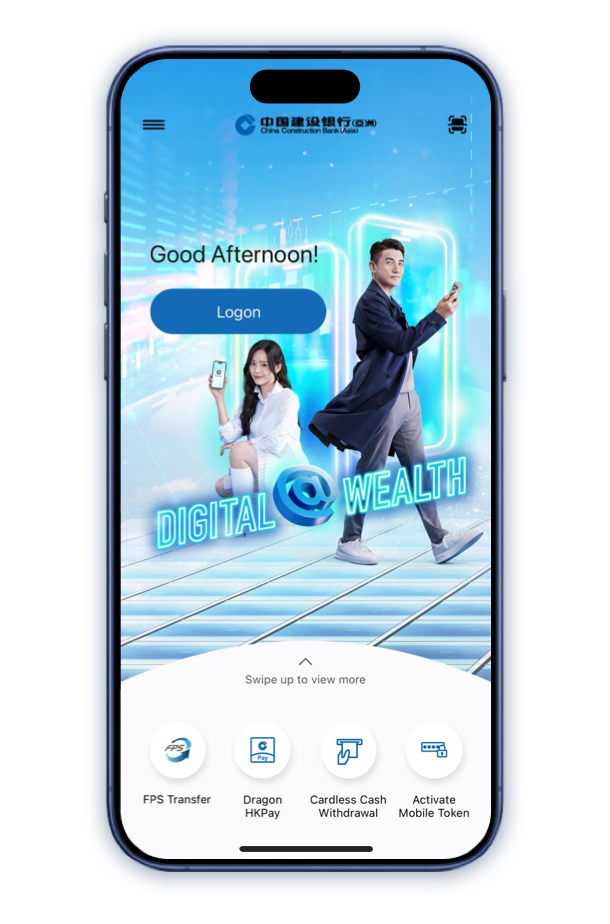

New features

CCB (Asia) mobile banking products are designed specifically for your needs and are constantly upgraded to provide a better experience, allowing you to take control of your wealth while enjoying a convenient banking experience.

Explore the new features of mobile banking for all your digital wealth needs!

Learn More

Selected Services

eAccount Services

The latest remote deposit account opening service allows you to enjoy basic services without having to go to the branch. It is easy and simple.

Account Opening Steps

Step 1

Account Application: Select e-Account Service and start account application in the App. Read and agree to the relevant terms and conditions.

Account Opening Steps

Step 2

HKID Card Verification (Capture HKID card):

- Capture your HKID card with sufficient light, avoid dark or messy background and reflective surface or blocking the light source;

- Hold the edge of the HKID card and avoid blocking any information on the HKID card, do not place it on a flat surface;

- Keep your HKID card within the frame;

- According to the instruction of your HKID card version, capture the HKID Card within the frame.

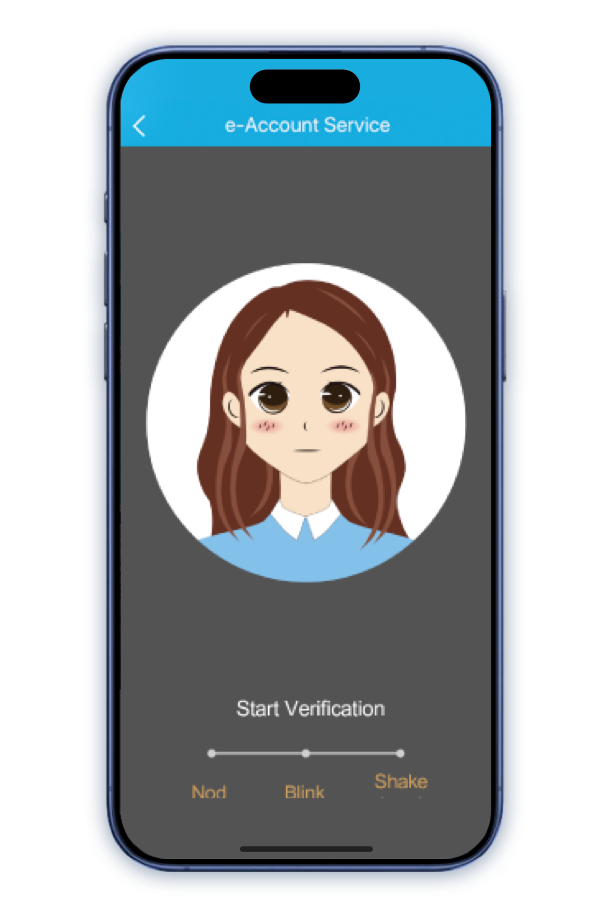

Account Opening Steps

Step 3

Take a Selfie: Place your phone at eye-level to ensure your face is within the frame with sufficient space around, then follow the random instructions for taking selfie.

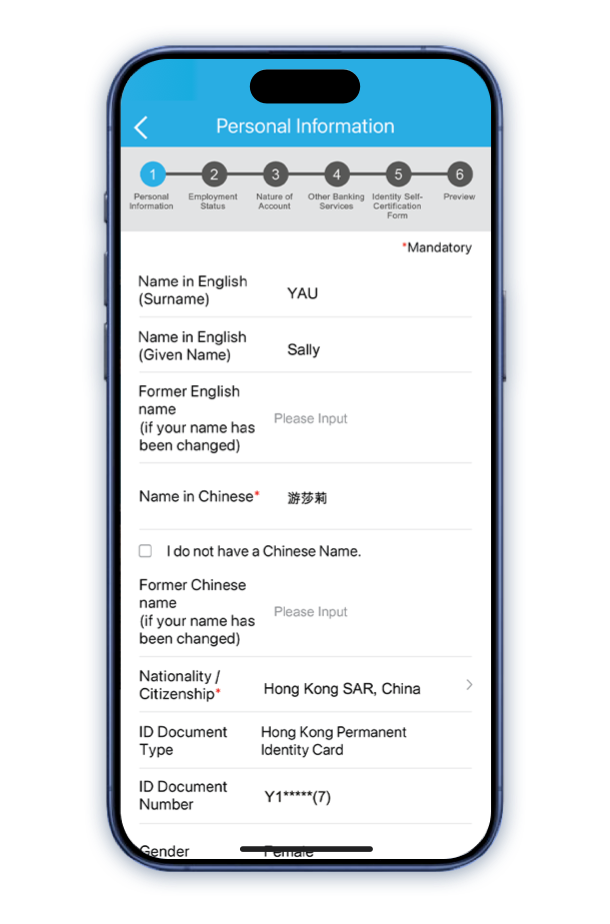

Account Opening Steps

Step 4

Input Personal Data: Follow instruction to input personal data*. You will receive One-time password via SMS and email separately. Please input the passwords respectively.

* For existing customers with incorrect personal information as recorded in the Bank, please contact us to update the relevant information.

