Personal Loan for Employees of China’s State-Owned Enterprises

Satisfy your financial needs

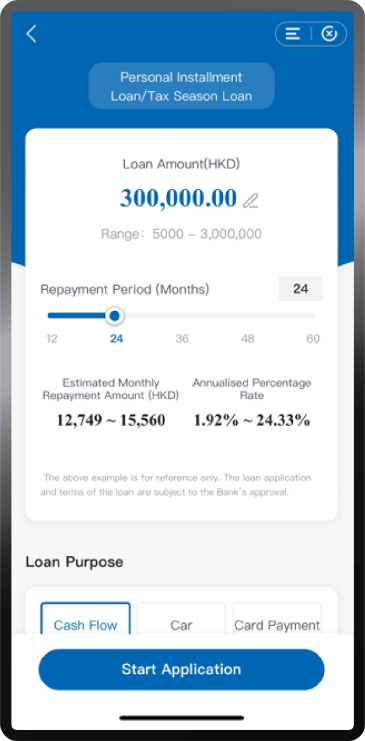

Submit application before 3pm and our Personal Loan Services Manager

| Drawdown Loan Offer | ||

| Repayment Period | ||

| 12 Months | 24 Months or above | |

| Drawdown Loan Amount (HK$) | Cash Rebate (HK$) | |

| 100,001 – 600,000 | 0.5% of drawdown amount (to the nearest dollar) Example: 200,000 X 0.5% = 1,000 |

