the right to early terminate the Swap Deposit and will pay the Mandatory Redemption Amount in the Deposit Currency (instead of the Repayment Amount) only to the customer on the Mandatory Redemption Date. The Mandatory Redemption Amount may be substantially less than the Principal Amount and in the worst case, is zero.

- RMB currency risk - RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.

- Credit and insolvency risk of the Bank - The Bank is acting as the principal of this investment product. This product is not collateralized. When you invest in this product, you will be relying on the Bank’s creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your principal amount.

- Deposits cannot generally be cancelled or withdrawn prior to the agreed maturity date without the consent of the Bank unless the terms of a Deposit expressly provide for it. If the Bank does consent to an early withdrawal, it will be a condition of such consent that the amount of any cost or loss suffered by the Bank by reason of early withdrawal is deducted from the Deposit. Such costs and losses may include the cost of unwinding a hedging position taken by the Bank to cover the Deposit, and may result in a lower rate of return than might be expected, or even a negative rate of return.

- PPD is a structured product involving derivatives and you should exercise caution in relation to this product. The investment decision is yours but you should not invest in PPD unless the intermediary who sells it to you has explained to you that PPD is suitable for you having regard to your financial situation, investment experience and investment objectives.

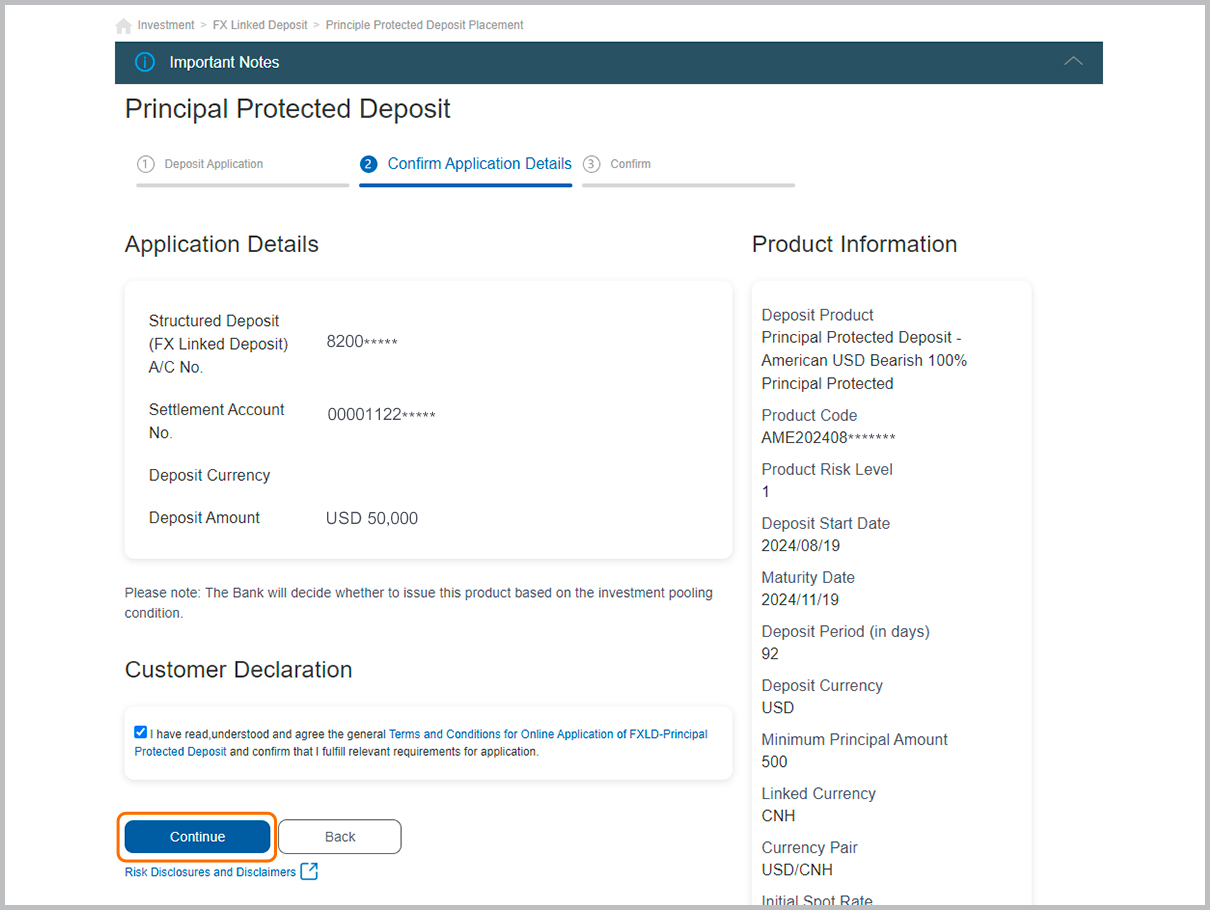

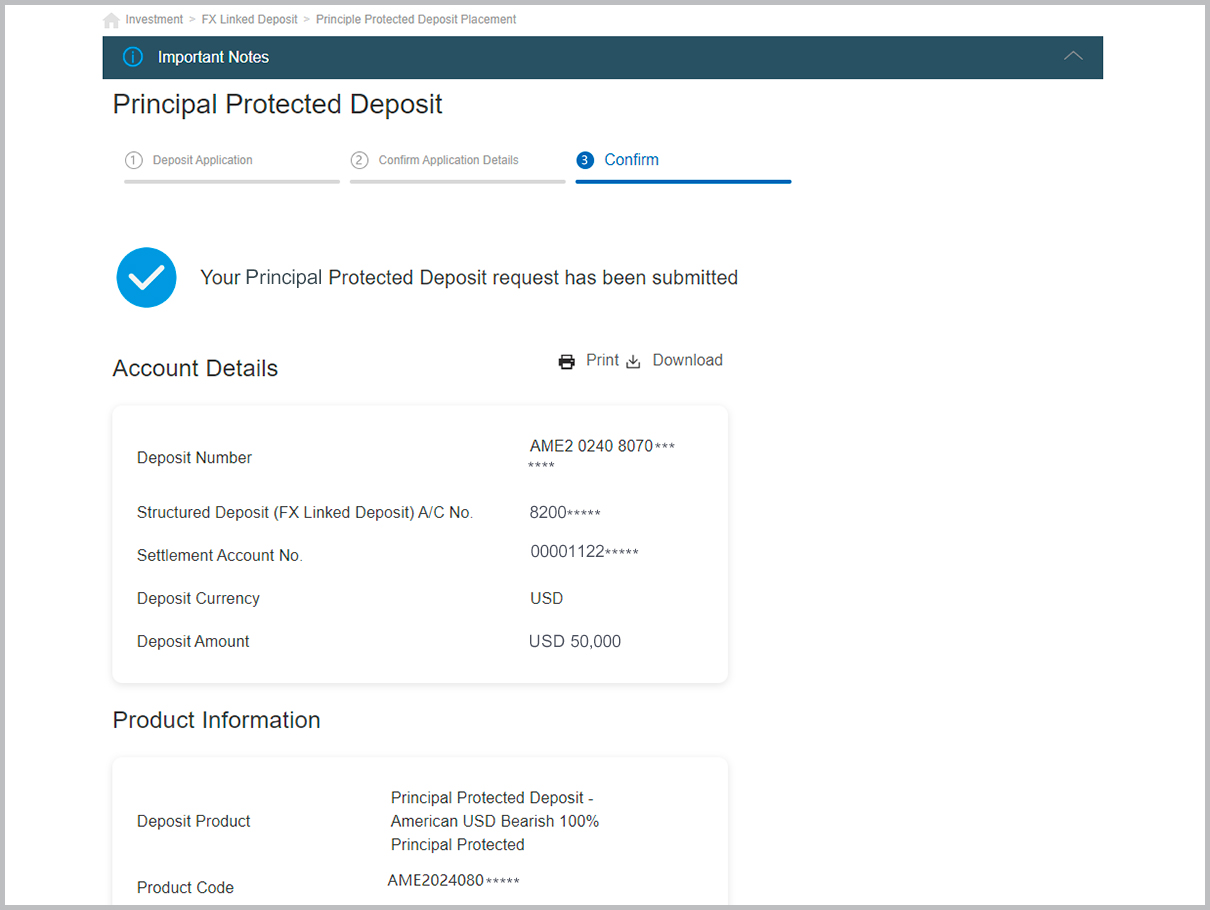

- The Bank will decide whether to issue PPD based on the investment pooling condition.