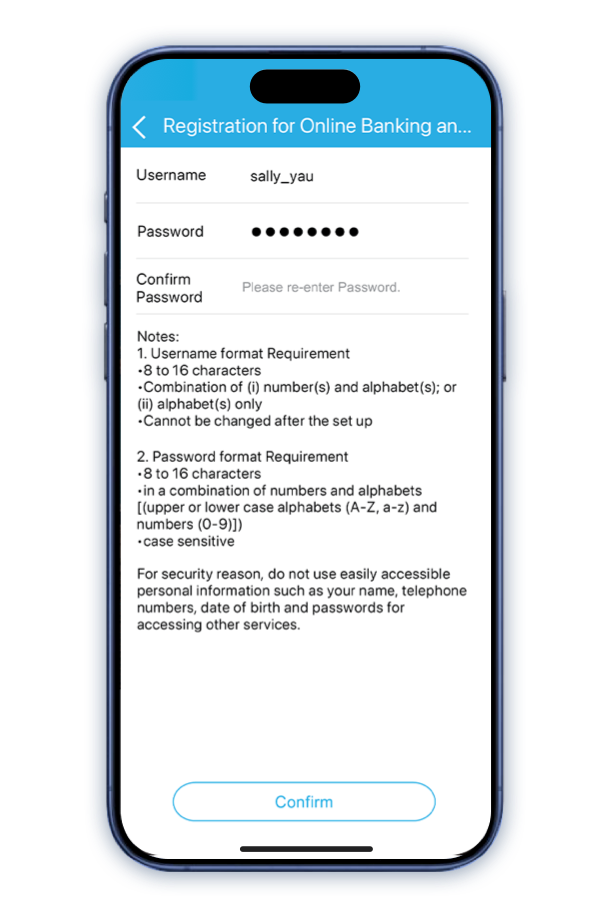

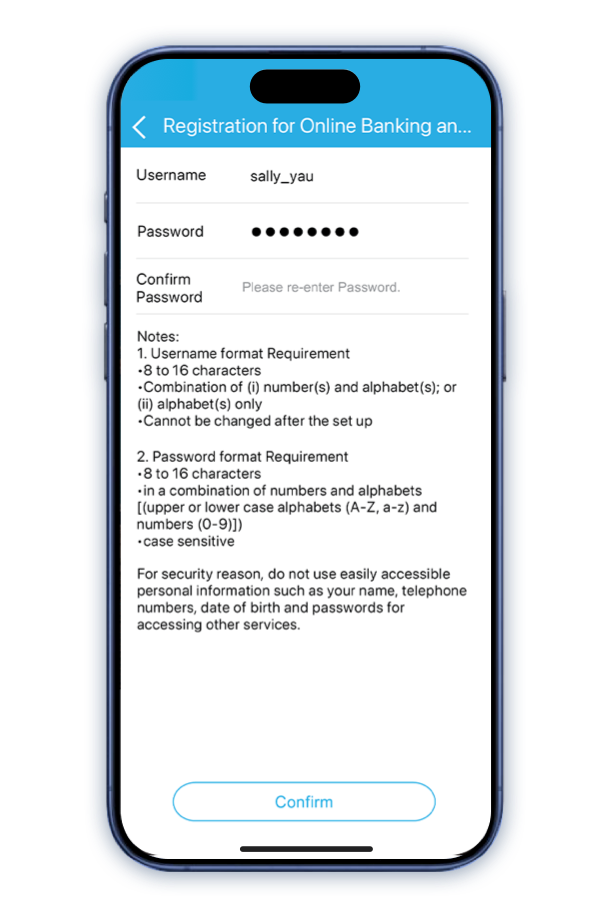

Account Opening Steps

Step 5

Set up Online Banking: Set up your username and password for Online Banking, then press "Confirm" to submit your application. You will then receive SMS and email notifications for your application number and result*.

* After successfully opening an account, the Bank will conduct a final review and your savings account will be available for deposit and withdrawal within 2-3 days.

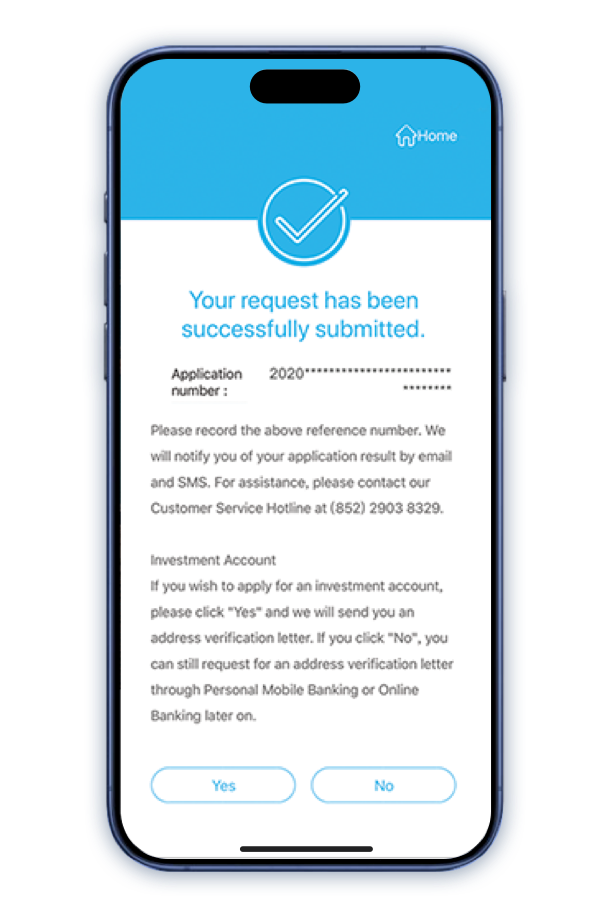

Account Opening Steps

Step 6

Investment Account Opening*: If you want to apply for an investment account, please click "Yes" for residential address verification. Letter of verification code will be mailed to your residential address.

* Investment involves risk, prices of investment product may go up as well as down, and may become valueless.

Account Opening Steps

Step 7

Verification: Follow the instructions for address verification after receiving the code, then you can open an investment account.

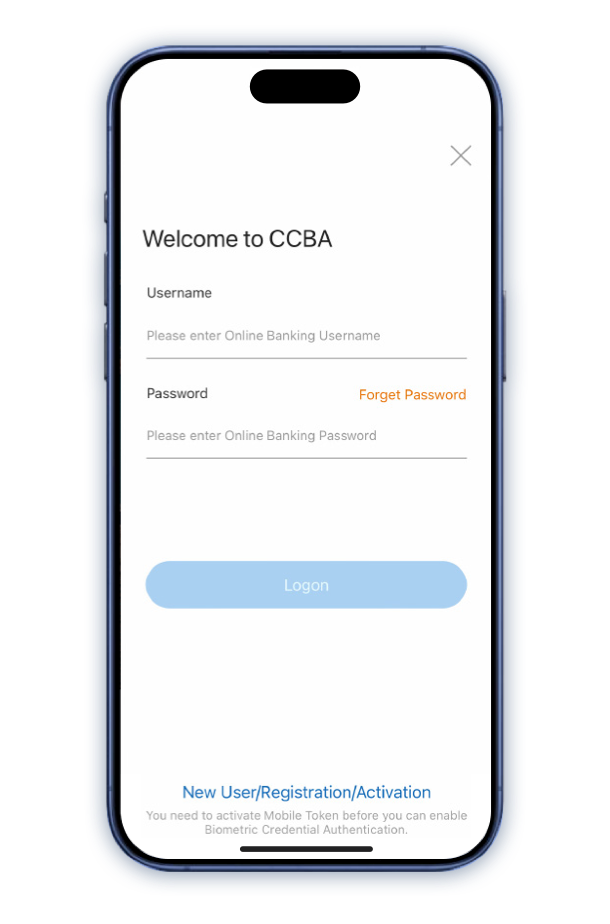

Mobile Token and Biometric

Credential Authentication Service

Through few steps to activate the Services for logging on our Mobile Banking or transaction authentication safely and quickly.

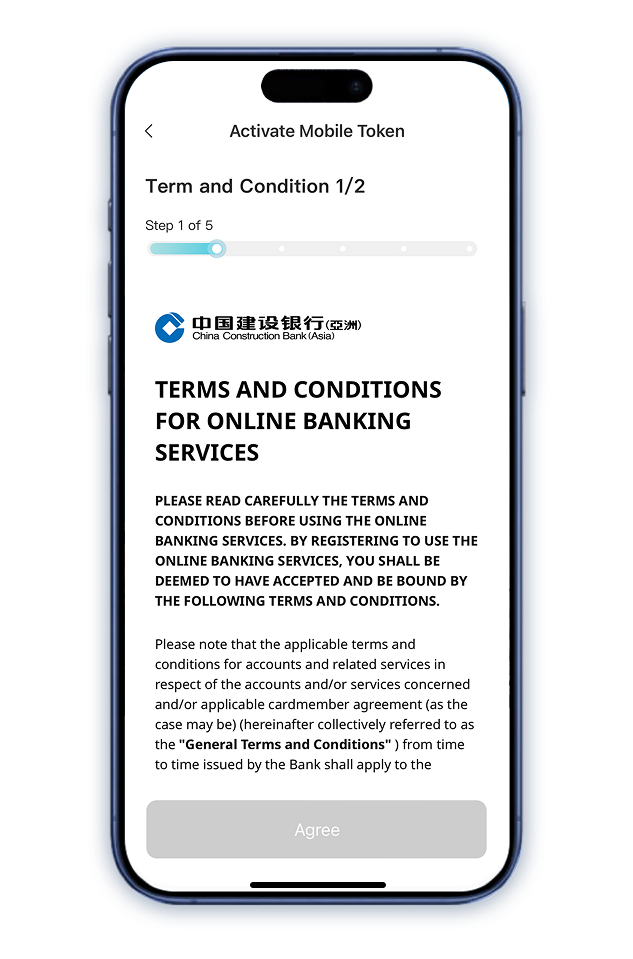

How to activate Mobile Token?