1% of drawdown amount (to the nearest dollar) Example: 200,000 X 1% = 2,000 |

| 600,001 – 1,000,000 | 3,000 | 6,000 |

| 1,000,001 – 2,000,000 | 4,000 | 8,000 |

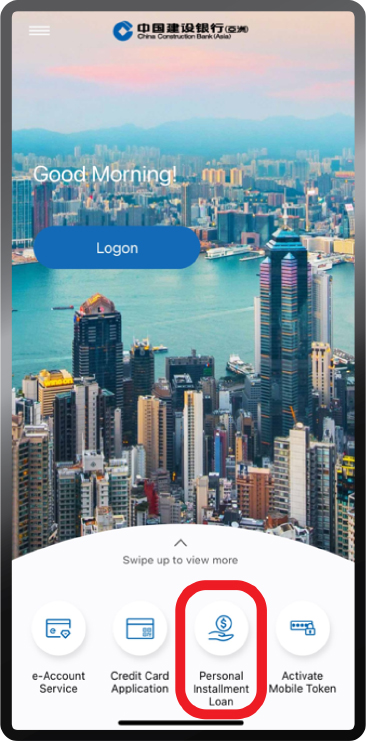

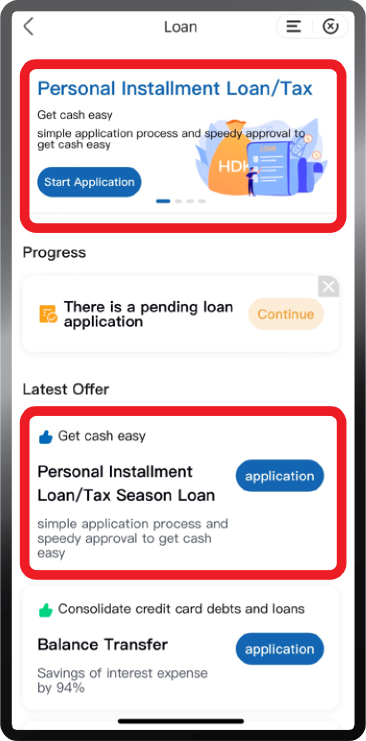

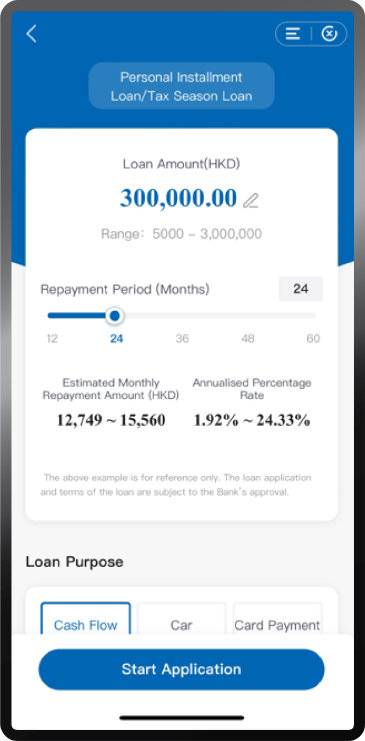

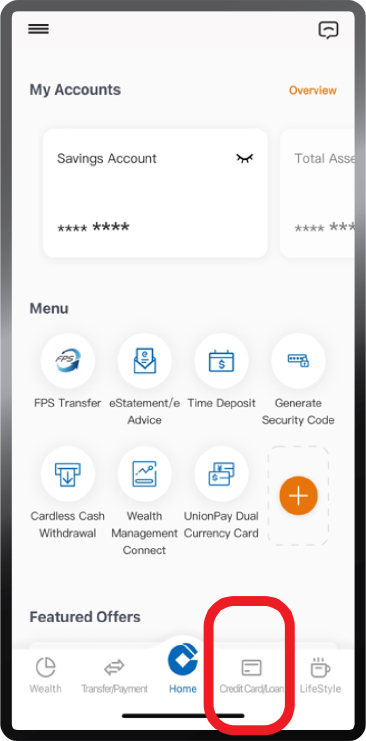

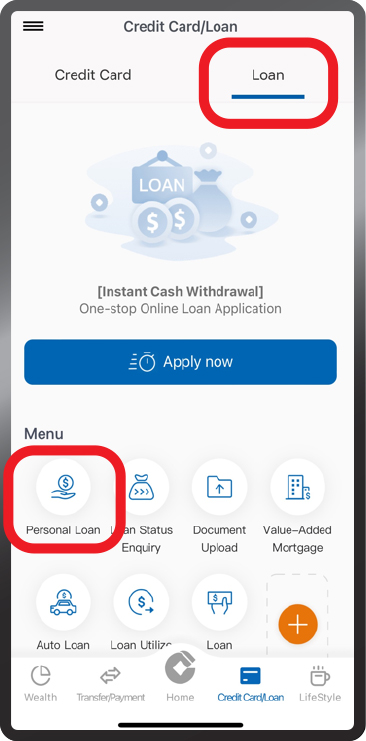

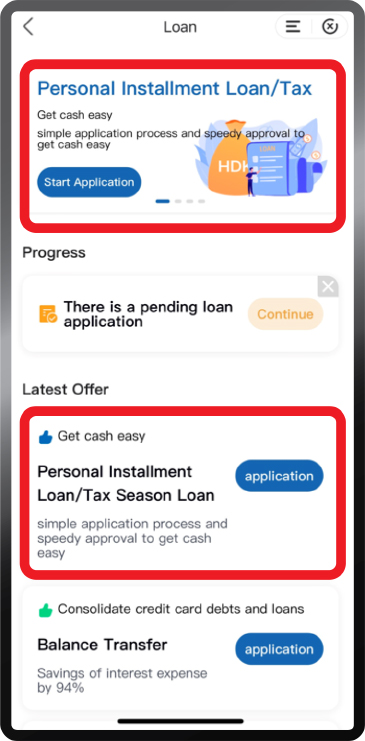

Application Method

| Repayment Period (Months) | Drawdown Loan Amount (HK$) | |||||||||||

| 5,000 – 100,000 | 100,001 – 300,000 | 300,001 – 600,000 | 600,001 - 1,000,000 | 1,000,001 – 2,000,000 | ||||||||