Disclaimer

This webpage does not constitute advice to buy or sell, or an offer with respect to any investment products. This webpage and the Principal Protected Deposit abovementioned are issued by China Construction Bank (Asia) Corporation Limited, which is a licensed bank regulated by the Hong Kong Monetary Authority. This web page has not been reviewed by any regulatory authorities in Hong Kong and investors are advised to exercise caution in relation to the offer.

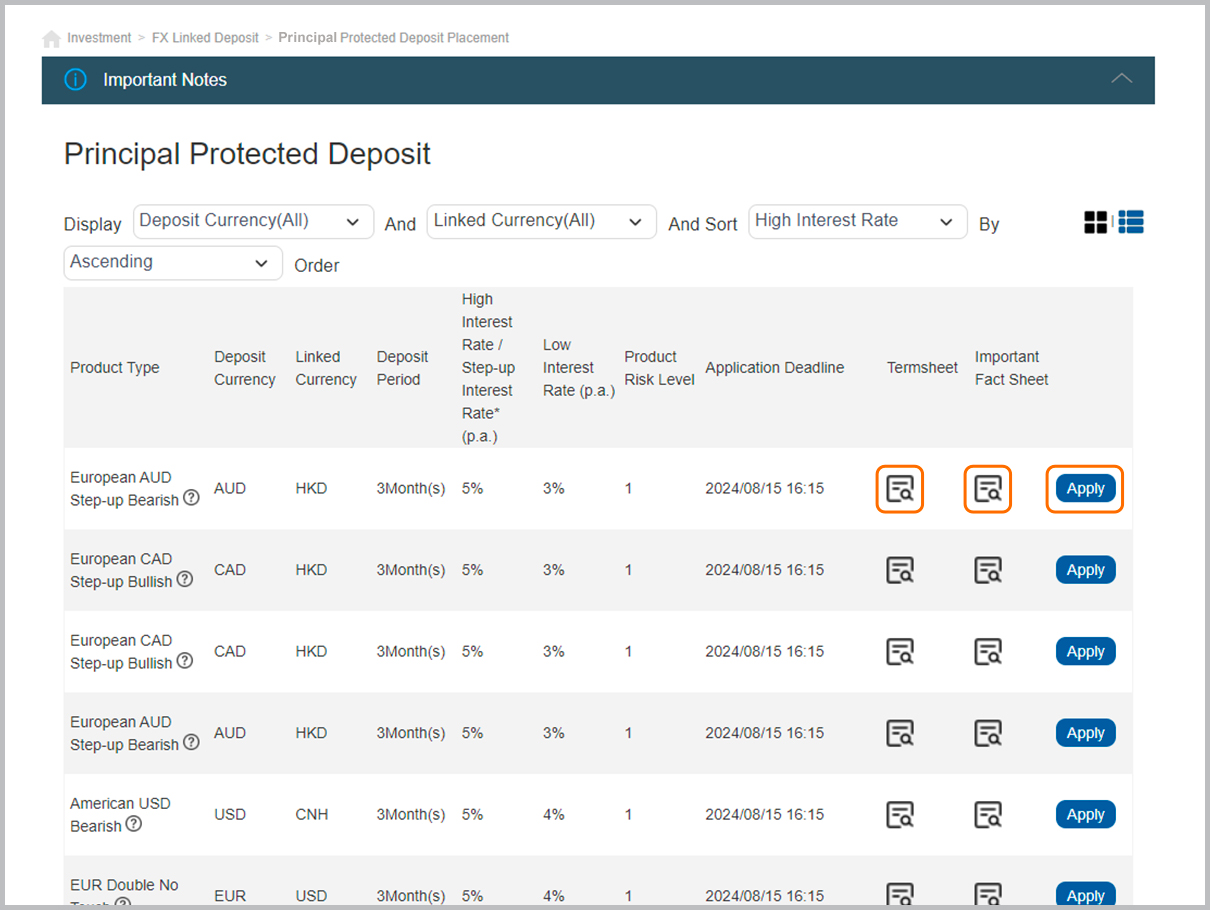

Click here to view the latest Principal Protected Deposit available for subscription

