CCB (Asia) Credit Card Installment Loan Program

CCB (Asia) Credit Card provides you an array of installment plans to maximize your financial flexibility.

Selected Customers enjoy Monthly Flat Rate as low as 0.26%1 and up to HK$1,000 Interest Rebate2 for Credit Card Spending and Insurance Premium Installments

“Chill” Spending Installment Program

Apply for Spending Installment via Mobile Banking

Better Budgeting with Flexible Installment Plans

Apply Now via Online Banking

If you don't have a CCB (Asia) Credit Card yet, click here to apply now!

Interest Rebate

as low as 0.26%

“Chill” Spending Installment First Successful Application via eBanking offer

From July 1, 2025 to July 31, 2025 ("Promotion Period"), selected customers can get up to HK$1,000 Interest Rebate2 for your first successful application to the “Chill” Spending Installment Program made via Mobile/Online Banking.

| Installment Plan Amount | First Successful “Chill” Spending Installment Application via eBanking Interest Rebate |

| HK$1,000 - HK$8,999 | HK$50 |

| HK$9,000 – HK$29,999 | HK$100 |

| HK$30,000 – HK$49,999 | HK$300 |

| HK$50,000 – HK$99,999 | HK$500 |

| HK$100,000 or above | HK$1,000 |

Monthly Flat Rate as low as0.26%1

| Installment Amount | General Spending Monthly Flat Rate | Insurance Premium Payment / Tax Payment Monthly Flat Rate* |

| HK$1,000 - HK$9,999 | 0.47% | 0.30% |

| HK$10,000 - HK$29,999 | 0.39% | |

| HK$30,000 - HK$79,999 | 0.35% | |

| HK$80,000 - HK$149,999 | 0.32% | 0.26% |

| HK$150,000 or above | 0.26% | |

*Applicable to Application by CCB (Asia) Credit Card Installment Hotline or Registration Form only

Repayment options 6/12/18/24/36/48/60/72 months

Unlimited number of applications, no document required!