Step 1

Click "Activate Mobile Token" in the menu of main page.

How to activate Mobile Token?

Step 2

Input your Online Banking Username and Password for logging on to Mobile Banking.

How to activate Mobile Token?

Step 3

Read and accept the Terms and Conditions.

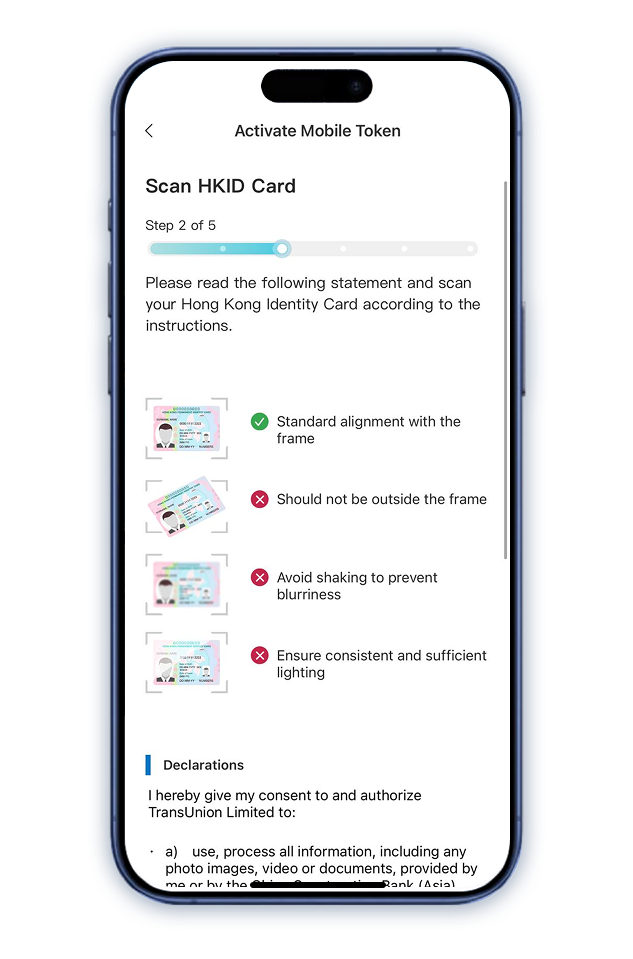

How to activate Mobile Token?

Step 4a

For Hong Kong ID holders:

If your registered document with the bank is a Hong Kong ID, follow the instructions to scan your Hong Kong ID.

(Applicable for first-time application only)

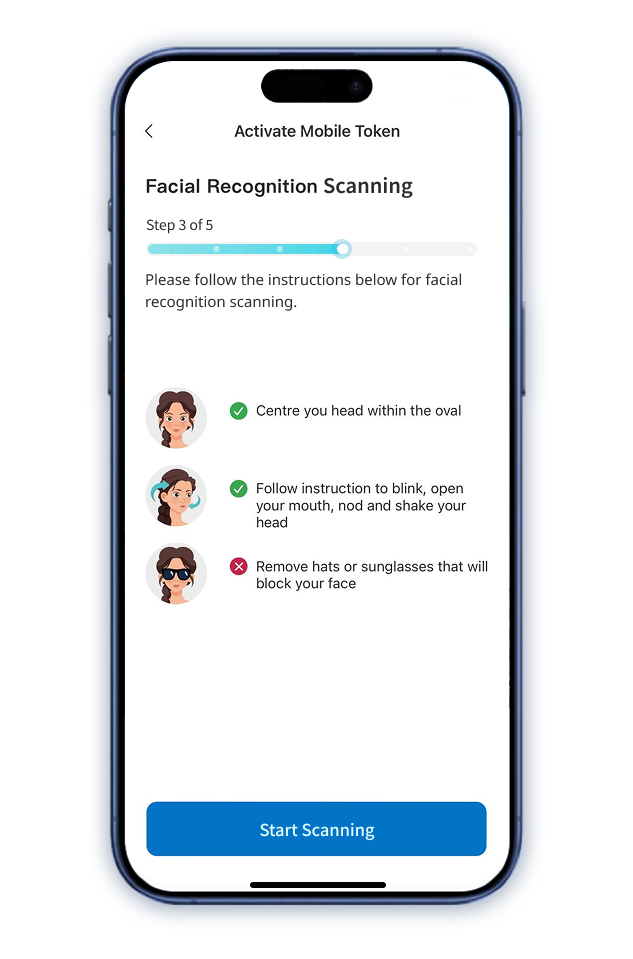

How to activate Mobile Token?

Step 4a

For Hong Kong ID holders:

Follow the instructions to complete facial recognition scanning.

(Applicable for both first-time and subsequent applications)

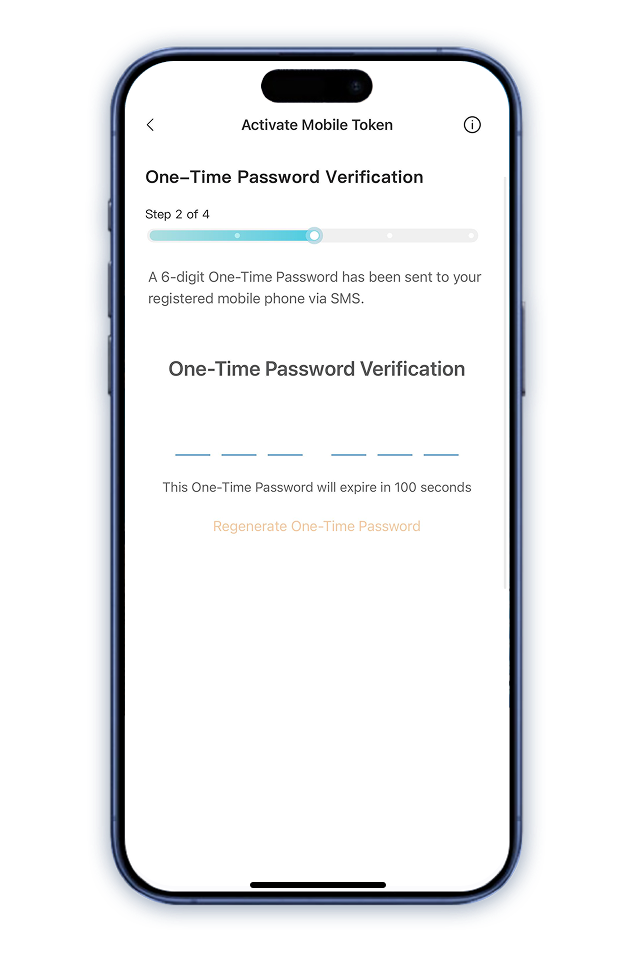

How to activate Mobile Token?

Step 4b

For non-Hong Kong ID holders:

A SMS with 6-digit One-Time Password will be sent to your registered mobile phone number. Input the One-Time Password to proceed.

How to activate Mobile Token?