| Monthly Flat Rate | APR | Monthly Flat Rate | APR (with Cash Rebate) |

Monthly Flat Rate | APR (with Cash Rebate) |

Monthly Flat Rate | APR (with Cash Rebate) |

Monthly Flat Rate | APR (with Cash Rebate) |

|||

| 6 | 0.27% | 5.75% | 0.27% | 5.68% |

0.26% | 5.47% | 0.25% | 5.25% | 0.24% | 5.03% | ||

| 12 | 6.48% | 6.11% (5.12%) |

5.87% (4.89%) |

5.64% (4.66%) |

5.41% (4.53%) |

|||||||

| 24 | 6.35% | 6.28% (5.25%) |

6.05% (5.02%) |

5.81% (4.79%) |

5.57% (4.76%) |

|||||||

| 36 | 6.58% | 6.30% (5.60%) |

6.07% (5.37%) |

5.83% (5.13%) |

5.60% (5.04%) |

|||||||

| 48 | 6.43% | 6.29% (5.76%) |

6.06% (5.52%) |

5.82% (5.29%) |

5.59% (5.16%) |

|||||||

| 60 | 6.32% | 6.25% (5.82%) |

6.02% (5.59%) |

5.79% (5.36%) |

5.56% (5.22%) |

|||||||

The Annualized Percentage Rate ("APR") stated in the Reference Rate Table above are calculated on the basis of 6, 12, 24, 36, 48 and 60 months repayment period and the loan amount of HK$5,000, HK$100,001, HK$300,001, HK$600,001 and HK$1,000,001 respectively. The APR is calculated according to the standard of Hong Kong Association of Banks and rounded to the two decimal places. An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of the product expressed as an annualized rate. Interest is charged daily and calculated on the basis of 365 days per year. Please note that the actual APR of customers may be affected by customers' credit status and different from that in the above rate table. All loan repayment terms should be subject to the Bank's final approval and discretion. Customers should refer to the loan confirmation letter issued by the Bank for the actual details of the repayment terms. The Bank reserves the right of final decision on the interest rate and approval result.

Remarks:

- “Personal loan for employees of China’s state owned enterprises” is the promotional program of CCB (Asia) Persoanl Instalment Loan and only applicable to overseas employees of designated Chinese enterprises.

- Only applicable for online loans applications received before 3:00p.m. of a business day, Bank designated staff will follow up on the application with the applicant by calling the mobile phone number provided on the application form within the same day before 5:00p.m. If the online loans application is received after 3:00p.m. or during non-business days, Bank designated staff will follow up on the application with the applicant on the next business day before 2:00p.m.. If the Bank cannot successfully contact the applicant by the mobile phone number provided on the application form the above-mentioned time, a notification SMS will be sent to the applicant's mobile phone number provided on the application form within the same day.

- Only applicable to loan amount equal or greater than HK$200,000.

- Application hotline service hours: Monday to Friday 9:00a.m. - 6:30p.m. and Saturday 9:00a.m. - 1:00p.m.

- 7-day Cooling-off Period

- Borrower who successfully apply and drawdown the loan may apply early repay the loan in full within 7 calendar days of the drawdown date ("7-day Cooling-off Period").

- Any application for early repayment of the loan within the 7-day Cooling-off Period must be made by Borrower within 7 calendar days of the drawdown date, contact the Bank's hotline 3179 5501 to request early repayment of the loan and visit the Bank's branches in person to settle the Principal Loan amount in full.

- If the Borrower repay the loan in full within 7-day Cooling-off period, the Bank may waive the handling fee, interest and Prepayment / Early Settlement Fee/ Redemption Fee under the relevant loan.

Remarks: For Personal Installment Loan amount of HK$100,000 with 12 months repayment period, the monthly flat rate is 0.27% (APR 6.11%), and the total loan repayment amount is HK$103,248 (handling fee is waived). The above example is for reference only. The loan application and terms of the loan are subject to the Bank's approval. The actual APR may vary for individual customer and the final interest rate will be subject to credit condition of the customer, please contact the staff of the Bank for details.

The above products and services are subject to relevant terms and conditions. Please contact our staff for more details.

To borrow or not to borrow? Borrow only if you can repay!

Terms & Conditions