Promotion Period till: July 31, 2025

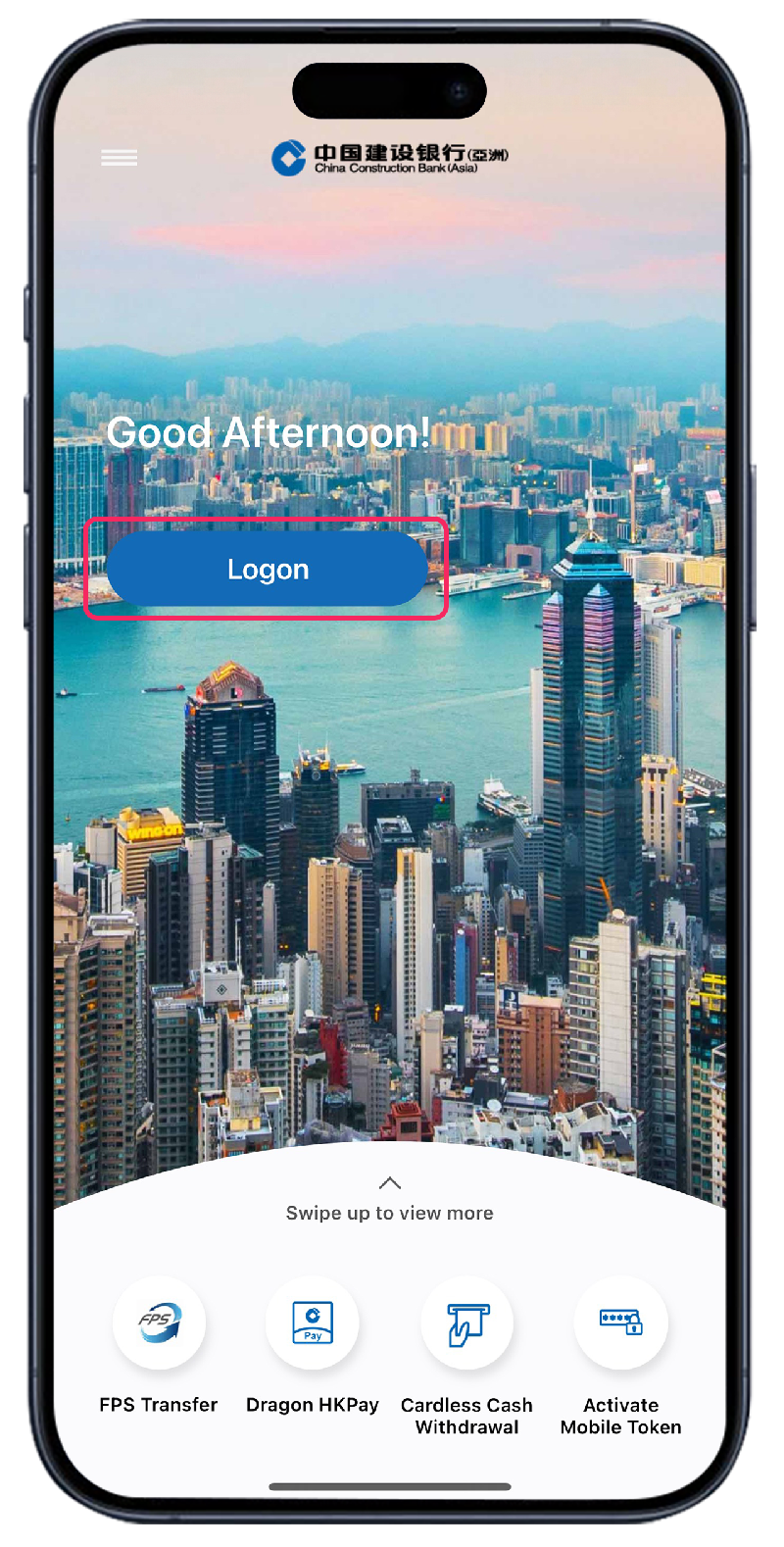

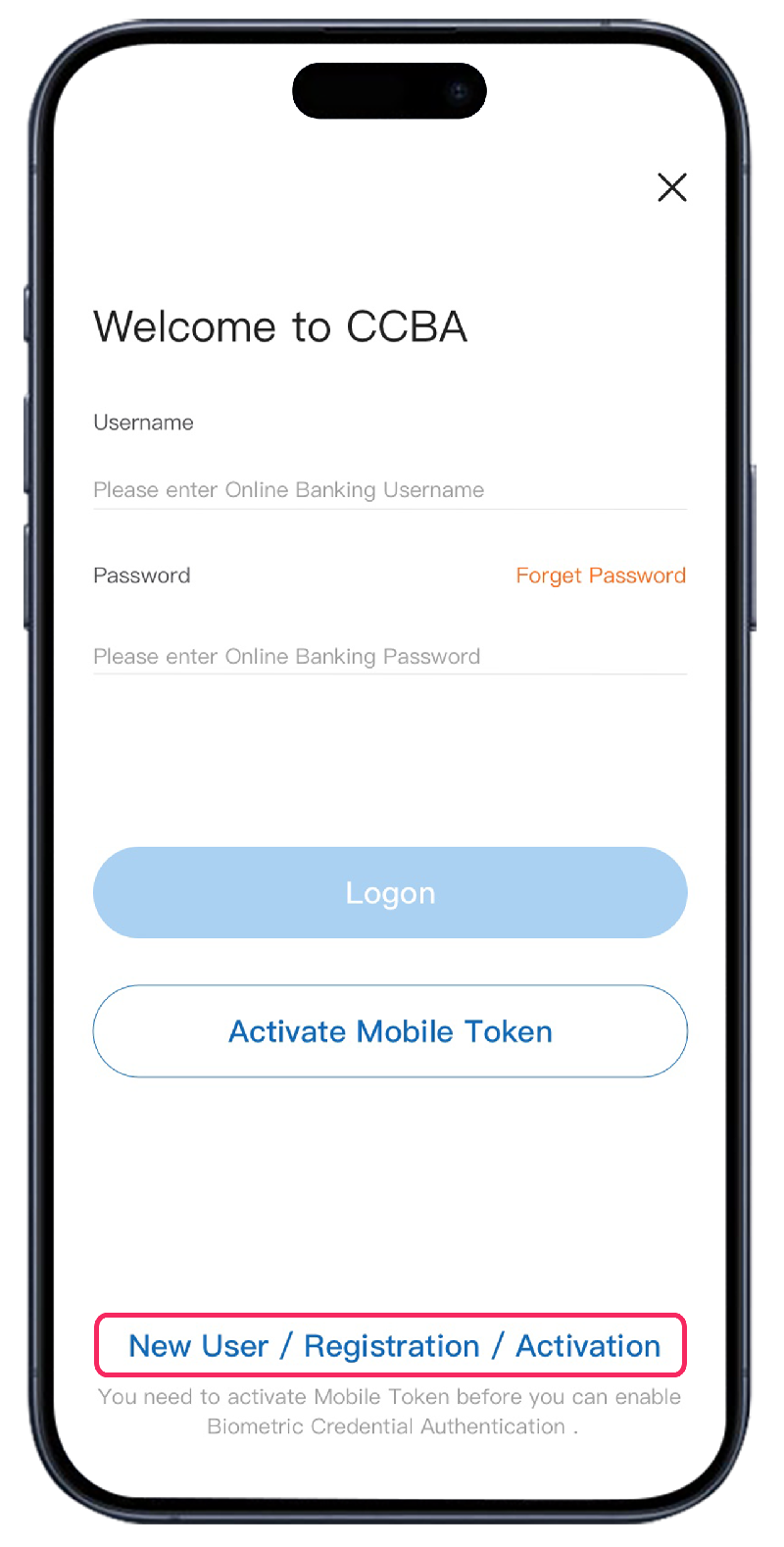

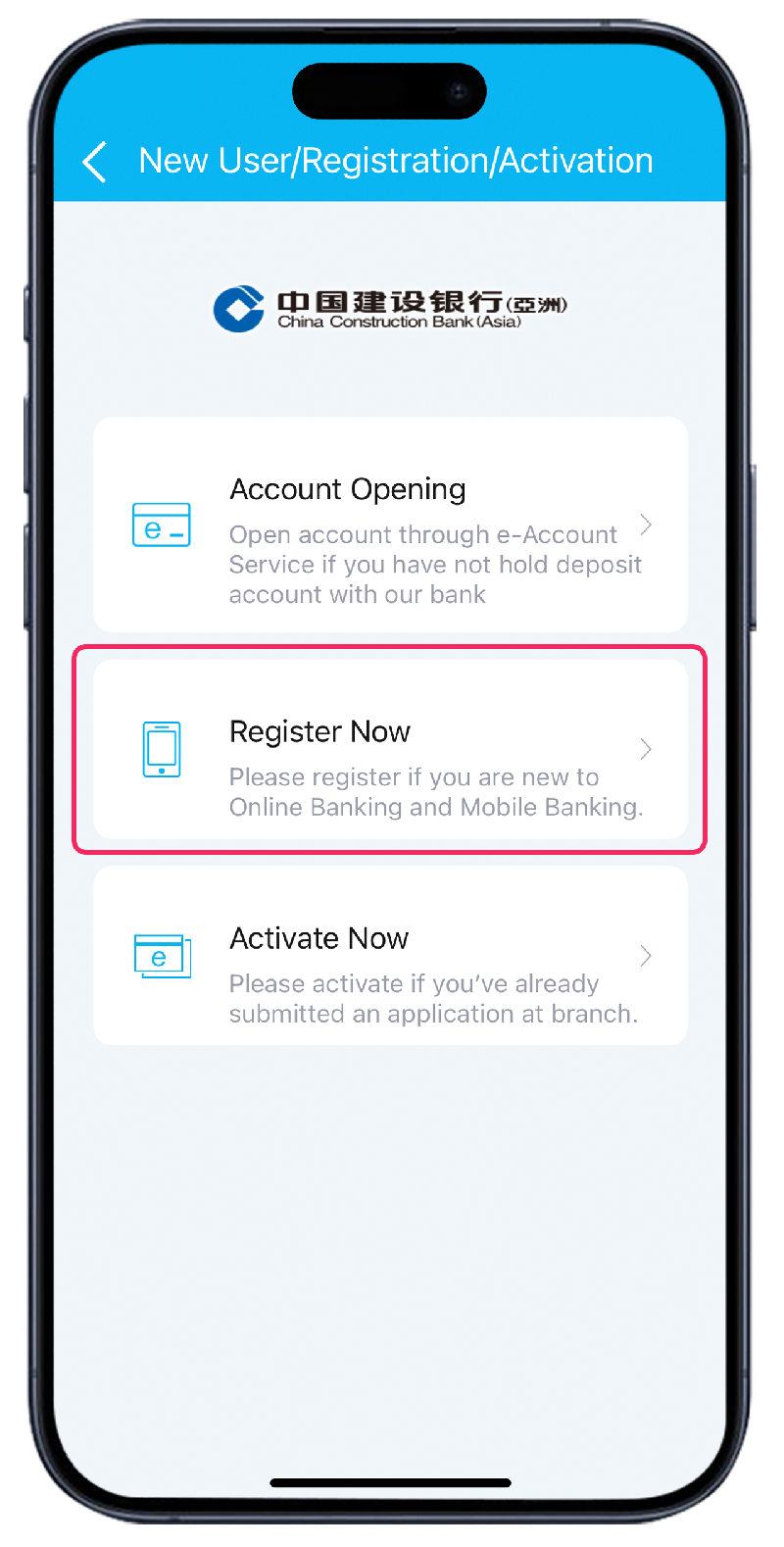

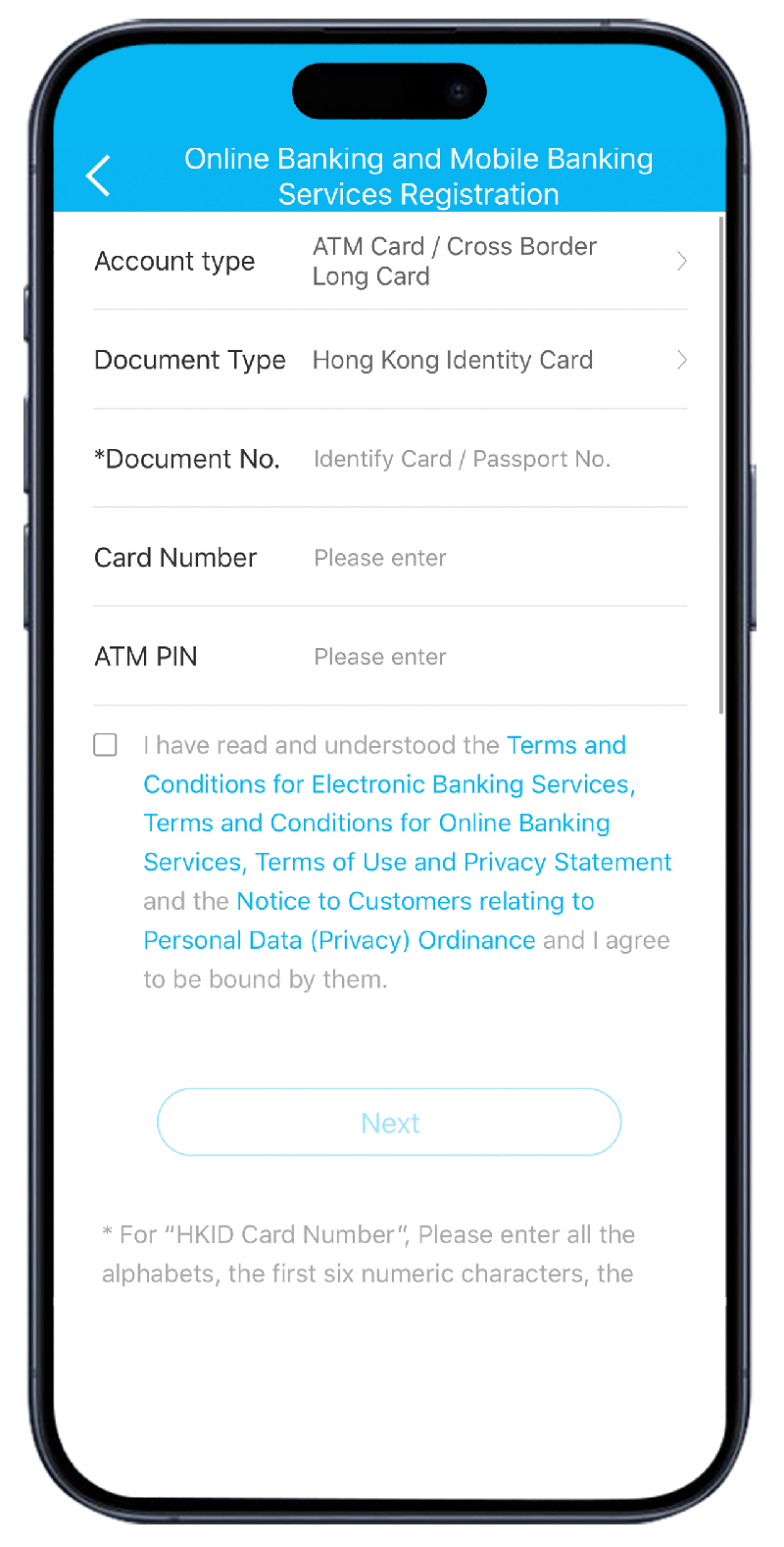

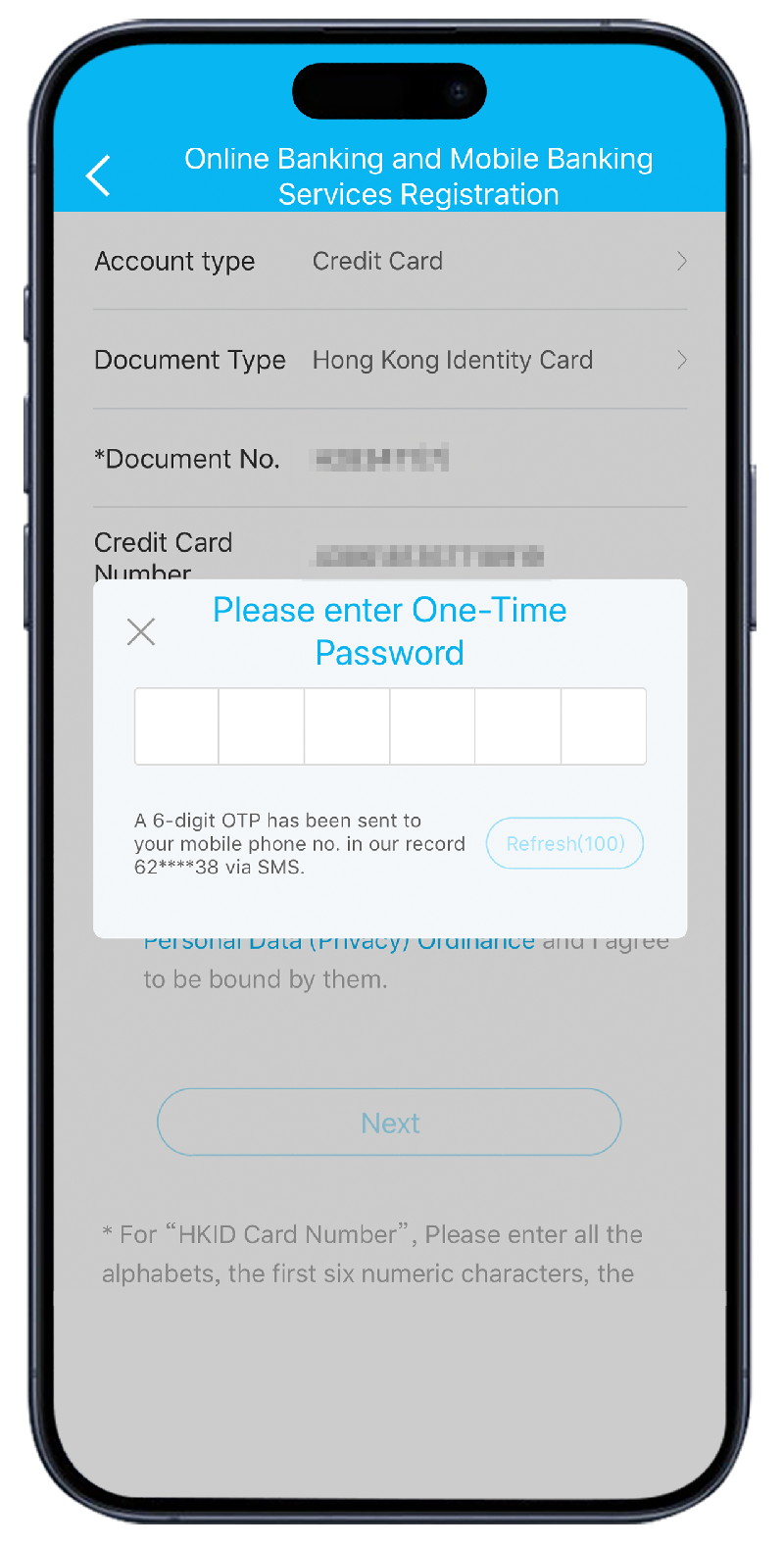

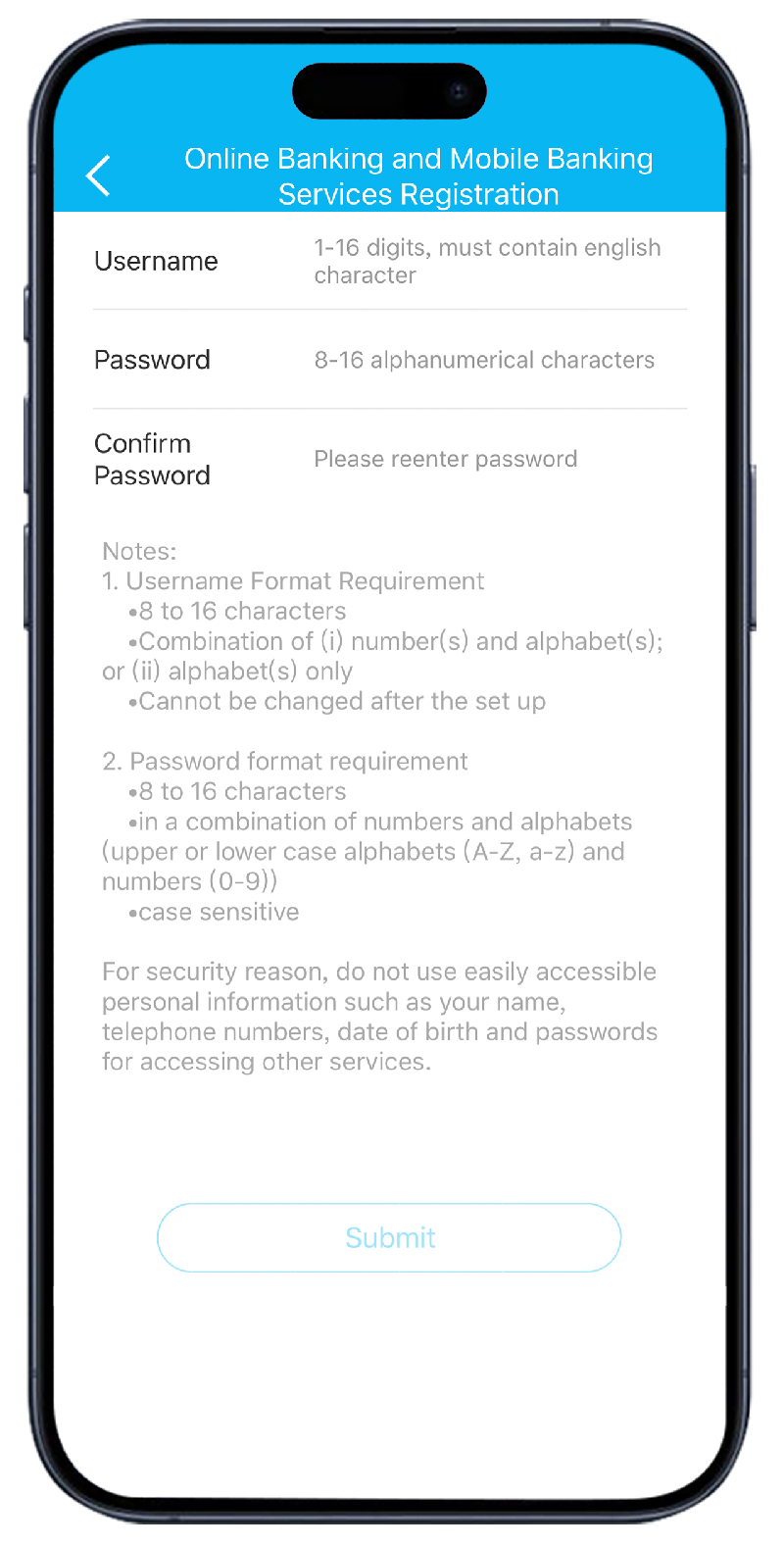

Download and enroll Mobile Banking

Login to Mobile Banking and select “Credit Card/Loan”,

then select “Spending Installment” under “Menu”

Remarks:

- The Annualized Percentage Rate (“APR”) for monthly interest rate 0.26% is calculated as follows: 6-month repayment period is 5.46%, 12-month repayment period is 5.86%, 18-month repayment period is 5.99%, 24-month repayment period is 6.04%, 36-month repayment period is 6.06%, 48-month repayment period is 6.05%, 60-month repayment period is 6.02%, 72-month repayment period is 5.98%.

- Each Cardmember will only be entitled to each Interest Rebate offer once only during the promotion period. Applicable to tenors of 12 months or more installment and customers who have not applied Spending Installment Program via Mobile / Online Banking from January 16, 2024 to June 15, 2025. If Eligible Customer chooses to make early settlement or cancel the Installment Program, the Bank reserves the right to charge such Eligible Customer an amount equivalent to the amount of the Interest Rebate granted. Please refer to relevant Terms and Conditions for details.

Remark: “Chill” Spending Installment Program is only applicable to selected CCB (Asia) Cardmembers.

Click here for Terms and Conditions for “Chill” Spending Installment Program.

Click here for Terms and Conditions for “Chill” Spending Installment First Successful Application offer via Mobile/Online Banking.