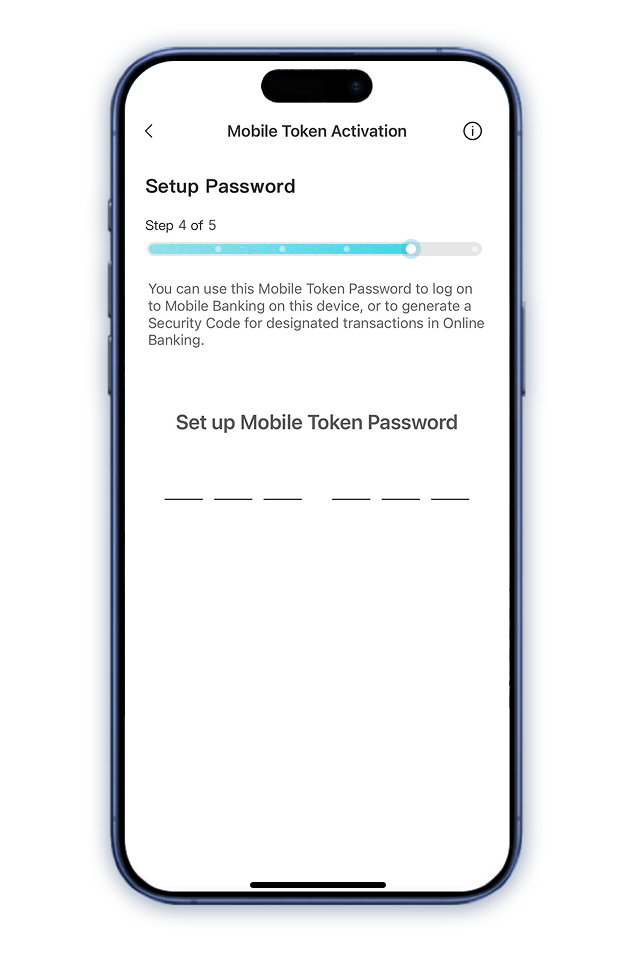

Step 5

Set up a 6-digit Mobile Token Password. Input the Password again to confirm.

How to activate Mobile Token?

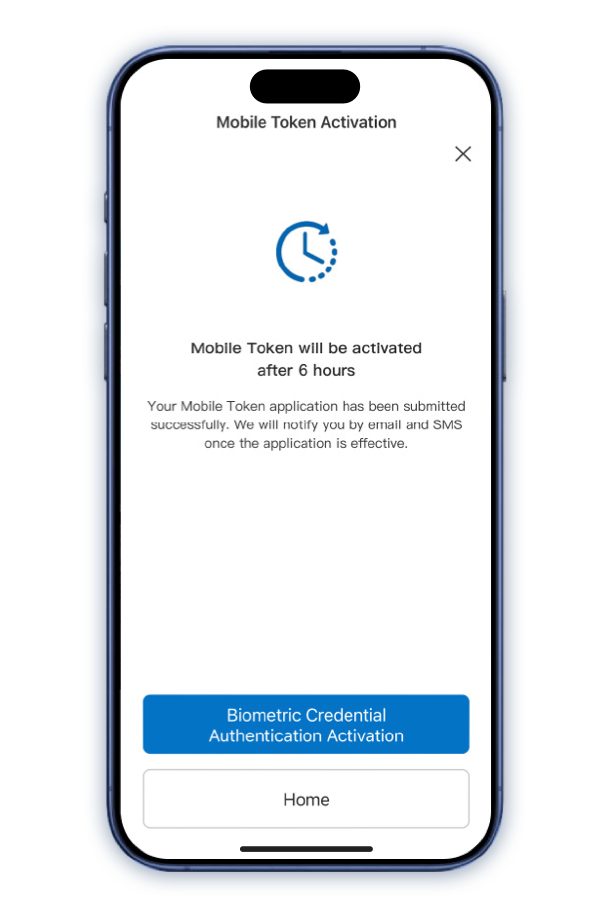

Step 6

The application of Mobile Token service is completed. For security reason, Mobile Token will be effective in about 6 hours.

After completion, you can activate Biometric Credential Authentication service simultaneously, enjoying more convenient mobile and online banking services.

Faster Payment System (FPS)

Simply use Faster Payment System (FPS) to pay or get paid in just a few taps. Set up now with ease!

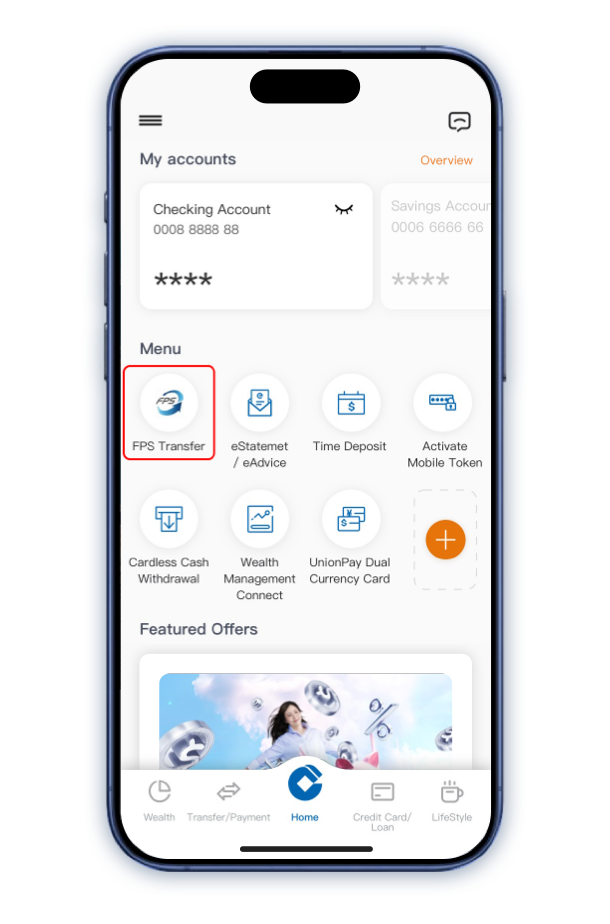

How to complete Fund Transfer?

Step 1

Logon your Mobile Banking account & tap "Transfer via FPS".

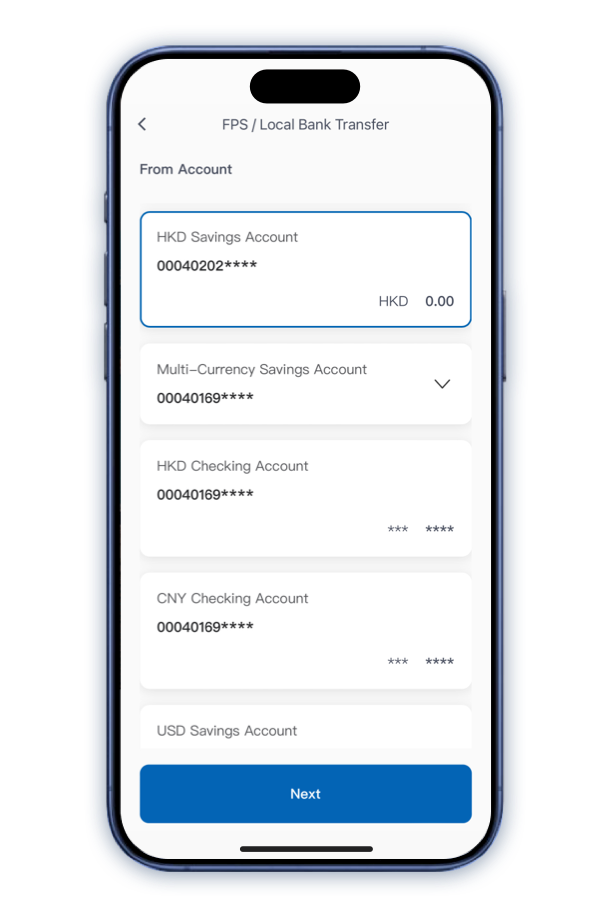

How to complete Fund Transfer?

Step 2

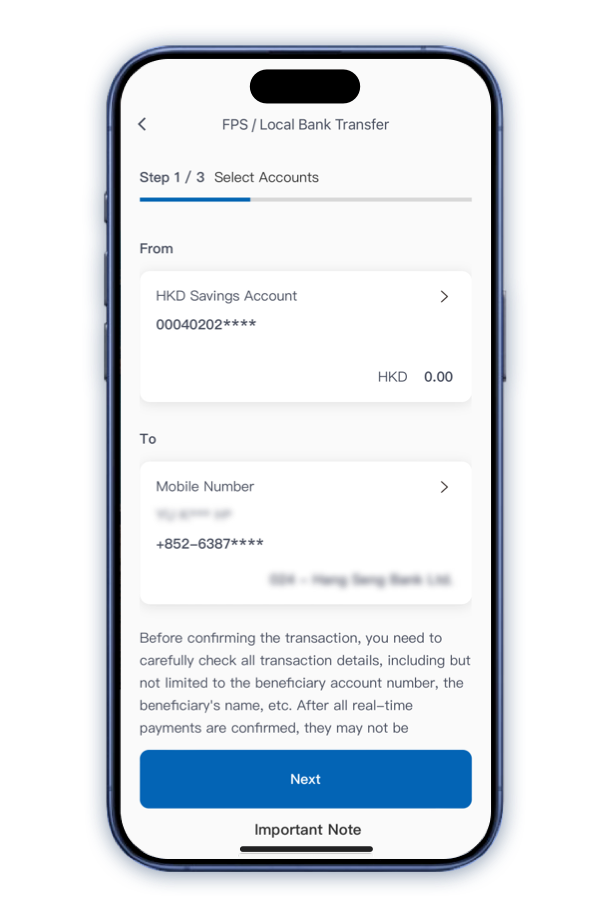

Select an account under "From Account".