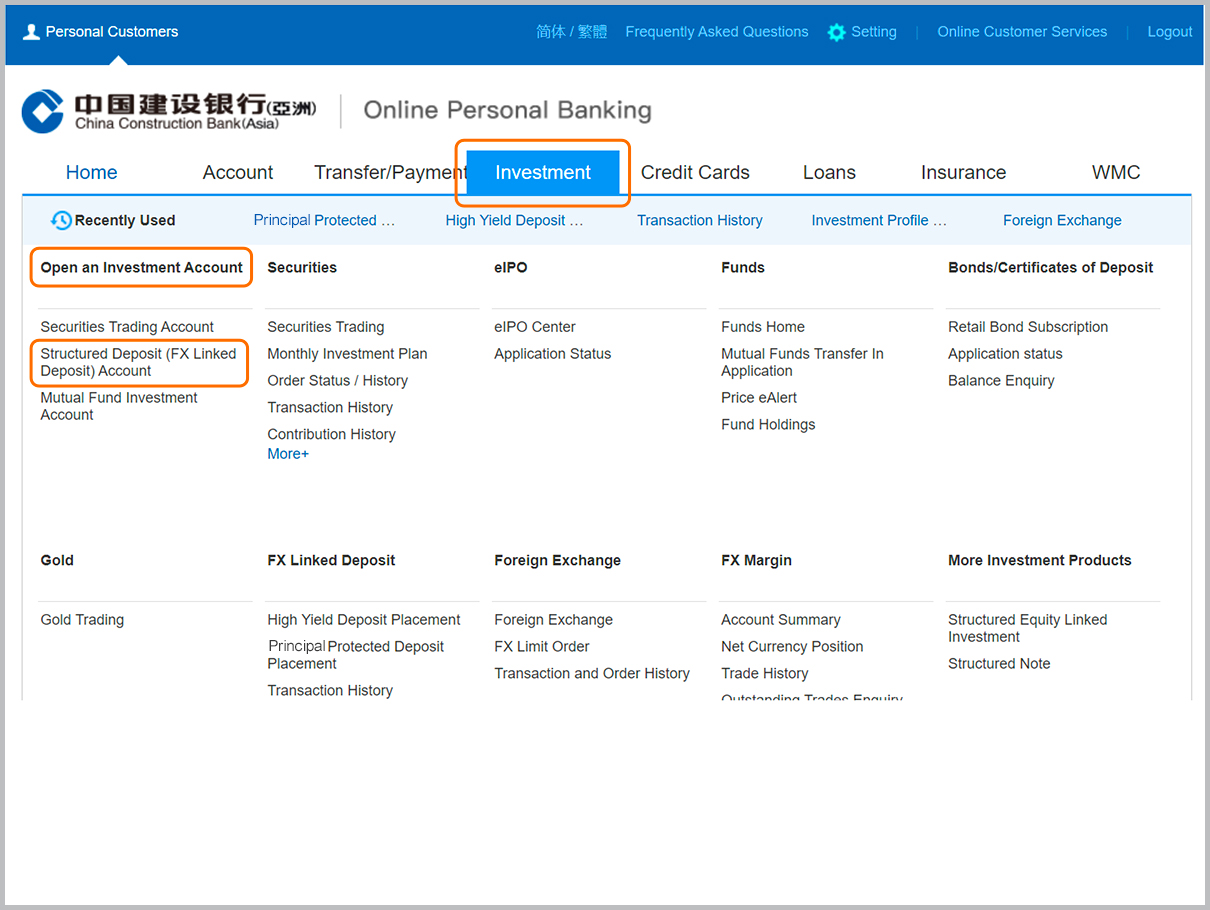

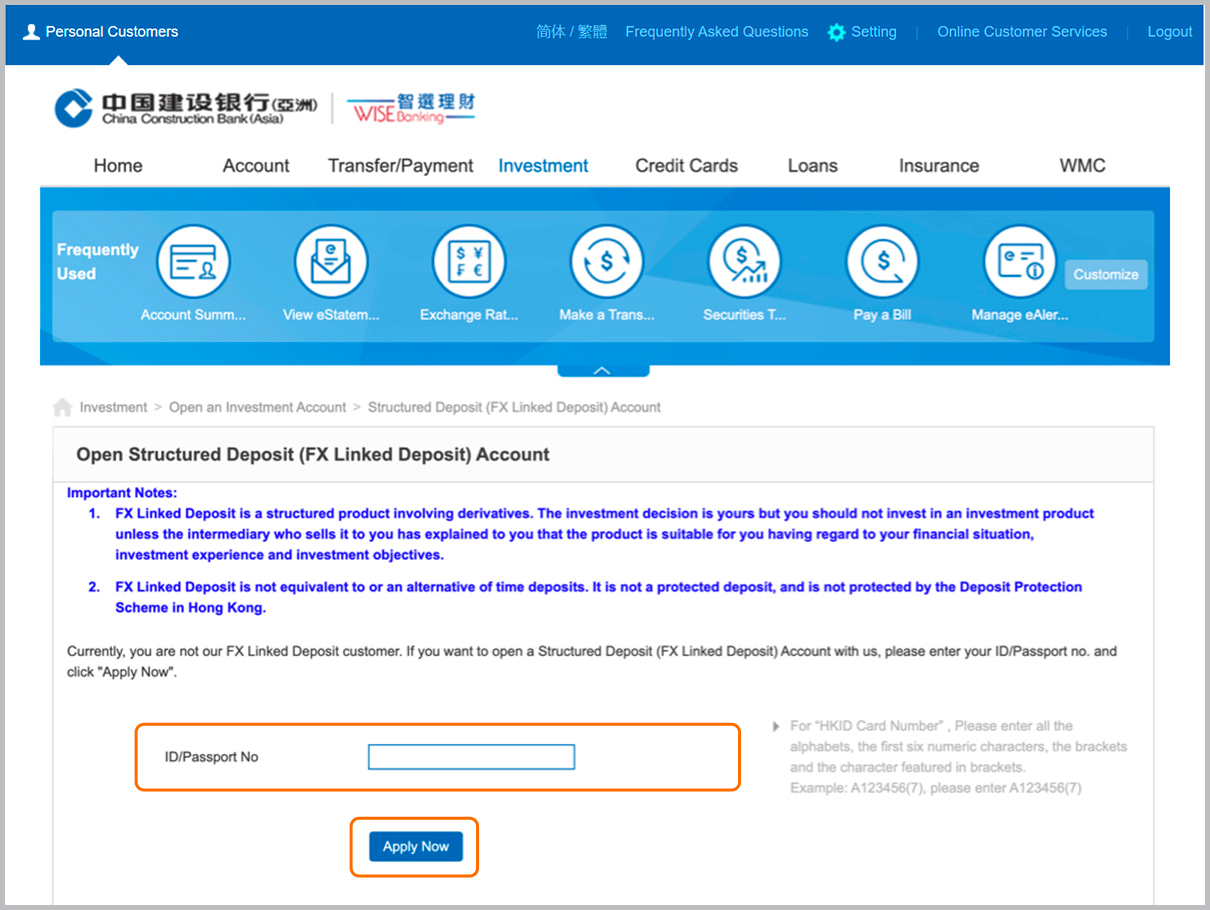

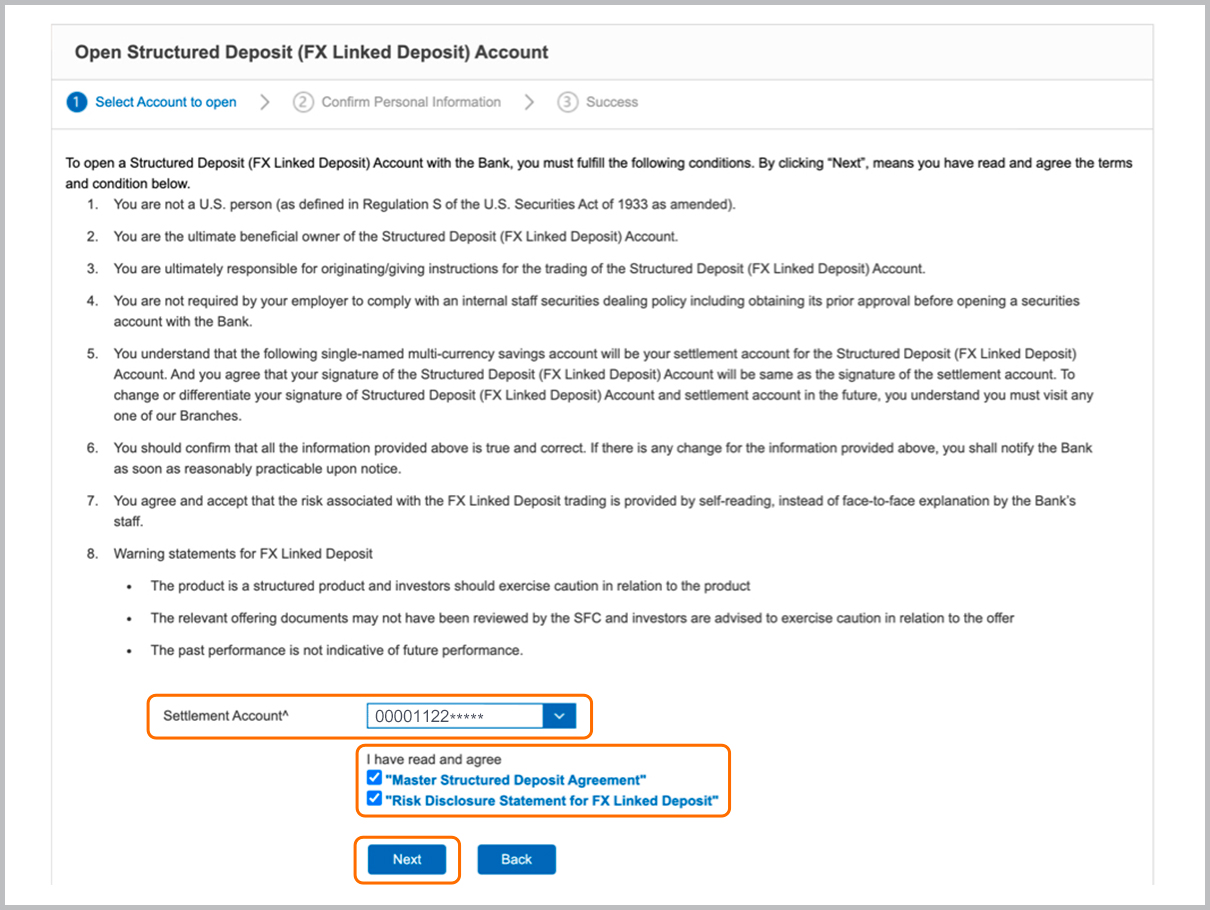