Click here for Key Facts Statement (KFS) for Installment Loan and Illustration Example of Making Early Repayment.

Click here for the Frequently-Asked-Questions

From July 1, 2022, the product name of spending installment program is revised from “Fun Express” Spending Installment Program to “Chill” Spending Installment Program. Terms and conditions that apply to “Fun Express” Spending Installment Program is also applicable to “Chill” Spending Installment Program. (Except terms and conditions otherwise specify)

To borrow or not to borrow? Borrow only if you can repay!

APPLY NOW

Apply at Mobile Banking

Search CCB (Asia) Mobile App from Apple Store or Google Play

Login to Mobile Banking and select “Credit Card/Loan”, then select “Spending Installment” under “Menu”

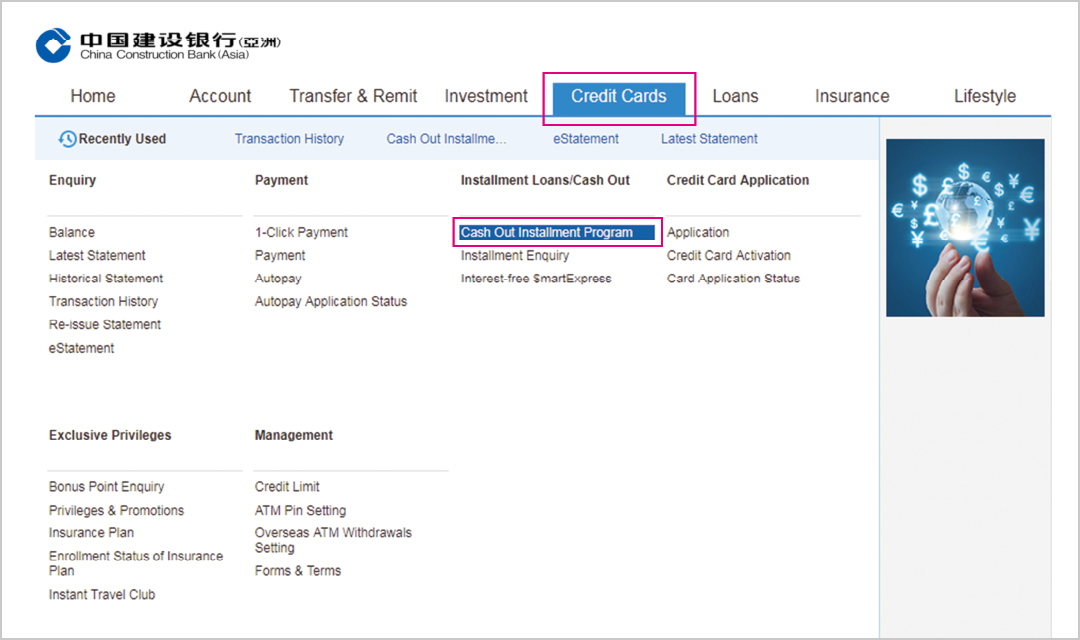

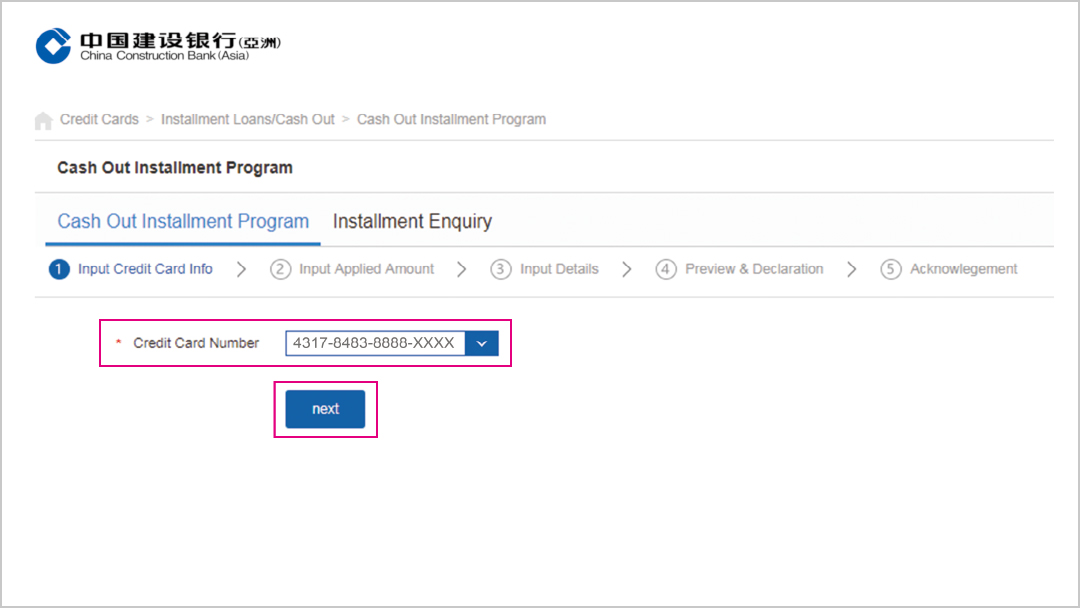

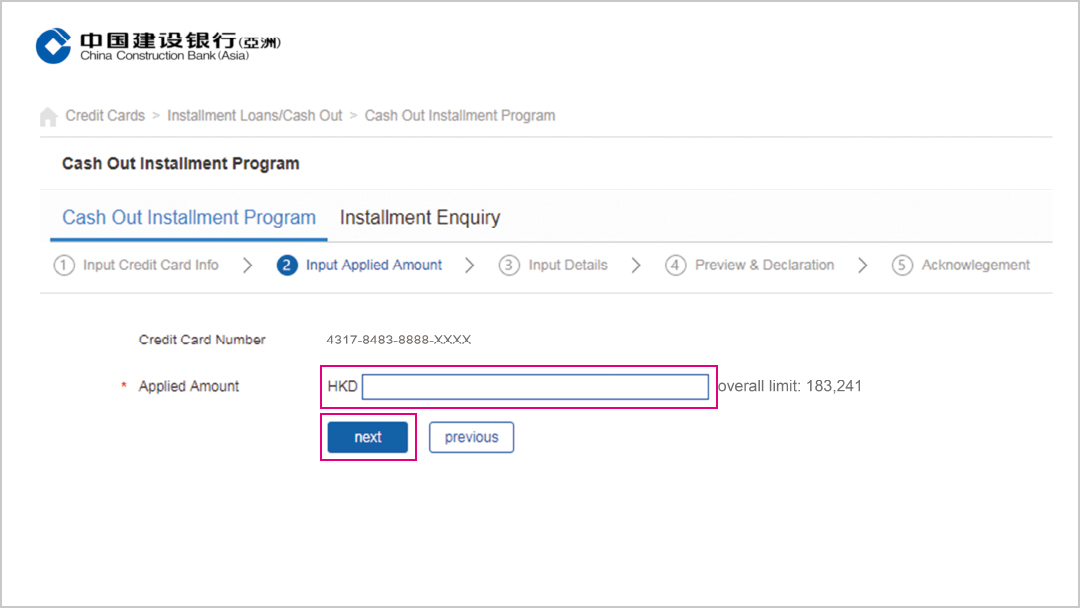

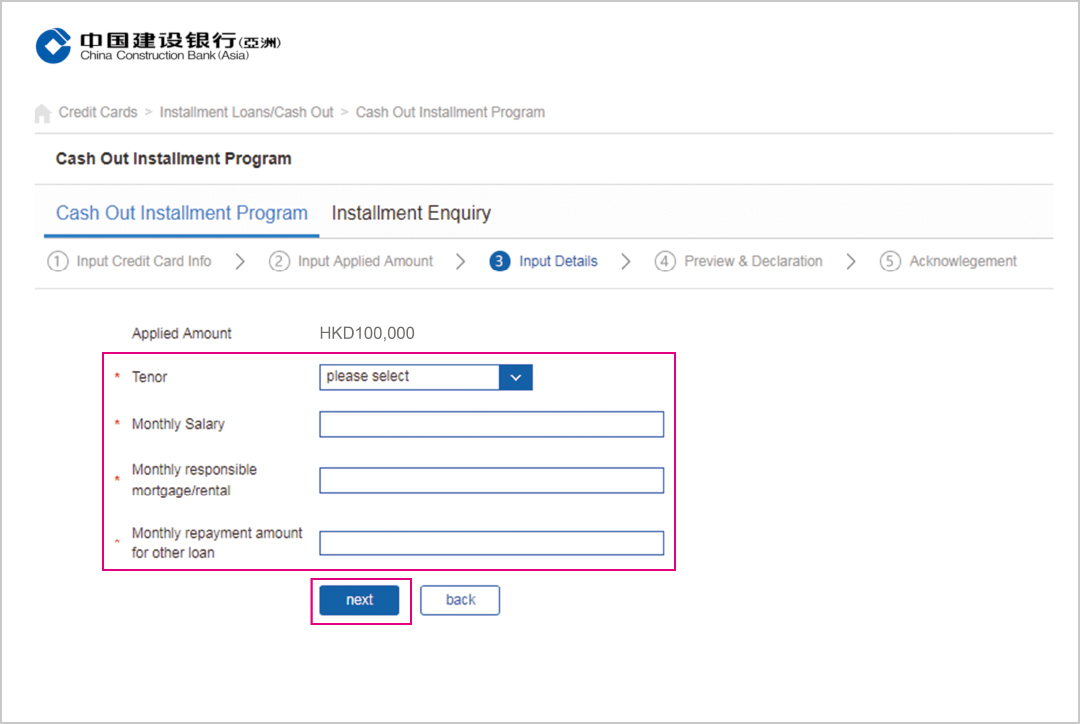

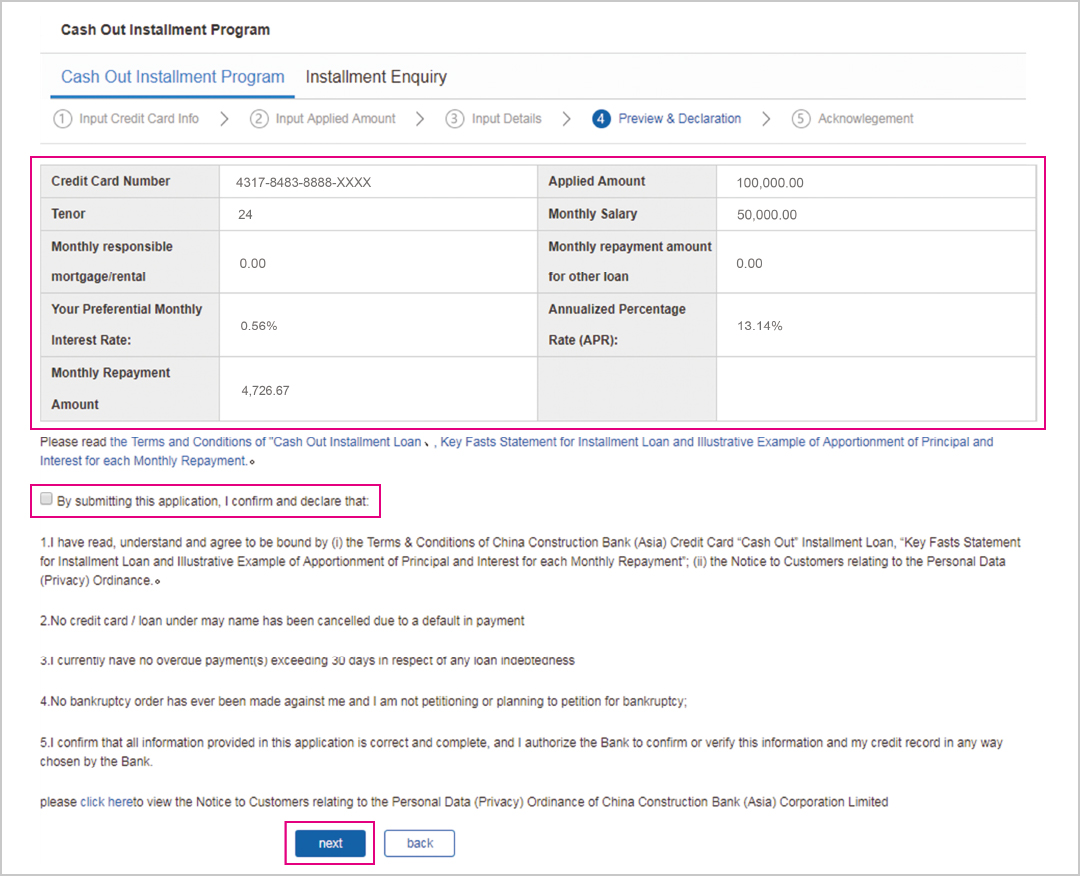

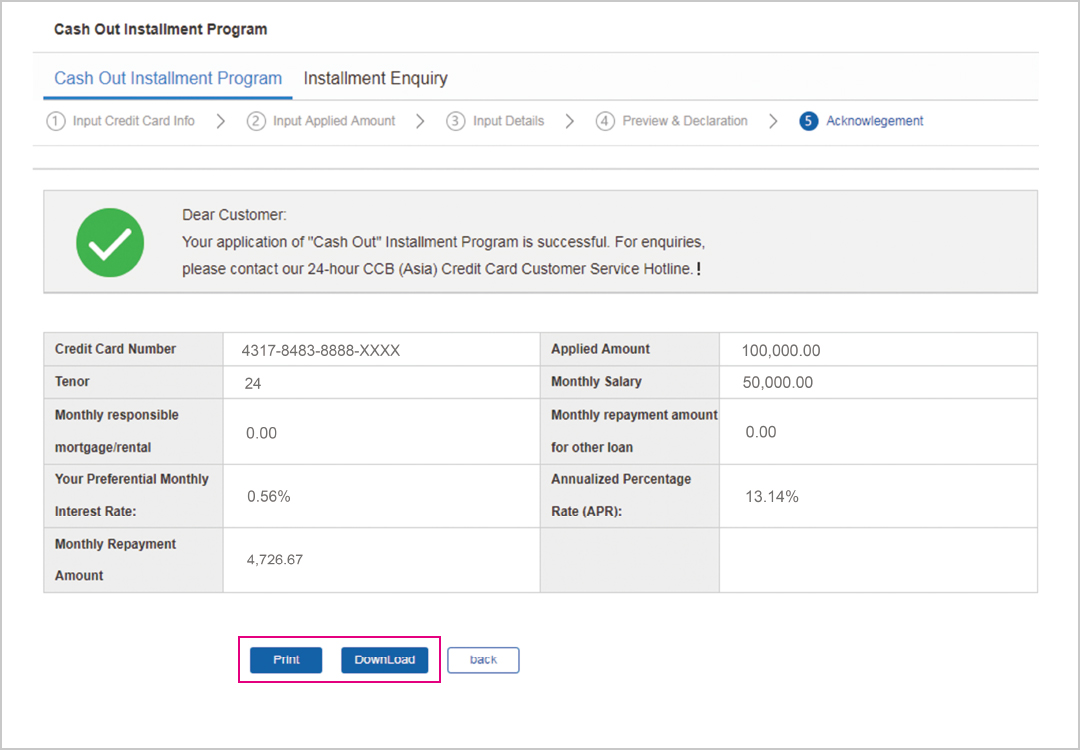

Apply at Online Banking

Login to Online Banking and select “Credit Cards”, then select “Spending Installment” under “Installment Loans/Cash Out”

Online Customer Services

Apply via Credit Card Installment Hotline#

317 95518

317 95518

Register Online for Insurance Premium Spending Installment Program

we will contact you within 3 working days

we will contact you within 3 working days

Register Online for “Chill” Spending Installment Program

#Connect direct to our representative after choice of language. Office Hours: Monday – Friday: 9:00am – 6:30pm, Saturday: 9:00am – 1:00pm, closed on Sunday and public holidays.