How to complete Fund Transfer?

Step 3

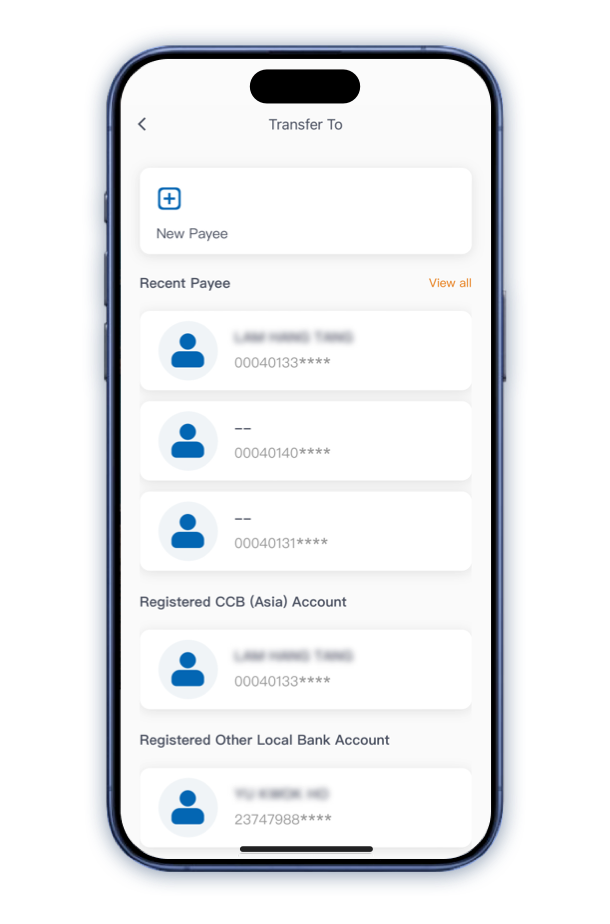

Select payee under "New Payee", "Recent Payee", "Registered CCB (Asia) Account" or "Registered Other Local Bank Account".

How to complete Fund Transfer?

Step 4

Review the accounts (From account and To account). Tap "Confirm" to proceed.

How to complete Fund Transfer?

Step 5

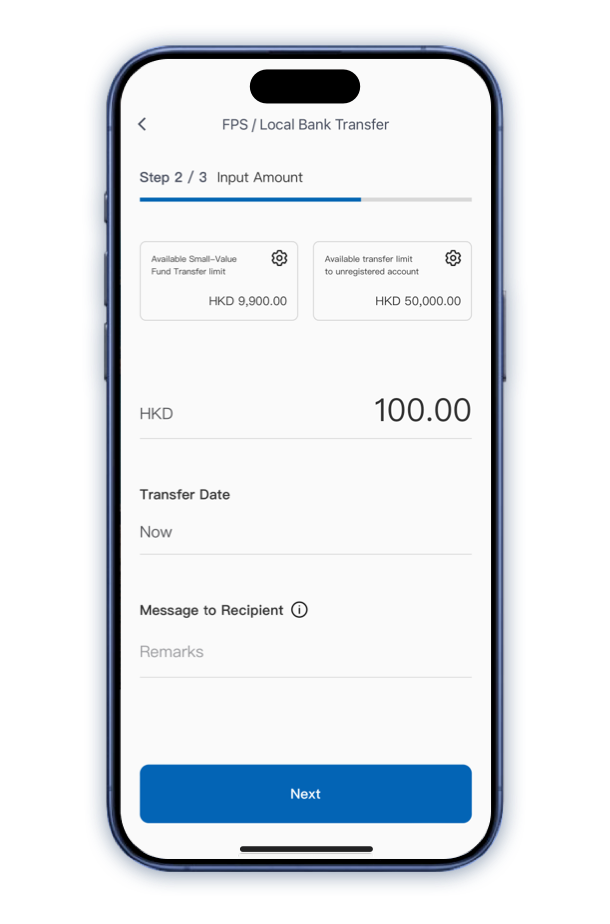

Fill in "Transfer Amount" and "Message to Recipient".

How to complete Fund Transfer?

Step 6

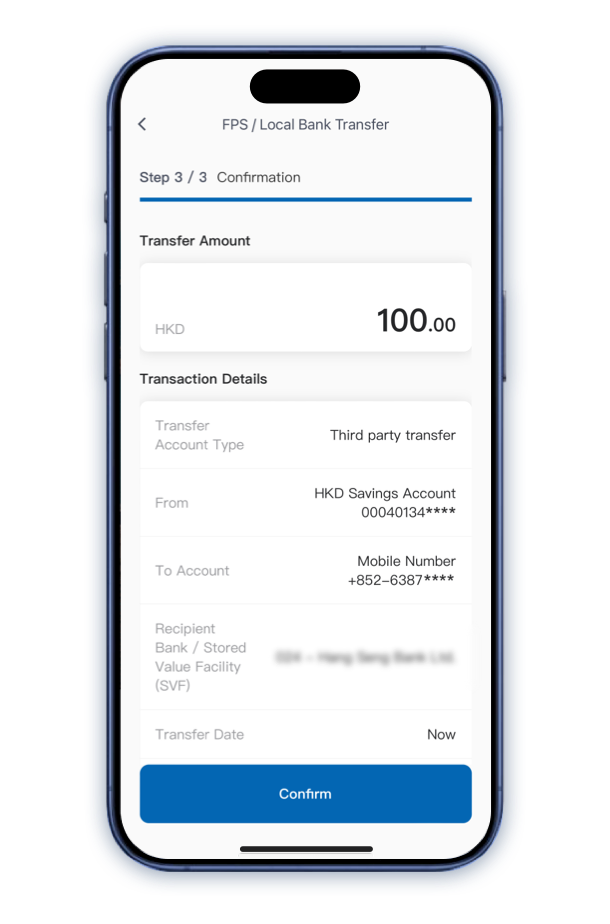

Read and accept the Terms and Conditions for fund transfer instruction. Tap "Confirm" to proceed.

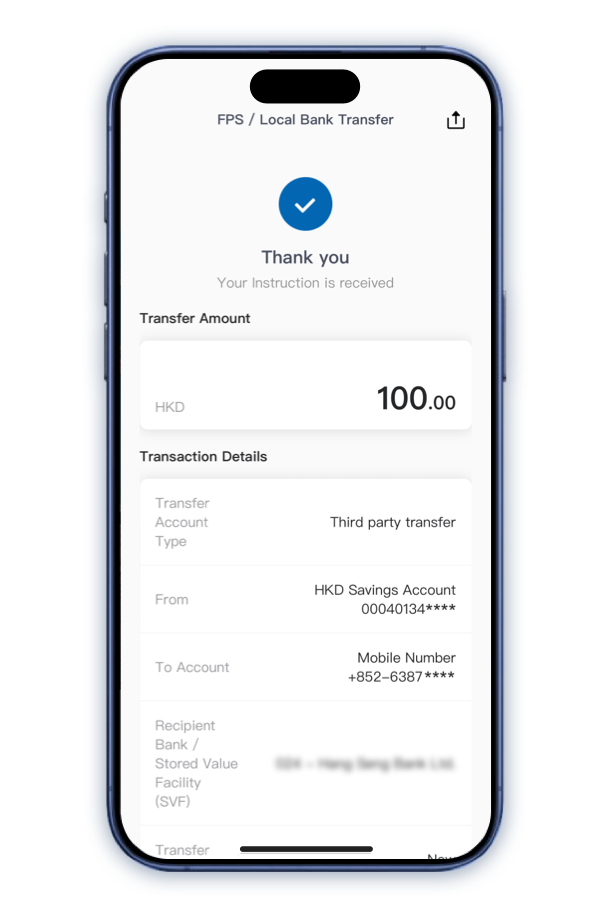

How to complete Fund Transfer?