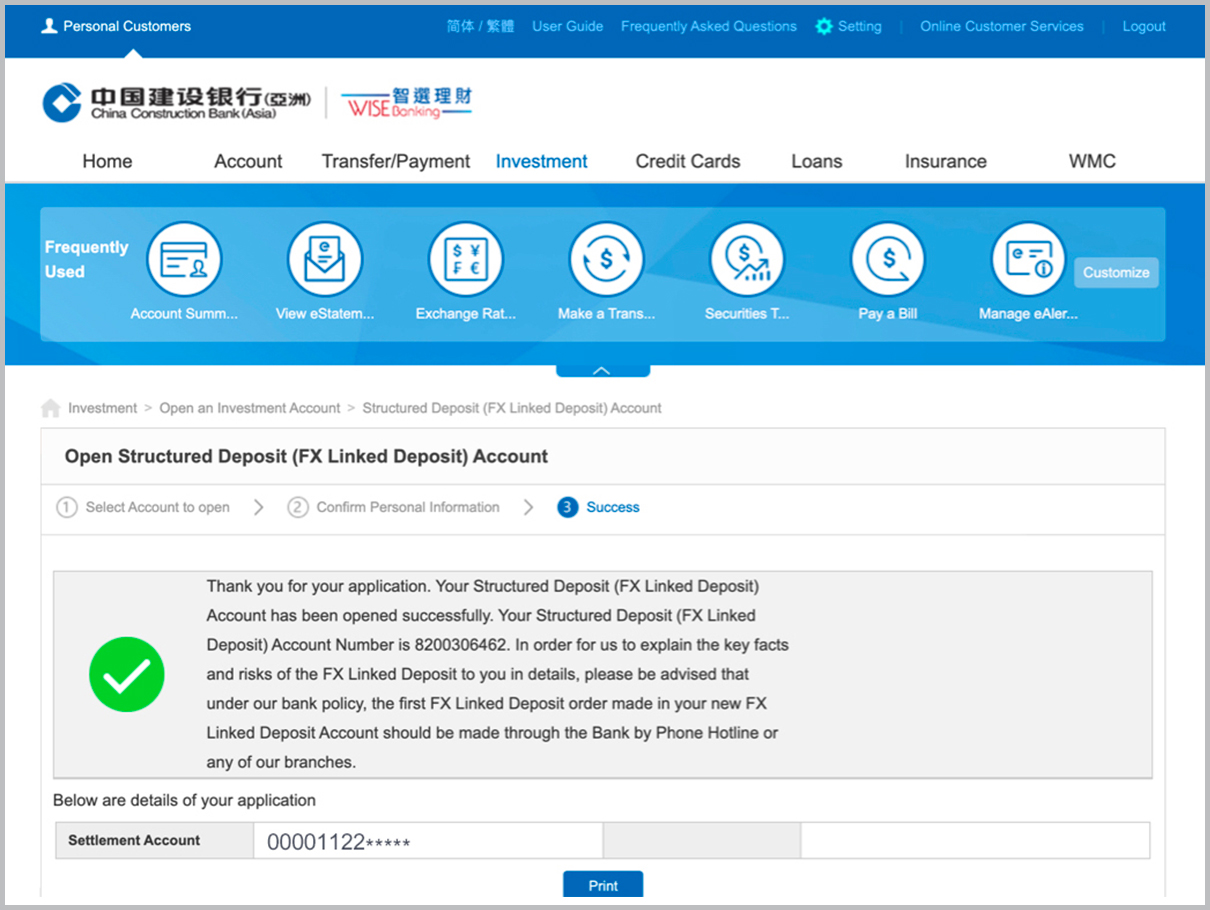

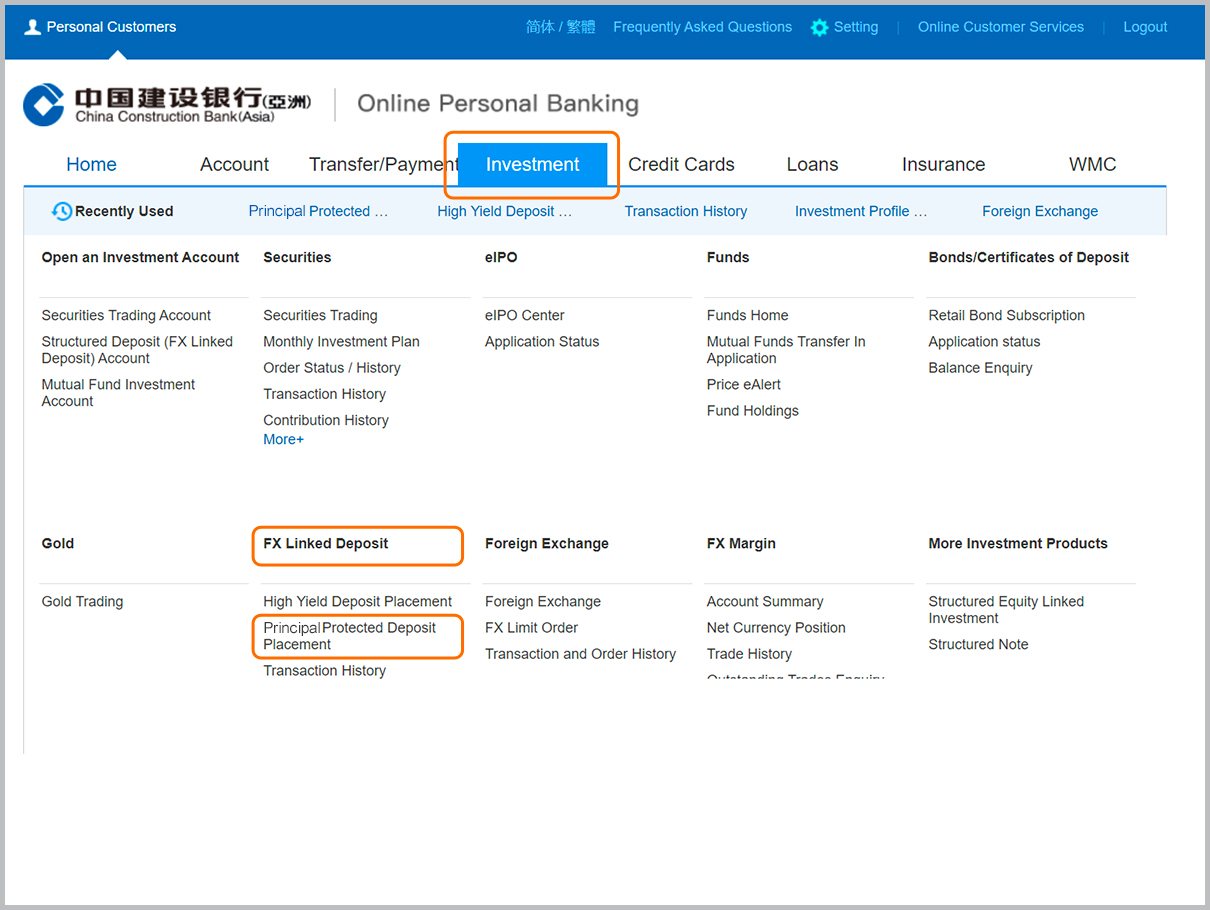