Step 7

Transaction completed. You will receive a confirmation email and SMS for record.

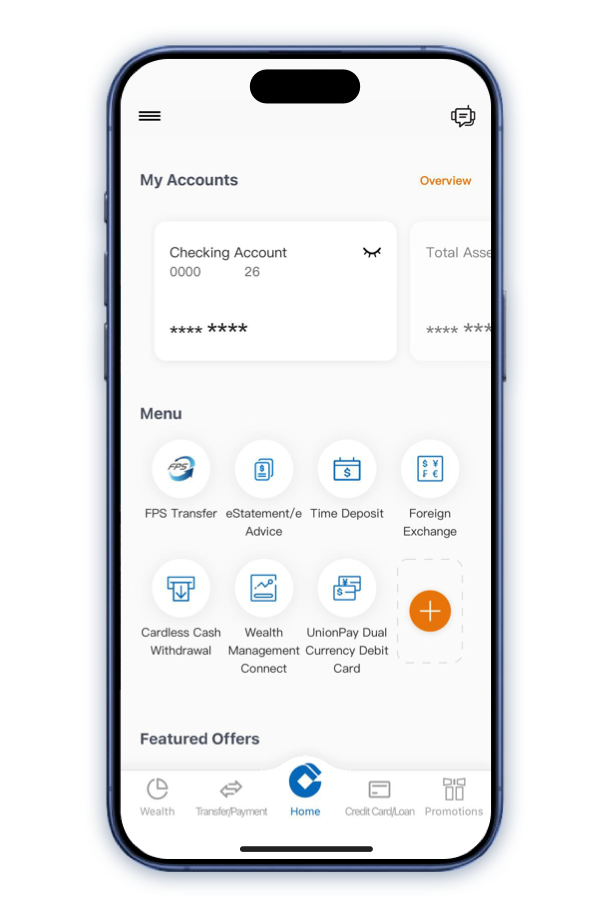

Cardless Withdrawal

JETCO Cardless Withdrawal

UnionPay QRC Withdrawal

All you need are simple and handy steps on your CCB (HK&MO) Mobile App to get cash instantly.

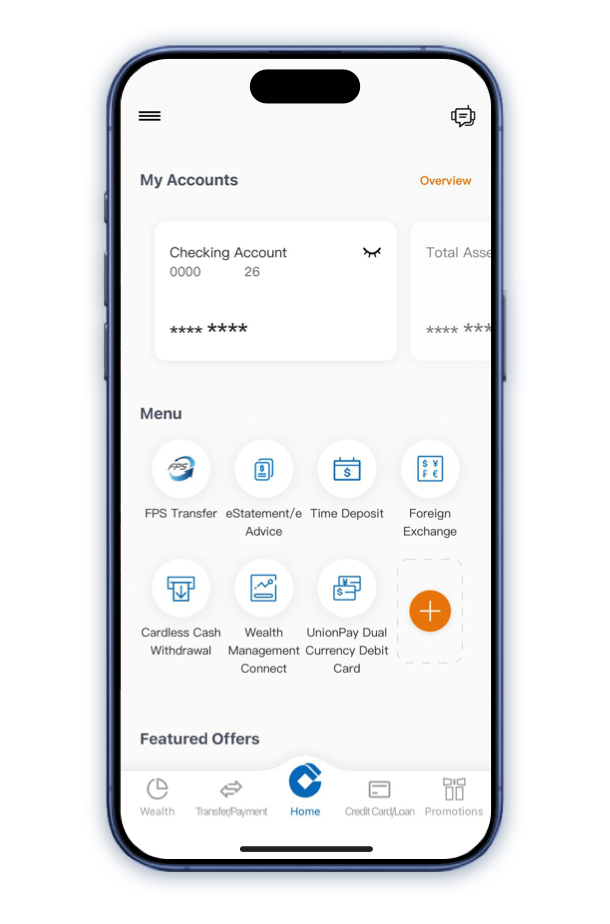

JETCO Cardless Withdrawal Steps

Step 1

Logon your Mobile Banking account and tap "Cardless Cash Withdrawal".

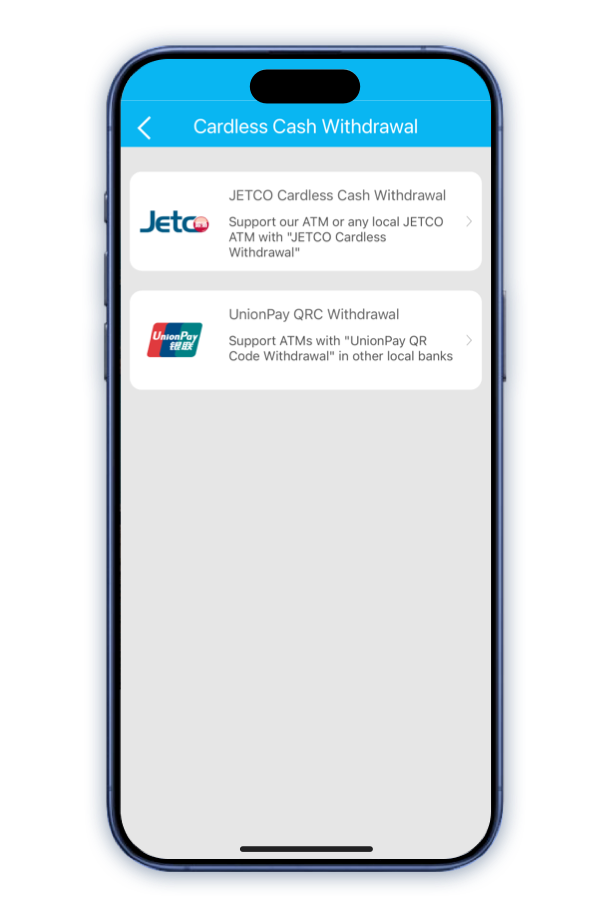

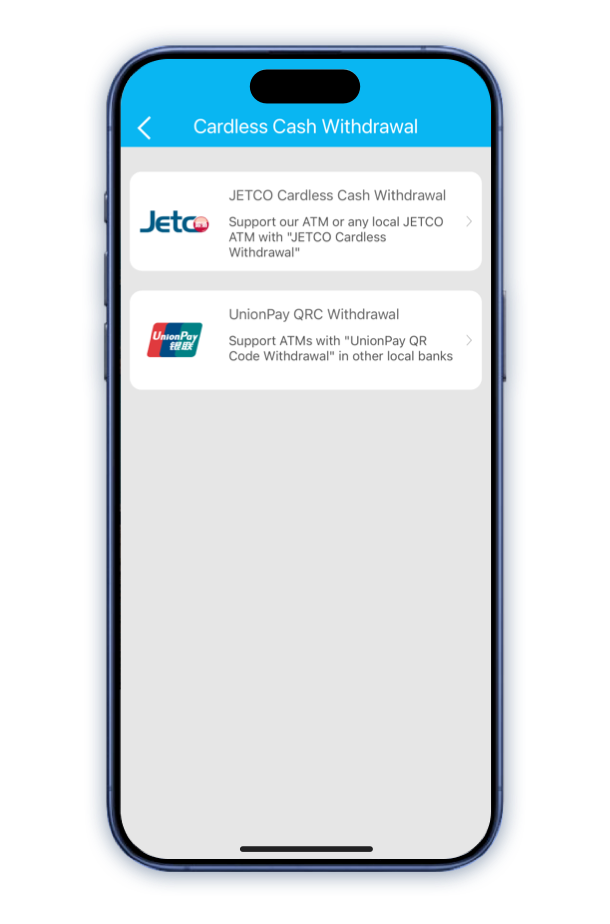

JETCO Cardless Withdrawal Steps

Step 2

Select "JETCO Cardless Cash Withdrawal".

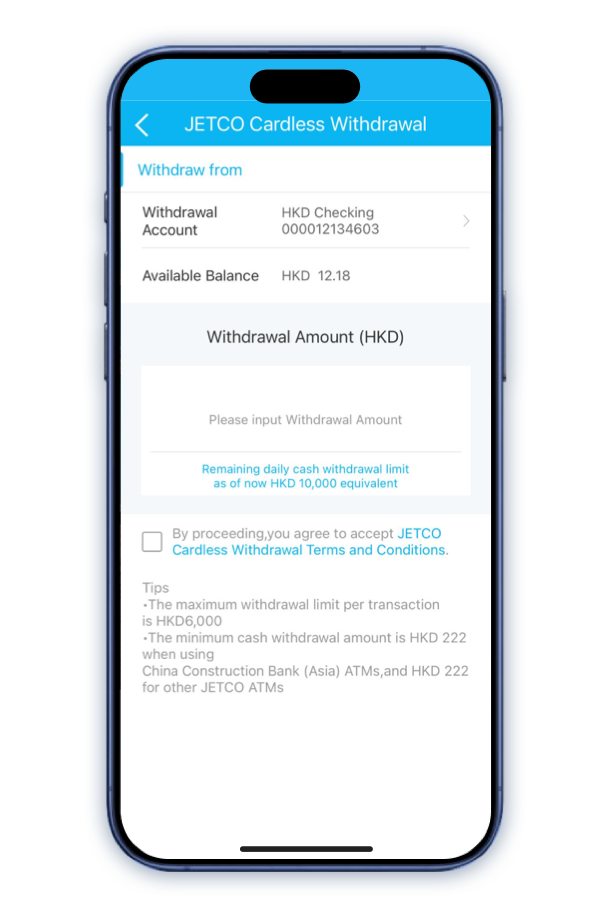

JETCO Cardless Withdrawal Steps

Step 3

Select the withdrawal account and input your withdrawal amount. Read and accept the Terms and Conditions.

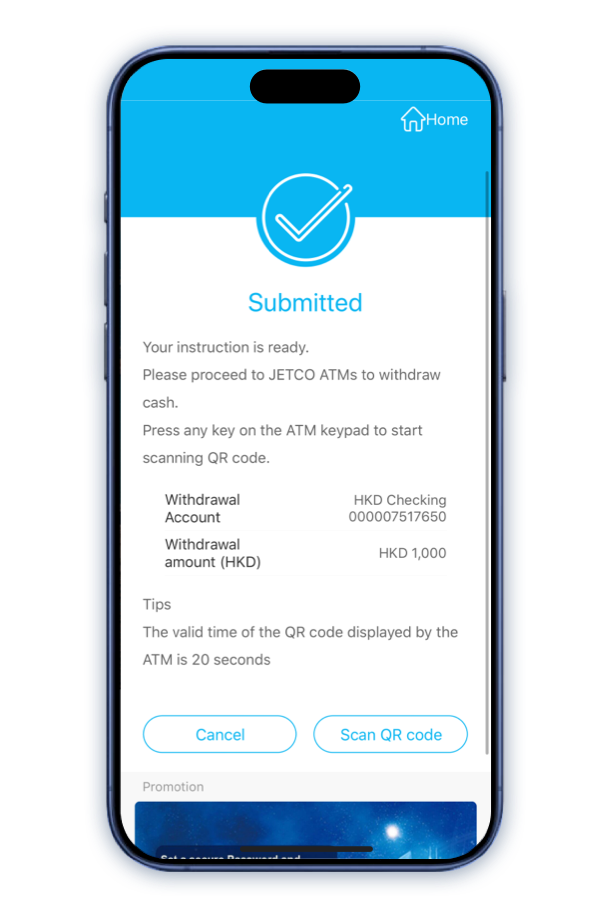

JETCO Cardless Withdrawal Steps

Step 4

After the withdrawal instruction is successfully submitted, tap "Scan QR code".

JETCO Cardless Withdrawal Steps

Step 5

If Mobile Token service is activated, please input your 6-digit Mobile Token Password to proceed.

If Mobile Token service is not activated, a SMS with 6-digit OTP code will send to your registered mobile phone number. Please input the code to proceed.

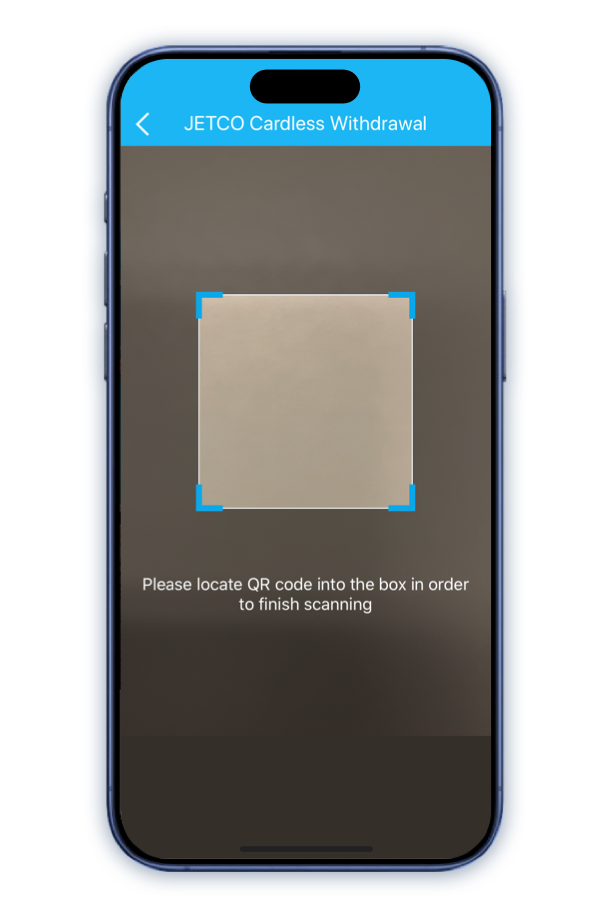

JETCO Cardless Withdrawal Steps

Step 6

Scan the QR code on the ATM.

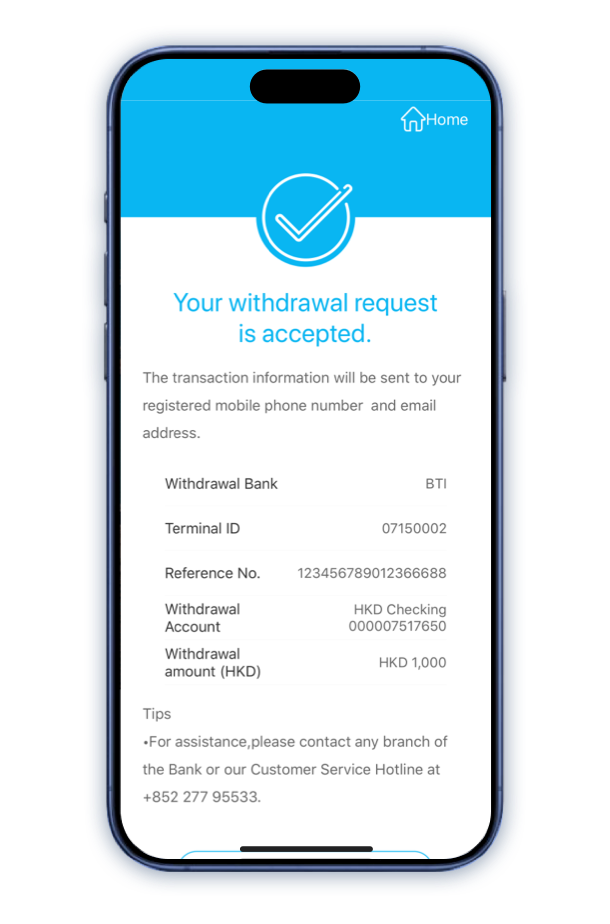

JETCO Cardless Withdrawal Steps

Step 7

Transaction completed.

Collect the customer advice (if applicable) and cash.

All you need are simple and handy steps on your CCB (HK&MO) Mobile App to get cash instantly.