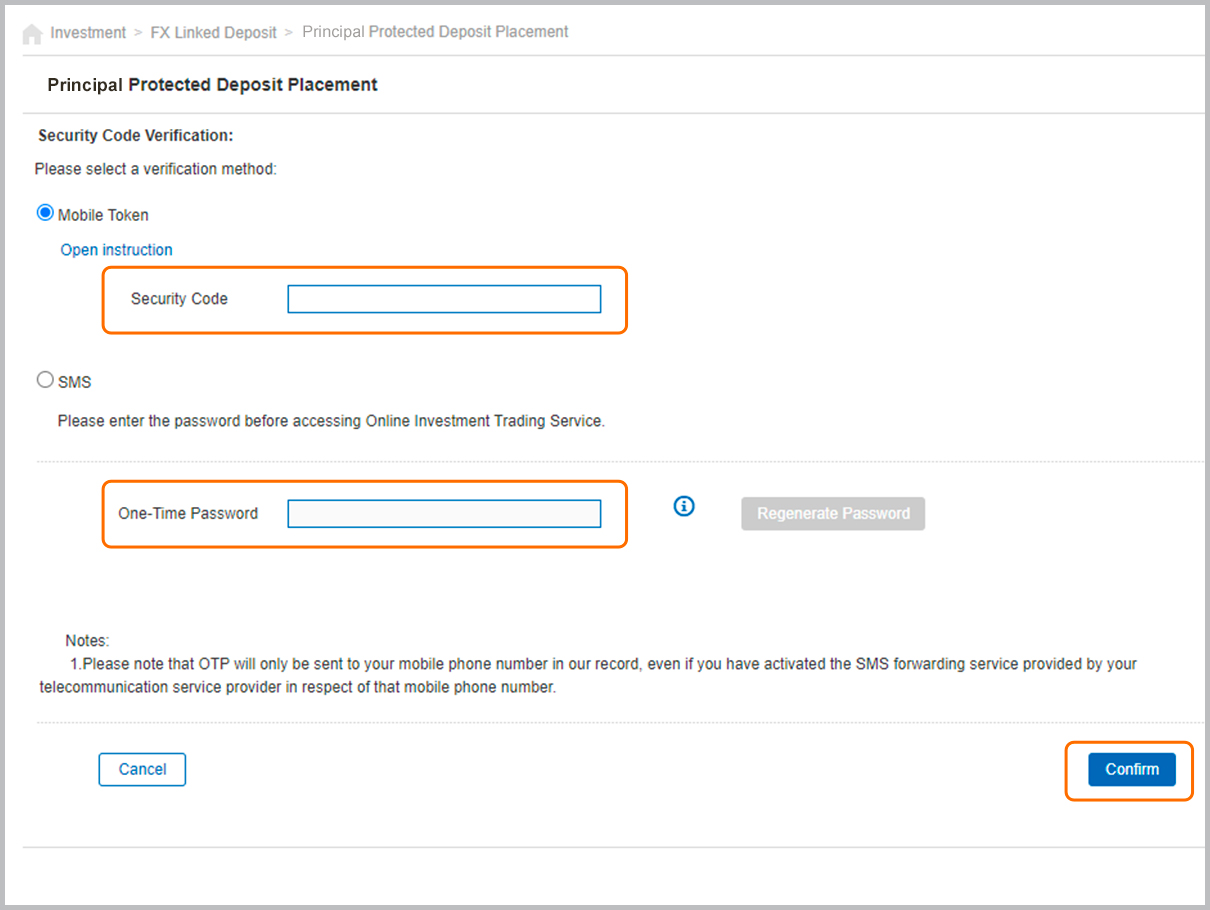

Click here to view the latest Principal Protected Deposit available for subscription  Online Banking

Online Banking Mobile Banking

Mobile Banking Visit Our Branches

Visit Our Branches Online Reservation for FX Linked Deposit Account Opening

Online Reservation for FX Linked Deposit Account Opening