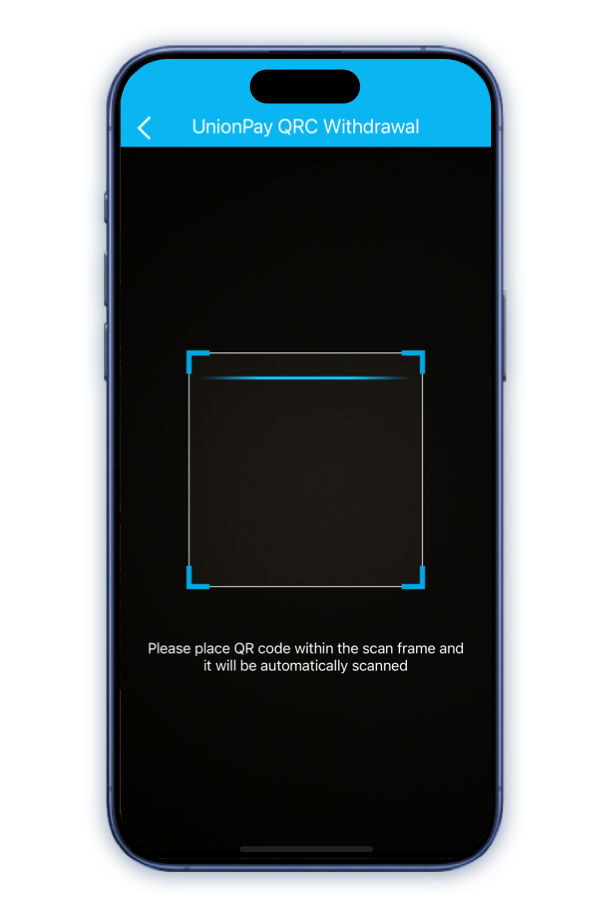

UnionPay QRC Withdrawal Steps

Step 1

Logon your Mobile Banking account and tap "Cardless Cash Withdrawal".

UnionPay QRC Withdrawal Steps

Step 2

Select "UnionPay QRC Withdrawal".

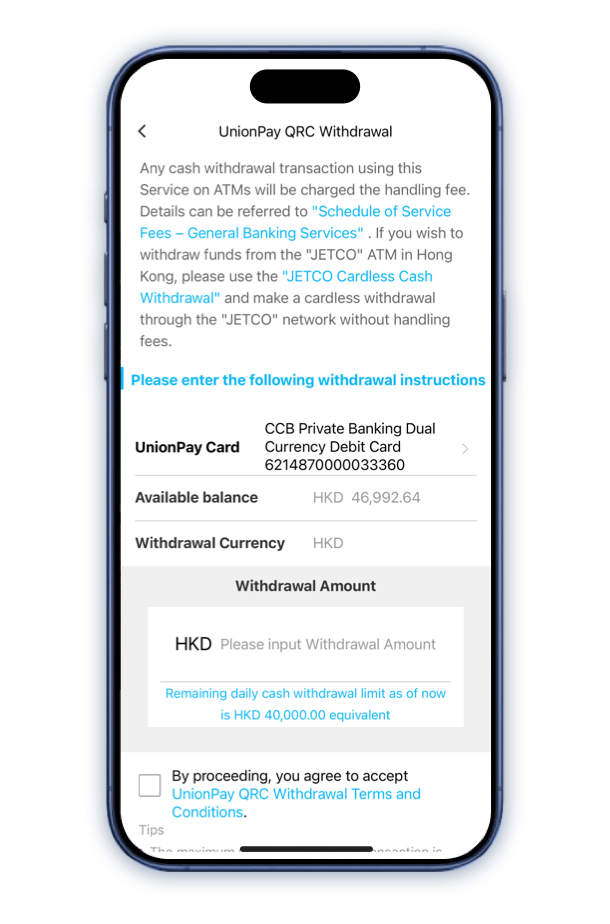

UnionPay QRC Withdrawal Steps

Step 3

Select the UnionPay Dual Currency Debit Card and input the withdrawal amount. Read and accept the Terms and Conditions.

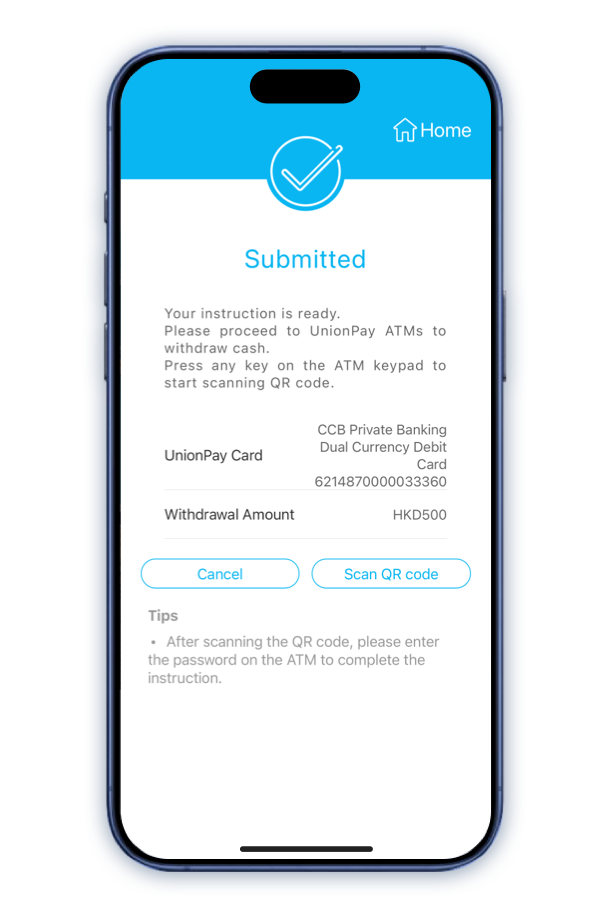

UnionPay QRC Withdrawal Steps

Step 4

After the withdrawal instruction is successfully submitted, tap "Scan QR code".

UnionPay QRC Withdrawal Steps

Step 5

Choose "UnionPay QRC Withdrawal" on the UnionPay QRC Withdrawal ATM.

Enable the camera function of your device to scan the QR code on the UnionPay QRC Withdrawal ATM, then enter your ATM Pin.

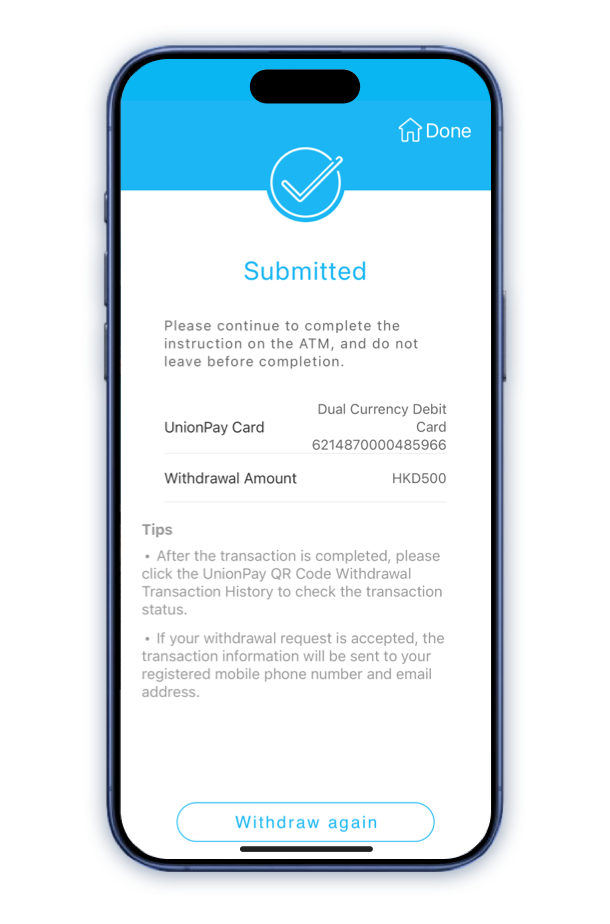

UnionPay QRC Withdrawal Steps

Step 6

Transaction completed.

Collect the customer advice (if applicable) and cash.

Other Services

Professional Investment Services

Provide diversified investment products to help you meet investment needs.

Learn MoreCross Border Financial Services

No matter where you are, you can check the account details of different countries or regions at any time.

Learn MoreCredit Cards Services

Credit card application, new card confirmation,

repayment and promotional offers.

Loan Services

A variety of loan plans cater to your needs, you can check the application progress and upload the required documents at any time.

Learn More